Good morning! Some updates which have caught my eye:

- Zoo Digital (LON:ZOO) - Trading update. "Confirms guidance for the full year results".

- FairFX (LON:FFX) - Full year results for 2017. New year off to a good start, outlook for 2018 in line with expectations.

- Utilitywise (LON:UTW) - Interim results. "Overall performance" in line with expectations. Anticipates softer H2 in the Enterprise Division thanks to 72% employee attrition rate.

- Safestyle UK (LON:SFE) - Trading update. Competitor activity has intensified. 2018 revenues and underlying PBT to be "significantly below market expectations". Strategic review. Cancels the dividend.

- Lok'n Store (LON:LOK) - Interim results. "Profits and margins continue to grow rapidly." Confident outlook.

- £D4T4 - Year end trading update. Adjusted profit to be slightly ahead of expectations. Confident that it can achieve expectations in the new financial year.

I'm writing this from a hotel room in Central London. The UK Investor Show was good fun on Saturday - congrats to Ed for his talks and to the entire team for a very impressive exhibit!

The value of these conferences is mostly in the networking, I find. But if you do want to investigate a particular company in more detail, it can be helpful to meet or at least to see the management.

For example, I enjoyed listening to the Sosandar (LON:SOS) presentation, which gave me a little bit more insight into their plans and the personalities of their co-CEOs. It's not a share I'll be buying personally in the near-term, but I'm glad to have seen them in person.

The talks are also worth mentioning. If you've been listening to someone online for a while, it's reassuring to confirm that they have a corporeal form, rather than merely existing on the internet.

Zoo Digital (LON:ZOO)

- Share price: 99p (-3%)

- No. of shares: 74 million

- Market cap: £73 million

In general, I try to focus more on results rather than in-line trading updates.

This update confirms guidance, but has been treated as a mini-profit warning by investors.

The company also announced today that it has commissioned some research analysis from Progressive, and will be at Mello later this week. So investors are being given every opportunity to find out more - good news.

For those new to the company: Zoo provides subtitling, dubbing, captioning and distribution services to the entertainment industry, using an army of freelance translators.

I've generally been lukewarm on the stock, failing to understand why its valuation has been so high, and rising.

Today's update confirms numbers we already had: revenues at least $28 million, adjusted EBITDA at least $2.3 million.

So it's strange to see the shares coming off, especially since most of the text in the announcement is very bullish on prospects. More voice actors are being hired and more languages will be offered by the group's localisation services.

One possible negative is that the company is still looking for a new CFO, although the exiting CFO remains in position to ensure an orderly transition. I think that investors have (rightly) become more sensitive to any changes and uncertainty around the CFO role at public companies.

Overall, I continue to fail to understand the valuation attached to this company. I am probably missing something, but my instincts are telling me that the share price reflects the company positioning itself as a "cloud-based" organisation. Investors have been falling over themselves to buy anything cloud-based, so perhaps that is what is happening here.

Looking at the numbers, commissioned forecasts put the shares on a prospective 2019 EV/EBITDA ratio of 33x, and prospective 2019 PE ratio of 81x.

The biggest customer was last reported at 28% of sales - this percentage has come down a lot, but it's still a heavy degree of customer concentration risk.

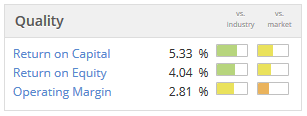

The demand for translation services is growing, and companies can and do benefit from this trend (e.g. £KWS). And yet a growing industry does not necessarily translate into shareholder returns. Zoo Digital (LON:ZOO) quality metrics are below average, which I think reflects the labour intensity of the service.

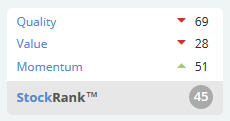

The StockRank is a lukewarm 38. This seems more than fair to me, at the current share price.

FairFX (LON:FFX)

- Share price: 103p (+2%)

- No. of shares: 155.4 million

- Market cap: £160 million

This is an "e-banking and international payments group".

Turnover is in excess of £1.1 billion - we expect big numbers from FX companies. The gross value of transactions is going to be large, with the company taking a small cut out of each deal.

The cut the company takes is very small: revenues were £15.5 million, while adjusted EBITDA fell out at £1 million for the year.

After taking into account acquisition expenses and all other costs, statutory PBT is £230k.

FairFX describes itself as a "challenger brand", offering a better user experience to individuals and to businesses than the banks and other alternatives.

It has been growing headcount, making acquisitions and building its infrastructure. The investment thesis likely rests on its ability to grow revenues while controlling its fixed costs from now on. This is what it's aiming for:

The Company is therefore optimally geared to take further advantage of top line growth by enjoying the economies of scale on payment processing that comes with higher transaction volume without significant increase in overheads.

Footnotes are extremely long and detailed, and I don't have the time to go through them in detail this morning.

