Good morning, it's Paul & Roland here with Monday's SCVR. Bright & breezy, and braced for more market carnage. Today's report is now finished.

I'm reminding myself that sentiment can turn very quickly, and the market has already priced-in considerable downside for the economy. It's strange how we're all super-confident when shares are over-priced (as they were in 2021), yet we're in the depths of despair when they're cheap (which many seem to be now).

I keep reminding myself that my SIPP being down 20% year-to-date won't be a problem long term. That's because I'm confident all the shares in it are long-term winners. It's not geared, so I can ride out any market downturn. I wish the same could be said of my geared accounts, where once again I'm taking a battering. That's my problem - gearing. Hence people who don't use gearing are very wise I think!

I'll definitely need to move to eliminating gearing, it's too stressful as much as anything, as these lurches down in portfolio value, magnified by gearing, are a nightmare to cope with. It's feast or famine, rapidly alternating! Hence why I'm so relaxed about a 20% drop in my SIPP, which in comparison is a breeze. I keep making the same mistake over & over again. No comments needed on this, I know exactly what I'm doing wrong. Hopefully other people can learn from my mistakes, as I never seem to! There's no point in crying over spilt milk - I'll get it back again, as has happened the last 3 times! It's like a morning confessional here at the moment!

Anyway, on to today's newsflow of trading updates & results statements.

Mello is tonight, starting at 6pm, the first show for a month. David emailed me to say that the audience melts away in times of market turmoil, such as now. So it's important to support the people putting out great content, by giving them the viewing numbers they need to attract interesting speakers. As always with webinars, we don't have to watch everything. I tend to keep it on in the background, on my headphones sometimes, and zone in & out whilst preparing dinner, or feeding the dogs!

Agenda -

Paul's Section:

Lookers (LON:LOOK) - a very interesting sale & leaseback deal for one freehold property in Battersea. It's being sold £28m, almost 3 times book value, and leased back on a 4.5% rental yield. This looks a very good deal, and I think it has positive read-across for the car dealer sector, and any company which owns freehold property.

Ted Baker (LON:TED) - Sycamore's takeover approach at 137.5p is rejected by TED's Board. I don't think Sycamore is even in the right ballpark, hence this looks an ill-judged approach. I'm keeping an eye on TED as a possible turnaround, am not convinced yet, but this bid approach adds credibility to the story.

Brighton Pier (LON:PIER) - cracking interim results today benefit from pent-up demand last year, and Govt support measures. Balance sheet has improved, with net debt down by a third. The strong share price rise looks justified, but I think valuation now looks about right

Luceco (LON:LUCE) - brief thoughts on today's webinar. It's going on my list of possible buys.

Roland's Section:

Bioventix (LON:BVXP): This highly-profitable specialist healthcare business has reported a small decline in revenue and profits for the half year, but results appear to be in line with expectations. The underlying story remains strong, in my view, but patience may be needed.

Tandem (LON:TND) - shares in this bicycle, toy and leisure product group are falling today due to a downbeat post-pandemic outlook. Although the business seems to be performing well, some factors are outside management’s control. I think some caution is justified after last year’s exceptional results.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

Lookers (LON:LOOK)

97.5p (Friday’s close) - market cap £382m

Sale & Leaseback of Battersea Property

This caught my eye as a very interesting announcement, with possible wider read-across for other companies owning freehold property. The car dealership sector in particular has several companies with mostly owned freehold property portfolios, which is often overlooked asset value. For me, companies owning freehold property have considerable attractions, e.g.

- Property can be sold, if cash needed

- Banks like lending against property, giving a secure form of funding

- Protects the downside risk for investors - so won’t go bust in downturns

- Attracts takeover bids

- Capital appreciation of properties long term

- Boosts profits long-term, as no upward rent reviews (as occurs with leased property)

Today, car dealer Lookers announce a property sale & leaseback in Battersea, key points being -

- £28m cash receipt - that’s significant, at 7.3% of the company’s market cap

- Book value is only £10.3m, so a large profit on disposal - are other properties on the balance sheet similarly undervalued? Hidden value here possibly?

- 20-year lease - so it seems that signing a longish lease, presumably with upward-only rent reviews, is a way to unlock considerable cash from a property

- £1.25m initial rent seems low - the initial rental yield works out at 4.5% p.a.

- Under IFRS 16, the freehold asset will disappear from the balance sheet, and be replaced with cash, and a £19m right of use asset, offset by £19m lease liabilities

- The company’s total property NAV is very considerable, at £290m (74p per share)

My opinion - this deal highlights the value on car dealer balance sheets, which could be unlocked using sale & leasebacks. The big premium to book value is striking - £28m sale proceeds, for an asset on the balance sheet at £10.3m, is a big boost to shareholder value.

