Good morning! It's Paul here, I'll be writing this week's reports.

Graham was scheduled to write today's report, but messaged me this morning, to ask if I could cover for him, as he's tired. Maybe he was up during the night to see the lunar eclipse? I got up at about 5am to see it, but couldn't see the moon at all - too much cloud, and background light. Pity. I studied astronomy at Uni, as my subsidiary subject, and found it fascinating. So have just bought a cheap plastic telescope, to rekindle my interest in the stars.

The vast scale of the universe means that there must be a very high probability of intelligent life existing elsewhere. Indeed, some astronomers believe that the universe could be teeming with life, but all a very long way away (too far for us to communicate with it, because by the time any alien signals reach us, they would be millions of years old). On the balance of probabilities, I think there must be life elsewhere, and I really hope we do discover extraterrestrial life forms in my lifetime. Providing they're friendly!

Markets

It seems to me that things might be turning bullish again. I'm certainly going back into buying mode, when companies put out positive updates, and providing the valuation is attractive (which many are, after savage recent falls).

My macro view, rightly or wrongly, is that the US-China trade problems seem to be getting resolved. I don't see any reason for a recession to happen. Real incomes are rising nicely in the UK, as wages rise (full employment) and inflation comes down.

As regards Brexit - it's not going to happen, is it? I don't think our politicians ever intended to actually implement Brexit. They just lied to us, in the hope that they could persuade us, over a couple of years, that it was a bad idea. The damage to our pseudo-democracy is going to be very serious, in my view. However, that's a topic for a Twitter rant, not for here.

Talking to many of my investor friends, most of them seem to be very nervous, and sitting on the sidelines in cash. That means that there's a wall of money to come back into the market, at some point. I want to be ahead of that wall of money, buying back into companies I like now, rather than waiting for them to rally 20%+ (which some things have started to do already).

I could be right or wrong. As always, am just giving you my current opinion, which is subject to change at any time. The onus is on readers to form your own views, of course.

Patisserie Holdings (LON:CAKE)

The accounting fraud saga here continues. This has to be (easily) the most bizarre, and shocking scandal of recent times. Others, such as Quindell, Globo, and Carillion, were easy to spot a mile off - indeed we warned investors of all 3 here, long before they blew up.

Patisserie Valerie however, appeared to be a wonderful, cash generative business, run by a highly respected business guru, Luke Johnson. True, its profit margins seemed bizarrely high, but like everyone else, I just assumed that it was a terrific business. It now turns out that the figures were being fiddled, by apparently accounting staff stuffing invoices into drawers, rather than booking them into the accounts, thus under-stating costs & inflating profits. This is very difficult for auditors to pick up.

In my auditing days, I don't recall any work being done to reconcile supplier accounts. Instead the emphasis was placed on agreeing customer accounts - by circularising the largest debtors, asking them to confirm the year-end balance. That wasn't done for major suppliers - CAKE shows that auditors really should be circularising & agreeing year-end balances with major suppliers too, as well as major customers. Even that wouldn't be fool-proof though, as a company could simply use a different supplier, and not tell the auditors. It's so easy to hide liabilities, thus boosting profit.

EDIT: several reader comments below, from other people with audit experience, suggest that I may have mis-remembered the point about auditors not verifying creditor balances. Perhaps they do? End of edit.

Clever, and unscrupulous people, can generally commit fraud, and fool the auditors very easily. Having seen myself (from both sides) how cursory the audit process is, I've since never relied on auditors to pick up on frauds. We have to do our own reasonableness checks on numbers, to see if something doesn't look right.

With hindsight, if CAKE was genuinely making a c.16% operating profit margin, then this should have been attracting many other new entrants, to open tea & cake shops on the High Street. That wasn't happening. Still, if anyone had said that Luke Johnson's biggest company was a fraud, they would have been laughed out of the room. So I don't think we can beat ourselves up too much for not spotting this one.

Undisclosed bank accounts were apparently used by CAKE accounting staff, to pay bills. The existence of these rogue bank accounts was apparently then hidden from the auditors, so these liabilities remained unrecorded on the balance sheet. Obviously senior management must have known what was going on, as they would have initiated the fraud.

Jeremy Grime of FinnCap makes an excellent point this morning. Namely, in the old days, setting up bank accounts required paper forms, with multiple Directors signatures. These days, bank accounts can be set up electronically, only needing scanned copies of Directors' photo ID, and a utility bill. In practice, to save time, lots of companies will already have those scanned ID documents on file, to use whenever required. So actually it would now be very easy for a senior manager or Director in the finance dept, to set up bank accounts without other Directors necessarily knowing about it.

