Good evening/morning, it's Paul here with the preamble for Monday's SCVR.

Estimated timings - it's a quiet news day, so I should be finished by 1pm.

Update at 12:57 - we're mostly done, but I've got 2 more sections to add, so revised finish time now 2pm.

Update at 15:08 - today's report is now finished.

Subscribers seem to like me preparing some general macro thoughts on Sunday evenings, and then feeding it out gradually during the week's SCVRs. I've tried out this idea, and it's worked well for me too, taking off a bit of the pressure on weekday mornings, so let's carry on with that.

PIWorld podcast about corporate bonds

I really enjoy the weekly podcasts or videos from PIWorld. Tamzin has such a natural interviewing style, asking concise, intelligent questions, and letting the interviewee reply without being interrupted.

The most recent interview was fantastic, I enjoyed it immensely. Paul Hawkins gives a masterclass in corporate bonds, and is successful in making potentially dry material very interesting.

I’ve been meaning to branch out into corporate bonds for a while, and this superb podcast explains everything very clearly. Well worth a listen. With stock markets generally so expensive, and lots of downside risk around, it could be a good time to shift some of my portfolio into safe, decent yielding corporate bonds, possibly?

Remember that bondholders rank ahead of equity, so if there is a deep recession, then it's divis that get cut, but bondholders normally get paid interest without fail (unless the company goes bust of course). Hence owning bonds can be a good way to protect capital in a market downturn.

Here’s the link - very highly recommended. Remember I only flag things that I genuinely think are excellent. That link is for the video, but personally I prefer to listen to the audio on podcast on my earphones, so I can go for a brisk walk at the same time.

.

Wirecard

I recall in 2016 seeing a damning shorting dossier on Wirecard, a German finance company. It seemed highly convincing. If I remember correctly, the main accusation was that Wirecard seemed to be facilitating online gambling transactions in countries where such gambling was supposed to be banned. It's a long time ago, so I might have mis-remembered, in which case I'll happily correct this.

The kerfuffle all seemed to die down, and the share price recovered from its spike down. Shorters had no choice but to buy back, tails between legs.

Here we are, 4 years later, and the thing has really blown up, with apparently a huge amount of money having disappeared.

It just goes to show, 2 things;

- Dodgy companies can take years to finally unravel, so for shorters there really needs to be a short-term catalyst. This reminds me of Globo, where I was certain the whole thing was a fraud, explaining precisely why in 29 articles here, but it took several years for the collapse to happen, and me (and other bears) to be proven correct.

- If there’s a bad smell around a company, then there’s usually something wrong. Sooner or later things usually turn sour.

I completely understand why some investors hate these shorting dossiers that are issued from time to time, designed to create maximum mayhem, to enable short sellers to make a profit. But, the track record of many such shorting outfits, can often be pretty good. Also, what is the difference between a shorter publishing his negative research, and brokers publishing almost universally positive research? Which side is being more dishonest? Answers on a postcard please.

If shorters attack a decent company, and cause a short-term spike down in price, then nobody should complain - it’s creating a buying opportunity! As happened with the bungled attacks on Learning Technologies (LON:LTG) and more recently Boohoo (LON:BOO) .

.

The re-opening trade

To a certain extent, I’m getting cold feet about this. As mentioned in last week’s reports, I decided to bank my profits on property REITs Hammerson (LON:HMSO) and Newriver Reit (LON:NRR) . For what it’s worth, I haven’t suddenly gone all bearish on either. I just mulled the situation, and decided it probably isn’t as bullish as I originally thought - so if in doubt, I’d rather sit on the sidelines and give it some further thought. We can always buy back in at any time. Selling half is sometimes a good idea too, if in doubt, I find.

NRR produced an absolutely excellent investor webinar last week, which I covered in detail. I’ve forgiven the subscriber here who fired off an abusive comment to me, without having read my report in full. These things happen, we all have off days, it really doesn’t matter :-) Apologies are always nice, but quite rare. I’ve never understood why people sometimes find it so difficult to say sorry? I find apologies are remarkably effective at resolving my minor misdemeanours from time to time - highly recommended.

