Good morning from Graham and Paul!

Today's report is finished (13:30).

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul's Section

MelloMonday reminder - tonight's online show starts at 17:00 - details here. I was chatting to Mello’s founder, David Stredder last night, and I managed to get 10 free tickets out of him, for SCVR readers who want to try before they buy! Our discount code is SHR100.

The highlight for me is David Cicurel, the long-standing CEO of Judges Scientific (LON:JDG) - so if you want to see what the CEO of a 100-bagger share is like, this is your chance!

I can still remember Cicurel first giving a talk about JDG at Mello Beckenham in 2008. He gave an interesting and quirky talk about his plans for JDG, all delivered with humour, and a wonderful strong French accent, hence why it was so memorable!

Other than being a nice chap, with a sensible business plan, there was absolutely no inkling at all that this share would be a 100-bagger! If only we could travel back in time & buy the shares again at one-hundredth of the current price!

Cicurel has just executed flawlessly over the past 15 years, making a series of shrewd acquisitions, and seemingly not putting a foot wrong. Could you have predicted that? Of course not. Early shareholders really just got lucky. Although the story did get better over time, as each acquisition added value. I wonder if there are any people who have held JDG continuously? I can remember people (e.g. CockneyRebel) flagging JDG when it was about 100p. The other thing is, it got pretty expensive at times, and I think it lurched down with the occasional profit warning too. So the path to a 100-bagger certainly wasn’t smooth. It’s fascinating to ponder though, in the hope that we can find the next one!

Bottom line for this 100-bagger - it’s all about backing great management, with a good strategy. Then holding, regardless of valuation & mishaps along the way. And just being lucky!

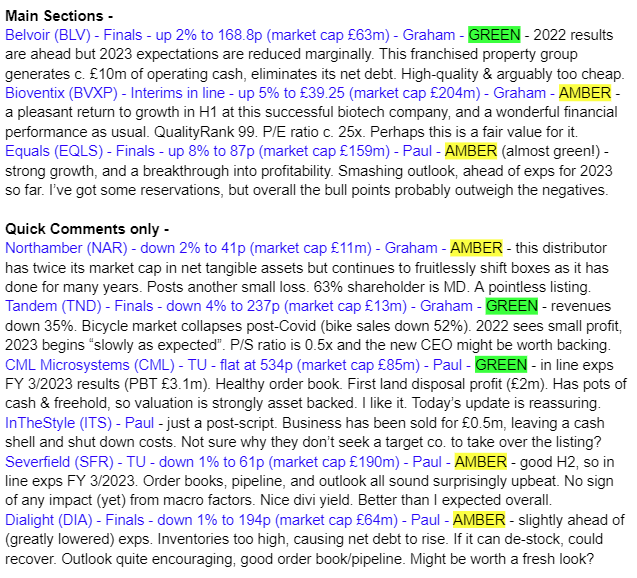

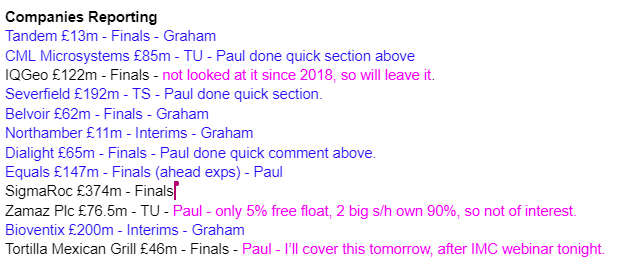

Equals (LON:EQLS)

- 87.3p (up 8% at 09:48)

- Market cap £159m

Equals (AIM:EQLS), the fast-growing payments group focused on the SME marketplace, announces its final results for the year-ended 31 December 2022 (the 'year' or 'FY-2022') and an update on trading for the period from 1 January 2023 to 24 March 2023.

'Well-invested platform delivering rapid growth, significant cash generation and enhanced profitability'

It’s mainly a forex business, a sector that has been doing well since the pandemic lows. Although if you zoom out on the chart, the long-term performance from EQLS is not actually that impressive -

Key numbers for FY 12/2022 -

Revenue £69.7m (up 58%)

Adj EBITDA £12.1m (up 81%), but as the company clearly discloses, it capitalised £4.2m of payroll costs onto the balance sheet, which by-passes EBITDA.

Adj diluted EPS is my preferred measure, which is 3.03p (2021: 0.02p), giving a PER of 28.8x

It’s worth emphasising that this is the first year of meaningful profitability - personally I prefer companies with a more established track record of profitability in good times & bad than is the case with EQLS -

As you can see, it doesn’t pay dividends, which suggests a business that has not as yet been significantly cash generative.

Of course shares are valued on future performance, not the past. So the all-important outlook section matters the most, and it looks really good - ahead of expectations again, this business is clearly on a roll -

Although note that 2023 forecast (the upper line below) was trimmed back in Jan 2023 from 6.2p EPS, to 5.067p, and we’re now told that the company is trading ahead of (lowered) expectations.

I really like this presentation of the P&L, which gives much more information than most companies do, enabling us to much better understand its cost structure -

Taking into account all costs, the PBT is only £3.4m, which isn’t a lot for a company valued at £159m.

Balance sheet - NAV is £42.9m, which includes intangible assets of £30.0m. So NTAV is £12.9m, or only 8% of the market cap. Hence negligible asset backing to support the share price, if earnings were to collapse.

No sign of that happening, but it’s important to know whether there’s asset backing to cushion things, which there isn’t here (that’s true of lots of growth companies though, to be fair).

