Good afternoon!

Quite a lot to get through today. I'm provisionally going to cover the following stocks, and will revise based on the comments:

- Accrol Group (LON:ACRL)

- Bonmarche Holdings (LON:BON)

- Diploma (LON:DPLM)

- Quadrise Fuels International (LON:QFI)

- Boku Inc (LON:BOKU) (new listing)

Best,

Graham

Accrol Group (LON:ACRL)

- Share price: 43.5p (-67%)

- No. of shares: 93 million (pre-Placing)

- Market cap: £40 million (pre-Placing)

Proposed Placing of £18m and Lifting of Suspension

This loo roll cutter makes a return to the market after suspension over its debt problems.

It listed in June 2016. Yet another reminder of the danger of IPOs. It's amazing how often that something goes wrong in the first year or two. It's almost as if the sellers tend to be better at timing their trade than the buyers!

Covering this back in July, when everything was still rosy, I failed to forecast that things would fall apart here as quickly as they did. Indeed, I thought the debt multiples looked "very safe". Net debt was at £19 million, or less than twice EBIT for the past two years. But since the company was still only a year on the market, I added:

[It] will probably get more interesting when something goes wrong and the shares can be bought for a recovery!

Well, today is our chance to do that!

I recall some readers thinking that I was a bit generous when I speculated that the existing equity might be worth c. 40% of the level it was at pre-suspension. The money is being raised today at 38% of the pre-suspension price, so perhaps I was indeed too generous!

The price action on the exchange adds a further discount, putting the existing equity at 33% of its pre-suspension price.

Accrol's Chairman tells us today the company "believes it is through the worst".

The proposal is for 36 million new shares at 50p each, raising £18 million.

Trading Update

As you would hope and expect, we get some news about what is going on with the company's business in the last couple of months.

Accrol's major input, hardwood pulp, saw its price increase by over 40% year-to-date, which was compounded by FX costs (weaker sterling).

It says that it has made "tangible progress" negotiating price increases with customers in the last few weeks:

In its evaluation of the funds needing to be raised as part of the Placing, the Board's financial model includes some acceptance of price increases across Accrol's customer base. The Directors will keep this under close review, in light of the highly sensitive nature of price increases to the Company's financial performance and working capital position. In addition, the Board notes that price increases may result in a reduction in volumes from customers. Again, the Board has assumed some volume loss in its financial model but, if there were to be greater volume loss than expected, then this would adversely impact expected financial performance and its working capital position.

That's very cautious, and may explain why the shares are now trading at an even deeper discount than the Placing price.

A greater volume loss than expected would inevitably affect the working capital position - but mentioning it explicitly suggests that more money would need to be raised.

Indeed, later in the statement, we get the following under "working capital position":

The Directors believe... that the Group will have sufficient working capital for its short-term requirements. However, the Board is unable to make any confirmations about sufficiency of working capital beyond this, due to the Group's working capital being highly sensitive to, amongst other things, parent reel pricing, foreign exchange fluctuations and level of turnover. As such, there can be no guarantees that the funds raised pursuant to the Placing, together with the available bank and other facilities that will be in place following Admission, will be sufficient for the Group's requirements for the next 12 months and that the Group may require further funds to be raised during this period to secure the Company's longer-term future.

That's all I need to read to know that I won't be investing here, as I have a severe allergy with respect to getting diluted.

And when the company puts things in black and white, it is clear why it may need further funding:

The net debt position of the Company on Admission, taking into account the net proceeds of the Placing of £18 million, is expected to be approximately £22 million and the Directors expect that this will move to no more than approximately £23 million by 30 April 2018.

I was initially hopeful that the announced placing might be enough to steady the ship, but to still have £23 million in net debt, by next April, suggests that this financial year's performance is going to be truly dreadful.

For the sake of current shareholders, I hope that the Directors are being overly conservative, but their forecast is for "a small profit at adjusted EBITDA level" in the year to April 2019. That would almost certainly be another material net loss, and even after the price negotiations which will have taken place and gone into effect by mid-2018.

Regrettably, I have to put these shares in the uninvestable pile. If pulp prices went back to where they were before, perhaps it would make a swift recovery. But surely that's gambling territory?

