Good morning, I'm back (Paul) after a few days break. Many thanks to Roland for covering.

It's certainly a very tough time in the markets at the moment, especially small caps. I always remind myself at time like this, that bearish market conditions are laying the foundations for the next bull run. So providing we hold sensible companies, reasonably priced, they'll usually go back up again.

Mello Monday starts at 6pm (online) this evening. Details here. I do think it's important to keep engaged, rather than withdrawing into despondency when markets are difficult.

Agenda -

Paul's Section:

John Menzies (LON:MNZS) - looks like a cash bid at an increased 608p is now enough to win over management to back the takeover bid from Kuwait's "Agility" infrastructure group. Are bearish stock market conditions creating opportunities for more investor windfalls from takeover bids?

Clipper Logistics (LON:CLG) - continuing the takeover theme, management has agreed a bid from US-listed GXO, 75% in cash (690p) and the balance in GXO shares, which UK investors may not want to hold. It looks a fair price to me.

Synairgen (LON:SNG) - a speculative drug treatment company delivers the news investors dread - that its product failed the main targets in testing. Although crumbs of comfort come from secondary results. It's difficult to see much of a bull case now.

Jack's Section:

Sylvania Platinum (LON:SLP) - I hold - production down due to flagged technical difficulties and cash costs are up. The stock remains cheap in my view, but that depends on the outlook for the group’s PGM basket price. Management continues to return cash to shareholders via dividends, special dividends, and share buybacks. Even accounting for the operational challenges, the company remains highly cash generative at these levels.

Wilmington (LON:WIL) - good H1 results, as previously flagged. AMT has been sold for a useful premium, which goes some way to mending a balance sheet that could still do with a little work. The group’s two segments are both growing organically, and the return of face-to-face events could lead to further upgrades. I think it’s one to watch.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s section:

John Menzies (LON:MNZS)

Agreed takeover bid at 608p

The Board of Menzies (the "Board") announces that it has received a further revised proposal from NAS, a subsidiary of Agility, regarding a possible all cash offer for Menzies of 608 pence per share (the "Final Proposal") . The Final Proposal is conditional on, amongst other things, confirmatory due diligence and the recommendation of the Board of Menzies (such conditions being capable of waiver by NAS).

The Final Proposal follows earlier approaches from NAS to the Board regarding possible all cash offers for Menzies at 460 pence, 510 pence and 605 pence per Menzies share.

My opinion - this is fantastic news for MNZS shareholders, and management seem to have handled the takeover bids very well - squeezing a higher price out of the Kuwaiti bidders several times.

Going back through the archive here, I can’t see anything obvious in the numbers to suggest that MNZS was a bargain, or likely to attract a bid. Although the broker forecasts were increased several times, and a decent turnaround seemed to be underway. So maybe it’s time to run a stock screen for companies where broker forecasts are being raised? A very weak balance sheet, heavily dependent on bank debt, ruled it out for me personally.

With such bearish stock market conditions currently existing, I wonder if we might see a rash of takeover bids?

An interesting point with MNZS, is that when the initial bid was announced (and rejected by management), the share price did rise, but remained a long way below the rejected bid price on the first day. I remember looking at that as a potential buying opportunity, but unfortunately didn't have any spare cash, so missed the opportunity.

.

.

Clipper Logistics (LON:CLG)

884p (up 14% at 08:18) - mkt cap £907m

Statement re. possible offer for Clipper Logistics plc

Continuing the theme of takeover bids, it looks as if Clipper is the next one to be taken over.

The Boards of Clipper Logistics plc ("Clipper") and GXO Logistics, Inc. ("GXO") are pleased to announce that they have reached agreement on the key terms of a possible cash and share offer for Clipper by GXO (the "Possible Offer").

The terms are:

- 690p cash, plus

- C.230p equivalent in GXO shares

GXO is a logistics group listed on the NYSE. If you have a US subscription for Stockopedia, then the StockReport for GXO is here.

