Good morning!

News releases are beginning to die down, as we head deeper into holiday season.

Indeed, those companies which issue things like their annual report on New Year's Eve, might be interpreted as not wishing very many people to read it! Or perhaps they are disorganised, and need six months to get their numbers ready (assuming their financial year ends in June).

Some things I've noticed today:

- Cenkos Securities (LON:CNKS)

- Nichols (LON:NICL)

- Minds Machines (LON:MMX)

- Zoetic International (LON:ZOE)

- Fulcrum Utility Services (LON:FCRM)

- Harwood Wealth Management (LON:HW.)

There is also a lot happening with NMC Health (LON:NMC), where the short-seller Carson Block ("Muddy Waters") launched a bear raid last week.

Timings: planning to wrap this up by 2pm. Finished at 2.30pm.

Cenkos Securities (LON:CNKS)

- Share price: 47.5p (+7%)

- No. of shares: 57 million

- Market cap: £27 million

"You learn something new every day" - today I learned that Cenkos is named after Andrew Stewart's first horse.

Andrew Stewart is the man who is also responsible for the naming of the old stockbroker Collins Stewart (later bought out by Canaccord Genuity).

Stewart is one of the founder shareholders of Cenkos. He returns to the shareholder register today with a 7.4% stake (4.2 million shares).

Prior to this news, he did not have a notifiable stake.

I've mentioned a few times (e.g. in September) that Cenkos is "cheap", since it has net assets of £26 million (mostly consisting of cash and liquid financial assets) and the market cap has only been around this level.

It reported a small H1 loss, but this doesn't detract too much from the very long track record of profitability - it has traditionally been very good at linking pay to profitability, so that staff can share in the misery when business is quiet (conversely, they do extremely well when business is good).

Cenkos returned to its traditions with the reappointment this year of Jim Durkin as CEO. He is another founder shareholder of Cenkos who was previously at Collins Stewart.

I have a little bit of dry powder in the portfolio at the moment, and it's tempting to get back into Cenkos with it. But it doesn't fit the investment style that I'm pursuing, so I will leave it for others.

Those who might be interested in this are investors of a Contrarian mindset. Stocko correctly identifies this as the category Cenkos falls into at present: it's got plenty of value and some quality characteristics, but the share price has been weak for around 5 years now.

Mr Stewart has invested nearly £2 million into the business at this level and is effectively "calling the bottom".

I tend to agree that the share price should not fall much lower than its net asset value, since losses under Jim Durkin should be rare or very small, barring exceptional circumstances. At the interim results, the pipeline for 2020 was said to be "encouraging".

If you're looking for old-school value, and are aware of the extremely lumpy and cyclical nature of underlying revenues in the investment banking business, then this share might be worth a second look.

Nichols (LON:NICL)

- Share price: 1415p (-17%)

- No. of shares: 37 million

- Market cap: £522 million

Slightly too big for a small-cap report, but I have this company permanently on my watchlist for a possible buying opportunity. It makes Vimto and other drinks.

2019 will be in line with expectations, sales up 4%.

2020, on the other hand, will (probably) be materially below expectations.

Saudi and the UAE have implemented (since December 1st) a 50% tax on pretty much all sweetened drinks, whether the sweetening is done by sugar or through artificial means. Nichols says that "product reformulation is not an option" (unlike the UK sugar tax).

Whilst it is difficult to estimate the future effect on sales volumes of the Vimto brand in these regions, at this point in time, we have to assume the increased retail price will have a negative impact from 2020. In order to mitigate the impact, we are currently developing plans in collaboration with our long term in-market partner which will require increased investment in the Vimto brand to maintain its strong market position.

The company reports that annual sales of drink concentrate to Saudi/UAE are c. £7 million.

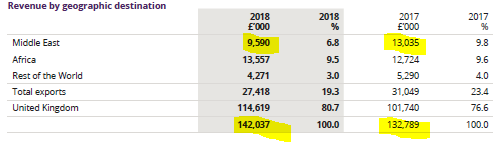

To help us out a bit, I've managed to extract the following from the 2018 annual report, showing where Nichols generates its revenues:

As you can see, Middle East sales are a small proportion of the total.

2018 was a troubled year for the region, so that sales were much lower compared to 2017.

For 2019, total Group sales are forecast to be £150 million. At £7 million, the Saudi/UAE sales are less than 5% of that. So why is the share price down 17%?

The substantial fall in the Nichols share price this morning could reflect a number of things:

- fear that a tax of this nature could be rolled out to other jurisdictions

- perhaps the Middle East sales are higher-margin, or there was a very strong Ramadan-associated growth opportunity in the region, which has now been lost?

- it could be a realisation that the Nichols share price was overcooked at a PER of 22x

- it could be an over-reaction

- maybe you can think of other explanations?

The Nichols P/E multiple might now in the region of 20x, on a forward basis. Group EPS was supposed to grow by over 5% in 2020, but we could assume instead that it will remain flat at c. 70p-72p (2018/2019 levels).

(Edit: this might be too optimistic, since the Middle East operation could be loss-making in the short-term, while Nichols responds to the new tax.)

I'm tempted to pick up a few of these. The share price is back at levels it first reached in mid-2015 - perhaps it has finally grown into its valuation, with the help of this profit warning?

Minds Machines (LON:MMX)

- Share price: 6.9p (+2%)

- No. of shares: 919 million

- Market cap: £63 million

Settlement of onerous contract

A short update from this owner of internet "top-level domains". It confirms that a previous annoyance has been dealt with, as expected, and the company has "continued to trade well in Q4" (which I guess means roughly in line with expectations).

It's an internet registry, not a registrar - the registrar is the customer-facing company from whom you buy an internet address. The registrar then enters your ownership at the registry, i.e. at MMX.

