Good morning, it's Paul here!

I've finally managed to work out how to put up my Bournemouth sunset picture from last week! Shrinking the file size dramatically seems to have done it - anyway, I hope you like the colours.

Preamble

Volatile stock market conditions remain, driven mainly by the USA (rising interest rates, trade war with China/EU), but also factors closer to home such as Italy/Eurozone crisis, Brexit & Corbyn worries.

I recall that, a couple of years ago, the Fed tried to start raising interest rates, but it triggered a stock market plunge, so they back-tracked. Maybe we've had QE & ultra low interest rates for so long, that our economies are now addicted to cheap credit?

I don't see any particular reason why there would be a continued bear market (based on the information we have as of now). In my view things got very frothy, and this is a sensible (and long overdue) correction.

I'm also starting to see some genuine bargains crop up - companies that are reporting decent trading, but are on fairly bombed out valuations. Last week, Flowtech Fluidpower (LON:FLO) and Photo-Me International (LON:PHTM) struck me as good value (I don't hold either, but they're both on my watchlist). There are some attractive (and sustainable) dividend yields out there, which make some high yielding equities look rather attractive now.

I'm thinking about running some stock screens, to look for bargains, much like I did in 2016 after the Brexit vote. Over the weekend, I revisited a video I made just after the Brexit vote. I was correct at the time that it was a one-off plunge, which would recover. Although looking back at the stocks that came up on my "Brexit bargains" screen, it's amazing now how far some of the low PER + high dividend yield retailers shares have more recently collapsed (e.g. Debenhams (LON:DEB) ). So I might use different criteria this time around, more focused on quality measures.

The speed of the decline in some conventional retailer shares has really surprised me - operational gearing in reverse. It's made me realise that chasing the lowest PER & highest yielding shares is a dangerous strategy - as that could end up steering us towards the lowest quality companies that are in structural decline.

The internet really has changed everything. In the past, when I first started investing, in the 1990s, you could rely much more on "reversion to the mean". So oversold, low PER, high yielding, strong balance sheet companies, would usually recover quite well, after a downturn. These days, we cannot rely on reversion to the mean, because the internet is disrupting so many sectors, on a permanent basis. This seems to be accelerating the death of weaker players in many sectors.

This is why evidence of a successful internet strategy should be a key item on everyone's investing checklists.

What am I doing with my own portfolio, in current volatile conditions? Nothing! I'm an investor, not a trader these days. So my portfolio is a concentrated group of high conviction positions, which I've researched thoroughly, and have the confidence to hold through any market volatility, providing there is no negative newsflow. I see indiscriminate falls in share prices as providing potential buying opportunities.

It's a stock-pickers market now. We can't rely on buying anything & it automatically going up, as we could in 2016-17 to some extent.

I don't believe in buying low to middle conviction things, because what's the point? You only end up throwing them out when they drop. So why buy them in the first place? Several years ago, I did some analysis of one of my main spread bet accounts. It showed that hundreds of transactions in low conviction trades, netted off to about nil, over the whole year! Yet I had a very good year overall. How come? Because I had 2 or 3 really big winners, which I had backed in size. Therefore, practically everything I did that year was a waste of time, I could have been lying in my hammock, reading books, rather than glued to the computer screen all the time! Therefore my approach now is to ignore almost everything, and just focus on my top handful of share picks.

Still, there are lots of different ways to make money in the market. As my mentor once said to me, "Just do more of whatever works".

Budget

I've double-checked, and it is definitely today! Coverage starts at 3pm today, on BBC2, and no doubt other media channels too.

The Chancellor has plenty of headroom to be generous. We're constantly being told how terrible everything is, but the reality is that tax receipts are doing very well, and the Govt's spending deficit has been largely eliminated - at least in real terms - i.e. inflation is scrubbing off about £40bn p.a. (my rough calculations, of £1.8trn National Debt, and 2.4% inflation). New debt is now being added at less than £40bn p.a. So the National Debt as a share of GDP should actually start shrinking slightly now.

The OBR website has useful updates, and tons of data. This shows the deficit rapidly reducing, which suggests to me that the economy could be stronger than official estimates.

We also have full employment, rising real wages, and consumer confidence is positive at the household level - people just have a negative view of the economy as a whole - hardly surprising considering the blanket daily doom & gloom in the media, and the political chaos.

Overall then I think perhaps the gloom is overdone? Time will tell.

Anyway, on to some companies reporting today.

