Good morning, it's Paul & Graham on duty this morning.

Agenda -

Paul's Section:

SThree (LON:STEM) - an impressive update. Profit guidance is raised, with trading at least 5% ahead of market expectations for FY 11/2022. This share looks excellent value now, and I think 319p looks an attractive entry point, providing your macro view is not too gloomy.

Cake Box Holdings (LON:CBOX) - updates on timing for FY 3/2022 results, and reiterates they're in line with expectations. A minor technical issue re distributable reserves has arisen during the audit, but it doesn't look to be a worry. Previous accounting/audit problems have left a lingering question mark over this share though, and major holders nearly all seem to be selling, which could leave a prolonged overhang in the shares maybe? Stays on my watchlist though, as I do like the underlying business model.

Filtronic (LON:FTC) - a positive, ahead of market expectations update. Although updated broker forecasts show a drop in profits next year. I'm not keen on the business model, and erratic historic performance, so not of interest to me. It's difficult to justify the current valuation, when the market is throwing many bargains at us.

Graham's Section:

Rank (LON:RNK) - this casino and bingo hall operator issues a nasty profit warning. The main problem appears to be lower-than-expected overseas visitors to the UK. But there are other niggles too, and inflationary cost pressures are also hitting the company. The last-seen balance sheet (December 2021) showed net cash and the company is still forecasting a respectable underlying profit for the current financial year, given the reduced market cap. An interesting but risky value opportunity.

SysGroup (LON:SYS) - this managed IT services company reports lower revenues but succeeds in maintaining profitability. Looking to grow through acquisitions and achieve success through increased scale. But for now the share appears to have few attractions. The cash balance has been spent on its two most recent deals.

Brighton Pier (LON:PIER) (no section below) - (£30m). This is a Luke Johnson company (Mr Johnson is Chairman and owns 27% of the shares). PIER owns Brighton Palace Pier, along with some bars, mini-golf sites, and a theme park. Revenue and adjusted EBITDA for the current financial year are tracking in line with expectations – a nice result for a domestic hospitality business! These expectations had already been raised in March thanks to a very nice update at the interims.

PIER is changing its accounting date from June to December. While the rationale for the change makes perfect sense, it would have also made sense in any prior year. So it is natural to ask: why wait until 2022 to change the accounting date?

Newmark Security (LON:NWT) (no section below) – Value investors love family businesses, but not all family businesses love them back. The daughter of Newmark Security’s Chairman was appointed CEO of the company back in April 2013. In all of the years since then, the company has paid out c. £1.5 million in total dividends, with the last one being paid in 2016. Meanwhile, the directors have been paid to the tune of £650k annually (2021 Annual Report).

Today’s RNS announces the grant of options representing 4.57% of company’s current share capital, so that total options now represent 10.68% of shares (most of these held by the CEO).

In my view, this pointless listing is a hazard for investors.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

SThree (LON:STEM)

319p (before market open)

Market cap £426m

SThree plc ("SThree" or the "Group"), the only global pure-play specialist staffing business focused on roles in Science, Technology, Engineering and Mathematics (‘STEM’), is pleased to issue a trading update for the half year ended 31 May 2022.

This looks good! PR headlines -

Double-digit net fee growth across all regions and sectors

Trading ahead of market expectations

There’s lots of detail in this update, so I’ll just note the key points -

H1 net fee income up 25% on last year.

Within that, Q2 (Mar, Apr, May) is up 23% on last year - the company says this is the first non-covid comparison, but I’d question that, as there were still some covid restrictions during that period last year.

Net cash £48m (flat vs LY)

Raised guidance - profit before tax (PBT) for FY 11/2022 expected to be at least 5% ahead of market expectations - helpful footnote -

(3) Current consensus PBT expectation is £66.2m for FY22. Source: SThree compiled consensus

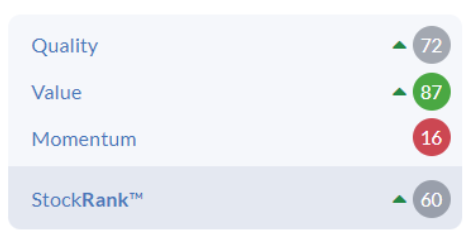

Upgraded forecasts - many thanks to Liberum for publishing an update this morning. It raises FY 11/2022 EPS estimate from 32.5p to 35.4p. That’s a PER of 9.0 - really attractive for an impressive company, with a good international mix of operations, in a niche that’s likely to do reasonably well, even in a recession, due to key skills shortages.

