Good morning, it's Paul here with the placeholder for Monday's SCVR, put up so that members can post comments from the 7am RNS.

Please see the header for the company announcements which have caught my eye today.

Estimated timings - the morning went by in a flash, so I'm having another go at adding some more sections after lunch. Looking to finish about 4pm.

Update at 15:54 - today's report is now finished.

Tourism shares (e.g. airlines) are down sharply today, as a resurgence of covid-19 has led to the UK Govt re-imposing a 14-day quarantine on tourists coming back from Spain (apart from Canary & Balearic islands). Sod's Law kicked in for me, as I booked a trip to Malaga for September, so am hoping the quarantine restrictions might be lifted by then. Although for me personally, I've worked from home for the last 18 years, so quarantine at home would be little different to normal life. In any case, who's policing it? The only practical difficulty would be buying groceries.

Gyms - I've seen some alarming stats about the willingness of clients to return to gyms. CNBC reported last week that a massive 59% of gym clients say they do not intend to return, instead intending to cancel gym memberships post-lockdown. That's a staggeringly high figure, which if people do what they say they intend to do (not always the same thing), then it would cripple the sector. The argument is that people have found other ways of exercising during lockdown.

There's an interesting article here about attitudes towards gyms in the UK. Attitudes might change as we go back into colder weather in the autumn/winter, where exercising outdoors becomes even more unpleasant than now. The problem is surely heavy breathing when exercising, which you can often see in strong sunlight projects saliva far & wide, and profuse sweating. All in an enclosed environment. That's surely a deeply unattractive proposition to visit a gym, with a nasty virus still in circulation, and likely to remain so for some time? Hence I'm keeping well away from Gym (LON:GYM) and Pure Gym (LON:PGYM) shares.

.

Revolution Bars (LON:RBG)

Share price: 18.5p

No. shares: 125.0m (after placing shares admitted today)

Market cap: £23.1m

(I'm long)

Admission to AIM, Director shareholding

This is just a formality, but the RNS confirms that RBG shares are now listed on AIM, having moved from the main list.

Increased Director shareholdings are also confirmed.

I was wondering if the move to AIM might have possibly forced out some institutional shareholders? There might possibly be some holders with a mandate to only hold fully listed shares? I'm surprised to see the share price dip below the 20p placing/open offer price.

A reader emailed me, asking for my current opinion on this share. Nothing has changed from my last post here about it. I see this as a binary situation, dependent on how covid develops. If things get back to normal over (say) the next 6 months, then RBG shares could conceivably double from here (maybe more?), since there was a nice turnaround underway before covid struck, and the bars were highly cash generative. People who say otherwise haven't done their research properly!

On the downside, we've seen how bars and nightclubs seem to be problem areas in other countries, in terms of spikes of covid. Therefore I can see why many investors may want to avoid this sector altogether, seeing it as too risky.

RBG should now have enough cash/facilities to survive well into 2021, so it's a nail-biting time for shareholders in bars generally, to see how things develop. We should get updates in the coming weeks, over how the gradual bars re-opening programme is going. RBG seems to be very cautious in re-opening slowly. Does anyone know which bars have re-opened? I'd quite like to visit one, to see how it's looking.

Clearly this share is high risk, and entirely dependent on what happens with covid. But it's got enough cash to keep going well into 2021, so we'll see what happens in due course.

Thinking more widely about sectors, it's clear now that all the assumptions that investors & management had about business models in the travel, retail & hospitality sectors, were completely wrong. The main assumption is that business would always continue uninterrupted. We now know this was wrong. Lockdown has changed everything. From now on, leases will have to be drafted differently, with clauses to allow for what happens in the event of more shutdowns in future. Someone will have to bear the risk, or take out insurance to cover it (if anyone is prepared to offer such insurance at a reasonable price?). Many businesses are carrying far more risk than we realised. Negative working capital (e.g. airlines funding their operations from customer deposits) is no longer viable, so that will have to be changed too. Plus, many companies that relied on debt, will need to re-think their risk. Companies need to bolster balance sheets, and pay less out in divis. How long before all this is forgotten, and everyone starts making the same mistakes again? 2 years probably!