Warpaint London (W7L)

Share price: 112.5p (down 45% today)

No. shares: 76.7m

Market cap: £86.3m

Trading update (profit warning)

Warpaint London plc (AIM: W7L), the specialist supplier of colour cosmetics and owner of the W7 and Technic brands, provides a trading update for the year ending 31 December 2018.

Bad luck to holders here. I will just get up to speed by re-reading our previous coverage of Warpaint in the archive, here. I quite liked it at the interim results stage, noting the high quality scores & strong balance sheet. Although I also flagged that the H2 weighting looked like a "steep increase" - to double sales from H1 actual.

As "Wimbledonsprinter" notes in comment no.4 below, it was only 42 days ago that Warpaint said this (on 17 Sept 2018);

The emphasis on Christmas gifting of our own brands across the Group has resulted in an order book that was significantly ahead at 30 June 2018 compared to the same point in 2017 on a comparable basis (including the own brand orders of Retra in H1 2017), allowing us Based on current expectations the Company's board anticipates that revenue for the year ending 31 December 2018 will be in the range of £48 million to £52 million. Consequently, the Company's board currently expects profit before tax for the year ending 31 December 2018 (excluding amortisation in connection with acquisitions and exceptional items, which total approximately £2.5 million) will be in the range of £8.5 million to £10 million..

Compare that with what the company says today (29 Oct 2018);

However, the UK market, as highlighted in our interim results, remains challenging. The UK market, which accounted for 44% of Group sales in the first half of the year, has seen further softening recently, with retailers reducing stock levels and Christmas orders.

This reduction in previously anticipated UK sales will have an impact on Group performance for the full year that will not be completely offset by better than anticipated performance in our major overseas sales territories.

Bit of a difference. It sounds to me as if the tone in the 17 Sep 2018 announcement was over-optimistic. That inevitably dents management credibility, and I won't be placing much credibility on outlook statements from now on. Outlook comments should be cautious. It's far better to under-promise & over-deliver, rather than hoping for the best and then disappointing.

I'm not surprised that UK retailers are reducing orders, because so much business is moving online in the UK. I understand that we have the highest (or almost the highest) proportion of sales carried out online, of any major economy. Therefore, this shortfall for H2 orders at Warpaint would make me want to look more closely at where its product is selling online, and why that hasn't offset declines from physical retailers?

Quantifying the damage - this bit is excellent - the company has provided us with revised numbers, in a range. I wish all companies would do this, it means investors can make informed decisions better;

Based on current expectations the Company's board anticipates that revenue for the year ending 31 December 2018 will be in the range of £48 million to £52 million.

Consequently, the Company's board currently expects profit before tax for the year ending 31 December 2018 (excluding amortisation in connection with acquisitions and exceptional items, which total approximately £2.5 million) will be in the range of £8.5 million to £10 million.

It makes a lot more sense to provide a range, rather than a specific figure, so this is at least good reporting, of a disappointing situation.

There is still uncertainty;

The reported level of profitability for the full year will be crucially dependent on the precise product and geographic mix of sales for the remainder of the year, the busiest period of the year for the Group.

This makes me worry that the company doesn't seem to have a lot of visibility on sales orders. We're almost into November, so I would have thought that retailers would have all their Xmas stock in stores by now. Maybe it doesn't work like that in make-up? I've noted before that Warpaint holds rather large inventories, so perhaps retailers are able to re-order fast-selling lines, and pull the stock from Warpaint's warehouse? That could help explain why visibility is poor, but I'm guessing there.

Retailers might have cancelled some existing orders too, perhaps? Even though they're contractually obliged to take delivery of goods which they've ordered, many retailers ride roughshod over this, and cancel orders at the last minute. If suppliers protects, then they're routinely told that they won't get any future orders from the retailer, if they don't accommodate the cancellation. These are just generic comments about the retail sector, by the way.

Valuation - there's a note on Research Tree, which gives an immediate update to forecasts, suggesting that this is a conservative initial view.

Forecast EPS for 2018 is reduced from 9.6p (flat vs last year, and down 23% on previous forecast). That gives a PER of 11.7 - which probably looks about right, for a company that has just disappointed, and may now even be ex-growth?

Due to the strong balance sheet, the previous dividend forecast of 5.5p is maintained. If that's correct, then the yield of 4.9% is beginning to look attractive - providing you are confident that divis won't be cut.

My opinion - if this is just a blip, then this could be an attractive entry point.