GXO looks expensive, for a low margin logistics group, on a forward PER of 29.5 - so personally I wouldn’t want to own any GXO shares.

The market cap of GXO is £6.9bn, so it’s a credible bidder, and it should be liquid enough for CLG shareholders to sell their unwanted GXO shares in the market. Although I think that all cash bids are always preferable to bids which contain some element of shares as payment.

My opinion - it seems that CLG management is backing this bid approach, although the 23.3% irrevocable undertakings to accept are not high enough to make it a done deal yet.

The overall price looks fair to me, although the mix of cash & GXO shares is not ideal. There’s always the option of selling in the market now for 885p, giving up c.35p, in return for a certain, immediate, and all-cash pay out.

Or there’s the possibility of holding out for improved terms - which does carry some risk that the bid might fall apart.

Quite often I sell half immediately, when takeover bids occur, depending on how credible the bidder seems. That locks in some profit, and makes me more relaxed about the outcome for my remaining shares. Although I know other investors who always hold, because bids usually succeed and you get the full takeover price (as opposed to a discount for selling early in the market). Also that way you capture the upside from a higher competing bid, which sometimes happens. In this case, it sounds as if CLG management have committed to backing the GXO bid, so maybe not so much upside from any higher bids?

We like CLG here at the SCVR - because it has a good track record of growth in EPS.

Another good logistics share to consider is Wincanton (LON:WIN) - although the low PER is due to heavy cash payments into its pension scheme (a non- P&L item).

I know a lot of investors are nervous about the situation in Ukraine, and worries over interest rates & inflation. All valid concerns. However, sitting on the sidelines in cash, does mean that you miss out on takeover bids. Takeover bids happening is also an indicator that the UK market is probably now quite cheap.

.

.

Synairgen (LON:SNG)

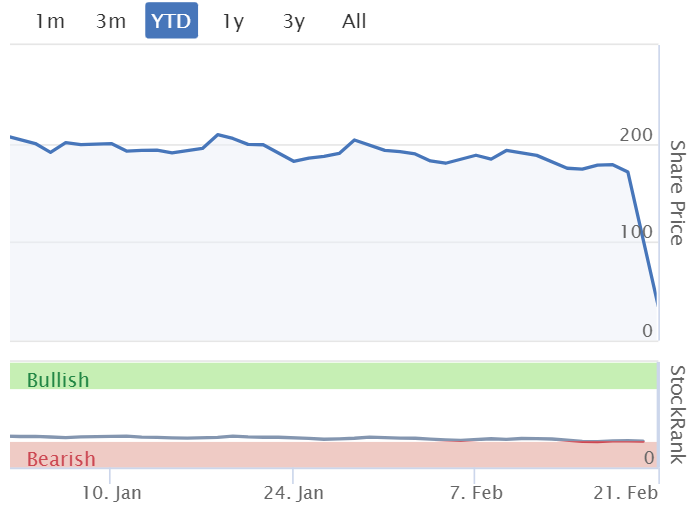

35p (down 79% at 10:02) - mkt cap £70m

Topline results from phase 3 trial

This share bottomed at under 20p first thing this morning, down from 171p at Friday’s close.

We don’t normally cover speculative drug companies here, or indeed anything blue sky with zero revenues (other than to warn people off!), because they’re impossible to value rationally. So investors are left to guess and speculate on what the future might hold.

The failure rate on such speculative shares in extremely high, so it continues to amaze me how many such shares are chased up to high valuations, especially in bull markets, when investors seem to confidently assume that the bull case is a near-certainty, despite evidence all around us that the bull cases nearly always fail, fully, or in part.

Synairgen’s bombshell announcement this morning is that its inhalable treatment for covid doesn’t seem to work in its “primary endpoints”.

Although there do seem to be benefits from the number of patients who received SNG’s treatment (compared with a placebo) in reducing the number of patients having severe disease or death.

The sample sizes look small though, so larger trials are needed. Meanwhile other treatments, and the severity of covid, are reducing. So whether SNG has missed the boat on this, is open to question?

