Good morning from Paul & Graham!

Podcasts went up on Saturday, I kept them a bit shorter this time, thanks to using my egg timer. Part 1 is a summary of the week's SCVRs. Part 2 is new material, being my roundup of macro/markets news.

I've written up about half of my half-year review of 2023's watchlist picks, so bear with me on that, should be up later today, or tomorrow.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

Summaries of main sections

Science in Sport (LON:SIS) - 13p (pre-suspension) (£22m) - Temporary Suspension - Graham - RED

“Final sign off from the auditors is still outstanding” on 2022 results which were published in an unaudited form last week. Those results weren’t very good and while the company talks up its outlook, I’ve lost what little faith I had that the company was turning itself around.

Eagle Eye Solutions (LON:EYE) (Paul holds) - up 5% to 540p (£154m) - Morrisons 5-year contract - Paul - GREEN

More a growth company than value. Paul sees something very interesting here. I use a contract win announcement as a trigger to review the company's progress this year, which I think is looking good. Shares are expensive, but I feel it's justified for the long-term track record being built.

CentralNic (LON:CNIC) - 118.06p (+2%) (£334m/$415m) - Expansion of Buyback - Graham - AMBER

Centralnic greatly increases its 2nd buyback programme from £4m to £34m. As a cash-generating business that reports in US dollars and issues quarterly numbers, it must view itself as cheap relative to US peers. But this is an unusual decision, as I explain below.

Porvair (LON:PRV) - 664p (+5%) (£308m) - Interim Results - Graham - AMBER

Solid numbers and a good outlook from this industrial technology company. There has been some destocking by customers of one segment. Porvair has an excellent long-term track record and my neutral stance is unchanged due to the earnings multiple pushing 20x.

Blancco Technology (LON:BLTG) - up 8% to 168p (£128m) - Trading Update - Paul - AMBER

Good to see an "above market expectations" trading update for FY 6/2023, although no figures or broker guidance is provided. I find the accounting a bit aggressive, and too many adjustments. But if you think growth can continue strongly, then it might be worth a closer look. I'm neutral.

Paul’s Section:

Let’s start with some quick comments to get up before 8am -

ME International (LON:MEGP)

164p (pre market) £619m - Japan acquisition - Paul - GREEN

Operator of photobooths, laundry machines, and other self-service machines.

One of my favourite value/GARP shares this year, it issued an ahead of expectations update on 9 June, when I commented that the shares still look reasonably priced, despite having doubled in the last year (not bad going in a nasty bear market for small caps).

Today it announces a modest, but attractive deal (only £5.5m) which can easily be afforded from either a cheap loan in Japan, or if not then from existing cash.

ME is buying a Japanese competitor's (Fujifilm) photobooth business. It’s currently only operating just above breakeven, but ME expects profit of £2.2m pa to be added from this acquisition. So presumably that is coming from stripping out duplicated costs.

It bolts on 20-30% extra revenue in the Asia-Pacific region.

Clearly this is an excellent deal, but not material, I reckon that looks about a 3% uplift in next year’s profit, so not something to get over-excited about, but it should be worth a few pence onto ME’s share price.

Yourgene Health (LON:YGEN)

Recommended takeover bid at 0.522p cash.

Novacyt SA (LON:NCYT) is buying Yourgene Health (LON:YGEN) for £16.7m cash. That seems a lot, given that NCYT’s market cap is only £26m - which seems to be way below its own net cash, so I’m not quite sure what’s going on at Novacyt?

It’s a 168% premium being paid for YGEN, but when your share price is under a penny, then it’s not been a good result overall for shareholders.

Both these companies had a boom during the pandemic, which has since fizzled out and they’re now cash-burning again.

NCYT could be an interesting one for special situations investors to have a look at - if the cash can be safeguarded and unlocked in some way maybe?

At least YGEN shareholders get to salvage something from this failed, jam tomorrow investment.

In the current market, nobody is interested in providing follow-on funding for loss-making cash burners. So it's better for YGEN shareholders to at least salvage something with this deal, rather than it going bust at some later stage.

Eagle Eye Solutions (LON:EYE) (Paul holds)

Up 5% to 540p (154m) - 5-year contract with Morrisons - Paul - GREEN

Eagle Eye seems to be that rare thing - a genuinely global specialist in a niche (customer loyalty schemes for big retailers, especially grocers). It has an impressive client list (and note the US is now its largest market) -

The Eagle Eye AIR platform is currently powering loyalty and customer engagement solutions for enterprise businesses all over the world, including Asda, Tesco, Morrisons, Waitrose and John Lewis & Partners, JD Sports, Pret a Manager, Loblaws, Southeastern Grocers, Giant Eagle and the Woolworths Group.

[Source: company website, investor section, Interim results slide deck]

The Stockopedia graphs show an attractive growth company is developing here -

This year, I’ve reported 3 times on EYE here, summarised as follows -

18 Jan 2023 - H1 TU in line. Strong organic growth. Forecasts look too low. Impressive growth company, but not cheap. GREEN.