My concern is that the products should be selling well online, so overall UK demand should not be reducing. Unless the product has perhaps been surpassed by other brands with better products & more effective marketing budgets? Maybe we should all be asking wives/girlfirends & femals friends & colleagues what they think of Warpaint's products? If they rave about how great it is, then the shares could be a buy at this level. If they're lukewarm or negative about it, then there could be a bigger problem. Is demand too fickle in this sector, I wonder, to be able to reliably forecast?

In more normal market conditions, the share probably would have fallen 30%, not 40%, bu that's not a big enough profit opportunity to make me want to catch the falling knife. I'll put it on my watchlist though, as potentially interesting.

A similar situation arose recently with QUIZ (LON:QUIZ). It fell sharply on a profit warning, and was looking tempting at 80-100p. However, it carried on falling, and bottomed out (possibly) around 45p. So it just shows, that diving in immediately after a profit warning can be very high risk. Many recently floated small caps, like Quiz & W7L don't have a fully developed private shareholder base. Brokers just place lumps of shares with institutions, because that's the easiest way to earn their fees. No thought is given to the after-market.

So, when a profit warning comes along, there's not enough liquidity from retail investors, to soak up any selling from institutions. I think that's why the share price can collapse far more than might seem reasonable. Maybe some fund managers also want to ditch lousy performers before year end, to clean up their portfolios before the end of year report on holdings?

These are the considerations which make it impossible to predict where a profit warning is likely to lead the share price. Hence why I tend to stay away. There's a lot to be said for selling on the opening bell, if you're a small shareholder, when profit warnings come out. You can always buy back later.

Gama Aviation (LON:GMAA)

Share price: 121.5p (down 20% today, at 13:01)

No. shares: 63.6m

Market cap: £77.3m

Trading update (profit warning)

Gama Aviation Plc, one of the world's largest business aviation service providers, today announces a trading update for the full year to 31st December 2018.

That's quite a bold self-description, for a £77m mkt cap business!

As above with Warpaint, the dreaded H2-weighting to profits strikes again;

At the time of the H1/18 interim results substantial growth was anticipated in the 2nd half of the year.

However, with Q3 delivered and with better visibility for the full year, trading in certain divisions has not improved sufficiently to deliver the full year expectations.

Quantifying the shortfall is always helpful, although there isn't any footnote to say what the original expectations were, so job only half-done here;

As a result, whilst no individual division is significantly weaker, in aggregate there is a material impact, and accordingly the board now expects the full year underlying operating profit to be $3m below its original expectations.

Valuation - the house broker has joined up the dots, and issued a flash note (on Research Tree). Its 2018 forecast is lowered by 19.3% to 21.3 US cents (note that the company reports in US dollars).

Converting that at £1 = $1.28, gives us 2018 EPS forecast of 16.6p, a PER of 7.3

Balance sheet - the most recently reported (interim) balance sheet seems fairly solid to me. Receivables look a bit high.

It did a big equity fundraising in Feb 2018. There seems to have been an unusual acquisition, with Gama buying something from its major shareholders. I'm generally not keen on deals like that.

My opinion - neutral. I don't recall having looked at this company before, as these days generally I try to avoid anything aviation related, because historically I've usually lost money when delving into that sector.

The more detailed commentary today sounds as if the problems affecting 2018 may be fixable, and hence perhaps 2019 might improve? If you understand the sector, then it might be worth a closer look, given the low PER. It doesn't interest me though.

2018 Budget

I listened carefully to the Chancellor's speech today, and it strikes me as a sensible package. It reminded me of the crowd-pleasing, giveaway budgets that Chancellors in the past have tended to do shortly before general elections. So I wonder if the Tories are gearing up to hold a snap election after announcing some kind of Brexit deal?

I don't see any need to adjust my portfolio in light of the Budget. The tax cuts from April 2019, through an accelerated increase in the personal tax allowance & higher rate threshold, are clearly going to give household incomes a boost next year.

As mentioned above, the economic data at the moment is remarkably good. There seems a total disconnect between the figures (rising real wages, low unemployment, strong Govt finances, etc) and the general perception.

Extra Govt departmental spending announced, plus more money for Universal Credit, etc, is all good for stimulating consumer spending.

The business rates cuts (for retail/pub/restaurant/cafes) with rateable value under £51k, giving them a third off, for 2 years from April 2019 - this probably won't benefit many listed retailers, as most will have sites with rateable values well above that level. It's more designed to help smaller businesses.

Victoria (LON:VCP)

Share price: 455p (down 25% today)

No. shares: 125.4m

Market cap: £570.6m

Victoria PLC (LSE: VCP) the international designers, manufacturers and distributors of innovative floor coverings...