.

Headlam (LON:HEAD)

Share price: 279p (up 9% today, at 08:29)

No. shares: 84.9m

Market cap: £236.9m

(I'm long)

Trading Update & New Distribution Centre

Headlam Group plc (LSE: HEAD), Europe's leading floorcoverings distributor, today announces a trading update in respect of the six months ended 30 June 2020 (the 'Period') ahead of announcing its interim results on Thursday, 3 September 2020.

Trading was OK until lockdown began on 24 March.

H1 revenue of £242.1 million was 30.6% below the comparative period in 2019.

Trading is recovering now, which is probably what has stimulated today's share price bounce;

UK revenue profile recovered strongly during June 2020 following the reopening of all of the Company's principal distribution centres by late May 2020 and the reopening of retail businesses in mid-June 2020.....

... trading to-date in July has seen a continuation in revenue growth back towards 2019 revenue levels. Currently, July 2020 UK revenue is running ahead of July 2019's UK revenue.

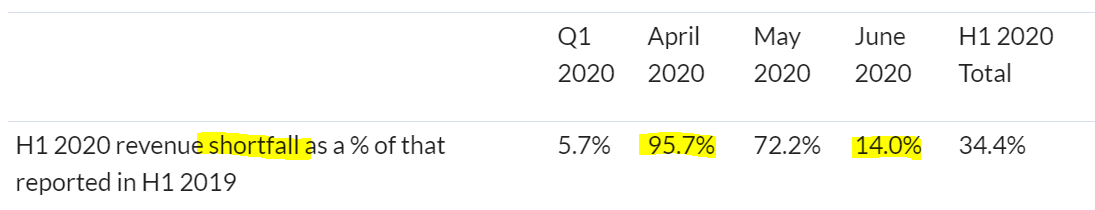

I like this table below. It's much easier to understand when companies provide a table like this, instead of sometimes ambiguous text;

.

.

That's a very striking recovery in June, and even better in July - possibly pent-up demand. Domestic demand must have been helped by lockdown - people spending months at home, with children charging about, must have worn out a lot of carpets! Although laminate flooring is popular these days too.

Outlook - limited visibility. H2 is seasonally stronger usually. Fear of another lockdown.

Whilst the current revenue performance is pleasing, it is still not possible given both COVID-19 and the economic backdrop to provide guidance at this stage on the expected outturn for the financial year ending 31 December 2020.

Liquidity - this sounds OK, although shareholders will sleep more easily once the Dec 2020 covenants have also been eased. Hopefully the banks won't force Headlam to do an equity raise. Although even if they do, the dilution would probably be only 10-20%, so not a panic situation for shareholders.

The Company announced in May 2020 that it had agreed revised covenant tests with its banks, Barclays Bank PLC and HSBC Bank Plc, for 30 June 2020 on the existing facilities which run to 30 April 2023.

The Company is currently in discussions with its banks regarding the extension of these covenant amendments for 31 December 2020.

As at 30 June 2020, net debt was £22.5 million, with banking facilities available to the Company of £110.7 million and headroom of £88.2 million. The Company remains confident it can manage the business and cash flows within these facilities.

Dividends - no interim divi will be paid. Makes sense. Wants to resume divis in future.

Profit guidance for H1 - this is very helpful;

... underlying loss before tax for the Period [Paul: i.e. H1: Jan-Jun 2020] of approximately £2 million.

Goodwill writedown of £20.9m - doesn't matter to me, as I always write off all goodwill anyway, and ignore the amortisation charge too, which is standard practice with most analysts & investors.

Cost-savings, efficiency gains, new £26m distribution centre, expected to improve future profitability.

My opinion - I'm pleased with this update, and will be looking to increase my position size here, when funds permit.