I do think this is worth putting in the "interesting / do more research" category. Important-sounding developments are taking place, in particular the new permission from Mastercard to issue its own cards.

FairFX is too early in its development to have shown good returns on capital, but I'm curious to discover whether the business model might be capable of doing this in future. An initial inspection of forecast earnings for 2018 suggests that it might be.

I don't own either of these, but I might mention in passing that both Visa (US:V) and Mastercard (US:MA) look like spectacularly good companies to me. Their shares offer a simple first step to gain exposure to the ongoing growth in the payments industry worldwide.

Utilitywise (LON:UTW)

- Share price: 29.8p (+7%)

- No. of shares: 78.5 million

- Market cap: £23 million

This describes itself as "a leading independent utility cost management consultancy". In simple terms, it helps businesses to switch utility provider.

Its accounts have had to be completely redrawn, as the old accounting methods were deemed inappropriate not just for the new IFRS 15 standard, but for the old standards, too. This led to the shares being suspended for February and most of March.

I deliberately avoided studying the company until this year, aware that it was dripping in red flags.

Now that its accounts have been redrawn, let's take a fresh look.

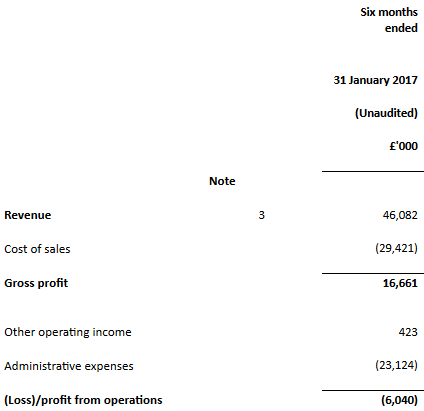

I've pulled open the equivalent H1 report from last year (the results to January 2017), and I note that the 2016 H1 results had to be restated then, too. What a mess!

Let's focus only on the 2017 H1 results for a moment.

These were originally reported as follows:

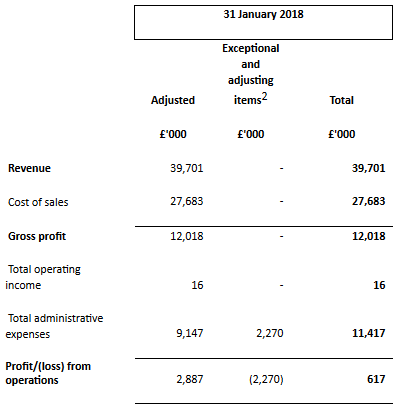

Today, they are restated as follows.

- Revenues: £38.4 million

- Gross profit £9.6 million

- Loss from operations: £13.2 million

The 2018 H1 result is much better. The gross profit improves to £12 million and there's a small operating profit:

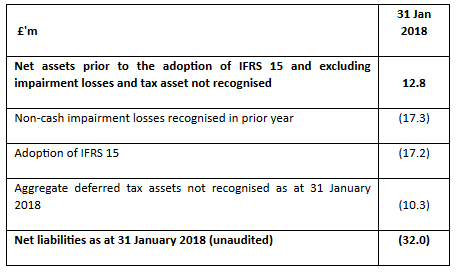

Scrolling down to the latest balance sheet, it remains more worrying than comforting. It has net liabilities of £32 million, so the company is equivalent to a homeowner in negative equity.

The transition from reported net assets to reported net liabilities is shown as follows:

This means £17.3 million of intangibles have been recognised as worthless, £17.2 million of revenue had been recognised too soon, and £10.3 million of taxes to be avoided in future have also been eliminated from the balance sheet.

The balance sheet, even after these adjustments, still holds £17 million in goodwill and intangible assets, and £15.4 million in accrued revenue.

If we apply a tangible asset value test, and deduct the goodwill and intangibles, then UTW has net liabilities of £49 million. Gross loans and borrowings amount to £27 million.

It is also disclosed that the attrition rate for the company's "Energy Consultants" jumped to 72% for the year to January 2018, compared to 59% for the previous twelve months, as employees were anxious about the prospects for the company while its shares were suspended.

I've seen enough, and don't want to investigate this any further.

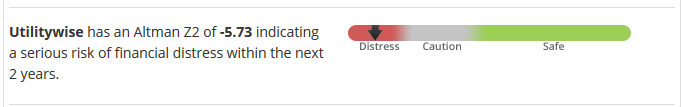

Stocko helpfully offers the Z-Score:

It attempts to entice investors by associating itself with "Internet of Things" technology. Bargepole material.