There are 3 announcements today, which I'll try to cover below, although it looks fiendishly complex;

Trading update - LFL sales growth continues;

... for the six months ended 29 September 2018, the Group has continued to grow sales in a challenging market and Group like-for-like ("LFL") revenue growth(1) has continued to exceed 3% compared with the equivalent period during the prior year.

Operating margins have fallen - which is buried in this section of PR puff below! Note to PRs - this stuff doesn't fool anyone. There is no such thing as "investment in operating margin". In reality, it is just lowering your prices & accepting a lower profit margin, in order to avoid losing sales to competitors.

Overall, as previously stated, the Board firmly believes that it should capitalise on the strength of the Group by driving sales and market share at this time, although this comes with a short-term investment in operating margin.

Based on year-to-date performance and taking into account seasonality, this is impacting the Group's overall margin by approximately 1 - 1.5 percentage points versus consensus market forecasts, although margins are still expected to significantly exceed the prior year due to organic growth and product mix effects from previous acquisitions.

That doesn't sound much, but if your operating margin is 10%, and it's going to be 1.5 % points lower, then that's a 15% fall in operating profit. Again, the clever wording doesn't fool people.

To be fair, the previous trading update on 10 Sep 2018 did also mention that the strategy was to drive market share through competitive pricing. Although that announcement did not quantify the reduction in operating margin.

Broker updates - I can't find anything, so we're in the dark. Reading between the lines, if I had to guess, I'd say that earnings are probably heading 10-15% lower than forecasted. The operating margin comment above suggests that, and I'm assuming that sales growth is probably similar to forecast.

Stockopedia shows a forecast PER of 47.8p for this year (driven by large acquisitions made this year - ending 03/2019). At a guess, it sounds to me as if we might be heading for something nearer to 40-44p? That's just my estimate, with little information available.

A PER of 10-11 maybe? That would be OK if the group had net cash, but it doesn't. Its taken on a ton of debt to fund acquisitions.

Outlook - I don't like this at all, it seems disingenuous - glossing over the profit shortfall, and instead talking about revenue growth;

The Board believes that seeking to increase market share is the correct strategy for the Group at this time as, even with current market conditions, the Group's year-to-date revenues are on track to exceed consensus market forecasts, and the Group plans to recover the margin investment in stages over the next twelve months.

Reminder - there's no such thing as margin investment. It's doublespeak for lack of pricing power, and competitive pressures.

Intention to offer 450m Euro senior secured notes - this separate RNS strikes me as very peculiar indeed. The group is trying to raise E450m in 2023 loan notes, with the interest rate & pricing as yet unknown.

Why is this happening? All we are told is that the net proceeds from the bond issue is to repay existing bank borrowings!

This rings loud alarm bells to me. Why replace bank borrowings suddenly, with what sounds like a junk bond offering? This suggests to me that the banking relationship may have broken down in some way. I don't want to speculate, but in the absence of any explanation from the company as to why it's doing this unexpected & very large refinancing, then I wouldn't want to be holding the equity at all.

Pro forma & interim financial information - again, a very unusual announcement, with reams of figures which look like an IPO document. Pro forma figures are used to show how acquisitive groups would have looked, if the acquisitions had occurred earlier. The purpose of this, is to enable investors to assess how the group would look at a steady state going forwards.

In this case, the pro forma numbers are not audited. Not that audits make much difference anyway, as they're certainly not, and never have been, the rigorous assessment of the numbers that many investors imagine them to be.

Adjusted pro forma EBITDA is £111.7m for the year ended 30 June 2018.

Balance sheet - looking at the pro forma balance sheet as at 30 June 2018, the following figures look quite shaky to me;

NAV: £331.9m, of which 500.9m are intangibles. Deducting those, gives;

NTAV: negative at £-169m. That's bad.

Working capital: Current assets of £330.8m, less current liabilities of £163.2m, giving a healthy current ratio of 2.03

Elephant in the room: £405.8m in long term creditors, called "other non-current financial liabilities" - which I assume is bank debt, or similar.

Net debt: this term is not used in the pro forma announcement, so working it out myself, I get to £349.4m (being cash, less current & non-current financial liabilities). This is 3.12 times adjusted EBITDA, and 3.36 times unadjusted EBITDA. That's quite high. It reinforced my hunch that something might have gone wrong with the banking relationship.