Are High Streets coming alive again, now that shops can open again? I’m reading mixed reports. One paper today indicated that footfall was 50% down overall in the UK on prior year. To my mind, that’s not a bad start, considering only some shops have re-opened. None of the cafes/bars/restaurants can open yet (but will do shortly), and that’s a big reason to go into town centres, or rather part of the package for customers. Hence I’m reserving judgement until the week commencing 4 July - that should give us a clearer picture.

What concerns me particularly, is that many smaller shops have not re-opened. Why would they, if they’re getting staff paid on furlough until end October, have a business rates holiday, and landlords can’t currently do anything about unpaid rent? It’s going to cost more to re-open, than to remain closed, at least in the short term.

Restaurants/bars - it seems that the UK Govt could be about to reduce the 2 metre distancing rule/guidelines to 1 metre. There’s been extensive lobbying from the hospitality sector, saying that business would not be viable at the drastically reduced customer numbers needed to keep 2m apart. However, they reckon revenues would be only about 30% down, if this were reduced to 1m - a level where the best operators could perhaps just about breakeven.

I’m not sure this is likely to give the hospitality sector share prices a boost or not, because it’s been widely anticipated already. So likely to be already in the price perhaps? Anyway, time will tell.

.

Re-closures?

I recently listened to a very interesting interview on CNBC with a restaurateur who owned some restaurants in Napa Valley called Gran Electrica.

He explained how his company had re-opened one restaurant for a week, but found it was not viable at 50% reduced revenues. Hence they switched to more of a takeaway model, with some success at plugging the shortfall.

Interestingly he said there was little incentive for staff to come back. They’re paid the same or more to stay at home. Staff asked why they would want to put themselves at risk of catching covid-19 (it’s rising in some US states now), for no extra money? Diners apparently come in wearing masks, but obviously take them off whilst eating.

The company is also experimenting with “private patio parties”.

It seems very clear that restaurants can probably only survive by pivoting to takeaway food, outside dining, and somehow figuring out how to evenly spread business throughout the week, rather than relying on exceptionally busy periods at weekends.

I don’t know what will happen, but the survivors, who innovate, are probably going to end up with a ton more market share. As I’ve seen in previous recessions, it’s often a time of great opportunity, where innovative entrepreneurs start or expand the next wave of successful businesses, and others fall by the wayside.

On the point of re-closures, the market didn’t like Apple indicating that it has decided to close a small number of recently re-opened stores in areas of the USA where covid cases are rising again. I think one was Miami, and a few other places. Florida, Texas, California, and a few other states are reporting quite a big rise in new cases, but not a rise in deaths. Maybe it’d down to more testing, maybe it’s not? Who knows - even the experts seem to disagree.

I feel that few retail/hospitality companies can make a profit with such reduced footfall, so why would then re-open? Some might re-open, then re-close, when they see how heavy the losses are? It’s not clear-cut either way. So all I can say is, I’m watching & listening, and will adjust my view based on the facts. At the moment though, I’m more sceptical than I was.

If we get a breakthrough in treatment, or hopefully a vaccine, then of course everything would be resolved, after a time lag.

.

That's everything from Sunday night. On to Monday's RNS results, trading updates, and fundraisings...

Please see the article header for the 4 shares which have caught my eye with trading updates today.

.

John Menzies (LON:MNZS)

Share price: 158p (up 9% today, at 08:14)

No. shares: 84.3m

Market cap: £133.2m

John Menzies plc, the global aviation services business, today provides an update regarding current trading and its financing position.

Liquidity - says it has enough cash to last into 2021, after cutting costs & getting Govt support. Headroom will peak at £180m towards the end of June, before reducing.

Trading - surprisingly perhaps, it says Q2 to date has been ahead of mgt expectations. However, later in the announcement it says that "very challenging" conditions in Q1 have continued into Q2, with most flights grounded. That sounds contradictory, but seems to be due to cost cutting stripping out more costs than expected. Revenues down 64% below budget.

Bank covenants - "constructive discussions on necessary revisions"

Bad debts - no material bad debts (yet) from airline customers - most of whom are adhering to payment terms.

Outlook - no guidance given, other than to say business is expected to improve from July onwards. Could benefit from market share gains if competitors fail.

Funding position - this sounds encouraging, at least in the short term;

During April and May, the Group has been cash generative as a result of unwinding its working capital and achieving good cash collection from customers, whilst also benefiting from reduced cash costs and the material benefits of government support and payroll schemes. These schemes covering many countries have helped to mitigate a large proportion of our direct payroll costs, the Group's largest cost, accounting for in excess of 60% of our revenue.

