Good morning! It's Paul here with the SCVR for Monday.

Today's report is now finished.

It's very quiet for small caps results/trading updates today. I've got family visiting, so want to get this week's reports out of the way by lunchtime at the latest, hence would prefer no reader requests this week, if possible!

Here's today's agenda;

Up Global Sourcing Holdings (LON:UPGS) - repaying Govt funds

Clipper Logistics (LON:CLG) - results FY 04/2020

Studio Retail (LON:STU) - results 52 weeks ended 27 March 2020

Motorpoint (LON:MOTR) - trading update

.

Up Global Sourcing Holdings (LON:UPGS)

As covered here previously, this product sourcing company has traded well throughout the covid crisis. I last covered it here on 6 July 2020, being impressed with its update.

Today it announces;

Return of Government furlough funds

An unusual announcement today;

Ultimate Products, the owner, manager, designer and developer of an extensive range of value-focused consumer goods brands, announces that it has taken the decision to repay the £465,237 that it has received under the Coronavirus Job Retention Scheme ('furlough scheme') and does not intend to make any further claims under the furlough scheme or for the associated Job Retention Bonus.

The Group is also no longer utilising the Government Time to Pay and VAT deferral schemes. All VAT and PAYE payments are up to date as at 31 July 2020.

These payments are possible because the Group's profitability and cash generation have been stronger than expected during this crisis....

... Returning this money to the taxpayer is therefore the right and proper thing for us to do.

.

I salute their sentiments, but do wonder if there's more to it than that? I've not looked into the finer detail of Govt support schemes, so am wondering if any readers know whether companies have to demonstrate that covid/lockdown has caused them financial hardship, in order to be eligible for these schemes? Particularly for a listed company, if they're putting out positive trading updates, then I would hope HMRC would push back against any requests for deferral of taxes.

Separately, but on the same topic, there are articles in today's papers saying that research from Oxford, Cambridge, and Zurich Universities suggests that a staggering 6 million people continued to work (an average of 15 hours per week) whilst on furlough. That's about two thirds of people funded by the taxpayer scheme, which was meant to prohibit working whilst on the scheme, until amended later on, to allow some work.

I've no idea whether this could be a factor in companies returning furlough monies, but it would be very easy for HMRC to ask to see email records, and then demonstrate that people were working, when they shouldn't have been. It does seem crazy having a Govt scheme that actively tries to make people idle, but I understand the reasons it was brought in as a temporary way to prevent unemployment. The unintended consequences seem to have been problematic though.

Maybe we'll see more companies return furlough monies? A friend's small business received a Govt grant, and is not sure if they are entitled to it. They're having a huge internal row about whether to give the money back or not, and asked my opinion. I said that, in their position, I would segregate the money into a separate bank account, then write to the body that awarded the grant, asking for written confirmation that the recipient is entitled to keep the money, describing the business, its activities, and any other relevant facts & figures.

.

Clarification re Up Global Sourcing Holdings (LON:UPGS)

An adviser to UPGS contacted me, to say that the company was very upset about the above commentary. I reported on UPGS's RNS stating that they have decided to return the Govt furlough monies. In the same section, I reported on another item on my agenda, an article in the Telegraph about research saying that furloughed staff had widely been working from home, part time, in the UK generally, during April & May.

On reflection, I shouldn't have put these two items together, in the same section, as that led UPGS to misunderstand, and think I was linking the issues, or implying wrongdoing on their part. That certainly wasn't my intention, at the time it just seemed to make sense to put the one subject in a single section. I thought my use of the word "Separately...." made it clear that I wasn't linking UPGS to the Telegraph article.

On reflection, this was a mistake on my part, and I can understand their point of view, so am happy to give an unreserved apology for any offence caused. If I'm wrong, am happy to admit it, and apologise, so this has not been forced out of me, it's a genuine apology from me, as I can see why UPGS took offence, even though it was unintentional on my part. As stated above, UPGS has traded strongly, and I have been very impressed with its resilience & financial performance throughout covid.

UPGS is adamant that it's returning the furlough monies because this is the right thing to do, and out of a sense of civic responsibility, so I am happy to pass that message on to readers here.

Clipper Logistics (LON:CLG)

Share price: 392p (up 6% at 09:52)

No. shares: 101.7m

Market cap: £398.7m

One of the increasingly popular PR summaries has been added at the top of this announcement:

An excellent year leading to record results; strong momentum throughout COVID-19

I can't decide whether I like those summary comments or not! On balance, they're probably useful for companies which have a track record of telling it how it is, and best ignored for rampy/speculative companies.

Clipper Logistics plc ... a leading provider of value-added logistics solutions, e-fulfilment and returns management services, is pleased to announce its Full Year Results for the year ended 30 April 2020.

