Good morning, it's Paul here with Monday's SCVR.

Please see the article header for the companies I'll be reviewing today, which have issued trading updates or results.

Estimated timings - I lost the section on PURP, so had a re-create it from memory. Hence running a bit late. Should be finished by 3pm. Update at 15:42 - today's report is now finished.

.

Hammerson (LON:HMSO)

Share price: 58.3p (down 9% today, at 10:45)

No. shares: 766.3m

Market cap: £446.8m

- Considering a rights issue.

- In advanced discussions to sell its 50% stake in VIA Outlets.

- Approved for£300m loan from Bank of England (CCFF scheme)

- Q3 rent collection improved to over 30% (still sounds awful)

My opinion - this share looks finely balanced, so I'm watching from the sidelines. I held it recently, but sold out once it became clear that the economics of its shopping centres don't work unless footfall returns to normal, and tenants can pay rents that are far too high for market conditions. Nobody knows what the new normal will be though. Hence I feel it's almost impossible to value this share at the moment.

Bigdish (LON:DISH)

(I'm long)

Another day, another operational update!

TGI Fridays has joined its ordering app, as have 500 more M&B sites. Therefore the 1250 new sites announced recently, has become 1850. Seems to be gaining traction in terms of restaurant recruiting. The platform is free at present. Needs to raise more funds this autumn.

Tekmar (LON:TGP)

Share price: 110p (down 3.5% today, at 10:56)

No. shares: 51.3m

Market cap: £56.4m

(I'm long)

Tekmar Group (AIM: TGP), a leading provider of technology and services for the global offshore energy markets, announces its final results for the year ended 31 March 2020 ("FY20" or the "Period").

