Good morning, it's Paul here. I hope you enjoyed the weekend. I'm possibly a little behind the curve here, but have this weekend enjoyed binge-watching The Crown - isn't it marvellous!

Also, I had to chuckle when my mobile went off at 12:30 am on Saturday morning, from a friend who happened to bump into a Stockopedia subscriber in what sounded like a busy bar or nightclub! They just wanted to say hello, and how much they like the SCVRs! So hello to DavidF and Davidj128 - who subscribed here 3 months ago - good man! They signed off by quipping that, seeing as it was me, with my reputation, they guessed I wouldn't mind them calling me past midnight to have a friendly chat. Absolutely correct!

Timings - I've got a call booked in with Cerillion (LON:CER) management just after 11 am, to discuss its results. These calls tend to take up quite a lot of time beforehand, to prepare (i.e. thinking up some intelligent-sounding questions, in order to avoid appearing clueless!), and afterwards, to digest and write about it.

I've mentioned here before that CER looks quite an interesting company. So when an adviser got in touch to see if I'd like to talk to management, I replied yes please. (it's not a share I currently hold, but is on my watchlist).

So that's likely to dominate most of my morning. After that, I'll try to cover everything else of interest in the trading updates/ results statements from small caps within my remit.

Therefore, we're probably looking at an all-day job, with completion estimated at 5pm.

Update at 17:33 - today's article is now finished.

My initial sweep of the RNS has thrown up these items which I'll tackle today;

Cerillion (LON:CER) - final results, FY 09/2019

Intercede (LON:IGP) (in which I hold a long position) - interim results, 6m to 30 Sep 2019

D4T4 - interim results, 6m to 30 Sep 2019

BRCK - interim results, 6m to 30 Sep 2019. This is a recent IPO.

Cerillion (LON:CER)

Share price: 192p (up 3% today, at 09:31)

No. shares: 29.5m

Market cap: £56.6m

Cerillion plc, the billing, charging and customer relationship management software solutions provider, presents its annual results for the 12 months ended 30 September 2019.

These figures look good;

- Revenue up 8% to £18.8m, although only 27% of this is recurring

- Big increase in order book - up 69% to £22.0m

- Adj PBT up 12% to £3.5m

- Tax - note that it pays very little corporation tax, due to R&D tax relief - that's fine, but worth bearing in mind if this valuable benefit is ever withdrawn by Govt, then it would whack the share price (as with other companies which also benefit from this policy)

- Adj EPS is 11.3p, giving a PER of 17.0 - this valuation looks reasonable, given the decent performance, and strong outlook comments. Note that 11.3p EPS is a beat against forecast of 11.0p, a good thing

- Total divis for the year of 4.9p, up 9%, giving a yield of 2.6% - not huge, but it's well-covered, and rising, so perfectly acceptable

Balance sheet - looks good, including £5.0m of net cash. Although receivables look unusually high, and there is £2.4m receivables within long term assets, which is very unusual. I shall ask management about this on my call later this morning.

Outlook comments - are upbeat. I particularly like the bit about winning major new contracts, but this section below is stuffed full of positives;

"Cerillion has delivered a strong performance with revenue, pre-tax profits and new orders all achieving record highs. The four major new customer wins continued a trend towards larger deal sizes with larger customers and stand us in good stead for further new wins. Three of the four were signed in the second half, increasing our back-order book to a new high. With a further major new win secured in October, we start the new financial year with greater revenue visibility than at the beginning of any previous financial year."

"Industry trends in our core telecoms market mean that demand for our solutions remains strong and with recent sales success, a strong new customer pipeline, the ability to rollout new and enhanced product modules, and ongoing recognition by industry analysts, the Company is very well placed for continued progress."

Broker forecasts for FY2020 and beyond have been increased today by about 7%.

We're now looking at 12.6p for FY09/2020, with comments that this could be increased again. If we say that 13.0p looks possible, then the PER would be 14.8

That looks good value to me.

EBITDA - is largely meaningless, as £833k in development spend was capitalised.

My opinion - I'm impressed with the numbers, and positive outlook, combined with a valuation that still looks reasonable, even after having had a good run this year.

Management is long-serving, and hold about 40% of the company - plenty of skin in the game there. I agree with Tim Martin (of Wetherspoons), in his recent comments that it's far better to have long-serving, experienced Directors, than to change the composition of the Board in response to box-ticking regulatory ideas.

Cerillion seems to be on a roll. I particularly like situations like this, where companies are winning large, multiple contracts. That usually tells us that the product is very good. Contract wins can then become reference sites, to give other new customers confidence, thus creating a snowball effect.