That's fine for now, but as business ramps up again, then pressure is going to be felt on working capital again.

Fundraising? I think this is telling us that an equity fundraising is going to be necessary, which is glaringly obvious;

... the Board remains focused on ensuring the Group's financial position continues to be robust in all circumstances and will continue to review all options available as required to achieve this.

My opinion - this looks an awful share to me. It's got a terrible balance sheet (with negative NTAV), is completely dependent on bank debt, and only ekes out a low profit margin in the good times. Serving the aviation industry, it's obviously having a very bad year so far.

In my experience, supportive banks are only supportive because that's in their best interests - i.e. keep the business going with short-term support, in return for an agreement that the company raises equity to plug the gap. Therefore shareholders assume the brace position, because I'd say a big equity fundraising is a virtual certainty. That could mean heavy dilution, which would lead to a high PER (since more shares in issue), and a lower dividend yield.

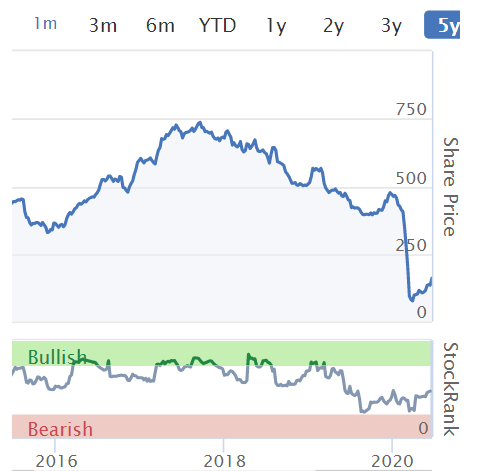

This is a good example of a company which paid out overly generous divis in the good times, leaving it with a weak balance sheet when this downturn hit. The shares get an emphatic thumbs down from me, due to the likelihood of dilution, and no divis for a while. Plus it's really not very profitable even when the aviation sector is busy, so what's the point? Deeply unappealing as a potential investment. Here's the 5-year chart;

.

.

Goodwin (LON:GDWN)

A reader has asked me to look at the "Supply Agreement" (i.e. contract win) announced today, from this engineering company. It's to make metal boxes for nuclear waste.

It sounds very good, and has triggered a 26% share price rise this morning.

Unfortunately, financial details are sparse, and no comment is made on how this affects market expectations (which don't seem to be in issue anyway). I would direct you to broker research, but there doesn't seem to be anything available.

So I cannot take this any further, other than to say it sounds positive, which has been reflected in the share price rise.

.

.

Saga (LON:SAGA)

Share price: 18.8p (up 2% today, at 11:32)

No. shares: 1,122.0m

Market cap: £210.9m

Trading Update (AGM)

Saga plc, the UK's specialist in products and services for people aged 50 and over, announces a trading update for the period from 1 February to 21 June 2020...

I always check our archive here, to see what I've previously written about each company, to quickly refresh my memory. In this case, there's nothing from me in the archive, and just one (year-old) article from Graham. That's probably because Saga has only recently become a small cap (by my definition of sub £400m mkt cap - that's not set in stone, it's just an arbitrary cut-off point I tend to use sometimes).

