Good morning from Paul & Graham!

Today's report is now finished.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Other mid-morning movers (with news) -

Made Tech (LON:MTEC) - up 32% to 12.25p (£18m) - £19.5m Contract Win - Paul - AMBER

This is another disastrous 2021 float, an IT services group that focuses on the public sector. Even after today’s bounce it’s still c.90% down on the IPO price.

I reviewed its last update on 1/2/2024 which sounded negative about the outlook due to slow order intake. Good to hear today that a large order has been won with the oddly worded Dept for Levelling Up, Housing & Communities (DLUHC). It mentions creating a database & portal of private rental housing.

Paul’s opinion - I had to flag the poor performance last time, with amber/red, although the decent balance sheet gives confidence. H1 results weren’t bad, although note that capitalising costs means cashflow is still negative. If you wanted to have a punt on this share, I wouldn’t try to talk you out of it, due to the solid balance sheet with plenty of cash, and today’s news of a big contract win. So I’ll shift up from amber/red, to AMBER. There could be a recovery trade for a bounce here, possibly? Although I'm still unconvinced about the quality of the business. Contracts like this are competitive tenders usually, and if things go wrong, they don't necessarily make a profit on them.

Revolution Beauty (LON:REVB) - down 8% to 28p (£91m) - Possible legal claim from Chysalis - Paul - RED

Investor Chrysalis issues this attack today -

“...has not been satisfied with the limited responses received from Revolution Beauty and its legal advisers to date, and accordingly the Company issued draft Particulars of Claim to Revolution Beauty on 19 April 2024. The draft Particulars of Claim note a claim of £39m, together with a claim for consequential losses of a further £6.2m. The Company considers that it has a strong case and is willing to pursue it….”

There have been lots of ongoing problems with this company, with both Graham & I being wary. We think it could need an equity fundraise. Auditors suddenly resigned recently. The trading turnaround is not yet convincing either. With this potential legal action further muddying the waters, I’m happy to keep well clear, so for now it’s RED to flag the higher risk. We don’t know what will happen in future, as with everything, so it’s not a prediction.

Aferian (LON:AFRN) - down 30% to 8.75p (£10m) - Trading Update (profit warning) - Paul - BLACK (RED on fundamentals)

CEO stepping down in Oct 2024, after 14 years.

Results for FY 11/2023 are now expected towards lower end of previous range EBITDA $1.6m to $2.6m.

Net debt is a problem - it was $6.1m at Nov 2023 year end, but has since risen to $12.3m at 31/3/2024, reflecting seasonal movements it says. This includes $1.4m owed to major shareholder Kestrel.

Outlook - further deterioration in the core business, so more cost cutting is being done. Now doesn’t see any improvement in trading in FY 11/2024 vs LY. In discussions with bank over renewal of borrowing facilities, set to expire Nov 2024.

Paul's opinion - looks a can of worms, so I’m keeping well clear. Will shareholders be prepared to stump up more cash in an obviously needed future equity raise? De-listing risk also seems high, with 3 dominant shareholders owning over 50%, who might want to take it private to give less prominence to one of their mistakes, and save further costs? RED I’m afraid, but good luck to everyone involved.

