Good morning, it's Paul here.

7-8am comments

Porvair (LON:PRV)

H1 results (6m to 31 May 2019) look strong;

Revenue up 21% to £72m

Adjusted EPS up 36% to 12.9p

Cashflow looks weak though, due to adverse working capital movements (inventories & debtors up, as you would expect from expansion, but trade creditors sharply down).

IFRS 15 has resulted in a large £8.2m provision for warranties being created.

Looks potentially interesting, so I'll take a closer look later today, in more detail.

Cake Box Holdings (LON:CBOX)

Full year results (y/e 31 Mar 2019) look a little below forecast;

Adj EPS of 7.9p versus consensus forecast of 8.1p

High profit margin, as it's a franchise business, selling cakes.

LFL sales growth in franchise stores of 6.5% looks very good - maybe this is an emerging winner in the current retail downturn? Doing a roll-out of new franchise stores, which seems to be working.

Looks potentially interesting - I'll take a closer look later today.

MySale (LON:MYSL)

Formal sale process & strategic review.

Mentions the dreaded word "stakeholders" - which is often code for the equity probably being worthless.

One of the options mentioned today is de-listing, so I imagine the share price is likely to suffer badly today, although at c.7p there's not much left anyway.

I don't see any value here. Management have completely screwed things up, and a change in Australian sales tax apparently clobbered gross profit.

Given previously unrealistic outlook comments made by management, I'm not minded to believe the RNS today, saying that drastic cost cuts will make it cash generative next year.

No further coverage today, as this looks a basket case now, with management having zero credibility in my eyes.

Afternoon comments

Now i have a bit more time, let's focus on the shares whose updates look most interesting today.

Porvair (LON:PRV)

Share price: 583p (up 3.4% today, at 15:11)

No. shares: 45.8m

Market cap: £267.0m

Porvair plc ("Porvair" or "the Group"), the specialist filtration and environmental technology group, today announces its half yearly results for the six months ended 31 May 2019.

As mentioned above, the financial highlights look strong;

The modest (3.4%) share price rise today, suggests that this good news was already in the price. Sure enough, if we check back to the last trading update here on 6 Jun 2019, the company told us then that revenues would be up 20% on prior year (actual today is slightly better at 21% up), and that profit would be up on last year (not stated how much), and in line with expectations.

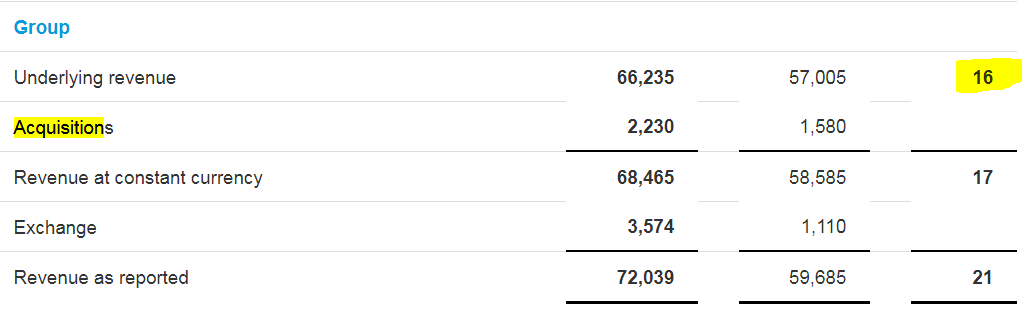

Acquisitions - the company made 2 smallish acquisitions in the prior year, which look to have had some (unquantified) benefit to today's interim results. There doesn't seem to be a split of revenue/profit growth between organic & acquisitions. Actually, scrub that, note 1 does give a breakdown, as follows, which shows that most growth (16%) was organic, but acquisitions helped a little extra (1%);

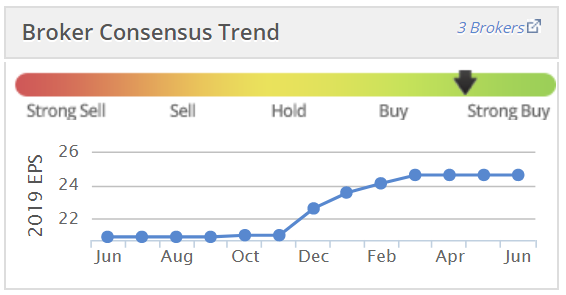

Broker forecasts - unfortunately, I can't find anything today on Research Tree, so am in the dark a bit. Note that Stockopedia shows broker consensus for this year steadily increasing in the last 6 months;

So it seems that strong performance was expected, and baked into the share price before today, as you can see below (note how the share price has mirrored the broker EPS forecasts in the last 6 months);

Outlook - the company doesn't specifically mention how it is performing versus market expectations - a glaring omission, which is annoying. Although this generally sounds positive;

Porvair has started 2019 strongly, with demand in aerospace and industrial markets more than offsetting the effects of global trade disturbances seen in some of our smaller product lines.

