Good morning from Paul & Graham!

The Week Ahead - just published (by Roland this week) - the excellent new macro/large cap editorial here on Stockopedia.

Mello Monday - starts at 17:00 today, with a talk I don't want to miss from Vin Murria at the start. Also React (LON:REAT) are on, which I think looks to have interesting potential, I was pleasantly surprised at some of the numbers when I last reviewed it recently. Although it has an ongoing challenge with lowly rated equity meaning it can't do any meaningful acquisitions without diluting away the benefit.

Housebuilders

Further investigation by CMA (competition & markets authority) - interesting news here, saying that the CMA has found areas of concern in its investigation into housebuilders -

The third bullet point above is the one that concerns me, more detail saying -

The CMA has also today opened a new investigation into the suspected sharing of commercially sensitive information by housebuilders which could be influencing the build-out of sites and the prices of new homes. While this issue is not one of the main drivers of the problems we’ve highlighted in our report, it is important we tackle anti-competitive behaviour if we find it.

These are the companies suspected of sharing information -

The CMA has therefore launched an investigation under the Competition Act 1998 into - [reformatted by Paul into a list] -

Barratt,

Bellway,

Berkeley,

Bloor Homes,

Persimmon,

Redrow,

Taylor Wimpey, and

Vistry.

The CMA has not reached any conclusions at this stage as to whether or not competition law has been infringed.

The CMA’s report today is only short, and very interesting, so I recommend others to read it in full. All sounds like common sense to me (Paul).

Looking at the early morning prices today, some of the above companies have seen 1-3% share price falls so far (written at 08:26).

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Paul's 2023 share ideas, with live prices.

New SCVR summary spreadsheet from July 2023 to date, updated at weekends (very useful quick reference tool, search for ticker using CTRL+F). Hover over cell for pop-up notes.

Frozen SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Other mid-morning movers (with news) -

Ocado (LON:OCDO) - down 5% to 499p (£4.2bn) - no RNSs, but the newswire here on Stockopedia often has useful news snippets, which today says that Peel Hunt has lowered its price target from 845p to 784p. Also I picked up news elsewhere that apparently Marks and Spencer (LON:MKS) has withheld payment for its joint operations, due to dissatisfaction with service. My view - Ocado has been a multiyear major under-performer, just losing money year after year. Apparently its robotic warehouses are a joy to behold, just a pity they don’t make any money!

Cambridge Cognition Holdings (LON:COG) - up 8% to 53p (£19m) - “Midas” share tip over the weekend in the Financial Mail. Interesting company, that we’ve followed for years, loads of stuff in the archive here. I’ve cooled a bit on the fundamentals, as it spent the cash pile on acquisitions, and losses are continuing. Note recent broker forecasts have trimmed expected losses. Might catch a wave of excitement about AI, big data, etc, so a possibly interesting trade maybe?

Invinity Energy Systems (LON:IES) - up 14% to 27p (£53m) - Strategic manufacturing deal & product validation - encouraging-sounding update from this battery developer , but nothing I can assess. We didn’t look at IES in 2023, as it’s a heavily loss-making jam tomorrow company, so not something we can value reliably on fundamentals. TU 18/12/2023 said 2023 revenue is up 500% to £21.6m. Reckons it should have enough cash into H2 2024, but doesn’t say how much cash it has now. I’ve looked at the numbers (H1 results & TU since), and I think it’s running low on cash, and will need another fundraise quite soon. Hence I’m keeping it on a RED view, but at least there are signs of life with rapidly rising revenues (although note in H1, it sold product at below cost!). Safest to wait until it's refinanced, in my opinion.

