Good morning!

We have plenty of candidates for coverage today.

In the end I covered:

- Duke Royalty (LON:DUKE)

- Miton (LON:MGR)

- XLMedia (LON:XLM)

- Xpediator (LON:XPD)

Cheers

Graham

Duke Royalty (LON:DUKE)

- Share price: 44.5p (-3%)

- No. of shares: 198 million

- Market cap: £88 million

Final Results and Notice of AGM

(Please note that I currently hold DUKE shares.)

Duke is "the first UK quoted non-resource royalty investment company", i.e. it's an unusual type of investment vehicle. It provides financing to small businesses and in return it receives a long-term income stream that varies in accordance with the revenues of the underlying businesses.

This is "mezzanine finance" - riskier than lending, less risky than buying an equity interest. I've discussed the business model plenty of times before so if you're interested, I'd invite you to check out the archives!

These results are for the year ending March 2018. They are pretty much irrelevant in my view, given how much has happened at Duke since then.

Some investors might be disappointed with the loss announced today but I agree with the company's view that its accounting treatment is a little bit harsh.

The underlying business model is simple: Duke puts big chunks of money into businesses and gets a strong, variable cash yield in return (e.g. starting at 13%).

Cash flow is then used to pay dividends or reinvest. Personally, I would be happy if the company would reinvest as much as possible, to enable it to compound and diversify as quickly as possible.

Plenty of investors do want income, however. The quarterly dividend at Duke is now 0.7p and the company's intention is that this will be "stable and increasing". In FY 2018, Duke achieved slightly better than its initial target of a 5% yield (2p) on the 40p placing price.

The real test will be whether the company can achieve the promised cash flows in the years ahead. It's still too soon to say whether the company can achieve its goals.

Keeping costs at a reasonable level will also be important. Duke is headquartered in Guernsey and has very few employees, so it should be possible to contain costs in such a way that shareholder returns aren't held back.

I've sized my position in this share so that I won't be devastated if one or two of Duke's investee businesses blows up. Investees include a European river cruise operator and a British glass merchant. Reflecting the origins of the business model, there are also some Canadian businesses.

In a bull case scenario, shareholders will enjoy a steadily rising dividend and compounding wealth for many years to come. It's far from guaranteed, however, and requires a long time horizon.

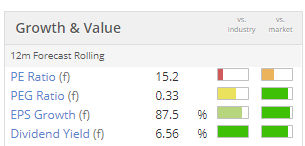

The StockRank is still very poor, as it usually is for new businesses. I'm happy to stick my neck out and predict that as the algorithms get more data, they will give Duke a better rating. The latest score is 33. But we can already see that there is big EPS growth in the forecasts and a juicy prospective yield:

Miton (LON:MGR)

- Share price: 71p (+7%)

- No. of shares: 173 million

- Market cap: £123 million

This asset manager had an AuM update in July which covered some of the headline figures in today's report. We discussed it at the time - see here.

It is enjoying a great bit of momentum with AuM up 35% at the end of H1, over the previous 12 months.

We have clear evidence that the company is growing market share and beating the competition in its UK strategies. The UK Investment Association records aggregate net outflows, while Miton itself had good net inflows.

I've mentioned before about the operational leverage of fund management companies: they build a platform with a lot of fixed costs but the potential to take on huge increases in AuM. This means super operational leverage.

The only major hurdles to this are A) whether the strategies can scale up (and this is a little bit questionable in the case of Miton, which has traditionally had a lot of emphasis in small-caps), and B) the fact that fund manager pay goes up with larger funds under management.

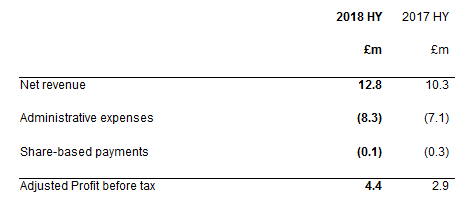

Miton acknowledges that higher pay is mostly responsible for the 17% increase in administrative expenses during this period. But despite the higher pay, we can still see the benefit of operational leverage. Miton's adjusted PBT increases by more than 50%:

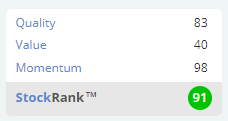

My view - I maintain my positive view of Miton and so do the Stocko computers. I consider the shares to be fairly priced but to offer plenty of upside if it continues to deliver

Like any fund manager, it's geared to overall equity markets. That's the main risk: a general rout in equities, or a long-lasting bear market, could dull the enthusiasm of clients. But the same is true for any manager.

XLMedia (LON:XLM)

- Share price: 103.5p (-2%)

- No. of shares: 220 million

- Market cap: £228 million

This is an online "performance marketing" group we have covered many times before.

The share price was more than double the current level in December 2017. Since then, regulatory changes have been affecting the business on a variety of fronts.

