Good evening/morning, it's Paul here.

I'll be writing this week's SCVRs, with Graham also chipping in some extra sections on Tuesday.

Book recommendation

I hope everyone enjoyed the wonderful, mild & sunny weather over the weekend. I've been sunbathing on my terrace (in late October, this is madness!) whilst immersed in a great book, "Open Secret", by Stella Rimington, the retired Director General of MI5. It's a fascinating, and at times highly entertaining book - I recommend it to you.

Clothing retailers

This very mild weather won't be helping the embattled clothing retailers though. They really do need a cold snap in Sept/Oct, to get the sales moving of heavy & more expensive winter ranges.

As we know the whole sector is struggling, apart from online-only operators such as ASOS (LON:ASC) and Boohoo (LON:BOO) , both of which have reported excellent trading & growth this year.

Shares in Superdry (LON:SDRY) hit an all-time-high of £20/share in Jan 2018, but have since plunged to only 733p. I had a look at the figures & profit warning last week, and came close to dipping my toe in with an initial purchase. However, a forward PER of only 7.4 tells me that the market is expecting a further downgrade. It does look as if it may have another profit warning in it.

SDRY's profit warning here on 15 Oct 2018, blamed forex hedges, and warm weather for a lowering of profit expectations, saying;

... the summer and autumn to date has seen unseasonably hot weather conditions in the UK, Continental Europe and on the East Coast of the USA. Critically, these conditions have continued through into September and the first half of October and have significantly affected demand for autumn/winter product, particularly sweats and jackets, which account for around 45% of Superdry's annual sales.

The Sunday Times reported that the co-founder, Julian Dunkerton, wants to return to sort out the business, which he sees as on "a completely wrong path". I wonder if there might be some activism in the offing, to oust existing management?

I'll be keeping an eye on this.

(this section was written on Sunday evening)

French Connection (LON:FCCN)

Share price: 58p (up 10% on Friday)

No. shares: 96.4m

Market cap: £55.9m

(at the time of writing, I hold a long position in this share)

Strategic review update - formal sale process

This announcement was issued after hours, at 4:45pm on Friday. I think it's likely to stimulate more interest in the shares in the coming week. The "for sale" sign went up, which I reported here on 8 Oct 2018.

The latest update said;

Since the announcement of 8 October 2018, the Company has commenced preliminary discussions with four interested parties and has had conversations with several other interested parties regarding the Company's plans...

The Takeover Panel has relaxed some of the rules to allow interested parties to remain private.

My opinion - I like the competitive nature of a formal sale process. FCCN received an unsolicited approach from an American bidder last year, but that fell through ( we were not told why). So I imagine they're likely to be back. I speculate that another interested party could be BestSeller, a large European fashion group, which bought Toast from FCCN recently, for a healthy price.

In my view this is a very nice each-way bet. FCCN's own working capital supports most of the market cap. Plus it is on track to move into profit this full year. Plus, it apparently has 3 heavily loss-making shops, which will disappear in the next 2-3 years on lease expiry.

By my calculations, this should mean (together with some cost-cutting), that FCCN could be a £5-10m p.a. profit business in 2-3 years time. Bidders may well have other ideas to focus on developing more lucrative licensing revenues. Plus FCCN's wholesale division is doing well.

The downside risk is that the share price goes too high, and bidding interest comes to nothing. Any business is only worth what someone is prepared to pay for it. Personally, I'm hoping for 100-200p as the final outcome here, but there are a lot of uncertainties. So it's little more than guesswork at this stage, until one or more bidder reveals their hand (or walks away).

Safestyle UK (LON:SFE)

Share price: 73.75p (up 31% today, at 08:34)

No. shares: 82.8m

Market cap: £61.1m

This double-glazing group is today's top percentage riser, hence why it has caught my eye.

If you recall, previously Safestyle had a dispute with some renegade former management, who set up on their own as SafeGlaze. Or, "Pat Butcher's lot", as one witty reader here quipped (because Safeglaze employed the former Eastenders actress Pam St Clement in its TV adverts). Although quite why anyone would be influenced in their home improvement decisions by an actress playing a big-hearted former prostitute, is beyond me.