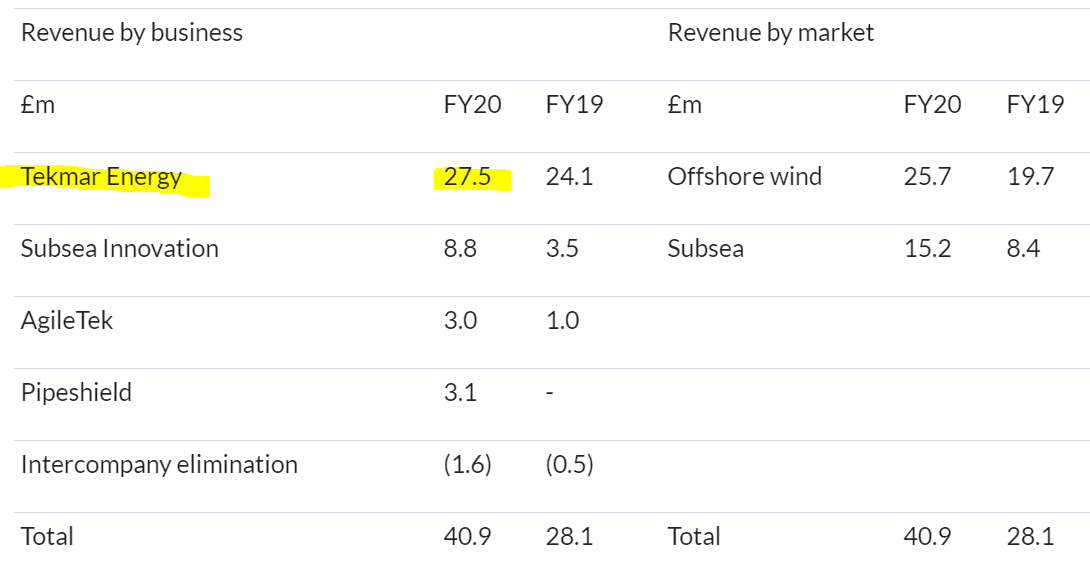

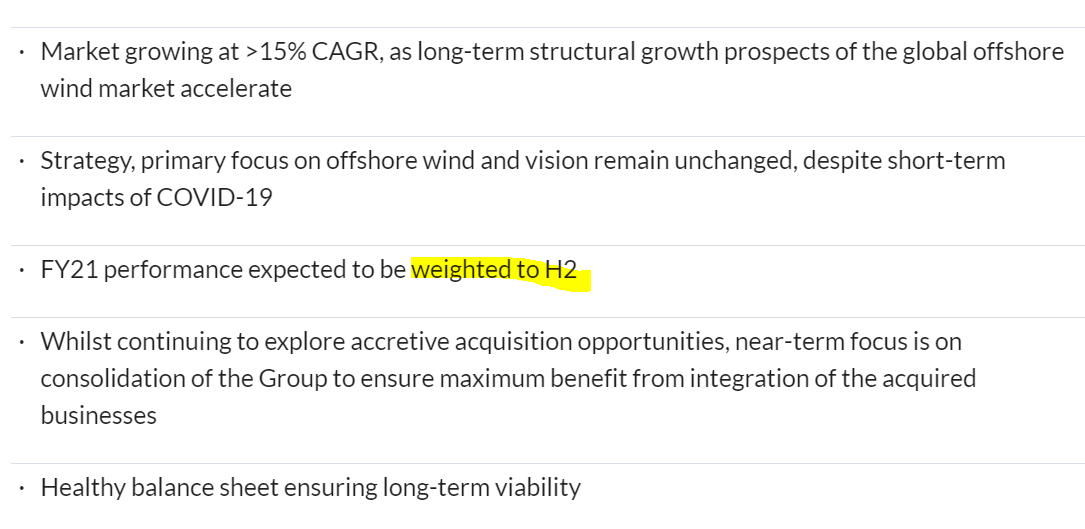

I did some research on this company earlier this year, and like the look of it. It's a profitable supplier of niche products mainly for the offshore wind farm sector - cable protectors. It's also diversified into other subsea markets (oil & gas, less than 20% of revenues), and growth is both organic and by acquisition. This is a good growth area. Performance was dented by covid, but the figures overall look quite decent to me in the circumstances.

Our trading update stated we expected our results to be broadly in line with those achieved in FY19, and I am pleased to report this was achieved.

Actual adj EPS is 5.8p (LY: 6.2p). PER isn't very useful at the moment, because earnings would have been higher, had it not been for disruption from covid. But for the record, PER is 19.0 - if we were to normalise earnings to exclude the impact of covid (which is reasonable in my view), then the PER would come down to probably the low teens.

This is a useful table, as you can work out that the organic growth is a lot lower than the total growth, but still not bad;

.

.

Balance sheet - NAV: £46.0m, less intangibles of £26.3m, giving NTAV: £19.7, which looks solid for the size of the group.

Receivables stands out as looking high, at £26.8m. Note 10 gives a breakdown, with trade receivables looking more sensible at £9.9m (around the level I would expect, relative to revenues). There's also £15.0m of contract assets, which seems a lot. An explanatory note says;

Trade and other receivables

We closed the year with trade debtors of £9.9m and contract assets of £15m. The majority of the latter sits within Tekmar Energy and relates to offshore wind projects that have large project milestones towards the end of the project that are not yet due for invoicing.

I'm not terribly keen on that. It introduces risk, that customers might challenge costs. Also why is a small UK company effectively bankrolling its larger overseas clients, by funding the work-in-progress? It would be better to negotiate payment plans with customers which better reflect the actual costs being incurred by Tekmar.

.

.

The Chairman sounds upbeat about the future;

"Whilst the level of growth in profitability in FY20 was inevitably affected by COVID-19 and the shutdown in China, our strong market position and track record in offshore wind cable protection projects remain unrivalled globally.

Our overall confidence in the prospects for the business should not be understated. I now see a Group which has truly been transformed and, with a much wider portfolio of complementary technologies, is able to offer an international customer base a unique customer-value proposition.

Coupled with a robust balance sheet, the Group is well positioned with a solid platform for growth over the next decade, which is supported by a positive market outlook, despite some short-term uncertainty as we transition through the COVID-19 recovery, which the Group has somewhat mitigated by receipt of a CBILS loan of £3m post year end."

My opinion - an interesting collection of niche businesses.

A while back, I found it very difficult to buy this share, as the market is so thin, so after 2 days trying, and only getting a scrap of shares I gave up. Perhaps management could work on a strategy to improve market liquidity, otherwise what's the point in having a listing?