I've listened to the results presentation given by the CEO this afternoon.

A summary of the regulatory headwinds affecting the business:

- the UK Gambling Commission's guidelines resulted in XLM's clients being unable to say for sure what XLM could and could not do in terms of its campaigns. Although not fully recovered, the CEO says there is more clarity now and he believes in the opportunity in the UK.

- Germany - some clients left the market, and some clients were nervous, due to unclear regulations. Clients also were "uncooperative" in some negotiations, wanting to do revenue shares instead of CPA (cost per acquisition). XLM likes to do revenue shares but it hadn't planned that negotiations would turn out this way during the period.

- Australia - banned gambling advertising. Not a complete surprise except for the timing. It wasn't expected to happen for a few years.

- GDPR & other data protection instruments - XLM is compliant.

These issues collectively were responsible for the drop in revenues, EBITDA and pre-tax profit during the period. Media revenues collapsed 31% as XLM ceased low-margin activities. For the group as a whole, PBT reduced to $16.8 million (from $19.5 million).

In the publishing side of the business, some of the company's owned websites were attacked during the period. There were "scraping attacks" (when data is maliciously extracted from websites) and also fierce competition in SEO, so that some of XLM's websites dropped in the search rankings. "Websites are now in various stages of recovery."

I note that there is still some concentration risk when it comes to the corporate clients who are paying XLM to be connected to end-users: the top 4 clients accounted for 26% of revenues.

The gambling sector generated 70% of revenue and mobile apps 20%, so the personal finance side of the business is yet to make a big financial impact.

Outlook - "on track to meet expectations for the full year".

My view - it's an impressive company in lots of ways. From a quantitative point of view, it earns huge returns on capital and has shown impressive growth for a long time.

It maintains a big cash pile and is likely to announce more website acquisitions soon.

However, I've never been much tempted to buy shares in it, as I place it within the category of Israeli internet companies. There are some things I just won't do - Chinese shoe manufacturers, Malaysian data centres, African gold mines, and Israeli internet companies. When I've ventured abroad to exciting locations, it usually hasn't worked out. So I rarely do it (except for the occasional mistake).

If you don't mind this factor, then by all means take a look at XLM.

The youthful CEO-founder has been involved with the company for pretty much his entire career (as far as I can tell). When it started, it was his entrepeneurial creation. He now owns 2% of the company and I wonder what his long-term plans might be.

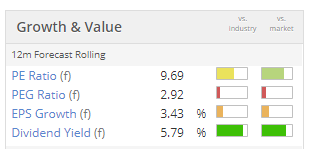

These shares look fairly priced to me. It might make sense for it to have a higher rating in its home territory, but I would say that UK investors are right to exercise caution.

Xpediator (LON:XPD)

- Share price: 73p (+3%)

- No. of shares: 134 million

- Market cap: £98 million

Xpediator Plc (AIM: XPD), a leading provider of freight management services across the UK and Europe, is pleased to announce its unaudited interim results for the six months ended 30 June 2018.

Paul and I have covered this logistics group before. We have mostly thought it looked alright, without getting overly excited about it. It has particular expertise in connecting the UK with Central and Eastern Europe ("CEE").

My caution in relation to XPD has had much to do with my fear that I simply don't have enough industry knowledge. I've also noticed a couple of listed logistics companies performing very badly in recent times, and this has naturally increased my nerves!

Additionally, XPD has been busy with acquisitions, and I tend to avoid acquisitive groups (except when they are explicitly designed to be investment vehicles).

But so far, XPD has performed fine since its IPO.

Adjusted operating profit in H1, excluding acquisitions, is up 30.6%.

Including the effect of acquisitions, adjusted operating profit is up 44%.

Those are the percentage numbers which I reckon are the most important, but you can honestly take your pick. You have a total of eight different profit numbers to choose from, and eight percentage growth rates. The joy of acquisitions and adjustments!

On a serious note, it's reassuring to see that the company is achieving good organic growth and growth by acquisition. Too often, we see a great deal of the latter and not much of the former.

Outlook:

Pleasing start to H2 2018 with trading weighted as usual towards the second half and the Board remains confident of delivering full year results in line with market expectations

Balance sheet - doesn't fill me with much confidence. There's very little tangible value, due to the build-up of goodwill from acquisitions.

It might also be worth mentioning that receivables and payables are extraordinarily large (there is probably a good reason for this in the freight management industry).

Summary - I can't get excited about this as an investment idea, based on what I've read about it so far. On the other hand it's performing well and hasn't put a foot wrong, so it could be worth looking into.

StockRanks view it as another High Flyer - strong on Quality and Momentum but without much Value.

Thanks for dropping by. If I get a chance, I will review some of the shares you requested (e.g. Spectra Systems (LON:SPSY) and Kape Technologies (LON:KAPE) ) later in the week. Bye for now!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.