A very unusual deal is announced today - a 5-year non-compete agreement with Mr M Misra. He will also be providing unspecificed services to Safestyle, and will be handsomely rewarded if targets are met;

Subject to satisfying the strict terms of the agreement the consideration will take the form of an allotment by Safestyle to Mr Misra of four million ordinary shares of 1 pence each in the capital of the Company (conditional on admission to trading on AIM of such shares) (the "Shares") and a payment of cash consideration of between £nil and £2.0 million (the "Cash Fees").Both the allotment of Shares and payment of the Cash Fees, if any, would only be made in Q4 2020.

NB this seems to be an agreement with one individual, and not with Safeglaze as a company. On checking Companies House, Mr Misra resigned as a Director of Safeglaze on 3 Oct 2018.

My opinion - clearly Safestyle regard Mr Misra very highly, to offer him a potentially lucrative deal. Perhaps he's bringing a team of successful salespeople with him? I don't know, that's pure speculation on my part.

It seems a pragmatic solution, to bring back (presumably) high performing staff, with a generous, performance-related pay deal. However, this also reinforces the lack of competitive moat for double-glazing companies. It's pretty easy for anyone to set up in competition, and eat your lunch, if you're making good money in double-glazing.

Safestyle appears to be on the mend, although whether it can get back to its former high levels of profitability, I'm sceptical. After debacles with this share, and with Entu (which went bust), personally I wouldn't touch any double-glazing company share ever again. There's no moat, it's highly cyclical, and often selling practices can be questionable. It's pretty obvious from events here that key staff are not likely to be loyal either - therefore good profits may not be sustainable. That's a fairly horrible combination of features for investors.

As you can see from the 2-year chart below, there were about 6 stages downwards in the collapse from 320p to a low of about 32p a couple of months ago. Anyone who managed to time their purchase at the lows was just lucky, in reality. How can anyone possibly predict at what level a falling knife will bottom out at? They usually bottom out at a level far below what people initially imagine. Hence why I try to avoid falling knives these days, having got so many wrong in the past!

D4T4

Share price: 207.5p (up 6.7% today, at 09:15)

No. shares: 38.1m

Market cap: £79.1m

This company describes itself as being;

specialists in data platform solutions

I've not got the foggiest idea what that is. Something to do with software, I think?

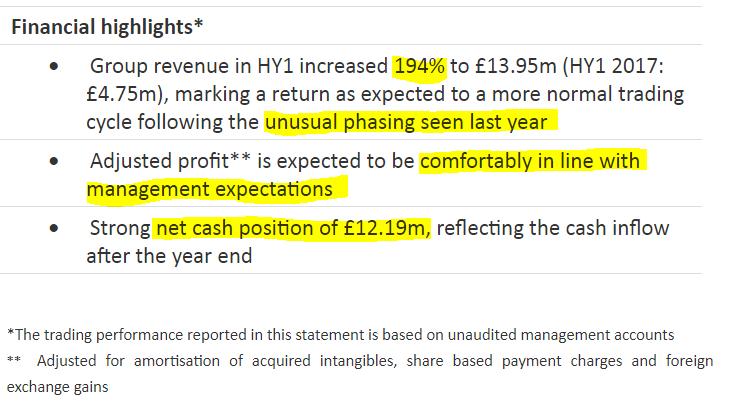

The company has a 31 March year end, so today's update covers H1, to 30 Sept 2018.

This (below) sounds pretty good, slightly above expectations, to translate from PR RNS speak, into plain English!

The net cash position sounds very strong - with it being material compared with the market cap.

Outlook comments are upbeat;

Based on our organic business, recent business wins and the depth and quality of the pipeline we remain confident about our prospects...

...Overall, our business is in a good position and together with a strong pipeline of opportunities makes this an exciting time for the business. Combine these with the people, skill set, and the flexibility to keep moving forward, we remain confident of delivering on management expectations for the financial year."

Valuation - there's an update out this morning from FinnCap, the house broker. The tone suggests that an upgrade could be on the cards, as the company has already achieved 60% of full year forecast revenue.

Adjusted EPS of 11.9p is forecast for this year. With the potential for forecasts to be raised, then we should probably see this as a conservative number. A strong H2 could see it achieve maybe 13-15p EPS? I'm inclined to use that sort of range to value the share, which would imply a PER range of 14-17. I like to use a range of forecasts, since predicting future earnings is imprecise. The probability of forecasts being raised, or lowered, is also a key point to consider with all shares. Things look tilted towards the positive side here.

My opinion - I need to do some more research on what the company's product is, to understand it better.

Performance has been very lumpy in the past, giving rise to a volatile share price. It is also rather illiquid.