The rental yield of 4.5% also looks a good deal for LOOK, that’s well below inflation right now, although may not be in future, and it does bring the uncertainty of future upward rent reviews, which is a horrible aspect of the current UK property system.

As regards read-across, this is clearly relevant to the other listed car dealers, and might shine a light on their hidden property value.

Another share is Joules (LON:JOUL) (I hold) which recently mentioned a possible sale & leaseback of its HQ in its going concern statement. If it can replicate the terms of this deal, then I hope JOUL goes ahead, in order to de-risk its current borrowing arrangements.

.

.

Ted Baker (LON:TED)

126p (Friday’s close) - market cap £233m

It’s worth noting how absurd the current rules are on takeover approaches. Despite these being highly price sensitive, companies only have to tell shareholders that they’ve had a takeover approach if someone leaks the information to the press! This is actually quite scandalous in my view, because there is effectively a false market in the shares of any company, once management have received a takeover approach, but not disclosed it to the market. Lord Lee has campaigned on this subject, but received a dismissive reply from the Takeover Panel, who seem to think the current arrangements are fine.

Anyway, we’ve been following this interesting situation at TED, which is trying to turn itself around after a disastrous time, even before the pandemic, with accounting problems, overstocking, etc. I think the jury is out on whether TED’s turnaround is working or not. Obviously the pandemic has muddied the water on this. It’s a similar situation to Superdry (LON:SDRY) (I hold).

TED’s shareholder register is dominated by 3 holders - aggressive hedge fund Toscafund, the founder Ray Kelvin, and Schroders. Put together, they own over half the company, so anyone wanting to acquire TED would have to get these big holders on side.

A US fund called Sycamore indicated a serious interest in buying TED (engaging Numis as its advisers, which won’t be cheap). Hence it seemed obvious to me that any bid would need to be at a serious premium price to have a chance of succeeding. Why would the major holders sell up otherwise?

Today’s update from TED says that Sycamore initially offered 130p to buy TED, which was rejected by TED, and then increased to 137.5p, also rejected by TED, saying -

The Board of Ted Baker carefully reviewed both of Sycamore's proposals with its advisers and concluded they significantly undervalued Ted Baker and failed to compensate shareholders for the significant upside that can be delivered by Ted Baker as a listed company. Ted Baker is a leading global brand with a strong future. The management actions taken over the last two years have put the business on a firm footing and it is now well on the way to recovery following a turbulent period. The Board is focused on delivering value for Ted Baker's shareholders well in excess of the price offered by Sycamore.

My opinion - this is a very strange situation. Sycamore seem to have completely misjudged things, and I reckon they’re wasting everyone’s time putting in a bid that the major shareholders seem likely to regard as way too low.

Why would anyone want to sell a turnaround that is still in the early stages, unless they had lost confidence in the turnaround?

Overall then (and remember this is educated guesswork only) it seems to me that the chance of a successful bid from Sycamore is close to zero. That then leaves the quandary over how to value TED shares in the market? A bid premium that has caused the shares to rise recently is no longer valid, as a bid seems highly unlikely to succeed - I reckon Sycamore would need to offer 200p+ to make any progress. So the share price should now lose the bid premium of c.30p, and go back down to about 100p maybe.

Or, you could argue that a bid of 137.5p means the company is maybe worth 30% more, around 180p, because the bidder clearly thinks the company is attractive at 137.5p.

Personally, I’ll wait to see what the next set of numbers are like. At the moment there’s not enough substance in the turnaround story for me, although there are some positive early indications, so I’m keeping an eye on TED.

That Sycamore made an approach seems positive, but I think a bid now looks very unlikely, as Sycamore don’t seem to even be in the right ballpark to persuade major holders to sell out.

.

Brighton Pier (LON:PIER)

92.7p (up 10% at 10:!2) - market cap £35m

This group owns Brighton Pier itself, and a small group of late night bars, and a few other attractions.

The results today start with a useful summary -

Very strong first half trading performance

Brighton Pier Group is pleased to announce results for the 26 weeks ended 26 December 2021 which highlight the strength of the business model, with revenues up by 178% to £22.8 million on the same 2020 period and importantly up 33% on the same pre-covid period in 2019. This has been driven by the sound underlying performance in all divisions as well as the successful integration of Lightwater Valley which is trading above expectations.

A consistent gross margin performance, the reduction in VAT and rates relief has enabled the Group to make good progress on maximising earnings and paying down debt. Since the end of the last financial year the Group has reduced net debt by 34%.