Summaries of main sections

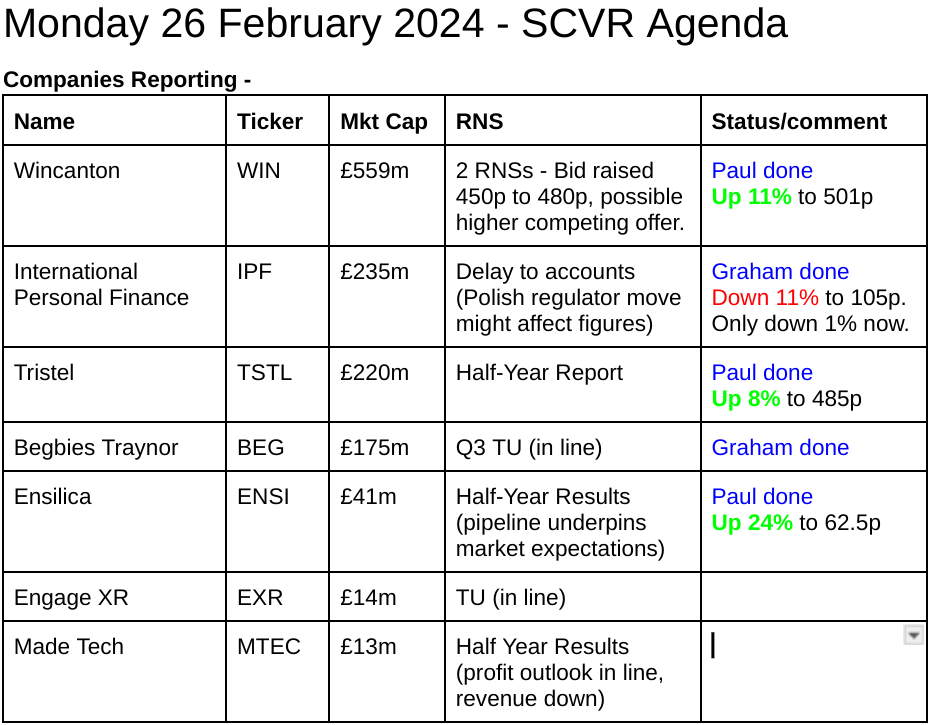

Wincanton (LON:WIN) - 449p (pre-market) £559m - Raised final offer to 480p & Possible competing bid - Paul - PINK (takeover situation)

Exciting news that the existing bid from a French logistics group has been raised from 450p to 480p. A separate announcement says another potential bidder has indicated potential interest, but there are no details. Could we see a bidding war? Looks a possibility.

Begbies Traynor (LON:BEG) - up 2% to 111.53p (£177m) - Q3 Trading Update - Graham - AMBER

This insolvency practitioner (now diversified into a range of related professional services) reports an unchanged full-year outlook and a slightly larger debt facility, enabling continued growth by acquisition. Share price has been soft; could be worth studying for value.

EnSilica (LON:ENSI) - up 26% to 63.5p (£52m) - H1 Results - Paul - AMBER/RED

It's trading around operating profit breakeven, but expensive debt tips this chip designer into losses. Balance sheet is wobbly, and going concern statement indicates it needs more funding. Massive claimed pipeline is the exciting bit! More a punt than an investment.

International Personal Finance (LON:IPF) - down 1% to 117p (£262m) - Delay of Results - Graham - GREEN

Some worrying news for investors to chew on this morning as a letter from the Polish financial regulator forces a delay to the full-year results. Hopefully it will take just a week for IPF to digest the contents of this letter. I continue to view this as risky but attractively cheap.

Tristel (LON:TSTL) - up 7% to 480p (£228m) - H1 Results - Paul - AMBER/GREEN

Nice H1 results, and I can't see anything wrong in the numbers (apart from grumbling about adjusting out share option costs, but many companies do that too). There seem very good reasons to expect growth to continue. The only question is valuation - it's up to you whether you're prepared to pay a hefty valuation for future growth. Overall I like the company a lot, but not so keen on the share price at this lofty valuation, but it may well be justified.

Paul’s Section:

Wincanton (LON:WIN)

449p (pre-market) £559m - Raised final offer to 480p & Possible competing bid - Paul - PINK (takeover situation)

Two announcements this morning, for this excellent logistics company (it was on my top 20 for 2023, so we like it here at the SCVR).

Raised offer - the 450p offer has been raised to 480p from French logistics group CMA CGM. This is excellent news for investors who hung on for the final payout. It’s so difficult to know what to do in takeover situations - sell in the market, or hold on for the full pay out and the possibility of a higher bid (but also the risk of the bid falling through).

The bidder says it’s now a final offer under Takeover Panel rules, but of course those rules allow them to increase their offer if a higher competing bid is received. So it’s not really a final offer!

Note that WIN’s board continues to unanimously recommend this bid.

“...received an approach from a potential competing bidder “

We’re not told who the company is, so can’t assess how credible this approach is.

WIN is providing due diligence information to the other party.

“No formal proposal” as yet, but I wonder if the new approach might have informally given an indication on price?

“This announcement has been made without the consent of the potential competing bidder.”

Paul’s opinion - exciting times for WIN shareholders! I can remember a bidding war for Lavendon some time ago, which proved lucrative for shareholders who sat tight, as it went backwards & forwards with higher bids. Hopefully WIN might do the same possibly? Worst case scenario, shareholders get 480p, as that deal sounds unlikely to fall through (unless WIN shareholders reject it, which can happen, as it did last year with a 74p failed bid for Tribal (LON:TRB) )

I imagine the share price might go to a small premium over 480p today, if the market thinks the new approach has credibility (writing this at 07:53).