My opinion - both Jack and I (Paul) think this is a good business. I reviewed its FY 11/2021 accounts here, and was impressed when the price was 467p. Today’s price is only 319p, yet the company confirms today it is trading ahead of expectations. This is obviously because the stock market is pricing in a recession now, which may or may not happen. If we do get a recession, then we don’t know if it’s likely to just be a blip, before Govts stimulate economies again, or something more prolonged. Hence as we know, lots of uncertainty, especially around inflation.

With my value investing hat on, this is the time we’re offered some cracking bargains by the market, as people fixated on their own personal P&L, sell at irrationally low prices, driven by emotions, primarily fear of further paper losses, and sheer despair.

Yet with STEM, I see a decent business, now being offered at a very attractive price.

For long-term investors, I think 319p looks an attractive entry point, if you can cope with market volatility, and recession risk. Shares are likely to bounce today, so it could be a good one to buy on the opening bell, I reckon.

Obviously if you think a deep, prolonged recession is coming, then you probably wouldn’t see this as an attractive entry point. That's your call, as none of us know what the future holds.

.

.

High StockRank too -

.

Cake Box Holdings (LON:CBOX)

173p (flat, at 08:42)

Market cap £69m

Diary date - 27 June, for FY 3/2022 results.

Confirms results in line with market expectations (but no footnote to say what this is).

Conference call on results day seems to be open to investors as well as analysts, which is good to see (details on how to join the call are in the RNS).

A problem has emerged in the audit, over distributable reserves re previous dividends paid. This sounds inconsequential, and is being fixed with a resolution at the next AGM, so it doesn’t seem to be a concern. That’s how the market has taken it too, with no change in share price.

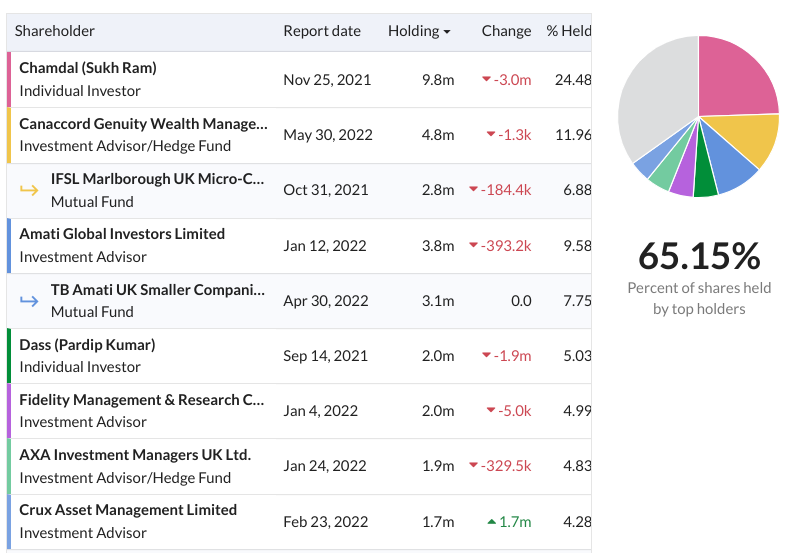

My opinion - as you can see from the graphs below, CBOX has a lovely track record as a growth company. I like the business model - rapid expansion of niche cake shops via franchisees.

.

.

The downside points are -

Accounting problems, and mgt castigated by former auditor (as flagged in an excellent report from Maynard Paton in Jan 2022).

Former CFO sold a lot of shares just before the accounting problems were revealed, hence there’s a lingering bad smell from that - it takes time to rebuild market trust.

Consumer downturn, so shares have moved down with other retailers.

Major shareholders almost all seem to have been selling - risk of a prolonged overhang of sellers in the market? That could depress the share price for a long time.

To be fair, CBOX did replace the CFO, and seems to be getting its house in order. The problems could be seen as growing pains, hopefully not something more ominous. Although personally, I rarely go near any share where accounting problems, and lack of financial control becomes evident, just in case more problems come out of the woodwork.

It might need more time to rebuild investor trust in CBOX, but it’s an interesting business I think, so am keeping it on my watchlist.

Lots of red (selling) in the major shareholder list, "Change" column below -

.