This looks a classic case of a business which has suffered a temporary, one-off impact from covid-19, which is now righting itself. Therefore, I think people who hold this share throughout the crisis, should come out the other side with a decent restored dividend yield.

I don't see any solvency risk, with a last reported balance sheet of nearly £100m NTAV. The modest bank debt is covered multiple times by liquid assets (inventories and receivables), and the bank should be fairly relaxed, given the rapid recovery of revenues.

Overall then, this gets a thumbs up from me.

Looking at the 2 year chart below, I don't understand why the price has failed to recover much from the recent lows. I would have thought the newsflow justifies a stronger rebound, if we accept that 2020 results are a write-off, but should still be profitable given the H2 seasonality. Looking to 2021 & beyond, I think the share price should recover. Buying now could lock in a low future PER, and high future dividend yield, for investors taking a long-term view. That's assuming nothing else goes wrong, of course. There are always risks, with every share.

.

.

Van Elle Holdings (LON:VANL)

Share price: 30.6p (down 3% today, at 11:15)

No. shares: 106.7m

Market cap: £32.7m

I last looked at this groundworks contractor here in Dec 2019, when it was already doing badly, before covid struck this year.

This is what it says today;

Van Elle Holdings plc, the UK's largest ground engineering contractor, announces that since its most recent update on 4 June 2020, the Group continues to trade slightly ahead of the mid-case scenario outlined in the announcement of its equity fundraising on 9 April 2020.

Group liquidity remains strong and its cash position as at 24 July was c. £10.0m having paid £2.0m of deferred PAYE payments to HMRC.

It doesn't say whether other taxes have been deferred, e.g. VAT, which could be a large amount. Hence we only have incomplete information, which isn't good. Companies need to be very specific about deferred taxes - i.e. confirming either way whether, and how much, they have benefited from tax deferrals. Otherwise we're not seeing the full picture, which could be misleading. The thing that concerns me, is VAT could be deferred until March 2021, resulting in a cashflow cliff-edge. That's a general point, which could could affect lots of companies. I'll need to pay particular attention to balance sheets in the coming months, when interim figures are published, to spot stretched creditors, in particular VAT.

Fundraising - it raised £6.7m in April 2020, at 25p per share - at the time this was a 21% discount, suggesting that there wasn't much appetite for the deal from investors. The mid-case scenario (referred to above) is this;

In order to assess the potential impact of the COVID 19 situation on the Group, the Board has modelled a series of scenarios to reflect what it believes to be the range of potential outcomes for financial performance in FY21. Based on its current assessment of the short-term outlook and informed by customer discussions, the Board's mid-case assumptions envisage that Group revenue would be approximately 25% below its plan for FY21. This assumes that Group revenue levels reduce to 40% of plan in May 2020 before recovering to approximately 80% in September 2020 and being maintained at around this level for the remainder of the year.

My opinion - I can't find any brokers notes, and am not interested in buying this share, as I rarely touch contractors's shares. Hence it's not a worthwhile use of time putting the above scenario through a spreadsheet.

With so many better quality companies out there in other sectors, I cannot see why anyone would want to own this share in preference. That doesn't make sense to me. The track record since floating on AIM in Oct 2016 has been lacklustre. Although to be fair, it has paid 8.3p in divis, so the total shareholder return isn't quite as bad as the chart suggests. Maybe profitability might return in 2021 or 2022?

.

.

City Pub (LON:CPC)

Share price: 69.6p (flat on the day, at 13:45)

No. shares: 103.8m

Market cap: £72.2m

This is a (mainly) freehold pubs company, with sites in London & Southern England. Here's a list of its pubs.

Ahead of the Annual General Meeting to be held later today, the City Pub Group updates on trading for the three weeks since 4 July, when pubs were permitted to reopen in England following the easing of social distancing restrictions.

Some pubs have reopened;

On 4 July, the Group reopened 24 of its 48 pubs, with a further 8 pubs reopening over the last two weeks, taking the total number of pubs open and trading to 32.