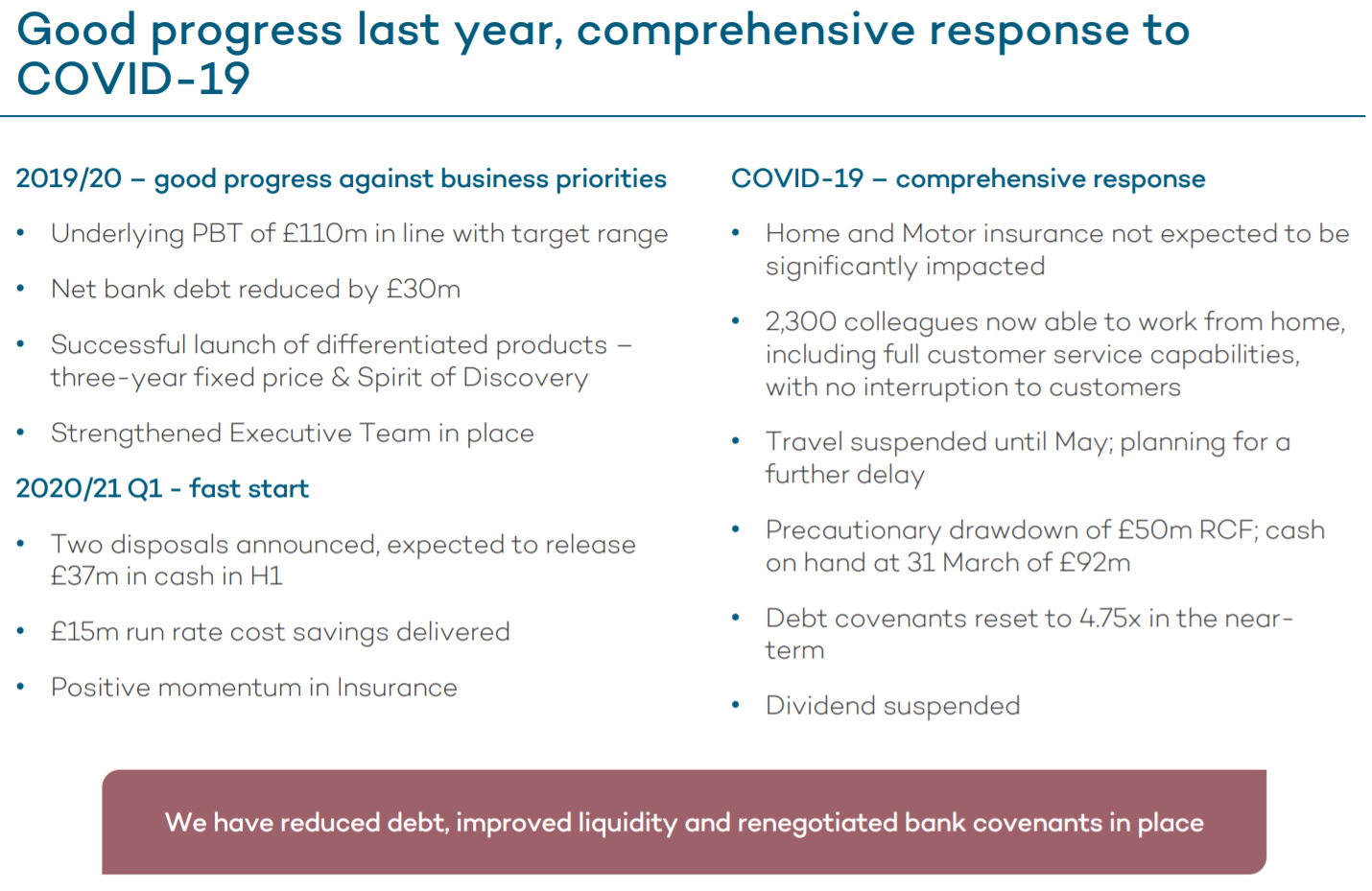

However, I do recall looking into Saga not long ago, to see if it was a recovery play, but didn't get round to writing up my notes unfortunately, sorry about that. It has an unusual 31 January year end. Results for FY 01/2020 are on its website here, including a results presentation, which I'm skimming through now. Slide 3 sets the scene;

.

.

To summarise, this was a highly profitable business pre-covid, but will obviously now be struggling because its travel operations (e.g. cruise ships) are mothballed.

Balance sheet is terrible - NAV is £588.2m, but that turns negative when goodwill is removed, with NTAV of £(247.3m). It's one of these situations where financial engineers came along, decided its income was annuity like, and its negative working capital (feeding off customer deposits) meant that the balance sheet could be geared up. As usual, that's ended up being a disaster. I think the Govt needs to consider making it illegal to excessively gear up balance sheets, since it now turns out there was an implicit taxpayer backstop for many companies which paid out excessive divis & took on too much debt in the good times. One idea I had was to offer differential rates of corporation tax, dependent on financial strength - i.e. lower taxes for the most strongly financed companies. That probably wouldn't work, because people always find a way of gaming the system.

The crux now seems to be whether the company can remain solvent until it's able to resume its cruise ship operations.