EnSilica (LON:ENSI)

Up 26% to 63.5p (£52m) - H1 Results - Paul - AMBER/RED

EnSilica (AIM: ENSI), a leading chip maker of mixed-signal ASICs (Application Specific Integrated Circuits), is pleased to announce its unaudited results for the six months ended 30 November 2023 ("H1 FY24" or the "Period").

Strong new order momentum supports growing order book and new business pipeline.

This floated in May 2022. I’ve only looked at it once, here on 14/12/2023, useful for background, when it did a small placing. Shares have almost doubled since then, including a 26% rise today, so it’s worth another look in case there’s a multibagger in the making here!

Last time I concluded that cash outflows were a concern, but the massive claimed sales pipeline looked interesting.

H1 Results (6m to 30/11/2023) - key numbers -

Revenue up 11.5% to £9.6m

Loss before tax of £309k (LY H1: £(202)k loss)

Makes a tiny operating profit, but finance costs high at about £750k annualised, so there must be debt - not good at small companies that don’t make much profit.

Balance sheet - NAV £16.5m, less £15.2m intangible assets = NTAV £1.3m.

Receivables of £5.9m look too high, and note the separate £1.4m tax receivable - presumably for R&D tax credits.

Cash of £2.1m, less borrowings (“bank loans”) of £3.7m, so net debt of £(1.6)m, plus lease liabilities. Not ideal, I think it needs to do another fundraise to be comfortable.

Going concern note - this needs careful scrutiny. It says that some big receipts are overdue, and it’s trying to line up an additional £1m borrowing facility, and invoice discounting, to give it more headroom. I don’t like that, it shows there is significant risk here.

Note that it raised £1.56m in a 40p placing in Dec 2023, and those new shares come with warrants exercisable at 55p. So that could be headwind for the share price, as at 63.5p the price now makes those warrants in the money, so some holders might be tempted to exercise them and sell in the market. Be aware of the dilution risk at least, you can decide if it matters to you or not, as with everything we cover here.

I’d say another placing looks likely, and would be good to strengthen the balance sheet and lower risk.

We saw a debacle at a similar company Sondrel (Holdings) (LON:SND) where it also ran out of money, and remains on a knife edge financially. When are brokers & companies going to learn, that floating with overly optimistic forecasts, but inadequate finances, is such a bad strategy. Yet they do it over & over again, thus turning sensible investors against IPOs altogether because so many of them see crashing share prices.

Outlook - there’s loads of exciting-sounding upside potential in the commentary, too much for me to copy/paste it here. So it’s your decision whether this is jam tomorrow from a cash-strapped small company, or tremendously exciting upside! I don’t have a view on that, because I don’t know the company or sector well enough.

The current sales pipeline of opportunities and potential contracts stands at c.US$512 million following a review by management to focus on projects which meet our criteria, and this pipeline remains a strong endorsement of the quality of our business output and our growing reputation in the chip sector…

Encouraged by the improving broader trading environment, management is looking ahead to the remainder of H2 FY24 and beyond with confidence and is excited to explore potential new mandate opportunities to add to the sizeable contract wins already secured in the second half of the financial year.

Paul’s opinion - based on the historical figures, including today’s H1 results, I would value the fundamentals here at very little.

So the £52m valuation rests entirely on expectations for future growth and as yet elusive profits.

I don’t know the likely outcome, so I’m leaning towards amber. Although the obviously stretched finances and need for more capital means that I also have to flag elevated risk, so let’s stick with AMBER/RED, my existing view last time in Dec 2023.

Given all the tech excitement in the US, especially around NVIDIA (NSQ:NVDA) and Elon Musk, punters are sniffing around for anything in a vaguely similar sector that could be a future multibagger. So being a chip developer with an apparently huge pipeline, means I could see punters gathering around this share, which seems to be happening today. Hence the share price is probably now detached from fundamentals, so we can’t really add a lot of value (or predict what happens next) in these reports. Good luck whatever you decide!

Tristel (LON:TSTL)

Up 7% to 480p (£228m) - H1 Results - Paul - AMBER/GREEN

Tristel plc (AIM: TSTL), the manufacturer of infection prevention products utilising proprietary chlorine dioxide technology, announces its interim results for the six months to 31 December 2023, exceeding internal growth targets by delivering 20% revenue growth and 44% growth in pre-tax profits. The Company also announces a doubling of its interim dividend payment.

The Company's core business is the sale to hospitals of its proprietary chlorine dioxide chemistry used for the decontamination of medical devices under the Tristel brand, and for the sporicidal disinfection of environmental surfaces under the Cache brand.