My opinion - obviously, I have incomplete facts. The company has not told us why it's seeking to raise a large bond offering, in order to pay off the bank. I'm inclined to draw my own conclusions - which are very negative.

I would not want to hold this share until its refinancing has been completed. You can't value the equity, if you don't know what terms the large debt pile is going to be refinanced on. It could be much more expensive than the bank debt. Or it might not be able to refinance at all, who knows?

I don't like this at all. The risk with acquisitive groups, is that they get carried away, and take on too much debt. That seems to have happened here. I'd give it a very wide berth, unless & until the financing position is sorted out.

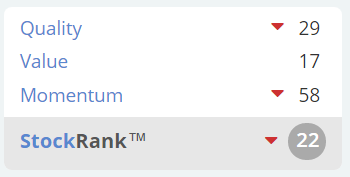

Stockopedia computers don't like it either - a very low StockRank of 22, and negative "Momentum Trap" description before today's 25% share price fall. As always, a reminder that the Stockopedia rankings are not infallible. But are statistically proven to out-perform the market, for a portfolio of shares.

UPDATE 31 Oct 2018 - Victoria (LON:VCP) has issued an update regarding its possible bond issue, here;

Credit rating and response to speculation

This carpet maker has given more details about its proposed bond issue, to replace the exiting bank borrowings. Summarising it, with my comments;

Credit rating - Fitch has given the rating BB(stable) for the intended bond issue. Using a table shown here on Wikipedia, this doesn't look very good - it's in the bracket described as non-investment grade, and speculative. "Higher degree of default risk, speculative" are the description provided by Google for BB credit rating bonds. So not something to brag about, I would suggest. The interest rate would therefore tend to be higher than better quality bonds.

"Misleading rumour & speculation" - what does the company expect, if it drops a bombshell on the market, with no explanation? At the same time as issuing a profit warning, which is what happened here.

Banking relationships (with HSBC and Barclays) - Victoria says;

Firstly, the Company continues to have a close and positive relationship with its lending banks, HSBC and Barclays, and continues to operate with significant headroom with respect to its covenants under the existing 2-year facilities put in place in August 2018.

Our lending banks are acting as joint global coordinators and bookrunners on the potential Bond issue and have been working with us on the project since April of this year.

That's reassuring on the banking covenants.

What I don't understand is this. If the banks are happy with their existing lending to Victoria, then why have they been working with the company to get their lending repaid through a bond issue? That just doesn't make sense to me!

More detail is given about why the company thinks a bond issue makes sense for Victoria;

Long term (5 year) funding of a bond - but this could also be done via a term loan from the banks. Maybe the banks don't have the appetite for long term lending to Victoria?

Fixed rate funding - again, this could also be achieved through conventional bank borrowings, adding an interest rate swap or cap if needed.

Flexibility - but not specified why a bond is seen as more flexible than bank borrowings. I would have thought the opposite is the case. Bank borrowings can be easily amended, whereas bonds are usually set in stone.

Depth of the bond market - suggests perhaps that the banks are at or near the limit that they want, in terms of exposure to Victoria.

Discretionary nature of this bond exercise;

The potential Bond issue is an entirely discretionary exercise, and a final decision will be made at the Company's discretion in the coming days on whether to move ahead or retain the existing facilities;

The potential Bond issue is an entirely discretionary exercise, and a final decision will be made at the Company's discretion in the coming days on whether to move ahead or retain the existing facilities.

My opinion - the proof of the pudding is in the eating. So let's see what terms (if any) are agreed for the bond issue. I cannot see the logic for replacing cheap bank borrowings with a (probably more expensive) junk bond. Whatever the company says, this suggests that the banks may not want continued exposure to Victoria. Why else would they be o-operating with the company to get all their debt repaid? I could understand if the banks wanted to lower their exposure, but it's perplexing as to why they are happy to see it all repaid.

The share price has fallen because of the profit warning a few days ago, and the bombshell announcement (with no explanation or detail) as to the bank borrowings being repaid through a bond issue.

Maybe the share price would go up again, once the refinancing has happened? That would depend on the terms of the refinancing. If the bonds are expensive, then that would reduce profits available to pay out in dividends.

I shall monitor things closely, but personally I remain of the view that this share looks too risky to hold unless/until the refinancing has completed.

That's all I have time for today. I didn't get round to looking at Wey Education (LON:WEY) in the end - sorry about that - but Victoria looked much more interesting, so I focused on that instead.

Graham will be looking after you tomorrow.

Best wishes, Paul.

.JPG)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.