Good morning, it's Paul here!

Today's report will be earlier, and briefer than usual, as I have to head over to Chiswick, to attend and speak at Mello London - David Stredder's team's latest investor event. I'm looking forward to catching up with many Stockopedia subscribers at the event.

Flybe (LON:FLYB)

Share price: 16.6p (pre market open)

No. shares: 216.7m

Market cap: £36.0m

(at the time of writing, I hold a long position in this share)

Takeover bid(s)?

There's lots of excitement surrounding this regional airline. It put itself up for sale recently, after concerns about it future viability emerged. On Friday we had 2 RNSs, one from FLYB confirming that it is having talks with several parties over a possible bid, or increased co-operation (e.g. code-sharing). Virgin Atlantic also issued an RNS confirming its possible interest.

An article over the weekend in the Telegraph suggests that British Airways is in pole position to buy Flybe, raising the spectre of a potential bidding war. That could be lucrative for shareholders, so I'm rather excited about this one.

It's quite high risk though, as if the bid interest comes to nothing, who knows where things will end up?

EDIT: The very low market cap means that buying Flybe would be pocket change for the bigger airlines. It could bring cost synergies, and act as a feeder for the more profitable transatlantic flights operating from Heathrow and Gatwick. I think there's also an opportunity to be denied to a competitor, which given the bad blood going back to the 1980s between BA and Virgin, could be an interesting factor.

The volume traded on Friday and today is huge, so we should see some "Holding in company" RNSs this week. End of edit.

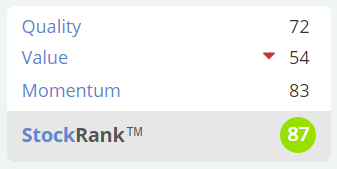

Sanderson (LON:SND)

Share price: 85p (pre market open)

No. shares: 60.0m

Market cap: £51.0m

Sanderson Group plc ('Sanderson' or 'the Group'), the specialist provider of digital technology solutions, innovative software and managed services for the retail, wholesale, supply chain logistics, food and drink processing and manufacturing market sectors, announces Preliminary Results for the year ended 30 September 2018.

These results look good, with the summary saying;

The Group trading results for the year ended 30 September 2018 are significantly ahead of the prior year and also ahead of market expectations.

Revenue has increased by 49% to £32.05 million (2017: £21.56 million) and operating profit* by 33% to £5.18 million (2017: £3.90 million)

Note that most of the revenue growth has come from acquisitions.

Adjusted EPS of 7.9p means that the PER is only 10.8

This is a significant beat against broker consensus of 6.4p adj EPS, so the share price is likely to rise strongly today. It could be a good one to buy on the opening bell, although the market makers have already marked it up, and the spread looks wide.

Outlook - also sounds good;

The Group has a clear growth strategy. Organic growth is planned from the fast expanding Digital Retail division and renewed growth impetus from the enlarged Enterprise division. There is an ongoing plan to accelerate the Group's growth with selective acquisitions.

Sanderson has a good reputation having built-up a strong track record of delivering customer-centric solutions. Whilst the Board is mindful of potential ongoing uncertainty surrounding economic conditions post the Brexit outcome, the Board believes that Sanderson is well positioned in its target markets and has good sales prospects, backed by a healthy order book.

This provides a good level of confidence that, at this relatively early stage of the new financial year, the Group will make further progress and once again deliver trading results which are, at least, in line with market expectations for the year ending 30 September 2019.

Bear in mind that current market expectations are for only 6.9 adj EPS in 09/2019, so clearly that bar is currently set very low. Expect brokers to increase their forecasts, I imagine to at least 8.0p EPS for the new financial year.

EDIT - I've just seen new forecasts (available on Research Tree) suggesting 8.1p adjusted EPS for the new year 09/2019, which is similar to what I guessed at above. End of edit.

Balance sheet - this is overall, weaker than I would like. NTAV is negative, at -£8.9m, this doesn't seem to be a problem - because the group receives cash up-front from customers - the debit entry is within cash, and the credit entry is in deferred income.

I'd like to know what the average cash/debt position is throughout the year, as the year end snapshot can often be unusually positive at many companies.

The pension deficit has come down from £6.2m to £3.8m, which is a trend we're seeing with many pension deficits, as bond yields rise.