Filtronic (LON:FTC)

10.0p (up 11% at 09:31)

Market cap £21m

Filtronic plc (AIM: FTC), the designer and manufacturer of products for the aerospace, defence, telecoms infrastructure and critical communications markets, is pleased to provide the following trading update for the financial year ended 31 May 2022 ("FY2022").

PR headline -

Positive Trading Momentum maintained as improved second-half lifts earnings and net cash at year-end

Key points -

We are pleased to report top line growth and that adjusted EBITDA is set to exceed market expectations despite the challenges of the global semiconductor shortage…

… a strong sales mix and tight control of overhead costs resulted in adjusted EBITDA being materially ahead of forecasts.

The Board therefore expects, subject to audit, to report FY2022 revenue of approximately £17.1m (FY2021: £15.6m) and adjusted EBITDA of not less than £2.7m (FY2021: £1.8m).

It wastes time for us when companies just report EBITDA, because we then have to look up what real profits are. In this case, Finncap has helped by crunching the numbers, and £2.7m adj EBITDA turns into £1.4m adj profit before tax (PBT), clearly a big difference.

In adj EPS terms, that’s 0.5p, so the PER is 20.0 - seems high, in current bearish markets.

Especially as the latest forecast is for PBT to drop next year from £1.4m to £0.8m.

Outlook - sounds reasonably positive to me -

"The delivery of key semiconductor components will remain an industry-wide challenge for the foreseeable future, but we believe we have the resources to manage the disruption to our business and we start the new financial year with a strong order book and optimism to deliver further growth next year".

My opinion - I’ve followed FTC for years, and it has very patchy performance, with the occasional bonanza, then wilting. I seem to recall this is due to innovative products having fairly short life cycles, so it’s continuously having to invent new products.

I suppose investors must be hoping that at some point it might hit the jackpot with a blockbuster product.

As things stand though, I struggle to find any reason to want to own this share.

It's been listed a long time, and has been a long-term disappointment -

.

Graham's Section:

Rank (LON:RNK)

Market cap: £384m (-17%)

Good morning, everyone!

I’m intrigued to see this share languishing back in the double digits. I had some involvement with it, maybe about a decade ago, when I started focusing on FTSE-250 shares.

It operates Grosvenor Casinos, Mecca bingo clubs, a Spanish casino brand called Enracha, and a variety of gambling websites.

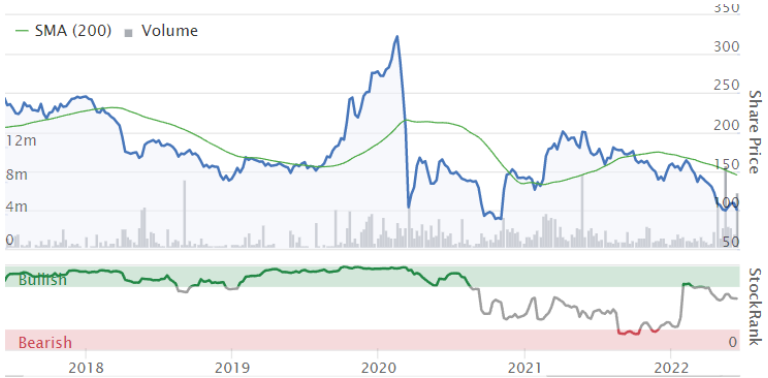

It was hit hard by the Covid crisis and despite temporarily recovering, the share price is back around those Covid lows again:

I last covered the stock in 2018, when I thought the company’s £77 million in “adjusted operating profit” was mostly real, not a figment of the adjustments. Statutory operating profit was running at £50 million for the year.

Today’s trading update – this is a profit warning, blamed in part on a variety of factors affecting Grosvenor Casinos (the bolding is mine):

We have seen some improvement in Grosvenor's performance post April, but it has been considerably weaker than expected, principally due to a slower than expected return of higher spending overseas customers to our London casinos, continued softness in visitor numbers across the UK and a lower-than-average casino win margin in the quarter to date.

I can speak to this myself: the only times I’ve entered a Grosvenor Casino have been when travelling! Once on a business trip, and the other time at the tail end of a holiday. But I’ve not been back in recent times.

Casinos don’t make all that much money from their weekly regulars, who are often sober and only there to make money, not to have fun! Instead, they thrive on tourists and business travellers, which is where they will find the high rollers.