Today's update - here are my notes;

insurance business "resilient". Stand-out feature is success of 3-year fixed rate policies.

Covid insurance cover - this is quite surprising. I hope they have re-insured the risks, as this sounds like it could be very costly in the event of a second wave of covid;

The Group continues to innovate its Insurance offering and has announced that treatment abroad for COVID-19 and repatriation to the UK has been included as standard as part of its travel insurance policies for all trips from 1 June. Saga has added the cover to help customers feel more comfortable travelling once the Government advice changes to say that it is safe to do so.

Motor claims "much reduced" as people driving less, due to lockdown.

Travel business still "on pause" since mid-March. Some activities to resume this year. Retentions (presumably this means cash deposits from customers?) "continue to be high". £44m cash returned to customers. Cruise advance receipts higher than expected retained over 70%. New bookings for next year have been very positive.

Disposed of one ship. A new ship is expected to be delivered end Oct.

Healthcare division has been disposed of fully.

Liquidity - "remains strong" it says. Cash is down from £92m at end March, to £30m at end May. That looks rather alarming to me, but is said to be in line with assumptions in stress tests (which scenario though?!). It's mainly due to cash burn in the travel division. A disposal is pending that should raise £23m. Debt holiday & covenant waiver agreed on its two ship borrowing facilities. No divis can be paid to shareholders while this debt is outstanding. There is also an undrawn £50m RCF.

I'm struggling to see how the company can describe this positions as "strong". It looks dicey to me.

Cost-cutting has been done, as you would expect.

Outlook - sounds like there's no immediate crisis, but certainly not a comfortable position;

The Group remains able to resume traveling as soon as restrictions have been removed but has continued to run stress tests based on a wide range of outcomes for the COVID-19 crisis, including a further delay to the resumption of travel until next year. Based on this analysis the Group continues to expect to remain in compliance with key banking covenants at the next two half-yearly testing dates, although further actions may be needed to stay ahead given potential uncertain long-term impacts of COVID-19 on the business and the maturity of bank facilities in May 2022 and May 2023.

My opinion - this is clearly a high risk situation. I'm trying to weigh up whether the upside potential (from a resumption of cruise ships) is enough to risk a possible 100% wipe-out, if things implode. How likely is that to happen?

Overall, I think this is probably too complex for me to want to bet either way on it, My hunch is that the company probably should survive, and will then almost certainly need to do a fresh equity fundraising, thus diluting the upside.

It's either something to have a punt on, as positive news on covid treatment and/or vaccines, would unlock pent-up demand for cruises. The news today on buoyant future bookings shows that customers seem to have an undiminished desire to return to cruise ships.

Must admit, I'm tempted to just dip my toe in with a very small punt on this. I wouldn't want to risk any significant money on it though. I'll give it some more thought. What do readers think? It's either a good recovery share, or a dead duck, I'm just not sure which! Note that there has only be a modest share price recovery so far from the March lows.

.

.

Surface Transforms (LON:SCE)

Share price: 20.6p (flat today, at 13:06)

No. shares: 149.2m

Market cap: £30.7m

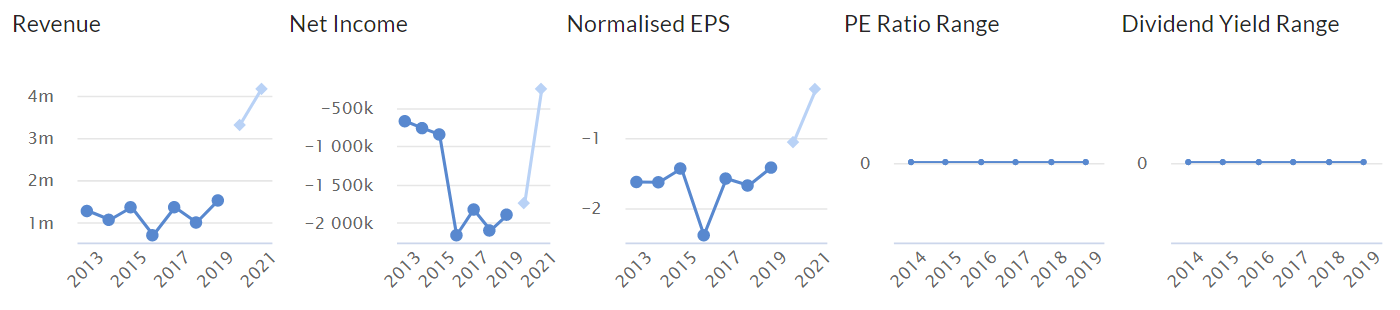

This company makes special brakes for vehicles, and seems to have been around, and promising jam tomorrow, for most of my career. I wonder how much the costs of listing, and Directors remuneration has cost over the last 18 years?