On the downside, the company seems to need a constant pipeline of new contract wins, almost running to stand still perhaps? The main risk in future is if it has a lean patch of new contract wins, which could cause a profit warning.

With a strong order book, the outlook seems good. Overall, this share gets a thumbs up from me.

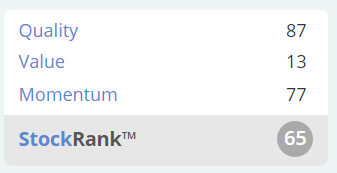

Stockopedia awards it the coveted "High Flyer" classification. The StockRank is positive, and I bet this is likely to rise, once the upgraded broker forecasts feed through into the data, which should push up the momentum part of the StockRank;

Call with management - I've just come off the phone to the CEO & CFO of Cerillion. The tone was upbeat, as is the RNS. It looks like a business that's on a roll. I asked some fairly dry accounting questions, and got reasonable-sounding answers. In particular, the long-term receivables balance of £2.4m relates to extended payment terms for customers, which they see as a useful differentiator. Keen to keep a strong balance sheet with plenty of cash, as customers expect a mission-critical software provider to have decent financial strength.

A subscriber here, Phil Dunfy, put forward 3 good questions in the comments below (no. 5), which I managed to get answers to, as follows;

1) What's your competitive moat? Standardised product set, straight out of the box, so quick to set up. Being a small & agile company, Cerillion can serve its customers better than large software companies, who can take years to write complex software.

2) How much reliance on a few key customers? Largest customer was about 20% of revenues, top 5 are 55% of revenues. But the top clients list changes each year. Lots of follow-on revenues, over many years, from new customers. So revenue much more predictable than 27% recurring revs figure suggests.

3. Growth plans? Yes most customers are tier 2 or 3, but it's modular software, so some larger customers take partial product. Size of customer wins is increasing, augurs well. Mgt want to grow the business faster, and scale it up. Possible acquisitions, but has to be complementary, and accretive to earnings. Private Equity are possibly over-paying, making it difficult to find sensible deals. There has been a reduction in competitors, e.g. Chinese & others withdrawing from the market - good for Cerillion.

Intercede (LON:IGP)

Share price: 34.5p (up 4% today, at 12:05)

No. shares: 50.5m

Market cap: £17.4m

(at the time of writing, I hold a long position in this share)

Intercede, the leading specialist in digital identity, credential management and secure mobility, today announces its interim results for the six months ended 30 September 2019.

On the face of it, these figures look unremarkable - a tiny company, producing only £4.4m revenues (up 5% vs H1 LY), and eking out an operating profit of £25k, a loss before tax (after the heavy finance charges) of -£263k, and a profit after tax (benefiting from R&D tax credits) of £184k (this last figure of £184k is the most meaningful number, in my view, as it takes into account everything).

What's the excitement then? Two things;

- Client list - is astonishing for a small AIM company. We're talking Government agencies (especially in USA), and some of the world's largest companies.

- Turnaround under new management, which is much more commercially focused than before.

Customers are very sticky, typically once signed up, remaining clients for 10-15 years, or even longer. It's high margin business, therefore the potential is for operationally geared growth, and potentially a takeover bid from across the pond (about 70% of revenues come from America) .

Set against that, Intercede has been around for a long time, with several false dawns under old management, therefore I can understand why UK investors want to see proof of progress before chasing up the share price.

I had a good meeting with Intercede's new management earlier this year, and came away with the impression that they know what they're doing. The strategy makes sense, they've stabilised the business, now the big question is whether they can accelerate the growth. If they can, then we could have a multi-bagger on our hands. That's why I'm holding this share. Or, it might disappoint again, we don't know.

Balance sheet - is a little unusual, in that Intercede has £4.8m of expensive, convertible debt. It has also accumulated a cash pile of £5.2m (+£460k tax credit received after the period end). Therefore, my hope is that the company could soon pay off the expensive debt, and thereby boost the future P&L by eliminating the finance charges. Management are tight-lipped on their plans, just saying they're considering all options.

Intercede has had to raise fresh equity in the past, thus diluting shareholders. It's looking a lot more positive now that the company is cash-generative, and I hope it should not need to dilute shareholders again.

Customers - this bit in the commentary caught my eye, as it sounds encouraging;

As outlined below in the Financial Results section, we have received some significant follow on orders from existing customers, which provides tangible evidence our secure credential management software continues to deliver measurable business value.