Perhaps banks need to add another layer of old-fashioned security, for larger accounts? Maybe even popping in to the customer's Head Office, and meeting Directors personally, when new accounts are opened? Also, perhaps banks should be sending summary statements, showing balances on all accounts, to all (including Non-Execs) home addresses?

Today's update - the group appears to be teetering on the edge of administration, as reported in the weekend press, with bank facilities having technically expired, but extension still being discussed;

Patisserie Holdings plc (AIM: CAKE) ("PH" or the "Company") announces today that, further to the announcement on 16th January, the Company is still in discussions with its bankers to extend the standstill of its bank facilities beyond 18 January and will issue an update when those discussions have concluded

Therefore all overdrafts are now technically repayable on demand. The banks could be tempted to pull the plug & let an administrator come in & quickly sell the business to whoever can come up with enough cash to cover the bank debt. Unsecured creditors & of course shareholders (who are last in the queue) usually end up with nothing in that scenario.

Who knows what the outcome will be? I really feel for shareholders here - they thought they were investing in a high quality, safe company, which was actually a fraud. That could not have been anticipated. Shareholders have really been extremely unlucky here. It doesn't look as if there will be much, or even any, shareholder value remaining for existing shareholders.

The guilty parties need to go to prison promptly. The big problem with white collar crime in the UK, is that perpetrators seem to often get away scot-free. So where is the deterrent?

Audioboom (LON:BOOM)

Share price: 1.17p (up 12% today, at 08:28)

No. shares: 1,173.3m

Market cap: £13.7m

Audioboom (AIM: BOOM), the leading global podcast company, is pleased to provide an unaudited update for the 13 months to 31 December 2018.

This company has had a dire track record, of heavy losses & cash burn, since it joined AIM through a reverse acquisition, in May 2014.

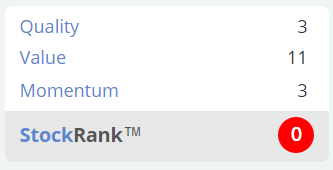

It has a current StockRank of zero;

The reason I'm looking at it today, is because there's an interesting snippet in its latest update, re improving cashflow;

Operating cash flow breakeven achieved in the final three months of the period...

If that's genuine, and the company is now moving into cashflow breakeven, and maybe profit, then I'm happy to suspend disbelief momentarily, and have a closer look.

Looking back at the last interim results (6m to 31 May 2018), shows;

- Revenue £2.6m

- Adjusted EBITDA loss -£2.2m

- Cash £0.3m (with a further £6.0m received after the period end, from placings) = £6.3m

Trading update to 31 Dec 2018 (13 months)

Note that they've changed to dollars;

- Revenue $11.7m - converts at £1 = $1.28 to £9.1m - this shows a large increase from only £2.6m done in H1, so revenue appears to be rising strongly

- Adjusted EBITDA loss of $5.2m or £4.1m. Since the loss was £2.2m in H1, then it appears the run rate of losses has slightly reduced in H2 (note this is a 7 month period), to £1.9m.

- Cash of $1.6m, or £1.25m. This implies that the company burned through just over £5m in the 7 months to 31 Dec 2018. This is not consistent with achieving operating cashflow breakeven, so these numbers don't seem to stack up

Looking back at the interim balance sheet, there seems to be quite a bit in trade creditors - namely deal costs for a large, aborted takeover that Audioboom attempted. So it looks as if some of the cash pile has gone to paying off those creditors. Also a previous RNS notes restructuring costs, which are excluded from the adjusted EBITDA numbers.

My opinion - there's not enough detail in today's announcement to judge whether the company has genuinely reached sustainable breakeven (I'd be very surprised if it has). One quarter's operating cashflow breakeven could be distorted by one-offs, so is not something I would hang my hat on.

The cash is running very low again, so yet another fundraising seems inevitable.

This is the type of jam tomorrow company, where things usually sound a lot better in its trading updates, then they look when you actually get the results statement, with comprehensive figures.

Nevertheless, I'll keep an open mind, and look at the year-end accounts with interest. The rapidly rising revenues look interesting. Although it could be pass-through revenues, for all I know.

Looking back at the guidance given in a trading update on 4 Oct 2018, today's numbers are not very good;

Revenues: guidance on 4 Oct 2018 was $11.5-13.0m. Actual today is $11.7m - near the bottom of the previous range.

Adjusted EBITDA: guidance on 4 Oct 2018 was $4.5-5.5m loss. Actual today is $5.2m loss, so again this is towards the worse end of the range.

Overall then, I'd be very surprised if today's rally in the shares proves to be sustainable. Another fundraising seems highly likely. Hence I'll maintain my stance of steering clear of this share, unless/until it can demonstrate a sustainable, cash generative, business model.

