Good morning, it's Paul here.

Please see the header for the company announcements that I'm covering today.

Estimated time of completion - 1pm mainly, but I might add extra bits after that.

Edit at 13:25 - it's cold & rainy, and I have nothing else to do, so will carry on writing - revised completion time: 4pm

Edit at 15:03 - today's report is now finished.

Worsening coronavirus spread

It looks like we're entering a choppier phase, with futures down heavily overnight. Hardly surprising, given the coronavirus is not being contained, and a global pandemic now looks a distinct possibility, or is already starting.

For this reason, I remain very cautious, and am not thinking about opening any new long positions right now - unless the buying case is compelling. Still, we need to keep up with the newsflow, to keep the archive up-to-date, so it's business as usual.

I think we need to be braced for further share price falls (and possibly some buying opportunities), as the coronavirus spread worsens. Although buyers can only buy if they have cash on hand. It's all very well people saying that it kills fewer people than normal flu, but just look at the economic impact of counter-measures in China - they all but halted economic activity in affected areas. We don't yet know whether the resumption of economic activity which is underway now, is likely to cause infections to increase - but that seems likely to me, based on common sense.

For anyone who missed it, I published a very interesting audio interview last week, with Andy Gossage, MD of Up Global Sourcing Holdings (LON:UPGS) - here. It's a non-commercial thing, with no fees or ads. I just did it for general interest, and to help inform readers on a topical subject. The conclusion seems to be that there will be disruption to China supply chains, but that this can be mitigated. Also, it's temporary.

Another aspect to consider, is that I imagine companies needing re-financing might possibly find it harder to do so, if this situation continues to worsen. It's essential to look more closely than ever at balance sheets, for companies which might be affected by coronavirus-related economic problems. I wouldn't want to be holding highly geared transport or holiday companies right now, for example - how would they service their debt, without any customers?

Let's start with some non-results snippets;

Countrywide (LON:CWD)

Confirms press reports that it is in discussions with Lsl Property Services (LON:LSL) regarding an all-share merger. All mergers are really takeovers, you just have to work out who is the dominant party.

LSL: market cap £350m (at 341p per share)

CWD: market cap £111m (at 340p per share)

In revenue terms, CWD it's the other way round, with CWD (£599m) being about twice the size of LSL (£313m).

In the all-important profitability terms, CWD is forecast to make barely above breakeven for 2019, whereas LSL remains strongly profitable. I'm scratching my head to work out why such similar businesses have such wildly different levels of performance. The only conclusion is that CWD must have been incredibly badly managed, and LSL well managed. There's no other explanation for the gulf in performance.

LSL has been the much better investment over the long-term. Look how, on the 5-year chart, CWD's began to diverge on the downside from LSL in mid-2016, and it's been a disaster for CWD shareholders ever since, being almost 98% down no the price 5 years earlier. Previous management at CWD all but destroying shareholder value.

.

.

Bear in mind that CWD paid about 46p in divis over the timescale of the above chart, which is about a 14% gain on the current share price. Therefore, the total shareholder return (divis + a small capital gain) has been about 18% for LSL shareholders over 5 years - not very good really. But a million miles better than the calamitous result for CWD shareholders over the same period.

I wonder if the competition watchdog might take an interest in this merger, since the combined group would be close to £1bn revenues?

Interestingly, both companies have weak balance sheets (which I define as having negative NTAV). Although CWD's finances are far worse, of the two.

Recent positive newsflow about an improving property market, since political worries of an extreme-left Government have disappeared, has made this sector very strong in the last 6 months or so. Both have recovered well, but LSL pulling ahead strongly in recent weeks;

.

Incidentally, I'm using the new Stockopedia site now, and the charts are much clearer than on the old site, so worth checking out. It takes a little time to grasp how to use the various features, but I'm getting there!

Reach (LON:RCH)

Share price: 181p (up c.4% at 08:22)

No. shares: 299.3m

Market cap: £541.7m

Reach plc ('Reach', 'the Company', 'the Group'), the largest commercial national and regional news publisher in the UK, today announces its preliminary audited results for the 52-week period ended 29 December 2019.

Formerly called Trinity Mirror, of course.