For background, I reviewed its H2 TU (trading update) here on 19/12/2023 which I described as brimming with positivity, and I came away with a moderately positive view (amber/green) despite the very high PER (which we always moan about here with TSTL shares!).

Then, TSTL shares wobbled 10% to 405p on 11/1/2024 when Director selling was announced. The CEO is retiring though. Interesting to note that the share price has since risen c.20% from that dip, so Director selling isn’t always necessarily negative - a topic we’ve discussed a lot here, with various opinions. Sometimes it’s bad, sometimes it isn’t, you just don’t know which it’s going to be!

Key H1 numbers -

Revenue up 20% to a record £20.9m (2022: £17.5m) - “exceeding internal growth targets”

Reported profit before tax up 44% to £3.4m (2022: £2.4m)

Adjusted* profit before tax up 34% to £4.1m (2022: £3.1m)

Reported EPS up 104% to 6.50p (2022: 3.19p) - note that this 104% jump in EPS is flattered by a low tax charge, so the 44% increase in PBT is a more reliable guide.

Adjusted* EPS of 8.68p up 87% (2022: 4.65p)

Are the adjustments reasonable? Not really, no. It’s all down to share options - although this is generally accepted treatment by analysts, I think some investors are more sceptical, after all share options are just staff bonuses, so why should we ignore that as a cost?

*Adjusted for share-based payments of £0.7m (2022: £0.7m)

Although I like that the share options have rewarded mainly staff, not Directors -

The share-based payment charge of £0.7m is derived from the Group's All-Staff share option scheme which is based upon periodic share option grants to staff members (£0.5m), and the Executive Management LTIP scheme (£0.2m).

It’s up to you whether you’re prepared to value this share on statutory or adjusted figures, but to be prudent I’m leaning towards the statutory figures as better reflecting reality.

Balance sheet is excellent, no issues there.

Regulatory approvals in UK & Europe - in a separate announcement today, this seems to expand the potential market for products which currently make up c.9% of TSTL global sales.

USA expansion - has only recently started, through a partner so I think it’s too early to judge, as the figures are obviously very small so far -

Parker's manufacturing processes have been validated by our quality team and production is now underway. The product has been through beta testing at a number of healthcare institutions in the United States, with very positive feedback. Parker Laboratories plans an extensive marketing and trade show programme throughout 2024 and is in the process of expanding its salesforce in order to capitalise on the potential that Tristel ULT represents. During the first ten weeks of activity our revenue and royalty income from North America totalled £46k. We are very encouraged by this positive start.

In the second half of the year, we will procure office premises and recruit a small number of United States based staff to support Parker's marketing and sales efforts and establish a local regulatory capability.

Broker update - thanks to Cavendish for an update note today. As mentioned last time, it seemed obvious that the existing forecasts are too modest, which Cavendish hinted at previously. It’s left forecasts unchanged again today, so given strong H1 performance, the next move in forecasts looks increasingly likely to be up.

I wonder if something nearer 15p might be on the cards for the full year? That would give a PER of 32x, a racy valuation, so holders must be factoring in the potential for considerably more earnings growth in the future. Given all the upbeat comments from the company, and growth in the US royalties, there seem good reasons to expect earnings to continue rising.

Paul’s opinion - same as before - the fundamentals here look great. It all boils down to whether you’re prepared to pay up-front for future growth, with a high (but probably justified) valuation.

So I’m happy sticking with AMBER/GREEN.

Graham’s Section:

Begbies Traynor (LON:BEG)

Share price: 111.53p (+2%) (at 8.06am)

Market cap: £177m

We have an in line with expectations trading update from this “professional services consultancy” many of us know as an insolvency practitioner.

Q3 trading update: the company is confident of delivering market expectations for FY April 2024, those expectations being revenue of £131.1 - 135.2m and adjusted PBT of £21.9 - 22.5m.

(Performance in the prior year: revenue of £121.8m, adjusted PBT £20.7m.)

Due to the highly acquisitive nature of Begbies, there are typically substantial adjustments made to profits. This includes the amortisation of intangibles and a bunch of costs which the company collectively refers to as “transaction costs”. I presume that there will be another substantial set of adjustments in the current year.

Last year: £20.7m of adjusted PBT converted to £6m of reported PBT.

The previous year: £17.8m of adjusted PBT converted to £4m of reported PBT.

New debt facility: the company’s existing debt facility with HSBC was due to mature in August 2025. It has therefore been replaced by a new HSBC facility:

£25m RCF (same as before)

An additional £10m accordion (up from £5m)

Matures Feb 2027, possibly extended up to Feb 2029.

