Good morning! Please feel free to share your comments and suggestions.

My updated list of stocks to view having seen your suggestions:

- Dialight (LON:DIA) - full year results

- Avation (LON:AVAP) - half-year report

- Quartix Holdings (LON:QTX)

- RTC (LON:RTC)

Cheers,

Graham

Dialight (LON:DIA)

- Share price: 508p (-4.5%)

- No. of shares: 32.5 million

- Market cap: £165 million

This company makes industrial LED lights for traffic control, building sites, etc.

Its market cap was £320 million when I covered it last year - which I couldn't understand, given its organic revenue growth rate of just 3% (ignoring its gains from currencies).

It had just produced H1 profits of £4 million, on revenues of £92.7 million.

Today it announces full-year pre-tax profits of £3 million, on full-year revenues of £181 million.

So not only did H2 revenues fall by about 5%, it swung into a loss for the period.

The "underlying" profit numbers imply that H2 was still profitable, but the underlying items were very big both this year and last year.

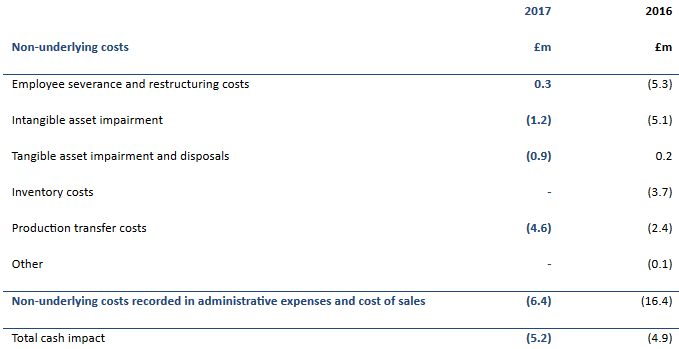

Here's a breakdown of all the "non-underlying" items. They mostly relate to set-up costs in outsourcing production to a site in Mexico ("production transfer costs"), along with a miscellany of others:

Problems at the outsourced manufacturing partner are to blame for the weak performance in H2, with issues which "hampered our ability to deliver orders to our customers".

The manufacturing partner was unprepared for the complexity and the scale of the manufacturing process required by Dialight. Certain Dialight employees are now stationed full-time there, improving their process.

As you might expect, these issues are ongoing through H1, so that the company is guiding investors for 2018 with the dreaded H2-weighting:

We are taking corrective action and in the near term are wholly focused on the manufacturing challenges which will continue to impact our results in H1. As a consequence our results for 2018 will be heavily weighted to H2 reflecting the successful resolution of these issues.

Market leader?

Despite the problems, Dialight remains very bullish on merits of its technology! It claims to be the market leader in industrial LED lighting.

Outlook - still confident in the "medium to long term".

My opinion

Checking the all-important organic revenue growth rate (at constant currencies), it fell by 4% year-on-year in 2017.

Last year, revenue was up 2% at constant currencies.

On these numbers, I don't think we can sustain the view that this is a high-growth opportunity. Granted that this year's numbers were affected by some exceptional challenges, but last year's numbers weren't huge either.

In the company's favour, the balance sheet is strong with net assets of £76 million or £42 million even if we exclude all non-current assets (the so-called "NCAV").

Also, cash flow was pretty good, with net cash from operations of £8.5 million offset by about £3 million in investments.

My impression is that there is a decent company underneath, although we should be cautious about the growth assumptions and earnings multiple we attach to it. We need to bear in mind that it has slipped up from time to time. Earnings downgrades for 2018 are very likely.

The share price has halved since last year, so clearly investors are starting to approach it with a more appropriate level of caution!

At a modest multiple, and with production issues solved, I don't think I'd have any problem with including this in a portfolio. It's probably still overvalued, but it's getting into more reasonable territory now.

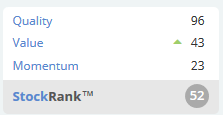

The StockRank confirms this view:

Avation (LON:AVAP)

- Share price: 224.5p (-0.4%)

- No. of shares: 62.6 million

- Market cap: £141 million

This is an aircraft leasing company with headquarters in Singapore.