EPS is up 20.5% to 15.9p - a good result, but that gives us a hefty PER of 24.7

Adjusted EPS is disclosed further down, and is more relevant as it removes amortisation of intangibles and is a bit higher at 16.6p (up 16.9% vs LY), a PER of 23.6

Dividends total 9.7p for the year (flat vs LY) for a yield of 2.5%

Current trading is strong;

... the Group has experienced a very positive start to the new financial year, with exceptionally high levels of demand for its e-fulfilment and returns management services in particular.

Consequently, the Board anticipates that the Group's results for the year ending 30 April 2021 will comfortably exceed market expectations.

It's a pity they forgot to include a footnote to tell us what market expectations are, which is best practice, and is being increasingly disclosed by many companies.

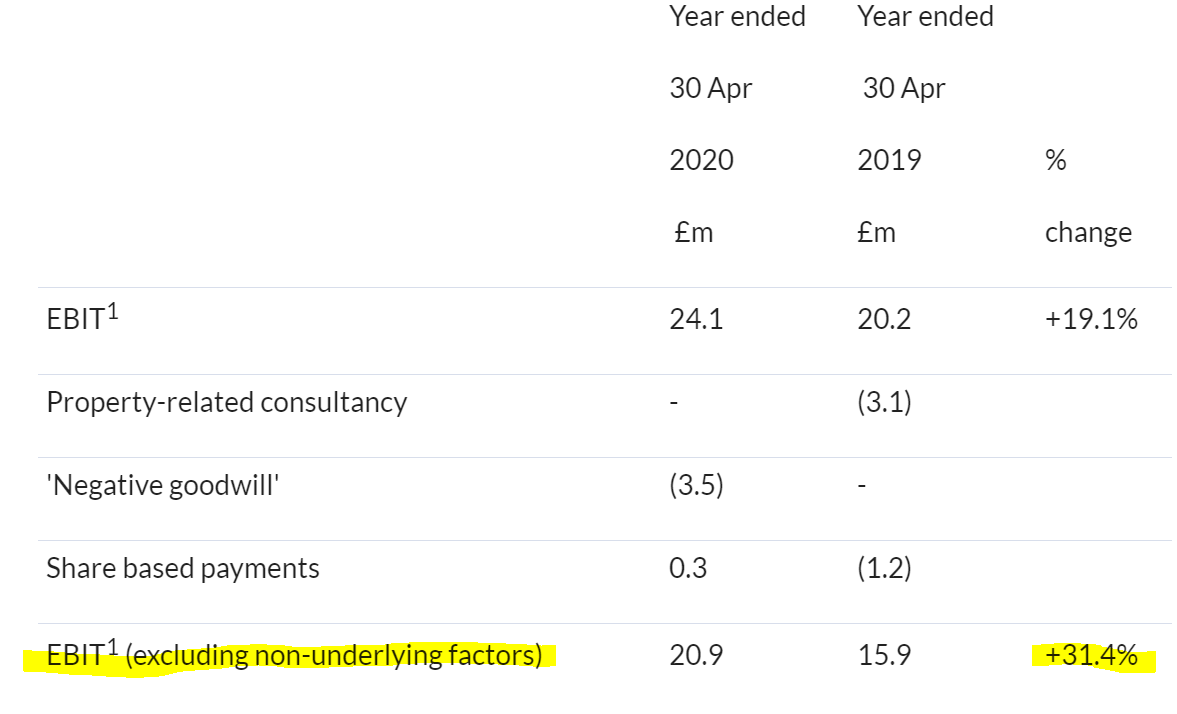

A table shows non-underlying items. I've highlighted the figures that seem to best reflect underlying trading;

.

.

Commercial vehicles division - I've not noticed this before, but Clipper owns 5 commercial vehicle dealerships, which generated £82.5m revenues (flat vs LY) and £2.0m of EBIT. Hence this division probably needs to be removed from the figures if you want to focus on the main logistics business only.

Finance costs - have shot up from £2.2m LY, to £11.2m this time. That's almost certainly due to the distortions created by IFRS 16. Let's have a look at note 8. Yes, that's the culprit, a new finance charge of £8.0m has appeared (obviously nil LY before IFRS 16). This is a massive distortion of the numbers, and now makes operating profit meaningless, because it excludes rental costs that are now shown within finance charges. What a mess IFRS 16 has made of company accounts, I despair.

This is why I tend to focus on EPS, because that should take into account everything.

Balance sheet - hugely distorted by large IFRS 16 entries.

NAV: £29.3m, less intangibles of £65.9m, gives NTAV is negative, at £(36.6m).

That's a weak balance sheet, but as we've seen with another logistics company, Wincanton (LON:WIN) , companies in this sector seem to be able to operate fine with negative net assets. It seems to be due to a favourable working capital business model - i.e. getting money up-front from customers, before creditors have to be paid.

I'm not keen on that type of thing, and prefer balance sheets to be at least positive in NTAV. Hence my personal preference would be for CLG to hold back dividends, and instead allow cashflows to gradually strengthen its balance sheet.

That said, CLG seems to have sailed through the covid crisis, hence is now battle proven in a crisis. Therefore a weak balance sheet isn't necessarily a deal-breaker for me - balance sheets need to be viewed in conjunction with other factors, such as cyclicality, quality of earnings, etc.