Note that the StockRank has been good since it floated in June 2018.

.

.

Nightmare, I've just lost the whole section on PURP, so will have re-create it from scratch. Apologies for the delay.

Purplebricks (LON:PURP)

Share price: 50.6p (up c.8% today, at 13:17)

No. shares: 306.8m

Market cap: £155.2m

Purplebricks Group plc (AIM: PURP), a leading UK estate agency business, announces its results for the year ended 30 April 2020 ("FY 2020") and provides an update on strategy and current trading.

Results for FY 04/2020 are of limited use, because they include Canadian operations, which were sold post year end. This has resulted in a very healthy cash pile of £66m, and UK operations trading at around breakeven. Being on online only business, it can dial marketing spend up or down, so profits are more a policy decision than a measure of performance. There's also a JV in Germany.

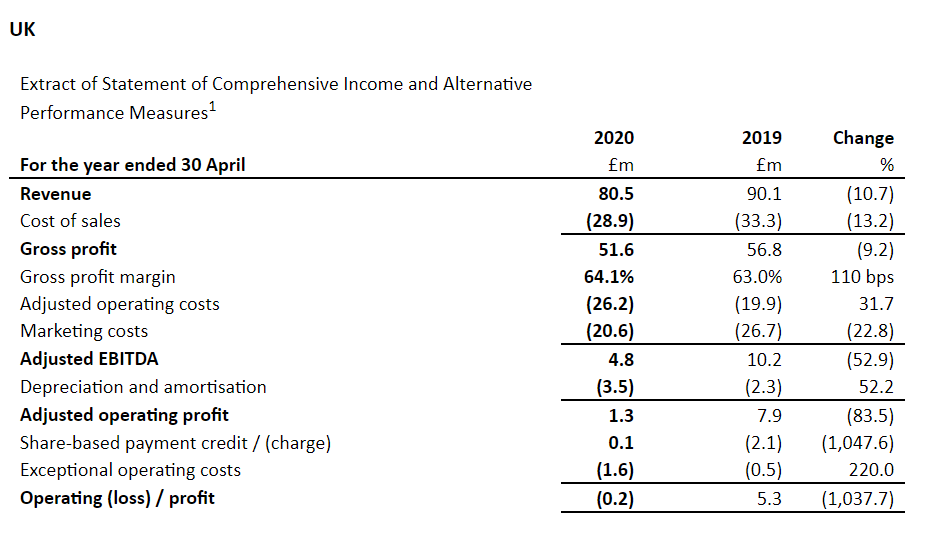

Here's how the UK performed;

.

Not great, with revenues down vs LY. Note how marketing spend was reduced, to arrive at a roughly breakeven result.

Current trading/outlook - market recovering well since mid-May. Record month for instructions in July 2020. Uncertain outlook. Stamp Duty holiday helping demand.

Pricing model - this is an important point. PURP has been criticised for its up-front charging model, leaving a long trail of dissatisfied customers whose properties fail to sell. As PURP collects its fees up-front, then it has no incentive to push sales through to completion. It sounds like this point is at last being addressed;

Evolving our pricing model

We have a business model that is based on value. It's unrivalled in the marketplace and offers consumers the opportunity to sell their homes for a fair, fixed fee. This single-minded proposition has got us to where we are today and created a business model that has resulted in Purplebricks becoming the largest estate agency brand in the UK. However, we also recognise that, to extend our market leadership, we'll need to evolve our pricing. That means looking at different pricing strategies to reduce the up-front fee and splitting the payment between listing and completion.

Following an in-depth pricing study in the first half of the year, we had hoped to pilot a new pricing structure in early 2020, but the lockdown has delayed this to the autumn. I believe reducing the level of the upfront fee will widen the market opportunity significantly, although a fixed fee element will remain a critical part of our success, as hybrid adopters remain more motivated to sell their homes. Reducing the upfront fee will reduce the barrier for many customers in instructing us - while higher fees on completion will allow our LPEs to earn more from each sale, ensuring our self-employed model will not only remain sustainable but become more attractive to the best talent in the industry.