Safestyle UK (LON:SFE)

- Share price: 62.25p (-22%)

- No. of shares: 83 million

- Market cap: £52 million

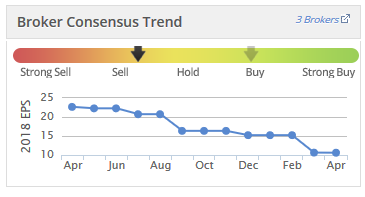

The fortunes of this windows and doors retailer have been waning for some time:

Today brings yet another profit warning.

The problem is that competition remains very aggressive, as an unnamed new entrant is doorstepping customers ahead of Safestyle and taking a bit out of its market share.

Paul correctly identified this news as a "bad" profit warning, when it was first announced, i.e. not a problem which could easily be fixed, and could lead to a permanent reduction in profitability.

This is now in full-on turnaround mode. The dividend has been cancelled today and the Chairman has resigned.

At least the balance sheet is not that bad. At December 2017, it had net assets (including intangibles) of £41 million. If you cautiously remove the value of all non-current assets, you are left with Net Current Asset Value (NCAV) of almost £4 million. That's not a huge buffer by any means, but it could be worse. The company should have a bit of time to remedy things.

Personally, I'm not tempted to get involved yet, because I still think we have a way to go before we reach "peak gloom" among investors, which is when I'd consider buying very cyclical stocks such as this one. As I said the last time I covered it: we aren't even in a recession yet!

The other thing is that I'd rather buy shares in companies which are winning market share, rather than losing it. While I'd have thought that Safestyle should be able to match its competitor's offers before too long, this will be at a materially lower level of profitability than it is used to. And it's beyond my ability to figure out what the new level of profitability might be.

If you can figure out where pricing and profitability might stabilise, then it could be worth a punt.

I usually place a lot of importance on Quality and Value, but in this case I respect the Momentum factor:

Lok'n Store (LON:LOK)

- Share price: 406p (-1%)

- No. of shares: 29.4 million

- Market cap: £119 million

This is a self-storage company competing with the likes of Safestore Holdings (LON:SAFE).

I like this entire sector, because I think that demand growth will be with us for a long time as population density becomes heavier and heavier.

On the other hand, we can't forget that this is a piece of the real estate industry, so we shouldn't expect extraordinarily high returns. What I do think we can look forward to are returns which beat the property market as a whole.

When I covered this company for the first time in February, I suggested that it hadn't borrowed enough! When rents and returns are reasonably predictable, then I'm happy with debt being a material percentage of the balance sheet.

Only a few weeks later, the company announced an increase in its banking facility by an additional £10 million. Great news, in my view. Interest is charged at a maximum of 1.65% above LIBOR, with the exact amount determined by a loan-to-value covenant test.

The company's loan-to-value ratio (LTV) finished last year at just 14%, which looked too low to me, compared to what the company could prudently carry.

Today, the company reports an LTV of 16.8% as of January, before the extension of its bank facility. 16.8% is still very conservative, in my book.

Adjusted NAV per shares increases by 8% year-on-year to 418p, a solid return and better than what you would normally expect from real estate. It is particularly impressive when you consider the very limited use of debt.

Performance metrics have strengthened, with pricing and occupancy both up on a like-for-like basis. There is still a lot of spare capacity, as occupancy is just 66% of the "current lettable area".

Looking ahead, 26% growth in overall space is planned in the current pipeline.

Scrolling through the report, I note that if you include a deferred tax provision, adjusted NAV per share falls to 352p. So on this basis, at 406p, the company is trading at a premium, not a discount to NAV. That makes more sense to me, given its positive prospects.

Even at that sort of premium to adjusted NAV, I think this could be worth a look, if you're satisfied by real estate-type returns.

£D4T4

- Share price: 143p (-8%)

- No. of shares: 38 million

- Market cap: £55 million

D4T4 Solutions is a contract-driven data management company (the name has apparently been chosen because "4" looks a bit like the letter "a"!)

I'm bringing fresh eyes to this, as it's not one that I've covered before.

Looking through the archives, I see that it had a very poor H1 2018, and that this has been followed by a strong H2, so that the overall annual result for the year ending March 2018 should be ok. According to broker estimates, the revenue split for FY 2018 is 25/75 between H1 and H2.

The same broker has reduced revenue forecasts for FY 2019 by 10% to £23 million, but leaves adjusted PBT forecasts unchanged at £5.3 million.

The statement itself is confident that business is going well:

We remain confident in the Group's strategy; our underlying business is delivering against our key KPIs and is performing well and D4t4 is well-positioned in its key markets. The current revenue visibility, order book and pipeline of opportunities bodes well for the future.This is another "SaaS" company, and I agree with those who suggest that it is cheap relative to its peers. However, I think SaaS as a whole is in a bit of a bubble! So the D4T4 valuation might be about right.

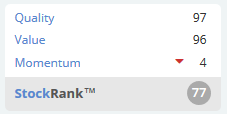

The algorithms agree that it is fairly valued:

All done for today! Thanks for dropping by.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.