Bonmarche Holdings (LON:BON)

- Share price: 98.5p (+11%)

- No. of shares: 50 million

- Market cap: £49 million

The women's fashion retailer has been in bargain bucket territory for a while, and today reports interim results and full-year outlook in line with expectations.

The share price has bounced, so investors were clearly pricing in something worse than this! Widespread pessimism around the high street outlook, and deteriorating conditions which haven't spared Bonmarché, have led to these shares being priced for further distress.

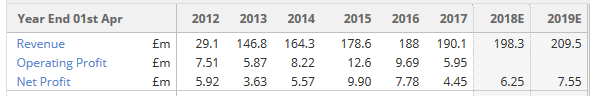

As I've mentioned before, Next (LON:NXT) is a part of my portfolio. But in terms of a cheap high street retailer, Next has nothing on Bonmarché! This one has net cash of £15 million (although that's before any adjustment for seasonality), making for some really low Enterprise Value/Operating Profit multiples. The enterprise value is only about £35 million, versus operating profit in a £6 - £10 million range:

Since its IPO at 200p in 2013, Bonmarché's share price spent considerable periods of time around the 300p range. I guess that means there are still plenty of stale bulls around here.

Key points from the financial highlights:

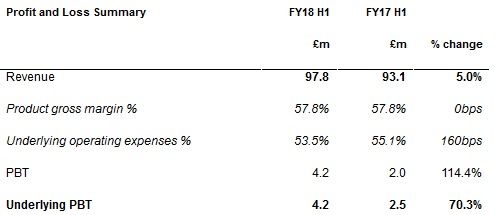

Total revenue up 5% to £97.8 million

Combined LFL sales growth 4.3%; store-only LFL sales up 1.6%, online sales up 38.6%

Paul covered Bonmarché's trading update in July, and estimated that retailers needed c. 3% in LFL store sales growth in order to keep up with rising costs.

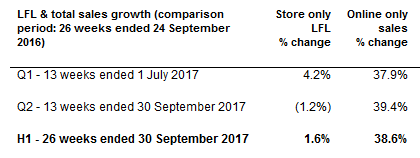

LFL store sales grew at 4.2% in Q1 (the financial year begins in April), so this 1.6% result looks a bit disappointing. It suggests to me that the Q2 result must have been quite a bit worse than 1.6%, since the Q1 result was so much better.

Indeed, when you scroll down further, you find the following:

As you can see, the Q2 period showed LFL deterioration in the stores.

Still, the company reckons that it grew market share overall for the H1 period, given how weak the sector is as a whole.

Since Bonmarché is a "value" retailer, the gross margin is nothing too extraordinary, at less than 60%.

The large gain in PBT is a result of the operating leverage which occurs when you have a modest increase in revenue and keep your large fixed overheads (underlying operating expenses) under control.

The company cites the following as having helped keep operating expenses down: "a reduction in marketing costs, lower logistics costs due to improved efficiency, a reduction in business rates costs, and a 6.5% reduction in head office staff numbers." Overall, it sounds like management have done really well managing their way through this period.

Online

Online is now approaching 10% of sales and continuing to make reasonable gains.

If you scroll back up, you'll see that Online grew faster in Q2, compared to Q1. So perhaps some of the LFL deterioration can be chalked up to cannibalisation by the website?

It does strike me that the over-50s will be increasingly savvy with respect to technology. The younger you were when the internet become widely used, the more likely you are to buy things online rather than visiting a store - so I'd be willing to bet that Bonmarché's online activities will continue to rise dramatically. In-store online ordering has been rolled out to all stores.

My opinion

Overall, I'm warm to this. The main negative I think is that the Q2 LFL performance was so poor.

Also, there's an acknowledgement that October was a very poor month overall for the retail sector, so Q3 performance is likely to be poor too. While the company is still guiding for the full-year result to be in line, it seems to me that the risk is skewed to the downside.

But a bad year or two is certainly priced in already at this valuation. So I'd be strongly considering buying this, if I didn't already have Next (LON:NXT) and other retail exposure.