Summaries of main sections

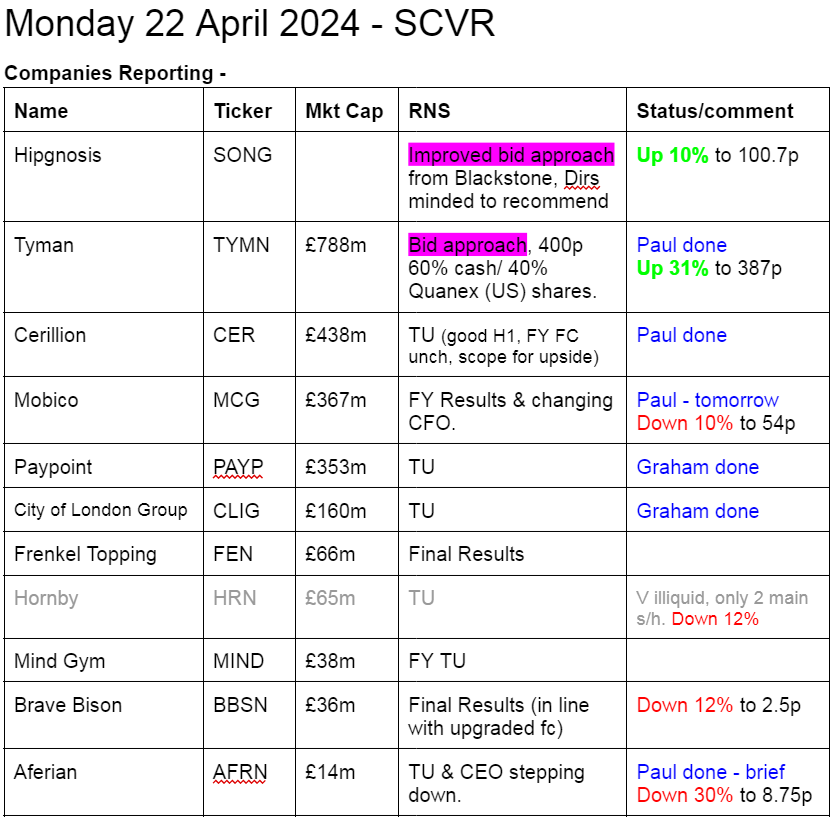

Tyman (LON:TYMN) - up 31% to 387p (£761m) - Recommended Cash & Shares Offer - Paul - PINK (takeover)

Recommended takeover deal from US building supplies group Quanex, which is not a lot larger than Tyman, so this proposal looks as if it will stretch Quanex's finances, and includes it taking on a $750m term loan. Many investors may not want a mix of cash & Quanex shares. Only c.17% support so far, from one institution - Teleios (persistent seller at CARD). I wonder if this deal will be voted through, it doesn't look particularly generous given how cheap TYMN shares are. Hopefully a higher, more credible bidder might emerge? Deals need to be in cash, not a mix of cash & unwanted shares.

PayPoint (LON:PAY) - up 3% to 499.5p (£353m) - Post-close trading update - Graham - GREEN

An “in line” update from Paypoint, which made it onto my best ideas list for 2024. The extra bit of news today is that directors are actively considering a buyback, given their ongoing confidence and PAY’s excellent free cash flow generation. I think the company should be able to comfortably afford this.

Cerillion (LON:CER) - down 4% to 1,435p (£423m) - Trading Update [in line] - Paul - GREEN

Good H1 performance, and FY 9/2024 forecasts are reiterated, and could be beaten I suspect. Plenty of cash. This is such an impressive UK growth company, which seems to be in a positive cycle of winning larger contracts. Not without risk, but I remain a big fan.

City of London Investment (LON:CLIG) - up 4% to 330.5p (£168m) - Trading Update - Graham - AMBER/GREEN

A good Q3 update from this fund manager as it sees strongly positive net inflows. I was previously AMBER here but I agree with Paul that divi yield is attractive. There is no denying that CLIG’s track record when it comes to flows is not bad, even if I struggle to understand the appeal of their strategies.

Paul’s Section:

Tyman (LON:TYMN)

Up 31% to 387p (£761m) - Recommended Cash & Shares Offer - Paul - PINK (takeover)

Tyman supplies building products related to doors and windows.

Directors have agreed a takeover from a US building products group called Quanex Building Products (NYQ:NX)

Price: 240p cash, plus 0.05715 new Quanex shares (worth 160p at Friday’s close - this could change of course, depending on what happens to Quanex’s share price in New York) - so 400p in total.

Dividend of 9.5p in the system will still be paid.

Premium: 35% to Friday’s close.

Reason: increased scale, cost synergies, diversification.

Funding: Quanex isn’t much bigger than Tyman, and is taking out a $750m loan to fund a lot of this deal, together with newly issued paper. This will leave the combined group geared up at 2.1x leverage.

Support from shareholders: the only significant holder mentioned is Teleios (who have been selling continuously in other UK companies, especially Card Factory (LON:CARD) ). Therefore this deal looks to be a mechanism to allow marooned institutions to exit, as we’ve seen with other takeover deals of late.

