Good morning, it's Paul & Jack here with the SCVR for Monday. Today's report is now finished.

Mello Monday is tonight at 6pm.

Agenda -

Paul's Section:

Revolution Bars (LON:RBG) (I hold) a short video I made over the weekend, mystery shopping the reopened, refurbished Bournemouth site. I was impressed. 19 refurbs underway (28% of the estate) should drive strong sales & profit performance this year, in my opinion. Hence I think the ducks are now lined up for a much improved performance in 2022, whilst remembering there are cost headwinds too.

M&c Saatchi (LON:SAA) - Vin Murria looks to be flogging a dead horse here, with her ill-judged takeover attempt. There's a 40p cash element added, but the bottom line is she hasn't got the firepower to buy SAA, so should back off.

EDIT: SAA has now issued an interesting update, worth reading if you hold, basically saying there's no merit in the deal, so the independent Directors have unanimously rejected it.

Gulf Marine Services (LON:GMS) (I hold) - an in line update. This is an interesting situation - very high debt, but the strong and predictable cashflows from medium-term contracts, being renewed at rising daily rates, gives a predictable path to debt reduction. The benefit of that could flow through to equity holders over the next few years. Guidance for 2022 is positive, and specific numbers provided.

Jack's Section:

De La Rue (LON:DLAR) - profit warning, with a c20% downgrade in FY operating profit from £45m-£47m to £36m-£40m. Seems like quite a change from interims reported in late November of last year. The turnaround is set back by a year and there’s a question mark over the profit growth profile going forwards, with ongoing substantial pension contributions to consider. FY results out on 25 May, so it could be worth waiting until then for more detail and commentary.

Corero Network Security (LON:CNS) - EBITDA to be ‘materially ahead’ of expectations, with a maiden profit before tax in sight. There has been a lot of equity dilution in the past and that makes me wary, but the direction of travel appears positive. Its ‘Highly Speculative’ riskrating is well-earned.

Here is mine & Jack's weekly SCVR summary on 29 minute audio. We rattle through almost all the companies covered in the SCVRs for the week, flagging the best ones. Typing up the written summary below the audio, takes a ridiculously long time to do, although it is useful, and I've only done about half of it so far - which ate up about 2 hours of my weekend, which wasn't good. So we might have to look at a quicker way of doing that.

Edit - shout out to Lawrence, who has got the podcast on Spotify! Here is the link, do follow us on there if you get the chance.

More shenanigans in the US markets late last week, with markets selling off again. Although futures are up strongly this morning, so who knows whether this is just a healthy correction from over-valuation, or a new bear market? With about a third of the trades in the US markets being programmatic trades, which chase direction (either way), rather than fundamentals, then it could easily reverse as fast as it fell. Plus, powerful rallies are the norm in a declining market. So if there's anything I want to sell, the trick is to wait for a strong up day, and ditch it then, not panic selling on a heavily down day.

I'm focused on the fundamentals of the UK shares I hold, and most of them seem to be putting out rather encouraging trading updates at the moment. To me it seems more like a necessary, and healthy correction.

The re-opening trade looks better than ever, since covid restrictions are now being dropped, and we look set for a strong recovery in trading at travel/leisure/hospitality. So it would be a pity to panic sell these shares now, just when the upside should start to come through, hence I'm sitting tight. It will be interesting to see how many sectors trend back towards pre-covid behaviour, and how many have changed for good? Everything seems unusually busy in Bournemouth - shops, casfes, bars, look more like a busy spring or summer, not late January.

Revolution Bars (LON:RBG) (I hold)

I made the above short video, mystery shopping Revolution Bars (LON:RBG) (I hold) re-opening after a refurb. The company is refurbishing 19 of its bars (28% of the estate) this spring - a benefit of having paid off all the debt, and now being net cash, after 2 placings at 20p. The refurb is fantastic, the whole place looks shiny & new, and is pulling in punters off the street at a time of day when it was normally dead. Even the food was great, which is not something I've ever been able to say about Revs before. It seems to me that management are rebuilding this business very well, everything was dramatically improved. Hence I'm anticipating strong trading from Revs during 2022 - refurbished bars typically trigger strong uplifts in sales & profits. Plus all that pent up demand from youngsters who are getting their lives back again, and want to party. Or "par-tay", as my niece tells me it is now pronounced :-)

My chat with the Bournemouth site manager was also very encouraging - he defected from a larger competitor, saying they exploit people. Whereas Revs now has a reputation for looking after staff, and having a great team atmosphere, which is the culture the newish CEO brought in with him, and is known for at his previous jobs. So I think we have the right management in place here, doing the right things. The problems have been sorted out, and I'm quietly confident that 2022 should see much better trading reflected in strong numbers. Time will tell. There are cost headwinds though, which nobody is immune from.