My opinion - with most overseas operations now out of the way, this is a more focused UK operation. I haven't looked into the Germany JV, but note PURP has gone over 50%, so it should now be consolidated into future group results.

Valued at £155m, I think PURP is starting to look interesting again. With £66m in the bank, it can continue to out-spend the competition on marketing. There used to be lots of online estate agents, running TV ads. I wonder how many have since gone under? PURP has emerged the clear market leader. This, combined with its very well known brand name, means there could be interesting value here. If that cash pile is spent wisely, then it could broaden its lead. Speculative, but gets a thumbs up from me at 50p per share.

.

Seeing Machines (LON:SEE)

Share price: 3.33p (up 7.3% today, at 14:00)

No. shares: 3,365.2m

Market cap: £111.1m

Seeing Machines Limited (AIM: SEE, "Seeing Machines" or the "Company"), the advanced computer vision technology company that designs AI-powered operator monitoring systems to improve transport safety, provides a trading update for the period ended 30 June 2020 ("FY2020").

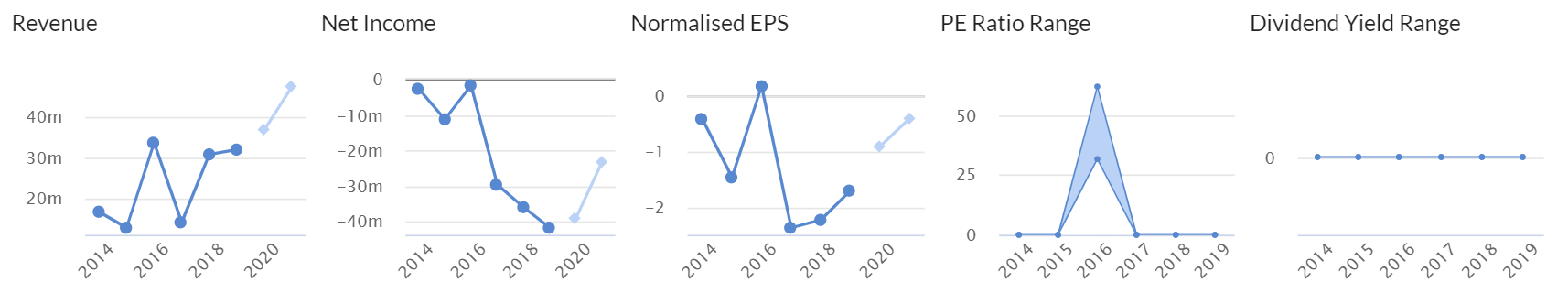

As you can see from the Stockopedia graphs below, performance of this company has been very disappointing historically. Look at the share count too, it's increased about 5-fold since 2014, with repeat fundraisings.

The numbers above are reported in Australian dollars. Current rate: £1 = A$1.84

Today it reports limited info re FY 06/2020 results;

- Revenues A$42.6m (up 30%)

- Cash A$38.7m

- No mention made of losses (which are still substantial)

- Transport sector impacted by covid

- Launch of 2 vehicles incorporating SEE technology in coming months

- Expecting connections to accelerate

My opinion - I've followed this company for years, and it constantly disappoints with continuing, large losses. Nevertheless, the technology is important, as it prevents accidents (monitoring the driver's eyeballs). The big hope for this share was always that it would achieve mass market adoption. That's been painfully slow to date.

Maybe it might make a big breakthrough? Given the poor track record, I'd take a lot of persuading to pay £111m market cap for things as they stand now. Mass market adoption of the product could however be a game-changer, so who knows what the future holds?

.

Byotrol (LON:BYOT)

Share price: 6.4p (up 7% today, at 14:38)

No. shares: 442.8m

Market cap: £28.3m

Byotrol plc (BYOT.L), quoted on AIM, is a specialist infection prevention and control company, operating globally in the Healthcare, Industrial, Food and Consumer sectors, providing low toxicity products with a broad-based and targeted efficacy across all microbial classes; bacteria, viruses (including coronavirus), fungi, moulds, mycobacteria and algae.