On the back of today's update, this share looks to me as if could be worth a closer look perhaps?

Intercede (LON:IGP)

Share price: 26p (unchanged today)

No. shares: 50.5m

Market cap: £13.1m

(at the time of writing, I hold a long position in this share)

I wouldn't normally comment on this type of thing here in the SCVR. However, executive remuneration is a hot topic at the moment. Especially since the appalling greed displayed at Persimmon (LON:PSN) , where the CEO got a £75m bonus - basically for being in the right place, at the right time. A booming housing market, fuelled by Government policy (Help To Buy scheme), resulted in a bonus scheme paying out far more than intended.

This is incredibly damaging for social cohesion, in my view. The major shareholders are to blame. The golden rule for all bonus schemes, is that there has to be a cap, to limit the maximum payout to what is reasonable. Otherwise, unforeseen consequences can kick in.

The obscene Persimmon bonuses, essentially funded via the taxpayer, are even more galling, given that the share price has been practically in freefall lately. So Persimmon is probably the worst recent example of a poorly designed, and inappropriate bonus scheme for Directors.

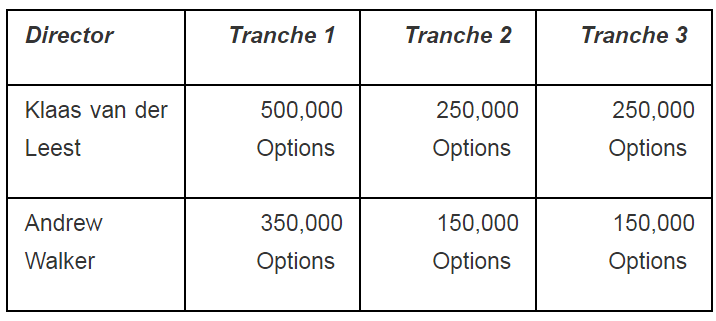

Today I'm highlighting below what to me, is the opposite - a really good incentive/reward scheme for Directors, from Intercede (IGP).

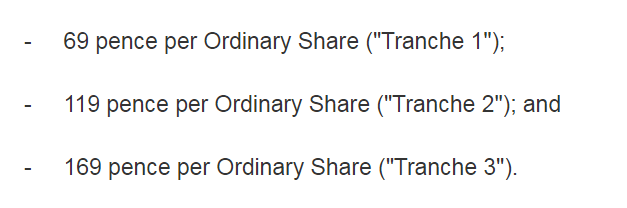

Strike price - Intercede has granted share options to its CEO & CFO, with a strike price of 27p - being roughly in line with the current share price. This is as it should be. Options should reward for creating upside on the share price. Therefore the only fair and reasonable way to do this, is to make the strike price at or above the current share price. Nil cost options, in particular, are appalling - why should management get free shares?!

Long-term - the exercise date should be at least 3 years from now. In this case, the exercsie dates are from 3 to 10 years. This is justified, since it's locking in (hopefully) good management. Therefore the dilution from the options can be justified, as it prevents good management from jumping ship to a competitor.

Stretch targets - this is the bit I really like. Bear in mind that Intercede's share price is currently only 26p. Look at these share price thresholds for the options to kick in;

I'd be delighted if just tranche 1 is achieved. If tranche 2, let alone tranche 3 kick in, then I'll be on my stepladder putting out the bunting, and shouting "champagne for everyone!"

What's interesting is that management must think these share price targets are achievable. Otherwise there would be no point in signing up to this scheme. Although a word of caution, in that this type of scheme can be used as a publicity stunt, to ramp the share price - Elon Musk and Tesla springs to mind as an example.

A more positive example is Geoff Wilding at Victoria (LON:VCP) who has benefited hugely from a similar scheme of stretch targets for the share price. This handed him a large percentage of the company. However, I imagine other shareholders were more than happy with the arrangement, as it enriched all shareholders overall, despite the big dilution.

Funnily enough, I was asked recently by a listed company Director, what sort of management incentive scheme I favoured. My answer was that I like stretch targets for the share price, based around options, set at the current market price. Although such schemes do carry the risk of management doing something reckless, e.g. taking on excessive gearing, to try to achieve a higher share price, and blowing up the company in the process.

Modest dilution - I think there need to be very special circumstances to justify over 10% dilution from share options. Personally, I'm not really happy with potential dilution of over 5%. As in many cases, I see management incentive schemes as being double payment, for just doing their job (that is usually handsomely rewarded already). Do bonus schemes really incentivise & trigger out-performance? I doubt it very much. I think they just tend to pay out randomly, depending on where we are in the economic cycle.