Perhaps trends have improved in recent months, but I noticed this February forecast by VisitBritain, where they predicted inbound visitor numbers to the UK in 2022 would only reach 52% of 2019 levels, and that spending would reach 59% of 2019 levels.

The same organisation also predicted that it would take “a few years” before there is a full recovery to 2019 levels.

I doubt that the forecasts for 2022 have improved too much in recent months, given what Rank Group is telling us.

Win margin – this measures the “edge” enjoyed by the House, or the profit margin on bets placed in the Casino. Rank says there was a lower-than-average casino win margin at Grosvenor.

I suspect this could be another consequence of fewer overseas visitors. The locals, or regulars, may be in the habit of playing games where they don’t lose too much, compared to the games played by tourists. So that could be an easy explanation for why the casino win margin is running lower.

Alternatively, Rank’s long-run win margin might just be declining – they were complaining about the lower win margin back in 2018, too!

Profit warning – Rank’s update ends as follows:

As a result of the recent performance in Grosvenor venues and continued inflationary cost pressures across the Group, subject to normal casino win margins between now and the year end, we expect like-for-like underlying operating profit to be approximately £40m for the year ending 30 June 2022, lower than the previously guided range of £47m - £55m.

My view

It’s a nasty profit warning on many levels.

Firstly, of course, you have the more than 20% reduction in underlying operating profit compared to the previous central estimate.

Secondly, you have the fact that this new estimate is far from guaranteed: it relies on casino win margins improving back to “normal” levels, which I would have very little confidence in.

Thirdly, the 20% reduction in annual operating profit has been caused by only two months of poor trading. It shows how vulnerable the results are to very short periods of poor performance.

And finally, if you are nervous about continued inflation like I am, this profit warning confirms that Rank is not immune to cost pressures. There may be little relief from this problem in the short-term, perhaps not for quite some time!

However, despite all of the above problems, I still retain a fondness for this company. I’d like to see it recover.

As of December 2021, it had net cash (pre-IFRS 16) of £55 million.

And depending on the level of adjustments in the results, it can still grind out a profit for this financial year (FY June 2022). The net income forecast was £33 million, prior to today’s profit warning.

So I do think there is potential value to be had with this one.

Here’s what the StockRanks say:

If you’re willing to hold your nose and ignore the terrible momentum (no doubt made worse by today’s events), then the Quality and Value scores are really quite good. Although of course these scores may be affected by lower profitability!

I would guess that more pain is due for Rank in the months ahead. But holding these shares in the bottom drawer for a few years could lead to pleasant surprise, somewhere down the line, in better economic times.

SysGroup (LON:SYS)

Market cap: £13m (unchanged)

Managed IT services provide very important facilities for businesses who need to outsource their IT function. But that doesn’t make them good investments!

When I’m studying a company, the first thing I want is a competitive advantage. That means an element of differentiation that creates an “unfair” advantage against its rivals.

If I don’t find any competitive advantage, then I need the company to at least have some assets that can generate a return. The return might not be spectacular, but at least the company can do something for its shareholders.

Where does a managed IT services company fit into this picture?

Unfortunately, I find it hard to come up with an investment rationale in this industry.

I see it as a labour-intensive, people-based type of business, with few ways to create a sustainable competitive advantage.

External shareholders aren’t needed, and are therefore unlikely to be rewarded.

This share has been knocking around for years, and has done little for external shareholders so far:

Results – revenues are down 19%, but profitability is steady. High-margin services increased as percentage of total revenues, and low-margin reselling activity declined.

Cash – finished the year ahead of management expectations at £3 million, but this money is gone now thanks to acquisitions. The two recent deals (after the accounting period ended) cost £5.8m in aggregate, plus an earnout of £3.075 million.

Here’s a snippet to help you understand the overall strategy:

The expansion of the business enables SysGroup to offer customers an enhanced suite of IT solutions, providing a competitive edge over competitors and better positioning the Company to take

advantage of the market opportunities in the near future. We continue to engage with potential targets and assess businesses that could enable the continued growth of the Group and ensure that our customers continue to receive the best possible service available.

Outlook – optimistic words from the CEO, who finishes with the conclusion: “I am confident that we will see improvements to both revenue and EBITDA performance in this new financial year.”

My view

I agree with the company’s assessment that increased scale does bring competitive advantages. It’s working on creating this scale through acquisitions. Perhaps, like £CCC , it will surprise me and achieve great things for investors! But personally this is not a bet that I would be interested in making.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.