The outlook for 2022 is robust. Given these excellent results and a current strong trading performance, the Board expects profits for the 52 weeks ending June 2022 to be ahead of market expectations.

H1 performance - note this is the seasonally stronger half -

Revenue £22.8m

Profit before tax £6.6m (including £0.8m of one-offs, re leases accounting) - very impressive, but helped by Govt support measures -

… the temporarily reduced rate of VAT and rates relief by way of Government support enabled the Group to make good progress repaying debt taken on during the height of the pandemic. Collectively, these factors provided a unique opportunity for the business to maximise revenue and earnings as it re-opened.

Inflation - remember that "mitigate" means only partially recoup -

... the Group believes it will be able to mitigate these inflationary cost pressures in the most part through targeted price increases and by operational improvements.

Balance sheet - NAV has grown by £5.3m in the last 6 months to 31 Dec 2021, to £24.6m.

Taking off intangible assets of £10.4m, and removing the IFRS 16 entries (a net £(2.0)m deficit), gives adj NTAV (the way I calculate it) of £12.2m - which looks adequate.

There’s £7.3m in cash. Borrowings take it to a net debt position of £8.2m - which looks OK to me, and has come down significantly due to bumper trading in Jul-Dec 2021.

“Other financial liabilities” has moved from long-term liabilities mainly into current liabilities - this is the bank debt.

Expiry date of bank facilities has recently been extended to Dec 2023, so no concerns there.

Overall, I don’t have any issues with the balance sheet.

Webinar - InvestorMeetCompany presentation is tomorrow, Tue 29 March, at 14:00

Forecasts - many thanks to Cenkos for publishing an update note today, on Research Tree.

It forecasts £6.0m adj PBT for FY 6/2022, implying a loss of £(0.6)m in the seasonally slower H2.

In adj EPS, this is 12.6p, so a PER of 7.4 - but caution needed as this is a one-off bumper year.

Valuation should I think be based on forecast profit for next year, FY 6/2023. This shows a drop in EPS to 9.4p, so a PER of 9.9 - which is probably about right.

My opinion - cracking numbers today, but not likely to be repeated.

It’s a collection of rather odd leisure/hospitality businesses, but it might appeal to some investors. Future capex might be a problem that emerges at some point possibly? Brighton Pier in particular worries me, with the potential for a nasty surprise if serious problems ever crop up on the regular surveys.

PIER shares have had an excellent run, and I think that does look justified.

Where do we go from here? Further upside looks a bit more challenging to me, now that the valuation has probably got to where it should be.

.

.

Luceco (LON:LUCE)

211p (down 1% at 12:00) - market cap £341m

Webinar - I’ve just finished watching the IMC webinar from management.

My (subjective) view is that management seem straightforward, and on the ball. The answers given to questions seemed very clear, including my 2 questions -

Q1. Was it a mistake to move production to China, given supply chain problems and geopolitical risk? Wouldn’t it make sense to move production to somewhere nearer, eg Turkey?

A1. We moved production to China in 1998, and the whole industry moved there. Companies which didn’t move, have disappeared. So no, it wasn’t a mistake at the time. More recently, we’re aware of risks, but don’t see them as pressing. Need to have the ability to move production out of China quickly, if necessary. So that’s being planned. Turkey - we have looked at it, but has economic problems, e.g. 40% inflation.

Q2. What went wrong in 2018, when profits & share price collapsed, and could it happen again?

A2. CFO answered this, saying it was a bit before his time. But cost inflation & bad forex hit the company, but was obscured by accounting errors. This resulted in a one-off poor half year, not since repeated. Shouldn’t happen again, because same inflationary factors have hit the company again (now), but it’s dealing with them fine. Expect to fully pass on input cost increases, but with a time lag that temporarily pushes down margin.

Management were clear that 2021 results were a bumper year, and are planning for a softer H1 this year.

Supply chains are beginning to ease, although possible further covid disruption in China. Sea container freight costs are continuing to ease - this is all useful for read across to many other companies importing goods from the Far East, as it may be a positive tailwind to help offset some of the inflationary headwinds in other areas. LUCE has stocked up, so further supply chain issues may not necessarily impact sales.

My opinion - I really like this company, it seems well managed, and generates a strong operating margin. There is obviously a question mark over whether performance can be maintained at 2021 peak? Given that the share price has more than halved, I reckon the uncertainty could now be in the price. So it’s on my list of possible buys around 200p. I’ll hold off for now, and see what happens.

Here’s my recent review (last week) of Luceco’s 2021 results.

.

.