I know it's never good to extrapolate from just one site visit, which could be unusually good or bad. However, with 19 refits underway in total (6 already done), the refitted Bou'mth bar should be a representative example of how much better the refitted sites look, which pulls in the punters. Newness is everything. I've emailed the CEO suggesting they move to a "little & often" maintenance strategy, to keep these sites looking new, instead of slow dilapidation - which seems to be the norm in this sector. Maintenance spending to keep the bar's appearance top drawer is not capex, it's essential spending to maintain profitability, in my view.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section

M&c Saatchi (LON:SAA)

175p (pre market open) - mkt cap £214m

This is a very peculiar situation. Vin Murria is trying to take control of SAA through a personal shareholding, bolstered by her listed cash shell AdvancedADVT also having used some of its cash to take a stake in SAA.

There doesn’t seem to be any strategic rationale for the deal, other than a change in control of SAA. Why would SAA shareholders want to swap their SAA shares for shares in a cash shell that would then own SAA? It’s all a bit ridiculous I think.

The offer has been raised by 20.7%, to 2.245 new ADVT shares, or a partial cash alternative of 40p cash (less than a quarter of the current share price), plus 1.633 new ADVT shares.

This is not an attractive offer, when the currency is mainly new shares in a cash shell. The problem with that, is the valuation of ADVT would just reset to whatever the market thinks SAA is worth. So there’s not really any premium at all.

My opinion - it’s a bum deal, and I hope shareholders reject it, as the independent Directors of SAA have. This seems a rare mis-step by Vin Murria - her fundamental problem seems to be that her acquisition vehicle hasn’t got the financial firepower to do the deal. This situation also raises the question of whether Vin Murria's place on the Board of SAA is tenable? I suppose she could stay on as a non-independent Director, but it looks an awkward situation.

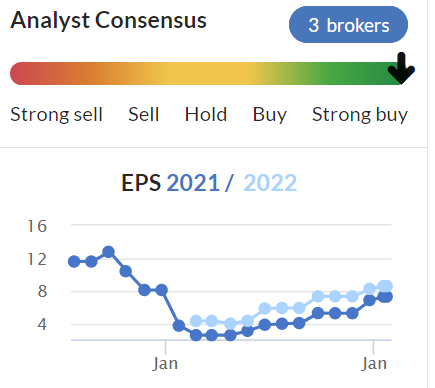

The company itself is trading well, putting out positive trading updates & upgrades to guidance. Looking at the neat Stockopedia graph, I wonder if earnings guidance might continue improving?

.

.

Gulf Marine Services (LON:GMS) (I hold)

6.4p (flat, at 08:08) - mkt cap £65m

GMS, a leading provider of advanced self-propelled, self-elevating support vessels serving the offshore oil, gas and renewables industries, is pleased to provide the following trading update.

Guidance for 2021 is in line with expectations -

Vessel utilisation for 2021 was in-line with expectations at 85%. As a result, EBITDA is expected to be between US$63-US$65m and within the previous guidance range given.

[£1 = $1.355]

That’s £47m EBITDA, for a company with a market cap of £65m - the reason for cheap shares, being that there’s a lot of debt. However, the bull case for this share is that the company is now a cash generation machine, maintenance capex is modest due to the fleet being fairly new, and there’s no expansion capex. Hence debt should be reducing now from cashflows.

Most vessels are rented out on contracts of typically 1-2 years, and supply is now tight, so when they come up for contract renewal, daily rates go up. Hence this is an easy situation to model, with predictable cashflows, that looks set up to resolve the excessive debt situation over the next few years. The upside then should flow through to equity holders, as debt reduces - hence why I hold this share, with a 2-3 year view, for a re-rating - as it should progress from being a financially distressed company, into a stable company generating good cashflows, and eventually dividends. It does depend on the price of oil though, which is driving the improved charge out rates for GMS’s vessels.