Today's update relates to FY 03/2021.

Trading for the current financial year to 31 March 2021 remains strong across the whole Group and multiple opportunities continue to be available, across both product sales and IP licensing.

Product sales for the first quarter to 30 June exceeded £3.4m and orders for July and August continue to look encouraging. Our order book at the end of June stood at approximately £2m. Our current net cash position is healthy at £1.8m.

Whilst it is early in the year, assuming continued easing in supply chains and a relatively orderly Brexit, the Board would expect revenue and EBITDA for the current financial year to be significantly ahead of current market expectations.

We could have used a footnote, to tell us what market expectations are. FinnCap to the rescue, with an update today which is available direct from FinnCap or via Research Tree. Adj PBT is raised to £1.2m, and adj EPS 0.3p - a PER of 21.3 - quite a punchy rating for a tiddler.

My opinion - clearly Byotrol is in a good space, specialising in infection control. So the burning question is whether this is a one-off bonanza year due to covid, or whether stronger performance has longevity? I don't know the answer to that, so have to say I'm neutral. The share price has already tripled due to covid. I've seen other companies launching sanitiser products, so wonder if there could be downward pricing pressure, as supply matches or exceeds increased demand, perhaps?

.

.

Ince (LON:INCE)

Share price: 26.5p (down 7%, today at 14:58)

No. shares: 68.5m

Market cap: £18.2m

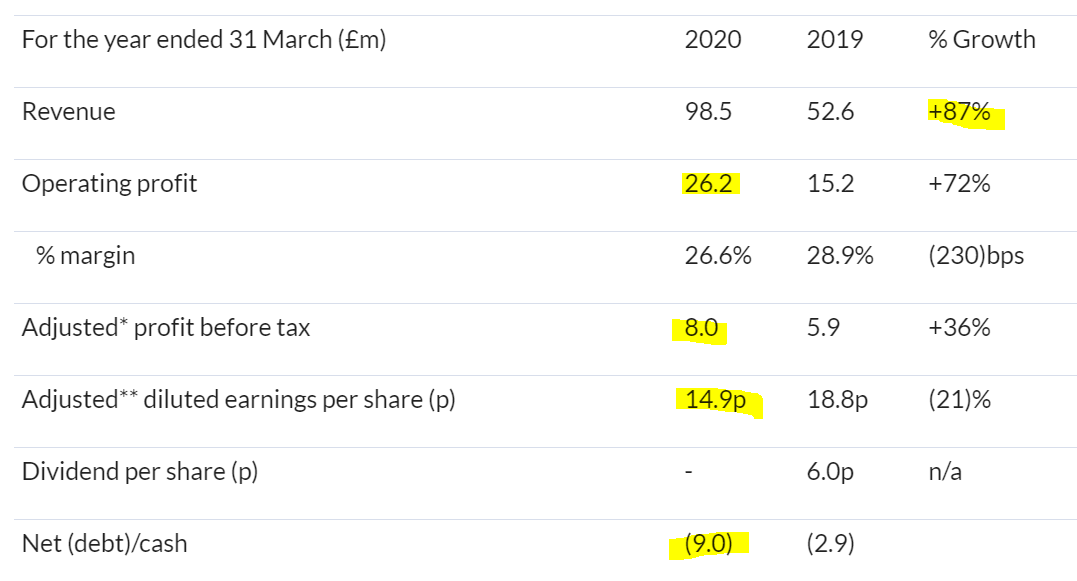

Subscriber fwyburd flagged these results first thing, as the share does indeed look incredibly cheap from the highlights section. Why would a company producing these figures be so cheap? There has to be a catch!

.

.