The Group's new product pipeline is promising and investment in capacity has continued.

Order books for the second half are robust and prospects are encouraging.

Valuation - with no broker notes available to private investors, it's very difficult to analyse this any further. If we assume that Porvair is performing in line with expectations, then this is how I work out the current year PER;

Share price 583p, divided by consensus EPS forecast of 24.6p = PER 23.7

Clearly that's a punchy rating, but with interim adj EPS up 36% on last year, then there's a good chance Porvair might beat full year expectations, which justifies a premium rating.

Balance sheet - overall this looks healthy.

NAV: £92.2m. Removing intangible assets (mainly goodwill) of £67.5m, gives;

NTAV: £24.7m - that seems adequate to me. Note that a pension deficit of £14.4m pulls down the NAV, and of course will mean cash being paid out in deficit recovery payments. I won't cover that here - it will be in the archive somewhere, so please check back if you're interested. With the madness on ultra-low interest rates seemingly now a permanent fixture, then pension deficits are becoming more of a problem again. So this is worth checking out, before considering a purchase, in my view.

Current ratio (working capital) for this type of business, I like to see it at 1.5 or better. The actual figure of 1.61 is good. Both inventories & receivables look reasonable (i.e. not excessive) in relation to revenues & cost of sales, so that's all fine.

As mentioned above, IFRS 15 has meant some re-jigging of provisions on the balance sheet. See note 15 if you're interested.

Net cash - it reports £8.2m of cash, less £4.9m of bank debt, giving net cash of £3.3m. That's a nice safe position, which is important at the moment, given all the geopolitical risks. This is a not a good time to be buying shares in highly geared companies in my view. So Porvair gets a thumbs up from me on its ungeared balance sheet.

Overall, I'm happy with this, the balance sheet passes my usual tests comfortably. Why does this matter? A solid balance sheet reduces risk for investors, and means that a company can survive, even if something goes wrong with trading. Look at how many highly geared companies have come a cropper in the last year or two, e.g. £AA. , Saga (LON:SAGA) , Debenhams (a wipeout for shareholders), and £TCG (where I have a short position) which has a ridiculous balance sheet, and whose equity is almost certainly going to 0p - since the large bond debt is trading at a deep discount - a sure sign that equity is worthless.

Return on capital employed - I rarely comment on ROCE, which can be a useful performance measure. Management that focus on ROCE tend to be efficient allocators of capital, as ROCE focuses the mind on using capital efficiently. This is impressive;

The Group's return on capital employed increased to 16% (2018: 14%). Excluding the impact of goodwill, acquired intangible assets and the pension liability the return on operating capital employed was 46% (2018: 44%).

Cashflow - the lack of cash generation is an amber flag for me. Adverse working capital movements seem to have absorbed all the profit generated in H1. However, the narrative explains this as being seasonal in nature, so it's probably OK;

Cash generated from operations in the six months to 31 May 2019 was £1.4 million (2018: £0.9 million). Working capital increased in the period by £7.5 million (2018: £5.9 million).

Working capital usually increases in the first half.

A particularly strong May trading performance this year led to unusually high receivables at the period end.

In addition, inventories are higher than the year end reflecting the strength of the order book over the next quarter and increases as a result of Brexit preparations, which have not yet been utilised.

I find those explanations perfectly reasonable. However, this will need to be checked at the next year end, to verify that the cashflow has normalised.

My opinion - the more digging I've done into these interim results, the clearer it is becoming that this is a quality business. I've always thought that actually, but the price has always been very high. The strong growth announced today makes me feel that the premium rating is deserved, as this is clearly a business that's trading well, and has a positive outlook. Although the growth is largely confined to the aerospace division.

I'm not really looking to buy any new stocks at the moment, unless they're a stonking bargain, which this isn't. However, as a quality growth business, I think it looks impressive, and seems well managed. So well worth considering as one worthy of more research. I'll add it to my watch list as something to possibly buy if we see another market sell-off over Brexit concerns.

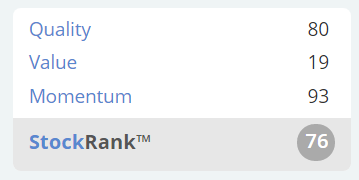

As is often the case, the Stockopedia StockRank nicely summarises what it's taken me hours to say! i.e. very nice business, with strong momentum (earnings & share price), but rather pricey;

I've just printed off the CakeBox results, and am heading to a local brasserie for a £DISH (in which I have a long position) meal, 25% off at one of my favourite local restaurants. So I'll jot down some notes here when I get back.