Roland’s section

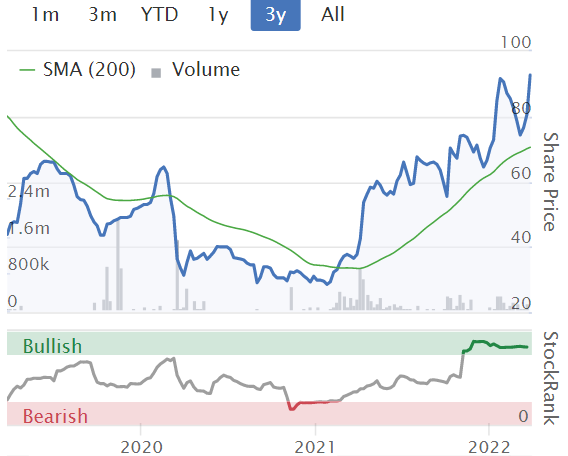

Bioventix (LON:BVXP) (I hold)

Share price: 3,044p (-7%, 08.30)

Shares in issue: 5.2m

Market cap: £170m

“We continue to have confidence in the strength of our core business and the outlook for the full year.”

Healthcare firm Bioventix is a fairly recent addition to my personal portfolio. This niche business produces antibodies that are used in clinical diagnostics (blood tests). The company’s products are supplied to almost all the main global immunodiagnostics companies for use in their blood-testing machines - companies such as Siemens, Roche and Abbott Diagnostics.

New antibodies take several years to develop and test, but once commercialised, they can provide reliable recurring revenue for many years. It’s a specialised business and one that I’m still learning about.

Bioventix initially appeared in my screens thanks to its long record of outstanding profitability and strong balance sheet. However, Bioventix’s revenue is dependent on a small number of key products and growth has slowed during the pandemic.

This has been reflected in the share price, which has fallen by around 20% over the last year, earning the shares a Falling Star rating from the Stocko algorithms.

Bioventix’s reduced valuation has left the stock looking attractively valued, in my view. But do today’s results support hopes for a return to growth?

Financial highlights

Bioventix’s financial reporting is refreshingly simple but, today’s half-year numbers do seem to confirm the downward trend suggested by broker forecasts for the current year (y/e 30 June).

- Revenue down 8% to £4.7m

- Pre-tax profit down 2.7% to £3.6m

- Period end net cash balance £5.1m (30 June 2021: £6.5m)

- First interim dividend up 20% to 52p per share

These numbers suggest to me that Bioventix’s profitability and cash generation remain intact. My sums suggest the following metrics:

- H1 operating margin: 75%

- H1 free cash flow conversion from earnings: 126% (aided by a reduction in debtors)

Both of these numbers are in line with Bioventix’s historic performance.

Commentary: The pandemic has led to delays or cutbacks in non-Covid diagnostic activity in many medical services around the world. According to Bioventix, this has seen sales of certain products slow. However, management expects the group’s core business to respond well as the pandemic eases.

I don’t see any reason not to expect a recovery as hospitals are able to return to more normal operations. For me, a bigger concern is that the group’s two largest revenue streams appear to be plateauing or in decline.

Vitamin D antibodies generated around 60% of group revenue last year. Today’s half-year report doesn’t explicitly break down Vitamin D sales, but does refer to a “plateau in the downstream global vitamin D assay market”.

The second-largest source of revenue last year was the NT-proBNP antibody. This generated £1.3m of revenue in FY21, but this revenue stream expired in July 2021. This led to a £600k reduction in H1 revenue, as expected.

The remainder of the business is said to have delivered a steady performance. From what I understand, the most exciting near-term growth opportunity is troponin, an antibody that’s used to detect evidence of heart attacks. Troponin sales are said to have grown “significantly” during the half year. For context, troponin revenue doubled to £0.7m last year.

Outlook: Management remains confident in the outlook for the full year and “optimistic about troponin revenues”. Current broker forecasts show earnings more or less flat this year:

These forecasts price the stock on 24 times forecast earnings, with a dividend yield of 3.7%. That seems very reasonable to me for a business of this quality, assuming Bioventix can return to growth in FY23.

Management/key shareholders: I think it’s worth highlighting the committed insider and institutional ownership here. CEO Peter Harrison founded the business in a management buyout in 2003 and remains a significant shareholder, with an 8% holding.

The other big shareholder of note is Sanford DeLand’s Buffettology fund. This is run by manager Keith Ashworth Lord, who is known for his long-term style, influenced by Warren Buffett.

My view

I don’t see anything in today’s results to change my positive view of this business as an investment. Rather like many pharmaceutical businesses, revenue streams from old and new products will vary over time and won’t always provide a smooth growth path.