It is our intention to open the remaining pubs over the course of the next two months, or earlier if social distancing measures are relaxed further.

.

Like-for-like ("LFL") sales are down 37%. The company says if finds this "encouraging". Hmmm, I'm not so sure about that. Pubs operate at very high gross margins, so any fall in LFL sales would have a punishing impact on profitability. I'd be very surprised is the company is profitable at this level of sales. Still, it's a start, I suppose.

No, I was wrong, it goes on to say;

Following thorough work during lockdown, significant reductions have been made across our cost base, including payroll costs, consumables, satellite TV, entertainment, recruitment, and these together with operational efficiencies from our streamlined offering, have allowed the Company to trade profitably and generate cash during the 3 week period.

That is surprising! Although bear in mind that freehold pubs don't have any rent (nor business rates at present), but instead pay interest on borrowings in lieu of rent. It's not clear whether this announcement includes interest charges or not, in reporting profitability.

Outlook - sounds promising;

The Board remains confident it will be able to rebuild its sales to previous levels on a much lower cost base.

Fundraising - it raised £22m in a placing/open offer at 50p in April 2020. That should have repaid a lot of the £30.0m net debt last reported at 30 Dec 2019.

Balance sheet - the end 2019 balance sheet shows NTAV of £74.8m, being mostly freeholds less some debt. Given that much of the debt was repaid in the subsequent placing, then the current balance sheet should look really strong. Even taking into account likely losses during lockdown, the market cap should be well below current NTAV. Therefore this company looks very financially secure.

My opinion - this must be one of the lowest risk ways to buy into the pubs sector. The share is basically a minimally geared property company, that also operates its freehold pubs portfolio.

Long-term, once we've got through covid, whenever that may be, this share could be usefully higher, perhaps. And in the meantime, it's not going bust, because of the value of the freeholds. So quite attractive risk:reward, I would say.

.

K3 Business Technology (LON:KBT)

70p (up 4%) - mkt cap £29.9m

Very late results for FY 11/2019 are out today.

There's a fairly worrying Going Concern note, which the auditors also draw attention to in their report.

A subsidiary was placed into administration.

The balance sheet shows negative NTAV.

I think this has to be seen as a special situation, to determine whether it could become a turnaround/recovery situation, or whether the future is more grim? It's not for me.

As you can see from the long term chart, it's back down to where it was 15 years ago. Maybe just not a very good business?

.

.

Boohoo (LON:BOO)

(I'm long)

Own factory - an interesting development here. Very clever, I think. BooHoo has decided to set up its own "model" factory in Leicester, making clothes directly for its own websites, and demonstrating best practice. This is great PR I think - as if anyone criticises BooHoo for using suppliers which operate sweatshops, then it will be able to point to its own impeccable factory.

The other aspect of this, is that it cuts out the wholesaler's typical 20-30% profit margin. In doing so, that could make UK production economically viable, even if paying full minimum wage. There might be opportunities to automate some processes too.

My opinion - an interesting development. I see the current depressed share price as a terrific buying opportunity, as there have been numerous allegations against many brands, for either exploiting warehouse, or subcontractors. As long as they're seen to do something about it, then these things quickly blow over.

.

Kainos (LON:KNOS)

1036p (up 25%) - mkt cap £1,266m

Much bigger than I normally look at, but a strikingly good trading update caught my eye;

Despite the impacts of Covid-19, trading in the period has been strong and we expect revenue to be well ahead and adjusted profit to be substantially ahead of current consensus forecasts for the full year ending 31 March 2021.

That's great, but look how forecasts had previously been lowered;

.

If it gets to say 20-25p EPS, then the PER would be 40-50 - that looks crackers to me, especially as the narrative says some cost-savings are one-offs.

My opinion - makes the FAANG stocks look cheap!

That's me done for today. See you tomorrow.

As always, thanks for the interesting comments.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.