SNG says it has over £25m cash remaining, so there doesn’t seem to be an immediate solvency risk.

It all depends on what the cash burn is likely to be though, for larger trials to take place? £25m doesn’t sound enough for major trials.

My opinion - it’s difficult to see how a market cap of £70m (at 35p per share) is justified now that SNG’s key product has failed its main aims. Also, with omicron now a milder strain, and herd immunity having been achieved in many countries, is it worth investing in anything that is developing covid treatments? That moment seemed to have passed once vaccines came out, so this feels a very stale story.

Small investors have a great advantage, in that you can sell, whereas the institutions are stuck with it.

This share looks a busted flush to me. So if I held, I’d chalk it down to experience, as a punt that didn’t work, and move on, rather than expending more mental energy worrying about it.

Clinging on, in denial about the changed facts, or just hoping that something good might happen against the odds, doesn’t usually work in these binary type of situations. You've either got a blockbuster, highly lucrative drug, or you've got nothing. That's why averaging down usually just makes a mistake a bigger mistake, unless you're lucky in catching a short term trading bounce.

I don't touch anything like this, as I've got no informational or knowledge edge. So once I've heard about a bandwagon, chances are the smart money is already selling!

.

Jack’s section

Sylvania Platinum (LON:SLP)

Share price: 96.5p (-4.46%)

Shares in issue: 272,985,435

Market cap: £263.4m

(I hold)

Half year report to 31 December 2021

With the caveat that pretty much all Metals & Mining stocks are to one extent or another geared plays on different commodities, Sylvania is a sensible operation with experienced management focused on optimising what is within its sphere of control.

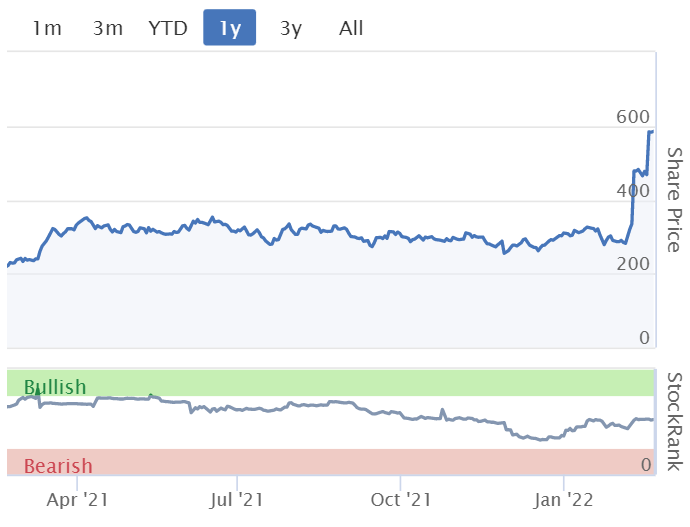

The shares have come down from highs of c140p last year to 101p as of the time of writing but, with a recovering basket price (that remains well above historical norms), there’s still a solid argument that the stock is cheap. Net cash is up year-on-year from $67.1m to $110.1m (and up c$4m since the start of the period), meaning the cash-adjusted forecast FY22 PER is just 3.1x.

A 2.25p is declared, to be paid in April 2022, while a 4p dividend was paid in December 2021 in addition to a total of 1,873,430 shares bought back. The group continues its good track record of returning cash to shareholders.

In terms of other highlights, we have:

- Sylvania Dump Operations (SDO) production of 32,376 4E PGM ounces (down from,

- Group cash cost per ounce is up 23% to $815/oz,

- Net revenue of $69.1m (HY1 FY2021: $84.9m),

- Average gross PGM (platinum group metals) basket price of $2,966/oz (HY1 FY2021: $3,184/oz),

- Group EBITDA of $36.2m (HY1 FY2021: $58m),

- Diluted earnings per share of c6.38p.

The market should have been expecting less good year-on-year results due to the change in commodity prices.