This newspaper business remains staggeringly profitable & cash generative, as I always say when reviewing it. Acquisitions & cost-cutting have preserved, actually improved, the operating profit margin of a remarkably high 21.4% - that's far better than many companies in growing, hot sectors.

Adjusted EPS today of 41.1p looks a beat against forecast of 39.2p broker consensus. Although I think some of the adjustments look questionable.

Core revenues are still falling each year, but note the LFL decrease in revenues was 5.3%, which is improved from the drop of 6.6% in 2018. This holds out the tantalising possibility that newspapers might reach a plateau at some stage, where some are still financially viable? Maybe people buy newspapers when their smartphone batteries go flat?

Pension deficit is still large, but at least is falling, down by £52.7m to £295.9m (or £242.9m net of deferred tax). Those are the accounting figures. The actuarial figures (on which deficit recovery payments are based, so arguably more realistic),

Balance sheet - looks weak, with NTAV negative, at -£216.8m (calculated as NAV, less goodwill & other intangibles). However, the pension deficit (which is a manageable liability) is the cause of making the balance sheet weak. If we park that to one side, the rest of the balance sheet is fine. Combined with prodigious ongoing cashflows, I don't see any problem here. The business should last long enough to sort out the pension deficit completely.

Net cash is £20.4m (improved by £61.2m in the year) - as a result of very impressive cash generation.

Cashflow statement - very impressive, and worth a look. To summarise, it generated £147.4m in cash from operations (up from £137.8m last year). A third of this went into the pension schemes. The rest paid tax & dividends, with £60.0m left over to eliminate the remaining debt. It's absolutely staggering how cash generative this business is, for a supposedly dying sector (newspapers).

Outlook - continues to trade in line with expectations in 2020 so far.

Dividends - total divis for 2019 are up 6.7% to 6.55p - giving a historic yield of 3.6% - the yield has been much higher than this, but a strongly rising share price has brought it back down again.

My opinion - this group has performed a lot better than people thought it would. Going back a few years, everyone (including the then Chairman!) thought it was a dying business. However, with a mixture of relentless cost-cutting, and mopping up competitors (and stripping out duplicated costs) has proven a remarkably successful strategy so far.

Sir Martin Sorrell has been utterly dismissive of old media/advertising, but it's striking to note that his rapidly expanding digital advertising business S4 Capital (LON:SFOR) doesn't actually make any significant profit or cashflow yet, despite being valued at almost double what Reach (LON:RCH) is worth. RCH's cashflows & profits dwarf those of Sir Martin, so who's laughing now?

I note that Reach generated an impressive £107m in digital revenues in 2019. This is over 15% of total revenues. I wonder how much its digital division would be valued at, if floated separately on a racy rating? It looks to me as if there is a good market for newspaper and digital advertising to be sold side-by-side.

Looking at the 12-month chart below, RCH shareholders can also thumb a nose at Sir Martin, in that whilst his fancy S4 Capital (LON:SFOR) vehicle has delivered a decent 69% gain for shareholders, this has been left gasping in the dust kicked up by Reach's wheel-spinning +194% share price gain in the last year.

.

.

Even after this superb share price gain, RCH is still ultra-cheap on conventional metrics, especially the PER of 4.7

Therefore, if the market is now re-rating RCH as a media company with a good future, then this could have further to run perhaps?

Overall, I think the combination of good figures, low valuation, and interesting future potential from digital, make this share worthy of a closer look. I don't have time to plough through all the narrative & detail, as I've got lots of other companies to review today. So over to you, if the above has piqued your interest.

Cloudcall (LON:CALL)

Share price: 94.5p (up 1%, at 09:30)

No. shares: 38.7m

Market cap: £36.6m

(at the time of writing, I hold a long position in this share)

Contract win (and trading update)

It's always worth checking every update, as sometimes (as in this case) a more general trading update is slipped in.

CloudCall (AIM: CALL), the integrated communications company that provides unified communications and contact centre software that integrates with Customer Relationship Management ("CRM") platforms, are pleased to announce a major contract win with Vaco

CloudCall has previously told us that it's been targeting larger customers, so it's pleasing to see one come through.