As you can see below, in recent years it has bumped along with £1-2m revenues each year, and losses every year. Forecasts suggest its time might be coming, but they always do. There are no profits or divis, hence the flat lines there.

.

.

Results for FY 12/2019 seem to be more of the same - revenues of £1.45m, and a £1.3m loss after tax (important because that includes the benefit of R&D tax credits).

Is it going to run out of cash? Not imminently, because it boosted cash by £2.25m after fees in a placing/open offer. That adds to the £770k cash as at end Dec 2019.

Operational highlights - this is where it starts to get more interesting. Details are given of some hefty contract wins. These must have been previously announced, as the share price has not moved today. An E11.8m contract with a major German OEM is shown, and a >£5m contract to provide brakes for Koenigsegg - I remember their cars from Top Gear, pretty damn sexy! This new model with SCE brakes looks utterly insane! Here it is. 1,700 bhp - have I read that right?!

It's a hybrid with mainly electric power, but also a 600bhp petrol engine, with 3 cylinders LOL! I'm not making this up.

.

Outlook - it does indeed seem that SCE is finally on track to deliver something like commercial viability;

The Company is still on progress to reach positive Adjusted EBITDA in 2021 and profit before tax in 2022.

My opinion - there's lots of interesting stuff in the commentary today, see the RNS for more details.

I think it looks potentially interesting. The crux here is whether the company can achieve scale, with decent profitability, or not? I would also need to find out what technical advantages the company has, and whether it has patents, etc, on its products, or whether there's a risk of competitors under-cutting them?

Overall, it's possibly worth a closer look maybe?

SCE certainly likes using TLA (three letter abbreviations). There have been delays to SOP (start of production). Anyway I'm off to HSL (have some lunch).

.

Mothercare (LON:MTC)

Share price: 7.38p (down 8% today, at 14:44)

No. shares: 341.7m

Market cap: £25.2m

The UK stores were put into administration last year. It seems to just be the international franchises now.

As set out most recently in our announcement of 30 March 2020, we remain on track to become a profitable international franchise operation, generating revenues through an asset-light model, operating in around 40 international territories.

The big question is whether the international business is viable long-term, or whether it is also doomed to eventual failure? I see that Mothercare's Ireland franchisee recently went bust.

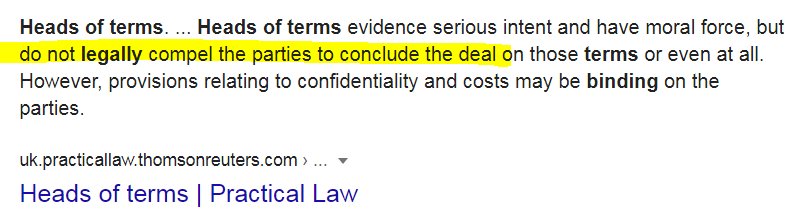

Constructive discussions are ongoing with ourexisting franchise partners (to establish a more sustainable and less capital-intensive business going forward with effect from the A/W20 season) and with Boots (to finalise the contractual arrangements for their appointment as our UK franchise partner as contemplated by the binding heads of terms signed in December 2019).

Are heads of terms actually legally binding? This is what google says on this question;

.

I don't know specifically what the Mothercare-Boots deal says.

Debt - it's looking to refinance, but without issuing new equity. Good luck with that.

Relocating head office to smaller premises, to save money.

Interim CEO is moving on. "At shortlist stage" for recruiting new CEO.

My opinion - neutral. The international business was previously highly profitable, so ditching the failed UK business was a sensible move. My worry is that Mothercare's franchisees may not survive. That could lead to a series of bad debts, and reduced scale.

Probably like many other investors, I just see this business as a relic from the past. So the shares don't interest me at any price really.

That's me done for today! See you tomorrow.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.