Diploma (LON:DPLM)

- Share price: 1182p (+10%)

- No. of shares: 113 million

- Market cap: £1,338 million

I'm covering this mid-cap, FTSE-250 stock thanks to some reader requests. It's a group supplying specialist products to the Life Sciences, Seals and Controls industries.

Numbers are superb:

The adjusted operating margin approximately tallies with the operating margin recorded on Stockopedia (you'd always expect the adjusted number to be a bit higher). The other quality metrics are very good too:

Getting myself more acquainted with the group earlier, I noticed that its subsidiary Hercules Sealing Products is based in Florida.

The group's US/global orientation bears out in the fact that FX changes resulted in a 9% increase in revenues, or half of the total gain. 2% came from acquisitions, so 7% of growth was organic and not currency-related.

That would have been a reasonable result, but clearly it was turbo-charged by the devaluation of sterling.

Ben Hobson wrote a nice article recently about the merits of investing internationally, and the diversification benefits are plainly obvious when you look at Diploma. Sterling's devaluation is a serious headwind when looking at GBP-denominated assets. But if the company is operating internationally, then its results translate back into large percentage gains in GBP terms.

The long-standing CEO is set to retire late next year, so there is time to prepare for that now.

His achievements are summed up as follows:

The Group has a long track record of consistent delivery against its key performance metrics by compounding stable "GDP plus" underlying growth with carefully selected, value enhancing acquisitions, funded by the Group's free cash flow. This strategy has been successfully designed and executed under the outstanding leadership of Bruce Thompson since he became CEO of Diploma PLC in 1996. Over the last 15 years, since emerging from a major restructuring of the Group led by Bruce, the Group has delivered strong double-digit growth in earnings, dividends and share price and has grown market capitalisation from ca. £60m to ca. £1.2bn today, without any new equity having been issued.

My opinion

Without having undertaken in-depth research yet, I haven't seen any red flags here. The big question I think is who the new CEO might be, and what his/her philosophy and execution capabilities might be.

Overall, I like it. It's very specific about targeting customers' operating budgets, not their capital budgets, and conservatively focusing on essential solutions, to make the revenue it achieves as recurring in nature as possible.

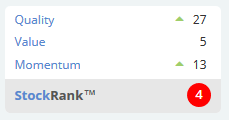

Stockopedia ranks it as a High Flyer. Value is poor by conventional metrics but in general, I think investors do well by sticking with high-quality companies like this.

Quadrise Fuels International (LON:QFI)

- Share price: 4.05p (+3%)

- No. of shares: 862 million

- Market cap: £35 million

Statement re: Media Speculation

This has been discussed in the comments so I am leaving an entry for it here, for future reference.

Also, someone was wondering whether it's ok to discuss stocks and sectors which aren't being covered in the main report. The answer is that there is absolutely no problem with that. If myself/Paul don't cover something, it can still be discussed below.

What we do recommend is that you use the pound symbol and then the ticker (£ and QFI together, for example), so that other people can quickly know which stock you are talking about.

Anyway, I haven't got much of anything to add here beyond what is being said by more well-informed readers below.

For newcomers to the stock, Quadrise claims to have a disruptive technology which produces a superior residual fuel compared to that which is traditionally produced.

It's a pre-revenue company and is gearing up for a big project in Saudi Arabia ("KSA").

From the final results a few weeks ago:

We are confident that the delivery of the KSA power project will demonstrate the value of Quadrise's MSAR® technology and fuel in KSA on a commercial scale, and the Company will continue to work with our partners to further evaluate commercial options for MSAR® production and supply in KSA to both marine and power plant consumers. This will help to ensure that, pending a successful trial and positive decision on the use of MSAR® in KSA, our technology could be deployed rapidly at a commercial scale.

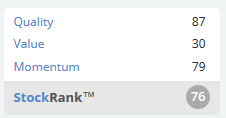

The StockRank is predictably low, since it's in such an early stage, and most early-stage companies don't work out. Another way of putting it is that there's an awful lot more work involved in figuring which few early-stage companies are the ones which will eventually succeed.

Good luck to those holding Quadrise Fuels International (LON:QFI).

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.