Robinson (LON:RBN)

Share price: 66p (up 1.5% today, at 11:18)

No. shares: 16.6m

Market cap: £11.0m

Robinson plc ("Robinson" or "the Group"; stock code: RBN), the custom manufacturer of plastic and paperboard packaging, today issues the following trading statement, prior to the announcement of its final results for the year ended 31 December 2018, which are scheduled to be released on 21 March 2019.

This is short & sweet!

Revenues are anticipated to be £32.8m for the year, which represents overall a 10% increase on last year with underlying volumes 7% higher. The directors anticipate profits for 2018 will be comfortably in line with market expectations.

Following the previously announced leadership changes, we foresee no change in strategy and will continue to pursue plans for incremental improvement in our bottom line.

Stockopedia is showing broker consensus forecast of £32.2m revenues (so they're £0.6m ahead of that), and 4.8p of normalised EPS. We might therefore be looking at around 5.0p, given the "comfortably in line" comment above?

That gives a 2018 PER of about 13.

Consensus forecast is for a decent increase in EPS in 2019, which seems to be based on expansion capex that the company did in H1 this year. If the 2019 EPS forecast of 6.6p is achieved, then the 2019 PER would drop to 10. That doesn't strike me as cheap, for a company with debt, in a highly competitive sector.

Surplus property - this is what the company said with its last interim results;

The sale of surplus properties in Chesterfield has not progressed materially in the six-month period due to the uncertainties in the retail sector and over-supply of housing land. Current market conditions in this sector of the market are now relatively unattractive which is likely to result in any realisations being beyond the next 12 months.

[NB. published on 22 Aug 2018]

Therefore, it doesn't look as if the surplus property value is anything to get excited about in the short term, but could be a longer term value driver, maybe?

My opinion - I can't see anything exciting here. Packaging must be such a competitive sector, with customers relentlessly squeezing out profit from their suppliers. You can see that from the downward trend in Robinson's profit margin over the last 5-6 years. I know that Robinson innovates with its products, which could give temporary price advantage perhaps, which are then whittled away by competitors.

Looking at the balance sheet & cashflow, it seems a capex-hungry business, with not much of a return being generated from a lot of fixed assets. I prefer capital-light investments, which make high profits from expertise & IP, rather than from factories full of expensive machines.

This share is horrendously illiquid - I've tried to buy in the past, but you can only usually get tiny scraps of stock, and if you stomach a very wide bid:offer spread. So what's the point in getting involved?

I should also mention the high risk of the generous dividend being cut. It was maintained at the interim stage, but the management comments then leave little doubt that a divi cut may well be on the cards in future.

Premier Technical Services (LON:PTSG)

Share price: 153.5p (up 4% today, at 11:57)

No. shares: 123.2m

Market cap: £189.1m

Preamble - This acquisitive group calls itself a "niche specialist service provider" - examples of its work include exterior cleaning & maintenance of high buildings, fire & electrical safety, etc.

I've met management several times, and they come across as very focused on relentlessly driving efficiency & profit margins, giving numerous examples. The idea is that they can acquire businesses which are managed in a more relaxed way, and then improve profit margins.

Management also have big shareholdings, usually a good thing. Although the tightly-held shares mean that liquidity can be poor.

Trading in 2018 - this looks fine;

... its results for the year ended 31 December 2018 are anticipated to be in line with the Board's expectations.

Acquisition - of Trinity Fire & Security - this is quite a big acquisition, relative to the size of the group. The £7.7m acquisition price (net of cash) looks attractively low, and is being funded from the cash remaining from a £20m placing a few months ago.

Stretch targets are included, to self-fund any earn-out payments which are achieved. Good idea.

The run rate of revenues are said to be £40m p.a., and EBITDA of £2.2m. PTSG reckons it can improve both of these, once Trinity is part of the group.

The logic of the acquisition looks good, and the price reasonable. So I can see why the market has reacted favourably to this announcement.

My opinion - the deal-breaker for me, with PTSG, is its balance sheet.

Looking at the last interim results, receivables on the balance sheet were enormous, at £32.2m.

That compares with revenues in the 6 months of £30.2m. Bear in mind that revenues are stated ex-VAT, and receivables inc-VAT. Therefore if we deduct VAT from receivables, it comes down to £26.8m ex-VAT.

Working out debtor days in this case is: £26.8m (receivables net of VAT) divided by £32.2m (revenues also net of VAT), multipled by 182 days (half a year). This works out at 151 days customers take to pay. That's crazy! The UK average is about 60 days.

There could be a complicating factor, involving acquisitions. Any companies acquired during the period would have the balance sheet figures included in full, but only part of the period for P&L figures. I've checked whether that's the case here, and it doesn't appear to be so. A flurry of acquisitions were made in 2017, but they have fed through to a full 6-months inclusion in the 2018 interim numbers, as well as the 30 Jun 2018 balance sheet. So a perfect match.