Working capital looks OK. There’s £31.2m in current assets, including £15.0m in cash), and £21.3m in current liabilities, which looks fine to me.

Substantial client cash balances are held separately, so are not on EQLS balance sheet. I can’t find a figure for this, but might have missed it. There must be a good opportunity for EQLS to earn interest on client cash, now that interest rates have risen. Although realising this, clients might well start demanding credit interest be paid to them. Or be reluctant to leave cash balances with EQLS perhaps (especially during a banking crisis).

My opinion - clearly this sector is a good place for investors at the moment, and EQLS is performing well, with superb growth. I really like the strong growth, and the operational gearing that’s coming through, from ramming more business through its platform.

So this looks an interesting growth company, with a nice bull case.

Quibbles are as mentioned previously here, EBITDA rendered meaningless due to heavy capitalisation of payroll costs, modest balance sheet, limited track record, no divis.

So it’s really a question of weighing up the pros and cons, and making your own choice.

I can see the appeal of this share, so whilst I’m neutral (amber), I’m leaning more towards green than red, for what it’s worth!

Graham's Section

Belvoir (LON:BLV)

- Share price: 168.8p (+2%)

- Market cap: £63m

Belvoir is one of the listed property franchisors, along with Property Franchise (LON:TPFG) and M Winkworth (LON:WINK) . Returns in this sector can be very good, and I gave these stocks an honourable mention in my list of ideas for 2023.

Today we get the full-year results for 2023 from Belvoir. The company claims that it now has a record of unbroken profit growth going back 26 years – I’m not able to independently verify this, but it wouldn’t surprise me based on what I know about it!

Key points for FY December 2022:

Revenue +14% to £34m (12% attributable to acquired businesses)

PBT down 2% to £9.1m, but after-tax profits increased marginally.

2022 results are ahead of forecasts, but broker estimates for 2023 have been reduced marginally.

Segmental analysis: lettings is the most important activity, providing 56% of gross profits.

Financial services is the second-largest contributor at 23% of gross profits. Belvoir did purchase a network of financial advisors during 2022. So while financial services revenue grew strongly, organic growth in this segment was just 4%.

The number of written mortgages by Belvoir is up even as the number of house sales is down.

Net cash improves to £1.2m.

CEO comment:

Whilst we have seen a bounce-back in our mortgage activity for the year to date, up around 20% on Q4 2022, with house transactions taking up to five months to complete from agreeing a purchase, the increased market activity so far in Q1 will take until H2 to flow through to our financial performance…

Our property franchisees benefit from the strong recurring lettings fees earned from their managed property portfolios, and our financial advisers are able to draw on their extensive bank of clients who are looking to remortgage.

At Belvoir, there are now just as many remortgages as there are new mortgages. However, the fees earned on a remortgage are only 70% of the fees earned on a new mortgage, so the company would certainly benefit from a return to a thriving new mortgage market!

My view

There’s little reason to change my view here - I continue to like this business.

Pulling out the cash flow statement for a quick sanity check, I see that the company generated £9.6m of cash from operating activities.

Investing activities cost £3.4m but there’s little in here that worries me much - £4m was spent on acquisitions, capex was negligible, and then there are some loan payments to and from franchisees.

I’m going to give this stock the thumbs up because I liked it anyway before today, and it has just generated nearly £10m in operating cash during a difficult year. At a market cap of £63m and with a dividend yield of over 5%, I like it.

It also passes no fewer than six of Stockopedia’s bullish stock screens:

Greenblatt’s Magic Formula (one of my favourite screens)

Philip Fisher Growth Screen

Neglected Firms Screen

Free Cash Flow Cows Screen

Buffettology-esque Historical Growth Screen

The Screen of Screens - Quality Investing

Bioventix (LON:BVXP)

Share price: £39.25 (+5%)

Market cap: £204 million

I provided detailed thoughts on this well-followed biotech share back in October.

In today’s interim results, I’m pleased to see a return to faster revenue growth. Broker forecasts for the current year are unchanged, although they now anticipate larger dividends:

Revenues +25% to £5.9m

PBT +27% to £4.5m

Cash balance £5.2m

A quick explanation of its performance from the company:

Sales of physical product have performed well and revenues from our vitamin D antibody and other core antibodies have all increased as anticipated.

Sales relating to troponin antibodies grew significantly once again during the period. The continued roll-out of high sensitivity troponin tests provides further encouragement for our future sales in this area.

The prose is quite brief in this report. It concludes with:

Forthcoming changes to both the UK Corporation Tax structure in respect of Research and Development and the headline rate of Corporation Tax will have an impact on our future reported earnings and cash flows. Nevertheless, we will endeavour to follow our established dividend policy…

In conclusion, after the difficulties experienced during the pandemic, we are pleased to see a solid performance of our core business and look forward to this continuing over the remainder of the year. We remain optimistic about our troponin revenues and the success of these high sensitivity troponin products around the world and we look forward to reporting further progress in the second half of the year.

My view

I have again gone to the cash flow statement for a sanity check, and am reminded of some of this company’s exceptional features. It generated £4.2m in net cash from operations, and then also generated positive cash from investing activities, as interest received exceeded capex! Remarkable.

Additionally, the rejuvenated growth figures help to wash away one of the concerns I expressed back in October, when growth appeared to have slowed.

The overall financial performance here is second-to-none, and this shows in a QualityRank of 99. I’ll stay neutral on Bioventix mostly on the grounds that its technology is difficult for me to understand, but I continue to greatly admire its financials.

The valuation for this sort of business is obviously not going to be cheap and the P/E ratio on forecast June 2023 earnings is c. 25x.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.