Outlook comments seem reassuring to me, and this highlights the excellent visibility on revenues & profits -

Recent contract awards have positioned the company well for 2022. Utilisation across the Company's larger and mid-size, high earning E&S class vessels, is currently 94% contracted, with overall secured vessel utilisation standing at 78%.

Average secured dayrates for 2022 are currently 10% ahead of 2021 actual levels. The Company expects dayrates to continue to improve further, based on a strong pipeline of new opportunities and as the market continues to tighten.

A two-year option period on a K Class contract has been exercised and the current Backlog (Firm + Options) stands at US $216 million.

EBITDA guidance for 2022 is expected to be in the range of $70-$80m million, which remains in-line with market expectations, and is supported by the improved trading conditions.

"Our markets continue to improve with dayrates on recent contract awards showing healthy increases from legacy contracts and secured utilisation for 2022 already close to where we finished 2021, underpinning the expected improvement in the performance of the business."

My opinion - this looks a very good, and predictable turnaround. It’s not dependent on guesswork, because of visibility from contracted revenues, at rising daily rates, driven by a shortage of available capacity for this type of vessel. Normally the high debt would have put me off, but in this situation, I like the high cashflow visibility, which makes it very easy to foresee decisive reduction in debt in the coming years.

So far, so good.

This is a special situation, so it won't appeal to everyone, and people need to be sure you understand the risks.

.

.

De La Rue (LON:DLAR)

Share price: 109.2p (-27.2%)

Shares in issue: 195,150,407

Market cap: £213.1m

De La Rue says the ‘significant headwinds’ of commodity and energy costs and supply chain challenges have become more pronounced. Omicron and Delta Covid variants have led to increased employee absences and this will result in lower total operational output for the full year.

The group now expects adjusted operating profit for the full year to be £36m-£40m compared to market expectations of £45m-£47m. That’s a material impact and a roughly 20% reduction in expected profitability.

This all sets the company back by about 12 months in terms of its turnaround plan, and the headwinds are expected to persist in FY22-23, slowing the operating profit growth profile.

Net debt expectations are unchanged (last reported as £43.9m of net debt at the half year stage) and the revised outlook still reflects ‘substantial’ year-on-year growth in DLAR’s two core businesses.

The Board retains full confidence both in the Turnaround Plan and in its execution. There is no change to the elements of the plan: the growth areas of Currency, driven by the continuing and accelerating trend of conversion to polymer, and Authentication, driven by increasing demand for digital and physical solutions for governments and corporations, remain strong and in line with the Plan's expectations. The Company is also intensifying its efforts to deliver further efficiencies and cost reductions, to mitigate some of the factors described above.

Currency and Authentication should see adjusted operating profit growth in the range of 35%-45% from the £27.5m delivered in FY21, so between £37.1m-£39.9m.

Diary date - full year results to be announced on 25 May 2022.

Conclusion

This is obviously a setback in what was a potentially interesting turnaround. De La Rue is making year-on-year progress but is facing cost inflation, supply chain disruption, and labour absences. The first two are now well known, but I wonder if the last will be more of a theme in the next couple of months?

Taking a longer term view, the shares are still well below previous highs. Shares in issue have increased from about 110m in 2012 to 195m today.

There is potential upside here even after the dilution but the tone of today’s update will be a further hit to sentiment. It’s not just a 12-month setback; the profit growth profile going forwards has moderated. So the shape and scale of the turnaround needs to be reassessed.

I wonder how long management has known about these issues? It strikes me as a vastly different tone to the one conveyed in the interim results back in November, when cost inflation was noted but management sounded more positive. That was only seven weeks or so ago.

The level of capex over the past few years has been making the group free cash flow negative. We’re not yet seeing the benefits of all this invested money, with ROCE declining, but there can be a lag between investment and tangible financial results.

There’s also a pension scheme to account for, with substantial cash outflows of some £15m per annum. It’s possible that modestly higher rates might lead to a reduction in contributions at the next actuarial valuation, so there’s scope for this to shift from a headwind to a tailwind. But right now it’s the former, and needs to be looked at more closely before forming a full view of the enterprise.

And as above, investor sentiment will take a hit with this update. The drastic change in tone from late November to mid-January jars slightly.

It’s worth a look as the valuation drops, but there are questions: the pension situation, the impact on DLAR’s turnaround and growth profile, and the fact that such a change in outlook comes as such a surprise to the market. Given the change in prospects and the brevity of the update, I wouldn't personally consider buying until we get more detail on the 25th of May.