In the spirit that investing is a team sport, take a a look at Carcosa's article recently. Lots of background info there for investors new to the stock. He has also provided the first comment in the discussion thread below.

I'm inclined to view this company as a financial stock. Returns are generated from deploying its balance sheet and earning the spread between lending (leasing) aircraft and its own total borrowing costs, along with the depreciation in value of the aircraft it owns.

The company has non-investment grade credit ratings from the credit rating agencies. S&P gives it a B+ rating. That sounds about right, given the sector and the size of the company.

How it works

Since it's a financial stock, let's consider how the balance sheet has performed over the period.

The company generated operating ROA (operating income versus average total assets) of about 2.5%. This is from my own calculations: it generated $25 million in operating profit from average total assets of very roughly $1 billion.

That's not bad over six months. But it does need leverage on top, to juice the return for shareholders.

In this case, balance sheet leverage ended the period at 5.4x. The entire $1.12 billion balance sheet is funded by $207 million in equity.

Interest costs are therefore key (as acknowledged by Carcosa). Weighted average cost of total debt reduces to 4.8%, from 5.1%.

When you put all of these numbers together, the after-tax return on equity comes out at a modest level. We will have to wait and see what happens for the full-year 2018, but previous years have seen ROE somewhere around the 12% level.

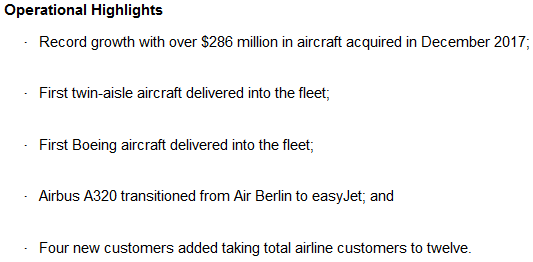

Operational highlights

We now have a decent understanding of the balance sheet - modest returns on equity, with lots of leverage helping to boost low returns on assets. In other words, the same as many financial-type stocks.

Moving on from that, let's take a look at at the operational highlights. These highlights are certainly promising in terms of achieving greater scale for the business, and perhaps lower borrowing costs over time:

Outlook is neither positive or negative, and mostly refers to risk. Lease revenue should "materially increase" in H2 and the company thinks that risk has reduced.

My opinion: Overall, it looks like a well-run company. Is it a good investment?

I think I need to study it more, but one thing I'd mention is that leading indicators in the junk bond markets suggest that capital might become more expensive in the months and years ahead.

So that could be a risk factor for Avation, putting pressure on the spread between ROA and borrowing costs, which doesn't look too big to begin with.

On the other hand, it might just keep growing its balance sheet and reach a scale where lenders become that much more comfortable with it. I'll keep an eye on its progress from now on.

Quartix Holdings (LON:QTX)

- Share price: 360p (-3%)

- No. of shares: 47.6 million

- Market cap: £171 million

I wrote positively about this telematics stock at its full-year trading update last month, saying that its attractive characteristics were probably enough to justify the big earnings multiple it enjoys.

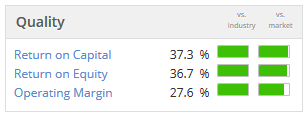

The Quality Rank is 93 and the major quality ratios are all undeniably good:

I also had the impression that cash flow was excellent and that it had a good chance to be a long-term winner in the telematics space. The major source of uncertainty was roll-out in the US.

Today's announcement confirms the strength of cash flow generation, as Quartix announces £5.3 million in dividends, most of this being in the form of a "supplementary" dividend to remove excess cash from the balance sheet. It has already paid out £1.14 million in the form of an interim dividend.

Financial highlights

There are two sides to this business - Fleet (helping businesses manage their fleets of vehicles) and Insurance (helping insurance companies track policyholders).

The Insurance side is in planned decline, as management don't want to chase low-margin work, but the decline has been lower than expected. So with 14% growth in fleet revenue and 12% decline in insurance revenue, total group revenue is up 5% to £24.5 million.

This translated to adjusted EBITDA up 6% from £6.8 million to £7.2 million.

Operating profit, however only grew by 1%. It looks as if the difference is accounted for primarily by increased share-based payments. As regular readers will know, I believe that share-based payments should in principle not be added back into adjusted profit measurements.