Management commentary suggests to me that Bioventix has a number of credible candidates for medium-term growth. Of course, we’ll need to see evidence of this over the next few years, but for now, I remain happy to hold this stock.

I’m tempted to view £30 as an attractive entry price, but I’m conscious of the risk that the stock’s Falling Star rating could be a sign that patience will be required. New revenue streams could take longer to arrive than expected.

As always, these are only my thoughts. I’d urge subscribers to DYOR and form your own view on this unusual business.

Tandem (LON:TND)

Share price: 449p (-10%, 09.00)

Shares in issue: 5.3m

Market cap: £24m

“A successful year” but “a degree of caution” for 2022.

Tandem produces a range of bicycles, toys, leisure equipment and home and garden products. These are sold through other retailers under owned brands including Claud Butler and Ben Sayers, and through licensed brands such as Peppa Pig and Nerf.

This stock was a notable pandemic winner, as sales surged across the board. Although the share price is down from the peak levels seen in 2021, Tandem is still a double bagger (or better) for anyone who owned the stock prior to 2020.

Of course, the surge in demand triggered by lockdown living was never likely to be maintained indefinitely. What is harder to predict is how much of this pandemic boost will translate into market share gains and structural growth for Tandem.

Today’s final results cover the year to 31 December and provide a useful and detailed update on trading so far this year. Let’s take a look.

2021 financial highlights

- Revenue +10.4% to £40.9m

- Gross profit +9.4% to £12.1m

- Operating profit +17% to £4.9m

- Basic earnings per share: +7.7% to 73.8p

- Total dividend 10p (2020: 8.62p)

- Net cash: 2.3m (2020: £3.8m)

Profitability: Tandem’s financials for last year look fine to me. Gross margin was almost unchanged despite challenges from higher costs and the group’s operating margin rose from 11.1% to 12.0%.

My sums suggest this operating profit performance equates to a return on capital employed of 20%, which seems attractive to me.

Cash flow/balance sheet: 2021 was a year of heavy expenditure. Tandem opened a new warehouse in Birmingham and appears to have invested heavily in stock. Year-end inventory of £8.1m was almost double the £4.5m figure at the end of 2020.

The cash outflows relating to this expenditure correspond to a free cash outflow for the year of around £1.2m and the consequent reduction in the group’s net cash balance.

I don’t see anything to be concerned about in terms of fundamental health – Tandem still has a strong balance sheet and good cash generation, as far as I can see.

Commentary: The company’s sales are reported in four operating divisions. Three of these generated growth last year. The exception was bicycles, where stock availability remained a problem.

In the largest division, Toys, Sports & Leisure, “classic licences” like Peppa Pig and Paw Patrol outperformed 2020. Tandem has also won some new licences, such as Disney Pixar Lightyear.

eMobility was a star performer with revenue up 56%, primarily due to sales of electric bikes and scooters.

Overall, last year’s results do not suggest any serious concerns.

2022 outlook

Commendably, Tandem’s management has provided some useful detail on 2022 year-to-date trading and the current order book. These numbers suggest that the outlook for this year is fairly uncertain at this point. I’d guess this lies behind today’s share price fall.

These numbers cover the 11 weeks to 20 March 2022, compared to the equivalent figures from 2021 and 2020:

- Revenue: £4.4m (-43% vs 2021, +7% vs 2020)

- Order book: £16.4m (-39% vs 2021, +220% vs 2020)

Tandem says the reduction in the order book is due to the completion of back orders, cancellations and a reduction in new orders. It doesn’t quantify these different factors.

Looking ahead, Tandem believes the eMobility business has strong potential. Electric scooter sales are expected to perform well if new legislation comes through as expected in 2023 (I assume this means making them road legal).

Conversely, the outlook for bicycles appears to remain weak. Many independent retailers are now said to have surplus stock and consumer demand has been slow.

Tandem plans to allocate more resources to eMobility, in line with these trends.

My view

Tandem looks potentially cheap, when valued against trailing profits. Today’s numbers put the stock on six times earnings after this morning’s 10% price drop.

An updated note from house broker Cenkos suggests adjusted earnings could fall to 56.7p this year, a decline of around 25%. This forecast implies a forward valuation of eight times earnings for 2022.

My concern here is that Cenkos FY22 forecast does not seem to reflect the full scale of the revenue shortfall seen so far this year. There may be good reasons for this, such as seasonality or uneven order trends from 2021. I’d need to do further research to try and understand this.

For now, my feeling is that Tandem shares are probably up with events. I think this looks like a nice business, but I don’t see the stock as a compelling buy at current levels.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.