Corero Network Security (LON:CNS)

Share price: 11.74p (-0.05%)

Shares in issue: 494,852,304

Market cap: £58.1m

This is a leading provider of real-time, high-performance, automatic Distributed Denial of Service (DDoS) cyber defense solutions. Cybersecurity is a long term growth market, but Corero itself has racked up a lot of trading losses and equity dilution.

It does appear to be closer to profitability now, but the above makes me cautious.

Corero performed strongly in FY 2021 with revenues broadly in line with market expectations at c$20.9m (2020: $16.9m), up 24%, and EBITDA anticipated to be materially ahead of market expectations in an estimated range of $3.8m to $4.2m (2020: EBITDA loss of $1.4m).

This should result in a maiden profit before taxation figure to the tune of $1.2m-$1.6m (2020: loss before taxation of $4.0m).

The profit figures include c$0.2m of foreign exchange gains (2020: $0.4m foreign exchange losses); and non-recurring income from the forgiveness of a US Payment Protection Plan (PPP) loan of $0.6m.

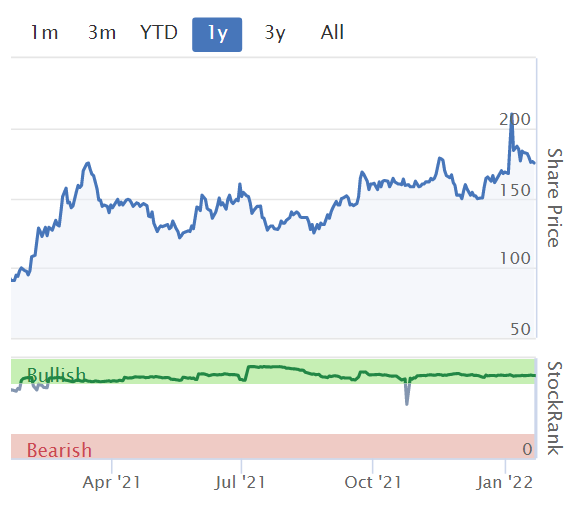

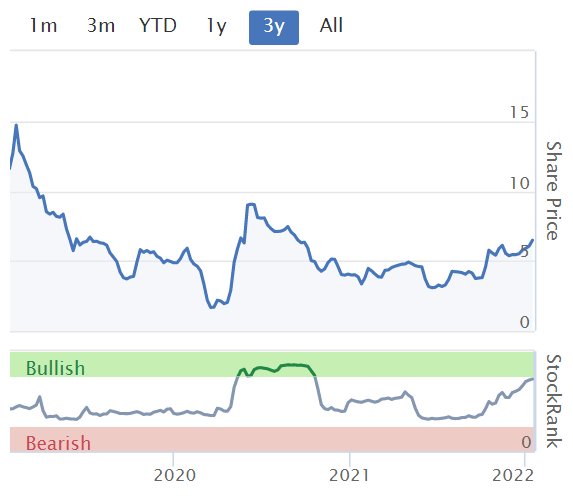

This upgrade was previously announced on 22 December 2021, with shares rising from 9.25p to 11.4p then, hence the lack of share price action today. You can see that move on the right of the chart below, but what also stands out is the general level of volatility here over the years.

Annualised Recurring Revenues ("ARR") increased to c$12.8m as at 1 January 2022 (up from $9.8m a year earlier).

Net cash as at 31 December 2021 was $8.4m (H1 2021: $5.1m; 2020: $7.6m).

Conclusion

This has been a good year for Corero, which looks to be on the brink of elusive profitability. The group intends to invest in additional resources in 2022 to further drive growth.

Corero has racked up years of losses and the rate of equity dilution is quite scary - sustainable profits could put an end to this, but the track record so far affects how I view the company.

I’ve got no particular insight in terms of the quality of its services, but I’m curious to see the more detailed final results.

The StockRanks remain fairly skeptical, falling by 9 points to 25 over the past 30 days. Corero is hardly cheap, with a £58m market cap on £18.9m of trailing twelve month revenue. The top line is forecast to grow quite quickly over the next two years though, and cybersecurity is likely a long term growth market. I'm open to the possibilities but aware of the track record.

It’s too speculative for me right now given the equity dilution, price volatility, and small free float (c30%).

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.