My opinion - this looks an excellent share. Sanderson has a very good track record of profit growth. The figures today are way ahead of broker forecasts by the looks of it, and the outlook comments sound positive too.

Unless I've missed something, this share looks outstanding value, and I'm tempted to buy some. I'd see this being 100p+ very soon. It's a good example of a share which has drifted down generally with the market in recent months, of no good reason. Hence this looks a clear buying opportunity, in my view. As always, that's just my opinion, it's up to individual readers to do your own research, and not rely on my view.

EDIT - the house broker points out in a note this morning (available on Research Tree) that EPS benefited from a lower than expected tax charge.

Cerillion (LON:CER)

Share price: 145p (pre market open)

No. shares: 29.5m

Market cap: £42.8m

Cerillion plc, the billing, charging and customer relationship management software solutions provider, presents its annual results for the 12 months ended 30 September 2018.

Another software company, which reports figures today that look to be ahead of forecast.

Adjusted EPS is 10.9p, up from 10.2p in the prior year.

Note that the Thomson Reuters data on normalised EPS often does not tally with the figures published by many companies. I have queried this, and apparently it's because TR adjust figures to make them consistent with other companies. So I find it's always best to check the source RNS, and to see what adjustments the company is making, and checking that for reasonableness.

Outlook - I like the sound of this;

Prospects for continuing growth remain positive. We have a strong new customer pipeline, including two potential large near-term orders, where we anticipate a decision being made over the coming months, and our pilot work for another new enterprise customer is also very encouraging.

This could be laying the groundwork for an out-perform update, if the 2 large potential orders are signed.

Balance sheet - pretty solid. Receivables look a tad high.

My opinion - I bought some of these shares some time ago, after Graham commented favourably on the company, and of course DMOR! However, it didn't survive my portfolio cull over the summer, for several reasons. Firstly, the profit growth seems lacklustre (hence justifying the low PER). Secondly, the market for this share is so illiquid, that you can't get in or out in decent size. So what's the point in holding a tiny position, which won't move the dial even if the company performs well?

With so much uncertainty around, I think it makes sense to focus on more liquid shares, so that there's an exit route available if needed. It's a double-edged sword though, as often panic selling is the worst thing to do. So being locked in, can be a blessing in disguise, if you're good at picking long-term winners.

The lacklustre chart (during a roaring bull market) is unimpressive. There's an opportunity cost to holding shares that quietly go nowhere. Although bear in mind that the divis are quite good, at about 3.4% yield.

Kainos (LON:KNOS) - excellent interims are out today. The company (which is an IT contractor, especially to public sector bodies) says performance is in line with upgraded market expectations.

I lost interest in writing any more about it when I saw that the forward PER is about 28. I'm not interested in paying that sort of multiple for this type of business. Although performance is impressive, and public sector work can be very lucrative.

Intercede (LON:IGP) (I hold a long position in this share) - interim results show a great improvement against last year, due to 14% revenue growth, combined with greatly reduced overheads. This is as anticipated - see the archive here for my previous comments on the turnaround story under new management, which is what attracted me to pick up a position here earlier this year.

Note that the UK's generous tax credit system for R&D actually moved the company into profit at the after tax level. The cash position looks fine - no need for more equity fundraisings, if this level of performance is maintained.

Encouraging outlook comments, in particular sales opportunities to US Federal organisations.

See my previous reports for more information on the convertible loan notes. I don't see this as a problem for now. Although opinions differ on this.

Overall, this share is looking potentially interesting. It's so illiquid that you can't buy in any decent size. I find it astonishing that a c.£16m market cap company is providing important cybersecurity products to Governments, and some of the biggest companies in the world. I imagine it might attract takeover bidding interest at some point.

It's riskier than usual for me, but if things go well, then this could be a multi-bagger. It's been a serial disappointer in the past though. New management seem more focused and commercial, which is encouraging.

Cake Box Holdings (LON:CBOX) - impressive maiden results today from this cake maker. I don't know anything about the business, which recently floated. So I'm just flagging that the good results out today look worthy of further investigation by readers (and me, when I have more time).

The business model seems to operate through franchisees. The products look excellent, but are expensive! Gross margins on these products must be very high - hence providing enough profit for both the company, and its franchisees.

It's a pity I don't have more time today, as this share does look quite interesting.

All a bit of a rush, but I have to leave it there for today.

I'll be running through this report live, at Mello London, around lunchtime today.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.