For this reason, if we have to have share option schemes, then I'd like to see them be relatively modest. Intercede ticks this box for me also;

Today's announcement confirms that total potential dilution is still reasonable;

Following this grant, there are a total of 2,062,500 Options outstanding, representing approximately 4.1 per cent. of the current issued share capital of the Company.

Overall then, I think the above points are a good test to decide whether a bonus/share options scheme is reasonable, or whether the Directors simply have their snouts in the trough?

So my key tests for management incentive schemes are;

1. Strike price of options should be at, or above, the current share price

2. Options should reward good long-term performance, and lock in key Directors

3. Vesting should be dependent on achieving stretch targets, ideally based on the share price (with safeguards to prevent management wrecking the balance sheet)

4. Maximum dilution should be modest - ideally no more than 5%. Or, in special cases (where management is genuinely indispensable) then possibly higher

5. There must always be a cap on the maximum possible payout, if a cash bonus scheme is put in place

If readers can think of any other useful points on this topic, then please add a comment below.

A few snippets to finish off with;

Gfinity (LON:GFIN) - diabolical figures are revealed in a trading update for the year ended 30 Jun 2018.

- Revenues of £4.3m (up 82% Y-on-Y)

- Adjusted EBITDA loss of £12.6m! (H1: £7.4m loss, H2: £5.2m loss)

- Cash of £3.7m at 30 Jun 2018, down to £2m as of today.

Good job then that another placing is announced today - to raise £6m (before expenses) at 8p per share. This doesn't look anywhere near enough to be safe, given the high cash burn.

My opinion - it's not a sector I understand. The figures are so bad, and the cash worryingly little (even including the placing today) that this looks extremely high risk to me. Good luck to shareholders, I hope you know what you're doing.

Cerillion (LON:CER) - in line update, for y/e 30 Sep 2018.

Outlook comments are upbeat;

Trading in the second half of the financial year has been very encouraging, well supported by new orders. The Company is advancing with contract negotiations with major potential new customers, and its new business pipeline, including the range and quality of opportunities, remains very positive.

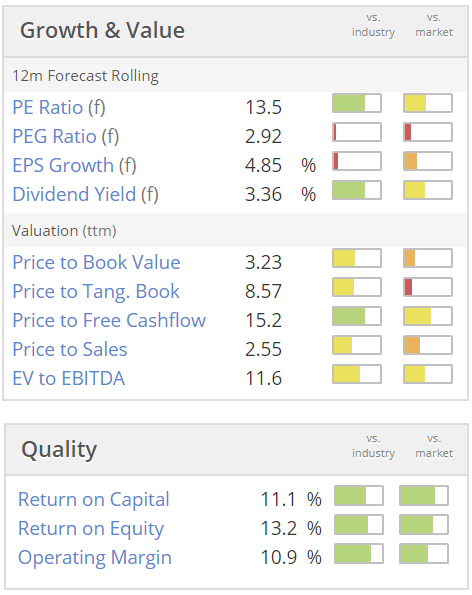

A quick look at the Stockopedia valuation section makes this look good value. I seem to recall that Graham likes or liked this one. Could be worth a closer look perhaps?

CML Microsystems (LON:CML) - trading update for the 6m to 30 Sep 2018.

It's in line with management expectations.

The Board expects to report unaudited half year results comprising Group revenue of £15m, pre-tax profit of approximately £2.3m, and adjusted EBITDA of approximately £5.1m. The Group had net cash of £13.5m at 30 September 2018 following the dividend payment in August.

Like many other small caps, it's come off about 20% from the highs earlier this year.

The valuation looks about right to me (based on the StockReport), but this is not a sector I understand, so I could be wrong!

Croma Security Solutions (LON:CSSG) - cracking figures issued today. The share price is unmoved, probably because the commentary says that the year benefited from some large, exceptional projects that are unlikely to be repeated.

At £15m, it's too small for me - am trying to avoid very small, illiquid stocks, unless it's something absolutely outstanding. The problem is, you can't sell them when you want to, very often, unless it's a tiny position size. With all the political & economic uncertainty out there, I think it's better to stick to more liquid stocks, so that there's an exit route available, if necessary.

OK, all done for today!

See you again in the morning.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.