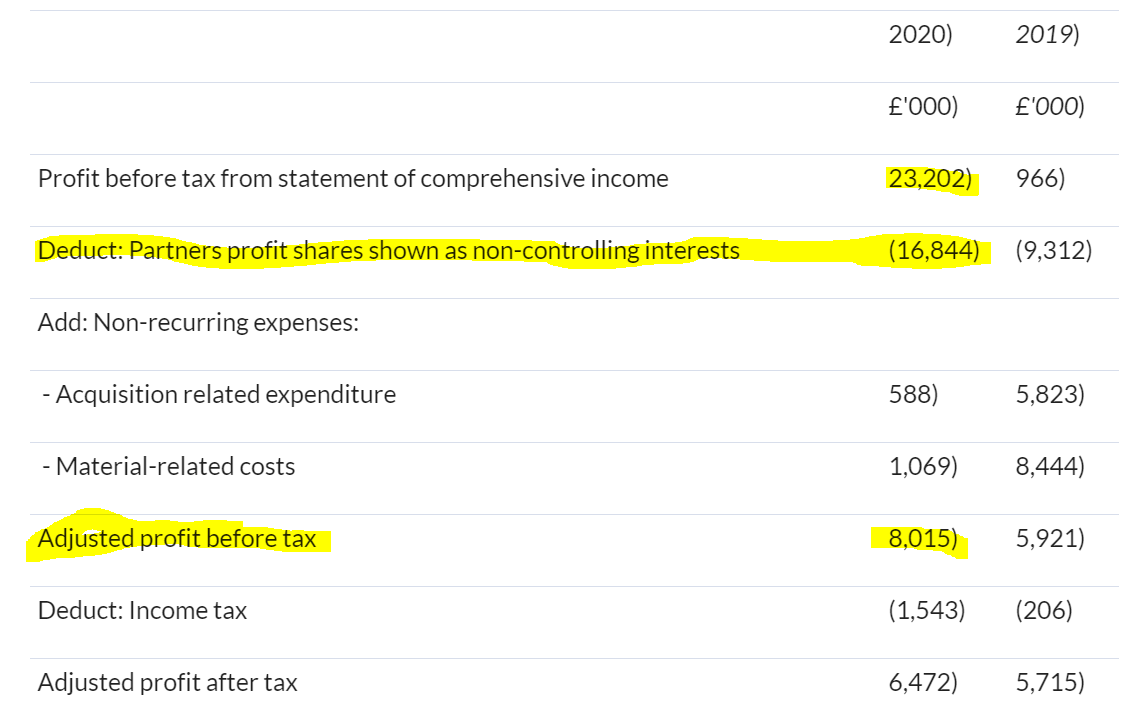

Note the large difference between £26.2m operating profit, and the much lower £8.0m adjusted PBT.

Also, given that adj PBT is up 36%, why would adj EPS be down 21%? That implies a large issuance of new shares, perhaps? Or a large tax charge, or a combination of the two. Note that it raised £14m in fresh equity in Deb 2020.

Net debt of £9.0m doesn't look excessive, which would have been another reason why the market cap would be so low.

Re-reading my notes previously, it's coming back to me. This is the company that did a terrible fundraising at a 50% discount, in Jan 2020 (before covid), which I was pretty scathing about here.

Non-controlling interests - used to be called minority interests. This shows what proportion of profits are attributed to minority shareholders within group subsidiary companies. I can't recall ever seeing a number as large as this, below (note 11 to today's accounts);

.

.

Hence the operating profit number is of no relevance, we should be focused on the adjusted figures.

The cashflow statement shows a cash outflow of £15.5m, called "Transactions with non-controlling interests". Therefore, the minority shareholders seem to be extracting most of the cash for themselves. How come? Does anyone know more detail re this strange structure. It doesn't strike me as a very good deal for ordinary shareholders!

Balance sheet - this is also a can of worms.

NAV: £51.3m, but of that £9.1m is non-controlling interests (minority shareholders in subsidiaries), so NAV owned by INCE shareholders is £42.2m.

Intangibles are £80.8, hence NTAV is heavily negative, at -£38.6m - or in common parlance, shot to bits!

Receivables look very high, so there could be some write-offs needed there.

Anyone interested in this share should look at the liabilities side of things, shown in note 21. Liabilities include £14.6m in deferred consideration (for previous acquisitions) payable in the next year, and £21.1m long term deferred consideration. Where is the money coming from, to settle these liabilities? It's almost twice the current market cap!

My opinion - this looks a real mess. Uninvestable as far as I'm concerned.

.

All done for today, see you tomorrow!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.