Cake Box Holdings (LON:CBOX)

Share price: 169p (up c.2% at market close)

No. shares: 40.0m

Market cap: £67.6m

Cake Box Holdings PLC is a United Kingdom-based franchise retailer and manufacturer of cakes. The Company operates its retail stores under the name Egg free Cake Box. It manufactures and sells personalized fresh cream and egg free cakes. [description taken from the StockReport here on Stockopedia]

I've bolded "franchise", as that's the key word. We've not reported on this company before here, so I've taken a proper deep dive into the figures, which has taken me about 4 hours. It's a lot of work to properly plough through the numbers, and think about the business properly.

Cake Box has been operating for about 10 years, and floated on AIM a year ago in June 2018.

Here are my initial thoughts from reviewing the StockReport, and today's RNS highlights;

Bull points

- Sound balance sheet

- Excellent growth track record, both in revenues & profit - adjusted pre-tax profit up 19% to £4.0m

- Roll-out (via franchising) of apparently successful cake shop format - 2 new shops per month being opened, total now 113 shops, with many more planned (how many shops could it end up with? 500 maybe, even 1,000, in the UK?)

- Good time to be doing a retail roll-out (through franchisees) as great deals available from landlords for new tenants of empty shops

- Franchisees are motivated to operate their own business effectively, and they fund the capex, thus enabling CBOX to operate with very low staff (only c. 67 people at Head Office)

- Reasonable forward PER of 16.3 - looks good value for a successful roll-out

- Decent & growing divis - forward yield is 2.7%, and growing fast

- Very high operating profit margin

- High quality scores, e.g. ROCE (since franchisees pay for the shop fit-outs)

- High gross profit margin on cakes - c. 69% - probably enough to share between franchiser and franchisee, and make both financially viable (NB. Franchise businesses only work if gross margins are very high)

- Strong LFL sales growth at franchise level, of +6.5% for y/e 31 Mar 2019, and this was hit by hot weather in H1. Improved to +8.6% in H2 - a cracking growth rate from a retail business, given lower footfall, etc. - so this looks a very promising retail format, to be delivering such strong growth right now

- Positive outlook statement, but no specifics given

- Immune from cost increases, e.g. wages, business rates, etc, as the franchisees suffer those

- Cashflow statement looks good to me (and prior year comparatives) - a genuinely cash generative business

Bear points

- Relatively low barriers to entry, and competing against thousands of independents, who have been personalising celebration cakes for decades

- Key point - I suspect that most of the profits probably come from selling new franchises, not from trading (more on this below) - hence profits not necessarily sustainable

- Note that receivables of £1.6m, most of which is extended credit given to new franchisees for their initial franchise fees. I'd like to find out more about that, and what the level of bad debts is? It might not be a problem. Note that ongoing supplies are on strict 7-day terms to franchisees, which I like, that's good tight control of receivables.

- Today's results look like a small earnings miss, reporting 7.9p adj EPS vs 8.1p forecast. Although as a small cap with little broker coverage, the consensus figures are not always certain

Observations

- Share price almost static since IPO in June 2018

- Egg-free cakes are not vegan, but are vegatarian - a fashionable, growing market

- Investment property of £650k should turn into cash, which is good - seems to relate to a compulsory purchase order, post balance sheet date (see note 16)

- Directors remuneration & share options, etc, doesn't seem to be disclosed in today's RNS, so needs checking to Annual Report & AIM Admission Document (which I've not had time to read yet, but is on my to do list, when I can find 6 hours of quiet time!)

- The franchise structure, means that CBOX won't be affected by IFRS 16 re leases. Does that matter? Probably not, as I suspect most investors are likely to just cross out the silly IFRS 16 entries that are going to appear on balance sheets soon. Just like goodwill is usually crossed out

More info needed

- How much does it cost to buy a franchise? I checked on Cake Box's website, which has remarkably open information, saying each new franchise costs £125k + VAT - although I imagine that's negotiable.

- Does CBOX have any guarantees over franchisee shop leases? (I suspect not, as nothing is disclosed, but would like to be sure on this point)

- An essential part of the research for this share, would be to go into some shops, and ask to talk to the franchisees. See what they think. Are they making a decent living out of the shop? Are they treated fairly, etc? Did they have to give personal guarantees over the shop unit rents (I bet they do), which can often ruin peoples' lives if things go wrong. I know this from personal experience, as I've been doing battle with a large pubco over personal guarantees for years. Never, ever, sign a personal guarantee - that is the most important thing I would tell any up and coming entrepreneurs.

Balance sheet - it's fine, nothing to worry about here.

My opinion - I was starting to get really excited, when ploughing through today's RNS, and all the figures & notes. It looks great - a reasonably priced roll-out, lower risk as it's done via franchisees. Could there be a catch? Yes, I think there is a catch.

The problem historically with franchise businesses, and I remember this from previous recessions, is that the profits can suddenly vanish when a recession kicks in. Why? Because it often turns out that small, growing, franchise businesses make a high proportion of their profits from selling new franchises, and not so much from ongoing support fees. That's not necessarily the case, but in my experience it often is.