What I'm struggling with is this - given that PTSG management seems to be so ruthlessly efficient in running the businesses, and squeezing out every drop of efficiency gains (assuming efficiency is, for the sake of argument, a liquid). Then how come they are so nonchalant about customers taking 5 months to pay PTSG's invoices, on average? It doesn't make sense at all to me. Management that drive efficiency, would be expected to have their staff constantly badgering customers to pay, once the 30 day invoice period is crossed. To let customers string things out to 151 days on average, is not credible to my mind.

So, for that reason, if the numbers don't make sense to me, then I won't invest.

Pennant International (LON:PEN)

Share price: 120.5p (down 1.2% today, at market close)

No. shares: 33.7m

Market cap: £40.6m

Pennant International Group plc ("Pennant" or the "Group"), the AIM quoted supplier of integrated training and support solutions, products and services which train and assist operators and maintainers in the defence and regulated civilian sectors, is pleased to provide the following update on the Group's trading for the financial year ended 31 December 2018 ("FY2018").

Trading for 2018 has been in line with expectations.

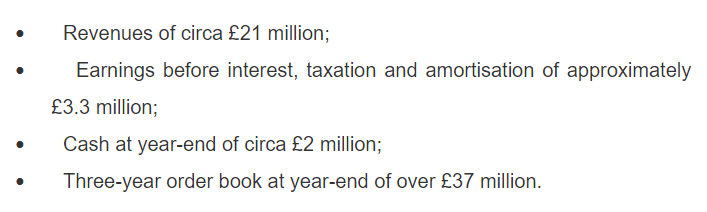

Guidance for 2018 is as follows;

Brexit - no significant exposure.

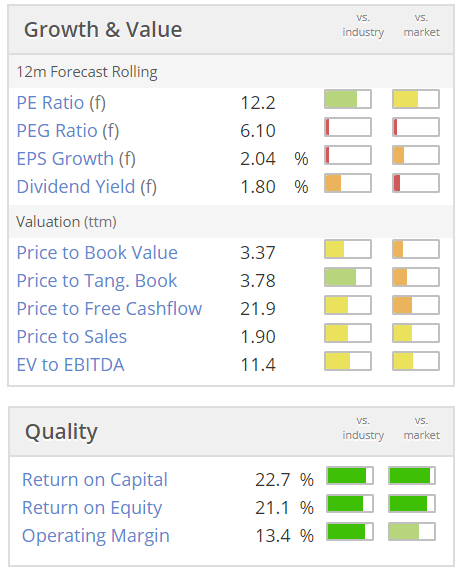

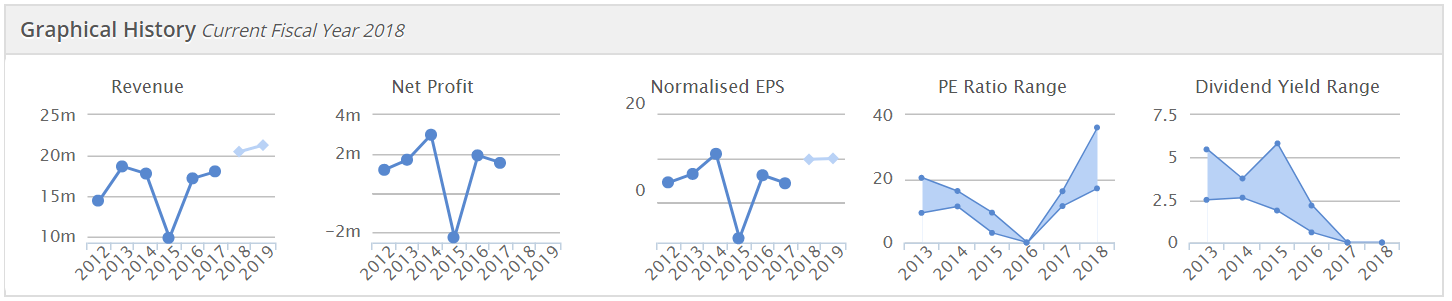

Valuation & my opinion - the quality scores are good. But for a fairly ordinary, small business, I can't see anything to get excited about here;

Dividends fizzled out in 2015, but are forecast to resume this year.

As you can see from the Stockopedia graphs, revenues & profit haven't really gone anywhere in the last 5 years, apart from the one bad year.

It's not clear to me why this company has a stock market listing. It's not really a growth company, and isn't really value either.

The only reason I can find for anyone wanting to own this share, is if you've done deeper research, and believe that the company could out-perform in future.

That's all for today. I'll do a write-up on the £CALL CMD in tomorrow's report.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.