Paul’s opinion - it’s annoying to see decent UK companies being sold off to the US, mainly to provide a liquidity event for institutional holders. The head of research at Peel Hunt was saying on a podcast with Merryn Somerset-Webb last week that the UK market is 25% undervalued compared with international peers, hence why companies here keep receiving takeover bids. Each cash deal injects liquidity, and the bargains on offer are attracting buyers, hence there’s plenty of money to be made from UK shares. I agree, its a highly attractive market as we’re being offered pound notes for 75p. Then we just have to wait, and Americans offer us £1 to buy them. It’s an absolute gift, why aren’t more investors excited about the opportunities we have on a plate in front of us?! I don’t recall ever seeing such attractive value opportunities in UK shares.

I’m concerned this deal from Quanex doesn’t look too great. 240p cash is nice, but then TYMN investors are lumbered with shares in a US company they don’t really want to own. So that’s bound to cause downward pressure on Quanex’s share price, hence the eventual value of this deal might be well below 400p.

With only 16.7% support so far, almost all from one institution, Teleios, this deal may not be voted through by shareholders, so I wouldnt be surprised to see this deal fail. Hence selling some in the market on the initial spike up today, could be a good strategy maybe? Tyman shares look good value, and pay nice divis, so I’d be tempted to reject the bid, as you should get a 30% uplift in a few months when the economy begins recovering. So not a good deal, in my view.

Cerillion (LON:CER)

Down 4% to 1,435p (£423m) - Trading Update [in line] - Paul - GREEN

One of the growth stars of the UK market, this niche software company (mainly billing software for telcos) has 10-bagged in the last 5 years.

As it’s concise, here’s the main section in full -

Results for the six-months ended 31 March 2024 are expected to set new highs for revenue and adjusted EBITDA. Revenue is expected to be approximately £22.5m (H1 2023: £20.5m) and adjusted EBITDA approximately £10.9m (H1 2023: £9.9m), both 10% higher year-on-year.

Net cash at 31 March 2024 has increased to approximately £26.6m (31 March 2023: £23.6m), providing a very firm underpinning to the Company's strong balance sheet.

The first half performance reflects ongoing strong demand from customers and the trading backdrop remains favourable. Telco digital transformation, the transition to Software-as-a-Service solutions and investment in enterprise software to achieve revenue and efficiency gains remain key features of the market, and consequently the Company's sales pipeline is strong. It includes a number of substantial potential new contracts, which are at various stages of the negotiation process. The Board believes that the Company remains well-placed to meet market expectations for the current financial year and beyond.

Paul’s opinion - I’ve been raving about this company for a while, and the last 3 reviews here have been GREEN. As we always say, it’s expensive, but it just keeps on delivering. Contract wins seem to be moving up the size scale, with each new bigger customer acting as a reference site for more bigger deals in the pipeline. Patience is being rewarded here. I can see a very strong argument for paying up the hefty valuation, and just treating it as a “coffee can” long-term hold type of share.

The main downside risk is that despite SaaS revenues growing, profit is still highly dependent on large up-front licensing wins. So there is a risk that at some point there could be a gap in the contract wins, triggering a spike down (which I would be inclined to consider as a buying opportunity, were this to happen, which it might not of course).

With the strong, cash-rich balance sheet, and down-to-earth owner manager in charge, this remains one of my favourite UK growth companies.

Liberum leaves forecasts unchanged, but hints there might be upside for FY 9/2024, depending on timing of converting pipeline into contracts.

Graham’s Section:

PayPoint (LON:PAY)

Up 3% to 499.5p (£353m) - Post-close trading update - Graham - GREEN

This is a short update for FY March 2024, I can paste almost the entire thing here (emphasis added):

The Group anticipates that underlying EBITDA will be in excess of £80m for FY24, year end net debt below £70m and underlying PBT in line with expectations, as outlined in our Q3 trading update issued on 24 January 2024.

In FY March 2023, PayPoint achieved underlying EBITDA of £61.3m. So the year-on-year growth on that figure will be at least 30%.

The acquisition of Appreciate completed in February 2023, and I expect that it made a meaningful contribution, so it’s important to bear in mind that this 30% growth rate is not organic. Many spectators view Paypoint as being inherently ex-growth!

The update continues:

The strength of this performance, underpinned by sustained strong cash flow and our confidence in the delivery of continued growth and achieving our financial targets, has enabled the Board to now have under active consideration a share buyback programme to further enhance shareholder returns. Details of this will accompany the announcement of PayPoint Plc’s preliminary results for the financial year ended 31 March 2024 on 13 June 2024.