Overall, it's a good financial performance. Growth is flatter than we would like for a highly-rated stock, but it still has the positive features we've come to expect from it in terms of margins and cash flow.

Operational highlights

I'm most interested in what happens in the USA, where Quartix has been making significant investments.

Revenues from the USA increased to £1.2 million from £0.7 million, and this segment generated losses of £0.3 million, i.e. not far off breakeven. Perhaps it is making a profit in the current year?

This sounds promising:

In December, we relaunched our US website (www.quartix.com) and integrated it fully with the marketing platform, thereby improving the effectiveness of our sales and marketing resources. We continue to receive significant numbers of new enquiries for our service in the USA, and the new platforms allow us to identify quickly the prospects which need immediate attention from our sales people, whilst at the same time providing a very effective automated response to all other enquiries.

The numbers for the entire fleet business are excellent. The entire subscription base is up 20% to 105,000 vehicles.

I guess that pricing pressure must be a bit of a headwind, as customer growth of c. 20% translated into much more modest revenue growth. This is to be expected in the sector, I suppose.

Outlook statement is confident, as the year has started in line with expectations.

My opinion

I still like this company and the valuation seems about right. It's expensive, with a PE multiple of about 29x. But that's due to the company's highly attractive cash generation, recurring revenues, high margins, return on capital and growth in customer numbers.

As I said before, success in the short-term will hinge on take-up in the US.

RTC (LON:RTC)

- Share price: 61p (+2.5%)

- No. of shares: 14.6 million

- Market cap: £9 million

We are back in sub-£10 million territory with this. It received several requests, so I'm happy to mention it.

RTC is a small recruitment group. The earnings multiple is "cheap", but it is also cheap for Empresaria (LON:EMR), Harvey Nash (LON:HVN) and Gattaca (LON:GATC). The market tends to treat recruitment as a commodity business.

One recruitment group with a slightly higher rating is the mid-cap SThree (LON:STHR). As an internationally diversified group, it has a lot of flexibility to allocate resources where margins and markets are strongest.

Anyway, back to RTC. The results are moving in the right direction:

- Revenue £71.7 million, up 6%.

- PBT £1.3 million, up 18%.

It also has some international diversification and works on long-term contracts in UK Rail and Energy, "which are not as sensitive to short term fluctuations in the UK economy".

Having bedded in and successfully developed its existing subsidiaries, it is now on the acquisition trail again.

In addition to our incremental organic growth plan the Board now believes the time is right for RTC to pursue a transformational acquisition plan. During, 2018 we will continue the process of identifying complementary organisations that offer a broad range of consolidatory and diversification opportunities for our Group to integrate into and alongside our existing subsidiary businesses.

Borrowings - the company has no "term debt", i.e. it hasn't got any bonds or bank loans which need to be paid back on a particular date. Instead, it has a £9 million invoice discounting facility with HSBC.

The way this works is that the bank lends to RTC according to the value of invoices which RTC issues to its customers. Customers on average are taking 42 days to pay their RTC bills. Some new clients are given 60 days to pay their bills. To improve RTC's access to cash during this waiting time, the bank lends to RTC on the basis that RTC will repay the loan when the customer pays their bill.

At the end of the period, RTC was using about £4.7 million in this facility. This doesn't concern me too much, as the interest expense is easily covered. Although without the facility, it would of course need to come up with the cash from somewhere else.

My opinion

It gives the impression of a tidy outfit which is performing adequately and treating shareholders well.

What's coming up next, probably, is an acquisition or two. It will be interesting to see how that will be paid for. Some new equity perhaps?

We believe we have a proven senior executive team to attract both the debt finance and new capital support that our ambition plans will necessitate.

Bluntly, I would never expect this stock to re-rate much higher. As you can see, its peers are all trading at weak earnings multiples too.

On the other hand, it does have an attractive yield and the acquisition strategy has a good chance of succeeding, based on management's track record. So I can see some reasons why this might be of interest to micro-cap hunters.

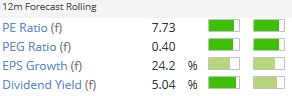

There is plenty of micro-cap value to be had:

I think that's it from me today. Thanks for dropping by.

Best wishes,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.