There has also been progress made on the Grasvally chrome mine, one of SLP’s exploration assets that has been up for sale for some time. An amended agreement sees the agreed upon sale move from 74% of the company to 100% for $6.7m.

Operational challenges include lower than planned Run of Mine (ROM) and PGM feed grades at Western operations and the temporary suspension of operations at Lesedi in Q1, which has commissioned a new water supply and tailings dam facility. Progress here is proving a little trickier than expected, however.

Regarding feed grades:

During the period, the SDO continued to engage with the host mines in order to address the lower PGM grades in ROM and current arising sources, as well as optimisation of blending activities from surface sources. Various sampling campaigns and investigations have been performed together with the host mine to evaluate potential alternative feed sources. It is anticipated that ROM feed grades should improve during HY2 FY2022.

Power supply to operations remains a focus area, as vandalism and cable theft at substations continue, often resulting in unplanned delays to the operations.

Opportunities - the group’s ‘MF2’ projects remain on track. Lesedi MF2 will be commissioned in March and Tweefontein should be later in the calendar year. These should add further production capacity, between 4.5-6k oz.

CEO Jan Prinsloo comments:

The SDO has achieved 32,376 ounces of PGM production in the period, with a solid performance from most operations, especially Tweefontein, which achieved new record quarterly and six-monthly production performances which helped mitigate the lower production from Mooinooi and Lesedi during the period. However, the lower PGM feed grade of Mooinooi ROM material received, the impact of the temporary production stoppage at Lesedi and subsequent water shortages, as well as some water supply issues which are being addressed, have affected production from our Western operations. As a result, we have made a modest adjustment to our annual PGM production estimate, with a range of 66,000 to 68,000 ounces now targeted by the Company.

Capex - a notable increase in maintenance capex here.

Capital spend increased during the current period compared to the prior year corresponding period from $2.5 million to $7.4 million, comprising $6.1 million optimisation and stay in business capital that includes the abovementioned projects, as well as $1.3 million spend on exploration projects. All capital projects are fully funded from current cash reserves.

Liberum notes ‘approved near term growth adding 6.2- 8.3koz PGM p.a. for $6.7m. Over next three years, possibly two new plants adding 25-35koz p.a. for $40-$50m.’

Conclusion

Cash costs are up some 23%, but still well below basket price levels. The major drivers here are higher electricity costs, higher mining costs as a result of trying to secure higher feed grades, and higher levels of oxidised materials.

Management is actively addressing this though, and my base case view is that the current operational challenges are temporary, although there is always scope for more complications to arise.

Assuming this is correct though, then the shares continue to look cheap at the current levels. But then there’s that second, more fundamental assumption: that today’s basket price is more reflective of the future than the pre-2019 levels.

I think the outlook is fairly positive here, given that Rhodium figures more heavily in SLP’s basket than it does for other PGM producers (around 2-3x the exposure), is used in catalytic converters for cars to reduce nitro emissions, and with automotive production set to recover at some point in the short term. Rhodium is a tight market, which makes the price volatile.

The medium term outlook is solid, with the switch to EVs not an immediate threat, although that volatility does need to be considered. In order to meet Rhodium demand, experts are forecasting record levels of recycling. If that fails to transpire, then there would be upside pressure on the commodity price. Here’s what management (which is generally cautious on giving commodity price guidance) says:

While the average 4E PGM basket price for HY1 FY2022 was approximately 30% lower than HY2 FY2021, we remain cautiously optimistic in terms of the PGM price outlook. Based on market forecasts for Palladium and Rhodium to remain in deficit and demand forecast to increase with vehicle sales as the global chip shortage is resolved, we are expecting PGM prices to remain healthy with potential modest upside from current levels as the year progresses. While electric vehicle sales have increased sharply during the past year, especially as internal combustion engine ("ICE") vehicles sales were impacted by the global chip shortages, PGM consumption in ICE vehicles is expected to remain robust for the short to medium term based on the balance of market fundamentals.