We have sold three new deployments to the US Navy, US Airforce and one of the largest US wireless network operators. All of these deals were for our traditional smartcard solution although it should also be noted that we are continuing to see orders, along with strong interest and bid activity, for Derived PIV solutions...

Channel partners - this is the chosen sales strategy. No specific news, but positive noises are made;

Good progress has been made in the past six months working closely with technology as well as channel partners on new opportunity generation in our chosen markets.

Outlook - H2 weighting, which is unavoidable because a large client renews its contract at the end of March each year;

The actions taken to refocus the Group's strategy continue to drive improvements throughout the business. As in previous years, revenue is expected to be weighted towards the second half of the year

Whilst the nature of Intercede's business and customer profile is such that the precise timing of orders is difficult to predict, the current sales pipeline and levels of bid activity continue to support management's revenue and profitability targets.

Forecasts - FinnCap has put out a short note today, confirming its £11.0m revenue target for this year.

My opinion - the main risk is large, lumpy contracts. There's nothing that can be done about that, in the short term anyway. The good news it that contracts are very sticky, and a lot of revenue is recurring, or at least repeat.

If new management is successful in driving more rapid sales growth, then things could get exciting here. We'll just have to wait and see what happens. Obviously, as I hold this share, then I think risk:reward could be good. But it is clearly quite speculative at this stage.

D4T4

Share price: 205p (down c.5% today, at 14:57)

No. shares: 40.2m

Market cap: £82.4m

Specialists in Data solutions, D4t4 Solutions plc (AIM: D4T4) announces its unaudited interim results for the six months ended 30 September 2019.

A theme is developing today - this is the third software company with lumpy revenues that I'm reviewing.

As readers have already commented below, the headline figures for H1 reported today look poor. My notes here from the trading update on 23 Aug 2019 are quite helpful in getting up to speed - the company advised the market then that it expected an H2 weighting to this year's results - a message which is repeated today. Hence why poor H1 results have only hit the share price by 5% today.

Also bear in mind that the same thing happened last year, in an even more pronounced way - i.e. awful H1 figures, but they recouped it in H2. Hence management assurances about this year do have credibility.

I've just spotted that there was another trading update here on 21 Oct 2019, which disclosed the anticipated H1 revenues & net cash position (which are the same as in the actual results today). Although that update withheld the H1 profit figure, saying only that it was in line with full year expectations.

Today's interim results are just a short summary, with a link here to the full H1 results. I can see that D4T4 is definitely a company that specialises in managing data!

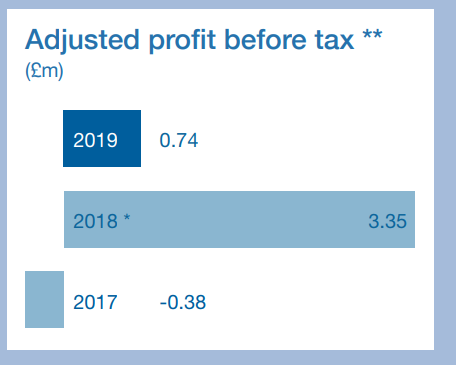

You can see how volatile H1 profit has been in the last 3 years;

Outlook - this is emphatic;

The Board remains confident in delivering a solid finish to FY20, in line with market expectations.

Therefore should investors be worried about the poor H1? Who knows.

The company does give sensible reasons as to why it thinks the full year should be OK;

Our prospects for H2 are strongly underpinned by a high level of contract renewals from new licences signed during the second half of last year and

strong visibility on new contracts due to initiate during H2.

This, combined with a significant pipeline of new business in negotiation with existing clients wishing either to increase the footprint of our software or to extend the use of our Hybrid Cloud Data Platform solution...

Given previous performance, I'm inclined to give the company the benefit of the doubt, although would want to price the increased risk into my valuation, just in case.

Balance sheet - absolutely bulletproof, including £11.2m in cash. The smallish divis look safe, given that the company has so much cash on its balance sheet.

Valuation - I've got an earnings forecast of 14.2p for this year. H1 achieved only 1.76p, so H2 needs to really delivery, to hit the full year forecasts. Management reckon they can do that.

My opinion - has to be neutral, as D4T4 has such wild swings in half-year performance, that we probably can't glean too much from today's figures. If it hits the full year numbers, then the valuation would look reasonably attractive at the current level. Especially when we take into account the lovely, cash-filled balance sheet.

Managing data seems to be a good growth area.

Overall quite interesting, although buying them at this stage is a leap of faith to a certain extent, relying on H2 being very strong.