Vaco is a global talent & solutions firm with annual revenues of more than $750 million. The three-year contract will see CloudCall providing its integrated telephony service to Vaco's thousand plus employees in quarterly tranches over the coming 18 months. The extended implementation period for this contract means that the resulting revenues will be spread throughout 2020 and into 2021.

Once again, CALL's close relationship with Bullhorn (software for recruitment sector) is mentioned.

Outlook - nice to see 2020 expectations confirmed;

... the Board remains confident in achieving its FY20 outlook.

My opinion - to put this into context, CALL ended 2019 with 42k users. Therefore, today's news of adding 1k new users, over 18 months, is pleasing, but not forecast-busting. Still, winning larger individual clients was a key aim, so it's good to see CALL delivering results, and confirming full year guidance.

With rapid organic growth coming from the US in particular (revenues up 55% in 2019), at high gross margins, I think CloudCall looks very cheap compared with how this type of company is valued in the US. This is further evidenced by the appearance of several US shareholders. Therefore, I'm quietly hoping for a US takeover approach. IF the price is right (over 200p for me), then I'd be happy to sell up.

Repeated cash calls of the past should be over now, because the last fundraise was big, and should leave CALL fully funded (how many times have we been told that in the past?!). But this time it does look different, as the cash pile is so much larger now.

It's taken years longer than expected, and cost far more, as with practically all growth companies, but CALL is clearly now getting there, in my opinion. That's likely to lead to a re-rating in due course, I reckon.

Loopup (LON:LOOP)

Share price: 60p (down 27%, at 11:13)

No. shares: 55.2m

Market cap: £33.1m

(I no longer have any position in this share)

LoopUp Group plc (AIM: LOOP), the premium remote meetings company announces a trading update for its financial year ended 31 December 2019.

Today's 27% price drop looks harsh, given that 2019 trading was only slightly below forecast. The trouble is, the market generally us selling-off heavily today, so we don't know how much of the 27% fall in LOOP shares is market-related, or company-specific. With illiquid small caps it only takes a few small sells to move prices a lot, at this end of the market;

The Group expects to report revenue and EBITDA broadly in line with market expectations at £42.5 million (FY2018: £34.2 million) and £6.4 million (FY2018: £7.7 million) respectively.

LOOP capitalises so much development expenditure into intangible assets, that EBITDA is completely meaningless. It provides a misleading, exaggerated view of profitability. It capitalised £2.44m of development spend in H1, therefore c.£5m looks likely for FY 12/2019 - consuming c.78% of EBITDA.

Adjusted EBITDA was £3.5m in H1, which implies it fell to £2.9m in H2.

Cash/debt - this sounds as if LOOP has cleared its debt, which sounds very good;

The Group's cash balance at 31 December 2019 was £3.0 million (net debt: £11.5 million).

I can't find any fundraisings since the interim results were published, back in Sept 2019. In those interims, this was the position (as at 30 June 2019);

Cash of £3.8m

Debt of £15.3m

Net debt £11.5m

Today's update ignores the debt completely, and just gives us the cash balance, now reduced to £3.0m. Not only do they ignore the debt, they also give a false comparative, of net debt of £11.5m, thus implying a dramatic improvement, where there hasn't been one. This is outrageously misleading! The cash figure may be technically correct, but showing a different comparative, is unbelievable, literally! Can we trust anything this company says? Based on this egregious attempt to deceive readers of the announcement, I'd say a resounding no.

The company blamed macro factors for a decline in user spending last time it reported. A number of us here didn't buy that explanation. Today it trots out the same reason for a worsening in USA of customer usage, from -2% in H1, to -8% in H2. It links this to a decline in US M&A activity. Again, I don't buy that explanation.

Intermittent service issues - this is the one thing that a telecoms service provider cannot allow to happen, as it's the quickest way to destroy the business - having a service that doesn't work.

... the Group experienced subsequent intermittent service issues during November and early December 2019, which gives rise to the potential for higher than normal churn in H1 2020.

All service issues have now been resolved and normal high-quality service levels have been resumed. We are focused on mitigating any potential impact.

If I was paying a lot for a premium service, and it doesn't work properly, then I'd be inclined to find an alternative that does work. Also, having many firms of solicitors as your clients, makes LOOP vulnerable to them demanding refunds, even damages, for poor service.