Cashflow statement - is just gibberish, due to the huge IFRS 16 entries, which obscure the real cashflows.

Ignoring all that, the profit seems to have been spent on (in descending size order): paying dividends, capex, and a small acquisition.

My opinion - good results, and a strong current trading update.

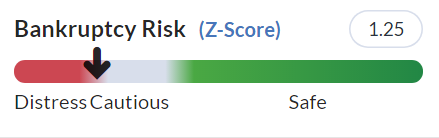

Balance sheet is weak, but that probably doesn't matter. This is confirmed by a borderline Z-Score;

Highish valuation seems justified due to growth.

It makes complete sense for retailers * eCommerce companies in particular to outsource their logistics. It's frequently an area that gets messed up internally (e.g. Joules (LON:JOUL) distribution fell apart last Christmas), and often consumes a high level of management time & anxiety. Therefore outsourcing it to experts makes complete sense. Clipper has an impressive client list, which seems to have low churn, so revenues are strongly repeating in nature, and rising for the eCommerce clients.

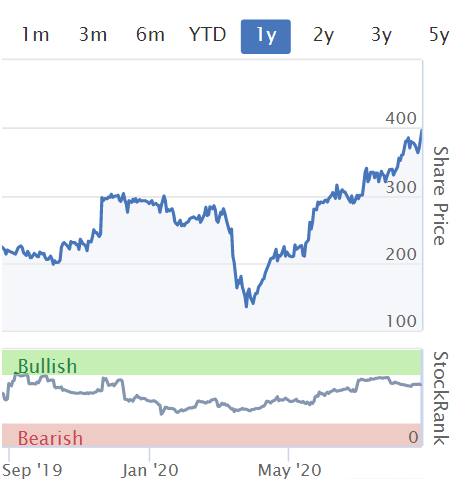

Overall, I like it, and think this could be a good long-term investment, although personally I wouldn't pay the current price, which looks up with events. Amazing recovery in share price, from the March lows, but it looks justified based on good trading;

.

.

Motorpoint (LON:MOTR)

Share price: 278p (up 2.6%)

No. shares: 90.2m

Market cap: £250.8m

This is a secondhand car supermarket chain.

Motorpoint Group PLC, the UK's leading independent omni-channel vehicle retailer, today provides an update on trading for the 20 weeks to 21st August 2020

The CFO for 5 years, James Gilmour, has suddenly resigned, as he was due to be re-elected at today's AGM. That's a concern.

Trading update -

"Over the last 11 weeks, the period which the Group's retail sites have been fully reopened, the Board has seen its key operational and trading metrics comfortably ahead of the equivalent period last year.

...Supply of stock and margin remains strong.

No figures. So what does "comfortably ahead" mean? That's not good enough, investors need figures, to be able to measure & compare performance. Other car dealers have reported good trading in Iune & July, as pent-up demand was unleashed. Most have given us reams of detail, facts & figures, so Motorpoint's update today stands out for how little it tells us.

Outlook - too early to give guidance. We have to wait until 8 Oct 2020 for a proper update on the half year performance.

My opinion - that was a waste of everyone's time, it tells us virtually nothing.

.

Studio Retail (LON:STU)

Share price: 239p (down c.4% today)

No. shares: 86.4m

Market cap: £206.5m

SRG, the online value retail and Education business, today announces its full year results for the 52-week period ended 27 March 2020.

This share used to be called Findel. I've started looking through these numbers, and wish I hadn't! It's more complicated than I thought, because it seems to be a bit like N Brown (LON:BWNG) in that it sells products online, but makes its money from offering credit.

There's a disposal pending (awaiting clearance from CMO - seems to be taking a long time, as sale agreed in Dec 2019, for £50m - significant in comparison with the market cap of £206.5m

So the continuing operations figures are the most relevant to the future - revenues of £434.9m (up 3.1%)

The financial highlights gives us a bewildering array of options for how to measure profitability;

.

.

Adjustments - I usually check, and accept adjustments made to company accounts, because they're usually bona fide one-offs, or non-cash things like goodwill amortisation. In this case however, I want to flag, and put a question mark next to the £20m adjustment called "Estimated COVID-19 bad debt impact", a cost which has been removed from the adjusted profit, thus substantially increasing it that measure of profit.

Pensions - see this section in the RNS for more detail, the numbers look significant.

Balance sheet - a huge receivables book, funded with long-term debt. I think it's high cost credit offered to customers, with all the regulatory risk that brings with it.

Outlook - very strong trading during lockdown, but this is expected to reduce back to normal in the future. Too early to give guidance.

My opinion - it just doesn't interest me at all.

Dividends seemed to stop in 2009, with nothing paid since. That doesn't suggest to me that this is a decent, cash generative business.

The shares have zig-zagged sideways for the last 5 years. What's going to change?

.

.

That's it for today, see you tomorrow!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.