Therefore, the key figures to find out, are what is the split of revenues & profits from one-off franchise setup fees, and the ongoing recurring profits (e.g. annual support fees, marketing contribution, training, markup on raw materials [CBOX bakes the cakes at central depots, then they are personalised for customers in-store])

In note 2.7 (revenue recognition) of today's results, CBOX says (inter alia);

Fees

Fee receivable from the franchisee for branding, equipment, training and initial support are recognised on delivery of the equipment and rendering of the services enabling the franchisee to operate at which time the company has performed its obligations under the franchise agreement in respect of the fees. Fees received in advance are held on the Consolidated statement of Financial position as deferred income.

I don't know how much of the fees are for equipment, or the various services, but I bet the profit margin that CBOX books on these initial setup fees for new franchisees is pretty high.

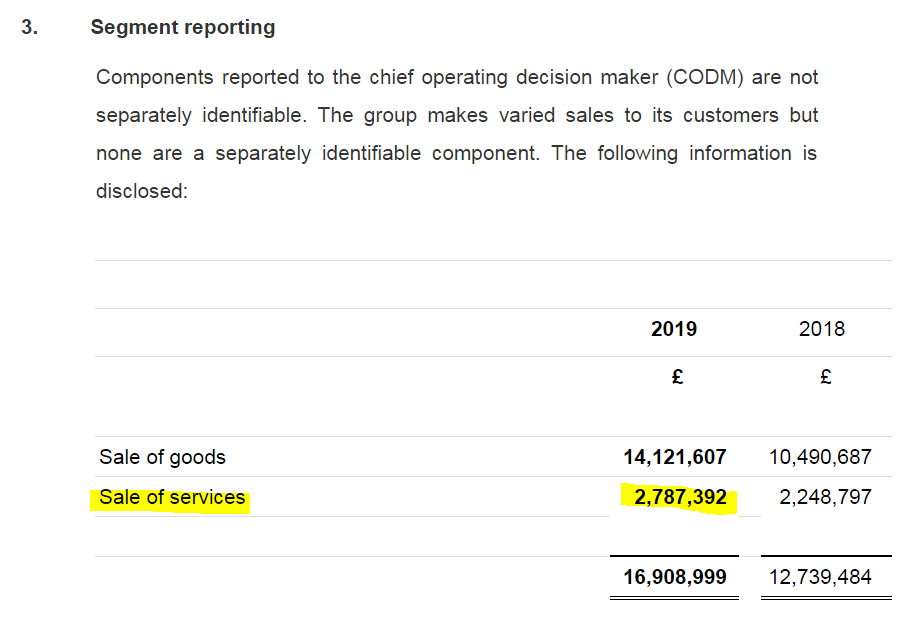

Reinforcing my hunch on that, is note 3, segment reporting;

If we assume that sale of services (to franchisees) could be at say 80% profit margin, then that would suggest profit of c.£2.2m comes from selling services to franchisees. How much of that is one-off in nature? I don't know, but it's a critical question to find the answer to, to determine how sustainable CBOX's profits would be, if new franchisee applications were to dry up?

Put it another way, CBOX appears (from its website) to be charging £125k for new franchises. No breakdown is given on that, but I would be surprised if that includes the store fit-out. It almost certainly would not include the costs of the fit-out. Therefore, I reckon CBOX could be booking a profit of maybe £100k on each new franchisee signed up. With 24 new stores opening per year, that could mean profit of £2.4m p.a. flowing from those fees, which is more than half the £4.0m adjusted profit reported today.

To emphasise, there's nothing wrong in any of this, but when we invest in franchise businesses, we need to be aware that sometimes a lot of the profit is not necessarily recurring in nature, if new franchise sales dry up, which they do in recessions.

There again, you could argue that everything dries up in recessions, whatever business model you have.

Providing Cake Box can keep attracting 24 new franchisees each year, or even accelerate that pace, then the profits should continue rising. There are many attractions of a franchise model - store staff are owner-managed, and motivated. Head Office doesn't need to monitor things so much, as opposed to the nightmare of trying to run a chain of owned stores centrally.

This is my first proper look at Cake Box, and I'm keen to learn more about it. So whilst I'm a little wary about where the profits actually come from, and whether that's recurring or not, this share certainly looks interesting & worthy of more research.

Further work - here is the AIM Admission Document - the IPO price was 108p, so it seems to have shot up after IPO, and then gone sideways - much better than many small cap IPOs I can think of. I'll have a proper rummage through that when time permits. Often admission documents answer many questions, and give a great deal of detail, so they're worth properly scrutinising.

Overall then potentially interesting, I shall add Cake Box to my watch list, but no plans to buy any at the moment.

All done for today.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.