Graham’s view

The Board may feel obliged to disclose this news (that a buyback is being actively considered), but I do prefer it when companies simply announce and start doing their buybacks at the same time, giving the market less time to react!.

After all, one of the attractions of a buyback is that the company has the opportunity to buy its own undervalued shares. So I wouldn’t necessarily want a share price to rise all the way to fair value, before that happens.

So far this morning at least, the Paypoint share price is up by only 3%. So if you’re a believer in this company, it probably still has some way to go, to get to fair value.

Here are the value metrics as of last night:

With excellent cash generation, a buyback should be affordable.

As of September 2023 (see SCVR commentary), the company reported having net debt of £83m. Estimates from Liberum suggest that the company will achieve after-tax adjusted net income of £48m for FY March 2024, rising to £52.6m for FY March 2025.

Most earnings are paid out in the form of a generous dividend yield (c. £25m p.a.), but the remaining profits could still pay for a helpful buyback that would boost EPS for shareholders going forward.

City of London Investment (LON:CLIG)

Up 4% to 330.5p (£168m) - Trading Update - Graham - AMBER/GREEN

A positive headline from this fund manager for its Q3 update (to March 2024):

City of London (LSE: CLIG), a leading specialist asset management group offering a range of institutional and retail products investing primarily in closed-end funds, announces that as at 31 March 2024, FuM were $10.1 billion. This compares with $9.6 billion as at 31 December 2023, an increase of 5.5%.

Thankfully the gain in FuM is not just the result of market movements: we also have positive net flows.

The positive flows are largely thanks to the “International Equity” strategies:

For context, in H1 (six months to December 2023) the company saw net outflows of $294m.

In the previous financial year (FY June 2023), net outflows were $357m.

Performance prior to that was up and down, with some positive years and some negative years.

So I think that net inflows of $224m in the latest Q3 period should be seen as significant - a much improved performance on the most recent prior periods.

Performance: “mixed”. As specialists in investment trusts, they continue to see bargains as trusts generally trade at wide discounts to NAV:

The investment teams continue to find value in the closed-end fund (CEF) universe as discounts remain historically wide across a number of asset classes.

Cost savings: the previously announced $2.5m of annual cost savings “will be fully realised in the next financial year”, i.e. FY June 2025.

Estimates: Robin Savage at Zeus Capital has prepared estimates including adj. PBT of $27.7m for FY June 2024, and adj. PBT of $29m for FY June 2025.

Graham’s view: I was neutral on this when I first looked at it in January. Paul followed up with a somewhat more positive outlook in February.

I remain unsure about the investment case here, perhaps because I’m unsure about the appeal of CLIG’s strategies.

I can understand why investors choose passives, and I can understand why investors choose active funds with a particular niche and a good track record.

But in an environment of fee compression, and as investors increasingly try to remove as many layers of fees as possible, I struggle to understand the appeal of investing in baskets of closed-end funds. I’m sure that this approach offers terrific diversification, but surely it must be expensive, when you consider all of the fees involved? CLIG itself charges about 0.7%.

Their developed markets strategy has delivered a return of 6.79% annually and net of fees over the past 10 years.

This has beaten MSCI’s All Country World Index (excluding the US) over that timeframe, but it says something that they exclude the World’s largest and best-performing stock market from their benchmark.

Their emerging markets strategy has achieved 3.59% annually over this time frame, also beating its benchmark, but this strikes me as a rather low return on an absolute basis given the long 10-year timeframe.

To be absolutely clear, I do not doubt CLIG’s expertise. I simply struggle to understand the appeal of these strategies, given the fees involved and the difficulty of earning a high return. It strikes me as a low-ish risk, low-ish reward type of deal, with more complexity than alternative strategies that could earn a similar return.

On the positive side, I will acknowledge that from the perspective of a CLIG shareholder, the track record in terms of flows hasn’t been too bad, considering the performance of other fund management groups in recent years. And this Q3 result is definitely something to be excited about.

I can’t quite bring myself to give this one the thumbs up. However, since Paul called it “AMBER/GREEN” last time, since I agree that the shares are cheap, and since today’s update was a positive one, I will also go with AMBER/GREEN.

It has been getting consistently cheaper for the past 10 years. With a yield of over 10%, maybe it has reached the bottom?

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.