14 Mar 2023 - H1 in line. “Confortably ahead” outlook. Profitable. Sky high valuation looks justified (Paul). GREEN.

26 Jun 2023 - John Lewis/ Waitrose contract win.

3 Jul 2023 (today) - Morrison's 5-year contract win.

Morrison s win - it’s not clear if this is extending an existing contract, or a completely new one, with ambiguous wording -

… to further develop its loyalty and promotional offering.

Loyalty schemes might sound old hat, but they’re developing into more targeted, and personalised offers, which is what EYE specialises in.

I believe EYE developed the newish ASDA rewards scheme, with its cash pots (instead of points), which I use, and it’s very interesting how it works. It sets targets for you, so called gamifying, to meet challenges by e.g. getting £2 off if you spend £20 on meat or fish within x-days. I’ve found this does engage me. Although it’s also sometimes wasteful - e.g. the other day ASDA unexpectedly gave me £5 in my cashpot, for meeting a target that I hadn’t even noticed! But the feelgood factor certainly makes me more loyal, and I've been shopping at ASDA more frequently since joining its loyalty scheme, created and run by EYE.

I also think EYE's acquisition of French market leader in the same space, Untie Nots, could be very interesting. There was a good webinar about this acquisition, which I remember listening to in April, whilst getting hopelessly lost, hiking in Gozo! So it clearly made an impression, as I remember it, and I listen to so many webinars, few stick in my mind.

Paul’s opinion - for disclosure, I bought a standard position size in EYE shares earlier this year, intended as a long-term hold. There’s little doubt the company is building an impressive track record, and is profitable now (but ignore EBITDA, it’s a nonsense number).

The only question is how to value it. PER isn’t a very helpful measure for growth companies in my view, and I also dislike multiples of EBITDA or sales. So valuation is really just guesswork. What size might the company scale up to, and what would it be worth then - that tends to be my way of looking at things.

There might be a clue in the April 2023 growth share plan. I despise growth share schemes, which seem like legalised theft to me, whereby management are given shares in an intermediate holding company.

However, for a bad concept, this one seems well thought through. It’s based on stretch share price targets, and the dilution isn’t excessive, as you can see below, so I can live with this -

4-5% dilution, for 6-bagging the shares, is acceptable to me.

Maybe this gives an idea of management ambition, and the potential upside scenario? Or it could be pie-in-the-sky, we’ll have to wait and see!

Stockopedia has the fwd PER at 37x, which is obviously high, but that reflects the strong organic growth, and recurring revenues.

I thought it would be useful to have a recap EYE shares. Today’s news about Morrisons is encouraging but not game-changing. I do think highly rated shares need to provide regular positive newsflow, so this helps underpin my view that this company looks unusually interesting. I wonder if it might also be a takeover target? Although I’d rather have a multibagger over the long-term, than a 30% premium now.

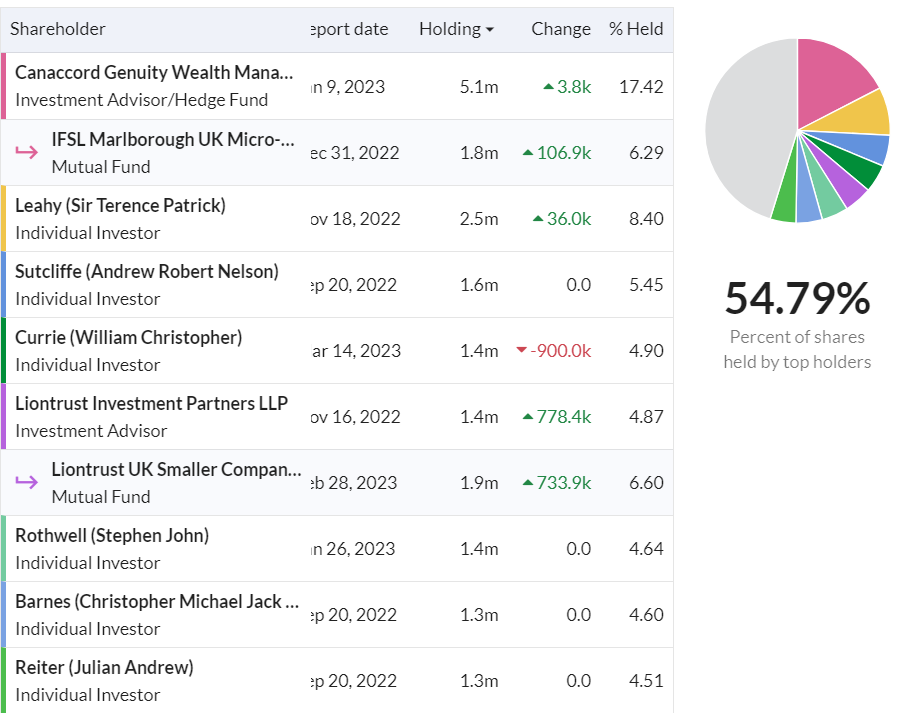

Notable shareholders include the biggest being shrewdie Canaccord/Marlborough at 17.4%, Sir Terry Leahy on 8.4%, and William Currie on 4.9% - google the names if you’re not familiar, all know what they're doing, in my opinion.

Blancco Technology (LON:BLTG)

Up 8% to 168p (£128m) - Trading