The new facility’s costs are “broadly in line with the previous facility”, presumably on the basis of a floating interest rate. The effective interest rate on the facility last year was 6.7%, which doesn’t seem excessive.

I also note that Begbies had a small net cash position as of the most recent interim results. The main point of the HSBC facility is to enable further acquisitions, as Ric Traynor (Chairman) confirms today:

"We are pleased to have agreed a new debt facility with HSBC which, alongside the group's cash generation, provides us with the flexibility to complement our organic growth with selective acquisitions. This will enable us to both build on our decade long track record of growth and execute our strategy to extend our scale and range of services."

Graham’s view

I don’t think there’s much news here that will change minds on Begbies. The new HSBC facility only shows a larger accordion facility than last time, signalling perhaps slightly more intent when it comes to acquisitions. But otherwise it’s a case of as you were.

Applying a 25% tax rate to the lower bound of the adj. PBT forecast, the company trades on a current-year PER of less than 11x (£177m market cap divided by adjusted net income of £16.4m).

This is consistent with what the StockReport is telling us:

However, this does require trust (some might say faith) in the usefulness of the company’s adjustments.

I remain wary of what the company refers to as “transaction costs” and adjusts out of its expenses - Paul and I have discussed this before many times, e.g. I discussed it here.

Transaction costs include some very large numbers, e.g. they include something called “deemed remuneration” with a value of £12m in 2023 and £10m in 2022.

These are payments to the sellers of acquired business, where the sellers are obliged to continue working within Begbies for a period of time after the sale. These payments are required by the accounting rules to be treated as an expense, instead of getting the normal acquisition treatment.

Personally, I agree with this accounting rule! Although I can also see that from the point of view of Begbies, it might artificially depress profits. From the point of view of shareholders and potential investors, however, I think the rule does a good job of highlighting for us that this is a people business.

I do generally have a positive view of this company and I note that the stock has made little progress in recent years. Could it be getting into value territory again? There is a level where I would have to turn bullish on it, but I’m not sure we are quite there yet. Sticking with AMBER for now.

International Personal Finance (LON:IPF)

Share price: 117p (-1%)

Market cap: £262m

Some tricky news for IPF shareholders today; full-year results for 2023 are delayed due to:

“…the receipt by Provident Polska, the Group's Polish business, of a regulatory communication from Komisja Nadzoru Finansowego (KNF), the Polish Financial Supervision Authority. The letter details the KNF's views on how existing laws and regulations relating to non-interest fees should be interpreted by credit card issuers. The Group is considering the potential impact of the communication from the KNF on the performance of Provident Polska and whether this needs to be considered in finalising the Group's 2023 year-end results.”

The good news is that this is thought to be a “sector-wide communication”, i.e. IPF’s Polish subsidiary has not been singled out by the regulator.

Additionally, IPF reckons that it will only need about a week to study what it has received, after which it will be able to publish its results.

The bad news is that IPF needs to consider whether the Polish financial regulator might be making “a significant change to the existing approach”.

IPF has already done a huge amount of work in recent years trying to understand and navigate new Polish regulations on non-interest fees. As we discussed at the time of its Q3 update, lending in Poland by IPF is down 23%.

Modifying its business model and shifting away from home credit, IPF issued over 100,000 credit cards in Poland, to comply with the new regulatory landscape. Credit cards are now responsible for 25% of IPF’s loan book in Poland.

Unfortunately, today’s news is another reminder of the inherently unpredictable nature of regulatory risk. Even without any new laws or regulations, a new interpretation can result in business upheaval.

The IPF update does also provide some positive news:

The Group confirms that its year-end results reflect a stronger than expected trading performance in 2023 and this momentum has continued in early 2024.

Graham’s view

I’ve been positive on this one due to what I perceived as an extremely cheap valuation which I sensed could price in the risks. That cheap valuation remains available today, and includes a chunky yield:

That valuation is despite a significant recovery in the share price over the past year:

Reminding ourselves of some balance sheet numbers, the report for June 2023 showed tangible net assets of c. £410m (the current market cap is a c. 36% discount to this).

IPF’s 2027 retail bond (paying a 12% coupon) has taken a hit today, down a few percentage points, but still officially trades at around 99p in the pound:

Personally, I think this 12% bond would suit my own risk profile better than the equity here. But they both seem to offer good value, for those willing to take a bet on home credit businesses in Eastern Europe, Australia and Mexico.

According to the newswires, broker Peel Hunt have today placed their target price and rating “under review”, due to the material uncertainty caused by today’s announcement. I’ll stay positive, while acknowledging that this is perhaps not a stock for the faint of heart.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.