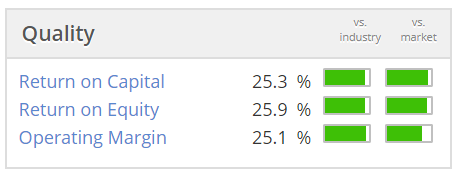

Stockopedia particularly flags very high quality scores;

Brickability (LON:BRCK)

Share price: 65p (up 6% today, at 16:15)

No. shares: 230.5m

Market cap: 149.8m

This is a new one for the SCVRs. It floated on AIM at 65p, 29 Aug 2019.

As the name suggests, it's a brick wholesaler, also selling other things to the regional & local housebuilding sector;

Brickability Group plc, the leading construction materials distributor, today announces its unaudited Interim results for the six months ended 30 September 2019 showing steady delivery of the objectives it set out at IPO.

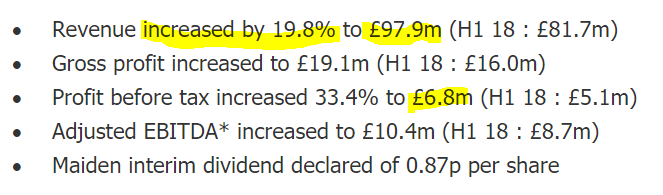

The highlights show a good improvement in profit for its maiden interims;

The net profit margin is just under 7%, which looks about right for a distributor.

Outlook comments are positive, and note that some of the growth seems to have come from acquisitions;

We are confident of building on a strong first half and the acquisitions made during the period are performing in line with expectations. We have a healthy acquisition pipeline, the outlook for our markets is positive and the board remains confident of meeting full year expectations.

Looking ahead, the longer-term outlook for our markets remains encouraging and we are pleased to see that all the main political parties have made substantial commitments to build more houses. Overall, the fundamentals for the housebuilding sector remain strong which gives us confidence that we will make further progress in the future.

I'm a little wary of groups which grow by acquisition. Whilst some have worked out brilliantly (e.g. Tracsis (LON:TRCS) and Judges Scientific (LON:JDG) ), others have run aground from stretching their balance sheets, and having incompetent management (Conviviality springs to mind). Let's have a look what this one is like.

Balance sheet - NAV is £78.9m. As you would expect, it's top-heavy with £74.8m intangibles, which will almost certainly be acquisition-related stuff. Writing off intangibles:

NTAV is only £4.1m - a little threadbare for my taste.

Another item that jumps out at me as looking extremely low, is inventories of only £7.36m. This is tiny, compared with receivables of £39.6m. How can the business operate with annualised revenues of about £200m (ex. VAT), with only £7.36m inventories? The only answer I can imagine is that perhaps it drop-ships products, direct from suppliers, instead of holding its own inventories? Or, the period end dates happen to coincide with drastic de-stocking?

I've had a rummage through the AIM Admission Document, and my question is answered on page 18, which says;

In the opinion of the Directors this has provided an opportunity for distributors like Brickability Group to build up an understanding of the products available from manufacturers, both in the UK and in Europe and to discuss and negotiate a wider range of options for the type, volume, price and timing of bricks needed by customers.

There is generally a cost advantage for the customer when sourcing product through a factor, as customers benefit from the factor’s scale of orders. Such sales often do not require the Group to take physical possession of the bricks and, instead, they are sent directly to the building site of the customer.

So my hunch was right, BRCK is acting as an intermediary, and not necessarily taking delivery of the bricks itself. Hence why inventories are so low. That's a nice business model, as it means that BRCK only ties up significant capital into receivables, and not the more usual combination of receivables + inventories. Therefore, I can see why BRCK doesn't actually need much NTAV for its particular business model.

Although I do wonder if the brick manufacturers might, at some point, decide to cut out the middleman, and sell direct to smaller housebuilders?

Valuation - the house broker is forecasting 6.2p EPS this year, and 7.4p next year. Therefore the PER is about 9-10, which looks about right to me. I can't see why you would want to pay more than that, for a distributor.

My opinion - it looks an OK business, but I wouldn't want to own shares in it, due to the risk of it being cut out of the supply chain by brick companies selling direct.

Also there is a question mark over all new floats. We've been caught out so many times by companies floating, and then it turning out that the stock market float was an opportunistic sale, at an inflated price, based on unsustainable profits. For that reason, I'm very wary of new floats.

Housebuilding in the UK is at a cyclical high, so maybe that has boosted profit margins for intermediaries like BRCK?

On the upside, this company has been around for a while, and the major shareholder list shows Directors owning about 28% - lots of skin in the game, which I like.

Overall, it's just not the type of sector that interests me at all.

That's it for today. See you tomorrow morning.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.