It’s not my area of expertise - something I might do more detailed work on this week though - but for now I think the valuation, cash balance & generation, and the way in which management returns that cash to shareholders, makes SLP one of the more attractive Metals & Mining stocks out there.

The stock has to come with that commodity price caveat, and sentiment has weakened recently. The shares are down this morning but I’m more relaxed about these results. I think it’s a competent management team here, focused on the controllables and returning cash to shareholders when prudent to do so - which is perhaps more than you can say for some others in this neck of the woods.

Wilmington (LON:WIL)

Share price: 248p

Shares in issue: 87,593,017

Market cap: £217.2m

Half year results to 31 December 2021

Increasingly strong outlook… If the major face-to-face events happen in March as expected, we anticipate our profitability to improve still further.

Highlights:

- Revenue +7% to £58.9m,

- Adjusted profit before tax +35% to £9.5m

- Adjusted basic earnings per share +34% to 8.6p,

- Statutory EPS up from 5.05p to 26.14p, helped by sale of AMT,

- Interim dividend +14% to 2.4p,

- Net cash of £11m (up from net debt of £17.2m a year ago).

Organic revenue is up 12%, driven by the acceleration of its digitalisation programme and the return of face-to-face events. Information & Data is up 10% and Training & Education is up 15%. It’s worth noting that the company’s performance is ahead of pre-pandemic levels.

Adjusted pre-tax profit margins have improved from 13% to 16% despite cost pressures resulting from staff, venue hire, and some increased travel.

Strategic sale of AMT for £23.4m in December leaves Wilmington free to focus on its strategy of establishing single technology platforms for its remaining two divisions in order to enable a more ‘digital-first’ approach, which could lead to higher margins in due course. This will likely entail acquisitions in GRC, funded by the group’s net cash and £65m bank facility.

Information & Data - the group breaks down its operating segments into sub-segments. Here, we see Healthfcare revenue is up 14% to £15.9m, Financial Services & Other is up 1% to £10.5m, and Identity & Charities is up 3% to £2.4m. Discontinued operations declined by 78% to £0.3m. The result is £29.1m of total divisional revenue, up 5%, with an improved 19% operating margin leading to a 28% increase in operating profit to £5.6m. The group is targeting an H2 operating margin of 20%.

Training & Education - Global +2% to £11.4m, UK & Ireland +17% to £11.7m, North America +74% to £2.6m. Discontinued operations are down 11% to a still material £4.1m. Total revenue is therefore £29.8m, up 10%, and an improved operating margin of 24% means operating profit is up 20% to £7.1m.

In North America, results were helped by the return to face-to-face events.

Current trading

We continue to derive considerable benefits from our diversified portfolio as well as the investment we have made in product development and digitalisation over the past two years. In addition to driving organic growth, we have continued to improve margins. Provided we can continue to run events face-to-face, we expect an additional boost to profitability in H2 FY22. If not, we still expect profits and revenues to be higher than last year despite the sale of AMT.

Conclusion

An attractive feature of Wilmington’s is its focus on GRC and regulatory compliance markets - demand for its products is strong because customers need them in order to operate successfully.

I think it’s one to watch, although that is reflected in the improving share price. It’s doing about as well as it ever has done, so now it comes down to growth prospects.

The group has restructured, revenues are rising, the return of face-to-face events could further bolster momentum, and margin-enhancing acquisitions might be in store.

Meanwhile, the valuation does not look too demanding based on a forecast rolling PER of about 14.6x and a dividend yield of around 3%. And the group itself is pointing to the potential for further upgrades. Whether or not those upgrades arrive will likely be the key driver of the share price over the next year or so.

Note the improving StockRank.

The balance sheet looks a little weak though. Goodwill and intangible assets make up around 54% of total assets, leaving a negative net tangible asset value of -£16.1m. The current ratio is just 0.93x, although this is actually a marked improvement on the 0.58x from a year ago. The group is quite cash generative, but I’d still like to see more of a buffer here.

Total debt has come down as a result of the AMT sale though, which looks to have been sold for a healthy premium, and the F-Score points to improving financial health.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.