I think it should be possible to make a lot of money from this business. Recurring revenues are generated every year by businesses which renew their ownership. The TLDs owned by MMX include .london, .boston, .fit, .yoga, .work and many more.

This one stays on the watchlist, too.

Zoetic International (LON:ZOE)

- Share price: 5.9p (-8%)

- No. of shares: 148 million

- Market cap: £9 million

This is "the only vertically integrated CBD company listed on the London Stock Exchange". It has two brands: Zoetic and Chill.

It was previously an oil and gas company, Highlands Natural Resources, and it still has a natural resources division. This division is up for sale.

The CBD (cannabis) operations are quite new, and are probably some time away from profitability.

It looks to me as if more funds are needed. The company ended the H1 period with cash of just £1 million, after making an operating loss of £1.7 million.

The CEO says that he is focused on cost-cutting, which will help, but I still expect that more equity will be raised. The company has arranged a listing in the US, where cannabis-related stocks are booming, and it will be working hard on investor relations over there:

Away from our business operations, we also successfully began trading on the OTC in New York in November this year, being the first London-listed CBD company to do so, and our investor relations activities now include the United States as well as the UK. Given the size of that investor community, this will take time to develop, but our plans for 2020 include greater dissemination of announcements in the US, specialist public relations and investor relations support, virtual investor conferences and attendance at investor shows. By trading on the OTC, we have given ourselves a platform and the onus is now on us to use it effectively.

I suspect that they have little choice but to promote the stock, as otherwise they won't have the funds needed to grow or perhaps even to survive.

My bargepole will not be touching this, for the time being.

Fulcrum Utility Services (LON:FCRM)

- Share price: 25.1p (-9%)

- No. of shares: 222 million

- Market cap: £56 million

Sale of domestic customer gas connection assets

Fulcrum, the UK's market leading independent multi-utility infrastructure and services provider, today announces its interim results for the six-month period ended 30 September 2019.

This is very complicated.

We have a business with many different parts and different services that it provides, selling off a large piece of itself in a rather complicated deal.

Annoyingly, the bit that is being sold off isn't treated separately as "discontinued operations" in today's interim results.

The net consideration from the sale is expected to be £33 million, after deducting future project costs from the total sale price of £46 million.

The price tag suggests that the assets being sold - pipelines and other equipment to do with domestic gas connections - are a very substantial part of Fulcrum's entire business.

Net proceeds from the sale, after professional fees and transaction costs, will be £32 million. Of this, £17 million will be paid upfront, and the rest will be paid in stages.

Some more numbers which might be useful: the book value of the existing assets being sold is £19 million, and they generated PBT of £0.5 million last year.

What's left

Following the Sale and excluding assets forming part of the Sale but yet to be transferred, Fulcrum retains a portfolio of approximately 6,500 I&C connection assets, a small number of domestic connections which form part of mixed networks and a small portfolio of electrical connections.

(I&C = industrial and commercial.)

Using the proceeds

The company's plans for what it will do with the disposal proceeds don't strike me as exciting, but I guess paying off its debts is important.

It will:

- repay existing borrowings of £12 million

- meet working capital requirements

- have a share buyback programme for £4 million (I agree with the reader who thinks this is very small in the context)

- focus on the industrial and commercial segment: designing, building and adding I&C assets.

Outlook - profit warning

At the end of the interim results statement, the outlook statement includes a profit warning:

...given the difficult trading conditions experienced in H1, offset by the improvement in activity experienced in Q3, the Board now expects that Adjusted EBITDA for FY 2019/20 will be approximately £5 million.

According to forecasts I can see, EBITDA was supposed to be £7 million this year.

No CEO

The previous CEO left the company during H1, and the Chairman is acting as CEO for the time being.

My view

Apart from the fact that its solvency is assured, I can see few attractions to this share.

Harwood Wealth Management (LON:HW.)

- Share price: 141.25p (-10%)

- No. of shares: 62.5 million

- Market cap: £88 million

Recommended cash acquisition of Harwood Wealth

Funds controlled by Carlyle are bidding 145p for all of the shares in Harwood Wealth.

In case it's not obvious, this is a discount to yesterday's share price. But 68.7% of Harwood shares are going to vote in favour of the deal.

Investors who don't want to cash out may be able to hold unlisted shares in Carlyle's holding company. Not many stock market investors like to do that sort of thing, since it means holding completely illiquid stock.

The Board of HW makes the following argument:

The Harwood Board believes that the Acquisition represents an opportunity for Harwood Shareholders to realise an immediate and attractive cash sum for all of their Harwood Shares in the context of the challenging market environment for organic growth, upward pressure on costs, the need for further funding to support ongoing acquisitions, as well as investment in the cost base, and the desire of certain major Harwood Shareholders, including senior management and their connected persons, representing approximately 68.7 per cent. of the share capital of Harwood, to sell some or all of their Harwood Shares.

Additionally, the Chairman points out that Harwood listed in March 2016 at just 81p. Those who invested around the time of the IPO have done fine.

My view - this looks like a done deal. If I held this today, I would keep holding on for a few extra percentage points, until I got taken out at 145p.

Gambling

I note the announcement by GAN (LON:GAN), welcoming a new Michigan law that "includes provisions for the legalization of full real money Internet casino gaming in the State of Michigan as well as Internet sports betting".

GAN shares are up 8% and 888 (in which I have a long position) is up 3%.

Things might finally be looking up in this sector, for those companies which are active in the US.

That's it for today, thanks for dropping by.

Schedule:

I'll be back again tomorrow (Tuesday). Please note that markets close at 12.30pm on Christmas Eve.

There will be no SCVR on Christmas Day (Wednesday) or Boxing Day/St. Stephen's Day (Thursday). Paul will then take care of you for the rest of the holiday season.

Cheers!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.