Cuts to sales pods - the previous expansion here looked excessive. 24 people have been cut from sales pods in Jan 2020. If they're on, say £30-40k each, that's a saving of approaching £1m p.a. - which is being spent on increased capitalised development spending, which is going up from £5.0m in FY 12/2019, to £6.0m in FY 12/2020. That seems extremely high - making me wonder if it is all genuine development spending, or might in part be a convenient place to dump operating costs, possibly?

Outlook - this sounds contradictory to me - demand is strong, but growth is only in the medium-term (i.e. code for demand being weak in the short-term). Previously in the RNS, they had told us that demand was falling!

While immediate business and forex conditions remain challenging, we continue to see strong demand for the LoopUp product and are confident in our ability to deliver medium-term growth. We continue to monitor market and financial conditions closely.

My opinion - my biggest problem here is management - based on their track record to date, of destroying shareholder value, I don't rate them. Also I don't trust them either, give the misleading elements of today's update.

I've previously held this share, because the product worked very well, when a friend and myself tested it out, prior to originally buying some shares a few years ago. Then more recently, I caught the falling knife, shortly before a profit warning unfortunately. What induced me to sell a few weeks ago were these factors;

- Portfolio clean-up, ditching small, low conviction holdings, when the coronavirus issue began

- Worries about LOOP's lack of cashflow generation, and the debt (trying to mislead us about debt today, just reinforces that it is a potential problem)

- A reader comment here, a few weeks ago, alerting me to the competitive threat from Microsoft Teams

- I spoke to a LoopUp client at Xmas, who indicated that the product seems basic, and they were not even aware of its sophisticated features & don't use them

- Poor management, who have made multiple mistakes, and destroyed shareholder value

On the upside, LOOP's client list is very impressive, and with a market cap of only £33m, it might attract bidding interest. It could also be a beneficiary from coronavirus - making people more likely to want to use remote meetings software, instead of traveling to physical meetings.

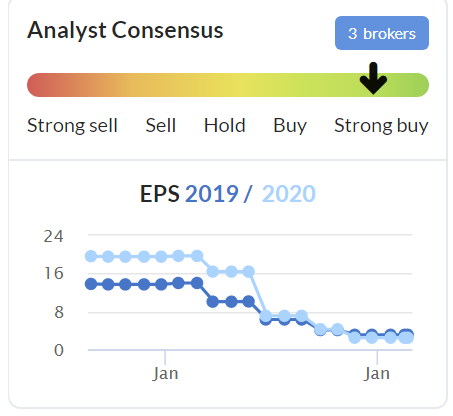

Expectations of profitability have collapsed for now;

Judges Scientific (LON:JDG)

Share price: 5220p (down 7%, at 12:20)

No. shares: 6.25m

Market cap: £326.3m

As it's fairly short, here is the announcement in full;

The Board of Judges continues to closely monitor developments in China and the potential effect of the COVID-19 epidemic on its business.

With the current scale of the outbreak, and provided it does not last more than three months and remains largely contained within China, it is not expected that there will be a significant impact to the Group's 2020 trading.

The Group operates with an average 3-month order book, so in the near term the current travel restrictions are expected to only have a temporary impact, deferring rather than reducing revenue. Unaudited revenues for China/Hong Kong represented £9.5 million in 2019.

In relation to Judges' supply chain, direct and indirect supply from China varies from business to business in the Group, with only one subsidiary having significant supply chain exposure. The Board is monitoring developments closely and at this stage of the outbreak, currently considers that supply chain disruptions will be manageable.

The situation remains under active review by the Board.

There are quite a few "if's" in the above - in particular, the one about it largely being confined to China is already starting to look out-of-date - given the sudden surge in cases in S.Korea and Italy.

Deferred orders are fair enough, but that still means a likely miss against planned performance in H1 2020, and that would hit the share price - because some investors would decide that an H1 miss and H2 catch-up may not happen.

My opinion - JDG has a fantastic long-term track record. However, that's baked into the price now, which is a lofty PER of 24 times. Given that there's a question mark over performance in 2020, if coronavirus gets worse, then I can see the sense in selling up now, and watching from the sidelines.

Or, if you're a long-term, ungeared investor who is no good at market timing, then I can also see the sense in sitting tight, and riding out the uncertainties.

Given the high valuation, and superb share price performance in recent years, then banking some profits might make sense for some investors, but as always that's your call - every investor has to make up your own mind & own the decision.

.

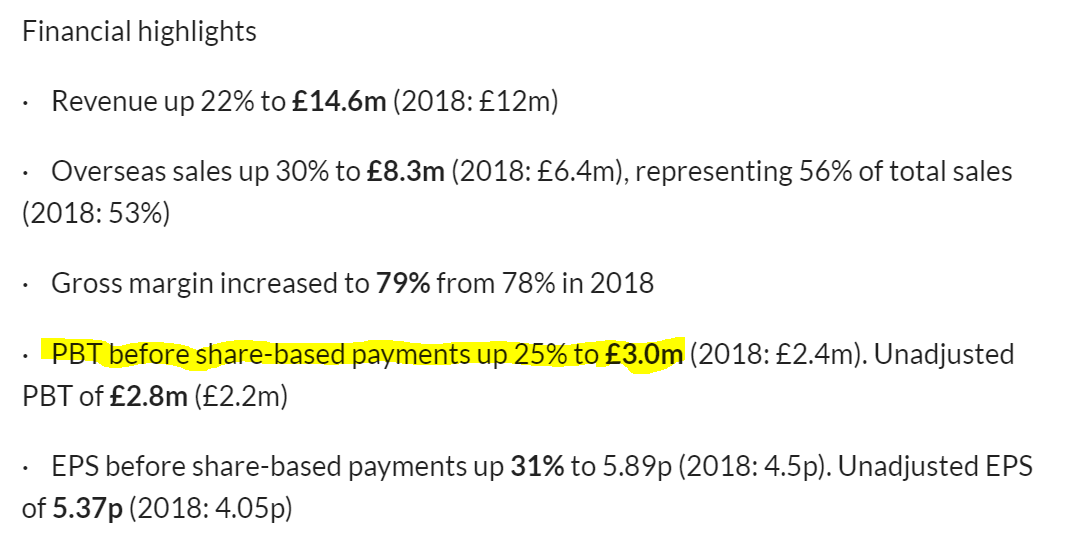

Tristel (LON:TSTL)

Share price: 428p (up 8%, at 12:47)

No. shares: 44.8m

Market cap: £191.7m

Tristel plc (AIM: TSTL), the manufacturer of infection prevention and contamination control products utilising proprietary chlorine dioxide chemistry, announces its interim results for the six months ended 31 December 2019, ahead of guidance at the December AGM.

Strange wording there. It should have had the words "which are" inserted in front of "ahead of guidance...", and the word "given" inserted in front of "at the December...". I do sometimes wonder if companies have anyone review their RNSs before they release them, to sense-check the wording? Maybe I should start a consultancy business, to improve reporting?!

Interim results look pretty good. It always strikes me how small the numbers are, when I look at the geographic breakdown of sales for Tristel. Its overseas sales have been boosted by buying in distributors. Nevertheless, put it all together, and the company delivers a decent profit, on modest revenues, in the first 6 months;

.

It also flags how coronavirus might be helpful, in driving increased sales of its disinfecting products.

Outlook - describes process for entering USA market as "extraordinarily protracted".

Progress of a new product called "Rinse Assure" is explained, which sounds interesting.

No-deal Brexit risk mitigated by transfering permissions to the Netherlands.

Coronavirus - no significant exposure to China for supply chain.

Overall;

The prospects for the Company remain very encouraging and we look forward to further progress in the second half of the year and beyond.

Balance sheet - looks fine to me.

My opinion - it's a nice little company. Is it worth £200m mkt cap though? That's really the only issue - valuation. How do you value something like this, which has a good niche product, selling is small quantities, in lots of markets?

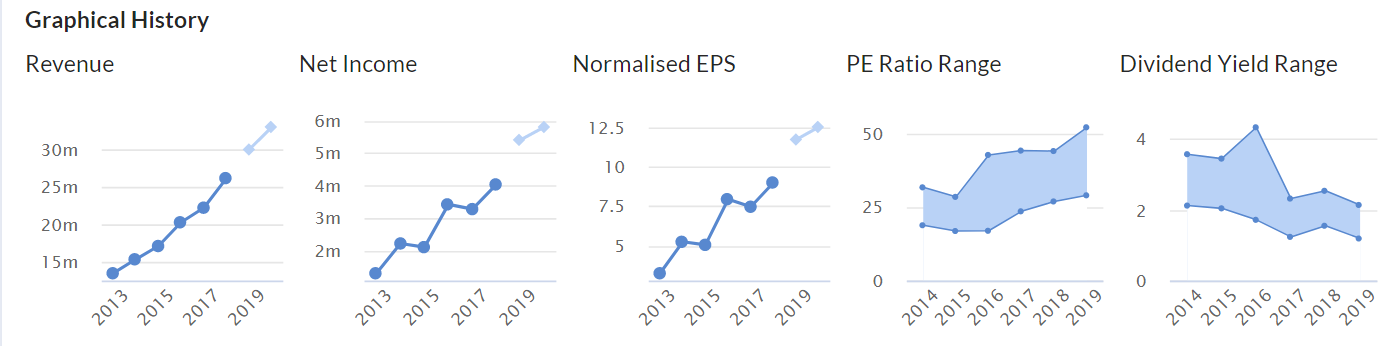

EPS for 2020 is forecast at 11.7p (confirmed today), hence a share price of 428p means you're being asked to pay a PER of nearly 37 times - that seems expensive for growth that's steady, but not exciting. As you can see below, the PER is getting more expensive over time, and the yield falling.

I like the company, but I'm really struggling to understand the valuation. Maybe people think the USA is a slam-dunk, and could raise future earnings considerably?

.

Accsys Technologies (LON:AXS)

Share price: 102p (down 1%, at 14:02)

No. shares: 162.3m

Market cap: £165.5m

I was about to delete this section, because the announcement today is too complicated for me to unravel.

Thankfully however it concludes with something I can understand;

Accsys confirms that trading is in-line with the Board's expectations and no changes are being made to the Board's expectations for the full year.

My opinion - neutral. The product looks very interesting, but I concluded some time ago that its development was taking too long, and too capital-intensive, to be of interest to me as an investment.

Rtc (LON:RTC)

Share price: 72.5p (down 4% at 14:17)

No. shares: 14.6m

Market cap: £10.6m

Results for FY 12/2019, from this minnow staffing group.

Given how many staffing businesses have been struggling of late, these results look respectable.

Revenue £94.9m, up 8%

Profit before tax of £1,758k is down 5.4% on LY, due to a higher finance expense line (operating profit is only down 1%)

EPS of 9.6p gives a PER of 7.6 - I can't see any reason as to why the PER should be higher than this.

Balance sheet looks OK to me - note that borrowings have come down a lot, at £3.57m, and this is quite low relative to the receivables book of £15.8m

Outlook - there's an interesting section about IR35;

The second predominant risk causing sleepless nights for CEO's is IR35. The IR35 cloud has been firmly on the horizon for twenty years as the initial legislation was first passed in the 2000 Finance Bill. Whilst the implementation date has been postponed on many occasions, HMRC is adamant it is not going to kick the can down the road anymore and the government is firmly committed to implementing its policy in April 2020. It is worth outlining that the legislation designed to combat tax avoidance by workers supplying services to clients through intermediaries is highly complex and with employment law relying on caselaw to determine the legal status of individuals, the complexity of the issue will be challenging for all concerned for the foreseeable future. Presently a significant contingent of workers deployed by the Group across its client base have been determined as residing outside the scope of the legislation as they are employed by the Government through Network Rail and the Government is responsible for determining the status of all workers engaged under their auspices. The status of workers engaged by Group within the private sector are subject to review by our various clients and we are working closely with all our clients to establish the most appropriate route to keeping the individuals engaged on their work programmes from April 2020.

My opinion - neutral. The valuation looks about right.

It's not clear to me why this company has a stock market listing, there's no obvious reason why the expense & hassle is justified.

A focus on engineering & infrastructure projects looks to have worked out well, given the major focus on this area of spending, from the new UK Government.

All done for today, see you tomorrow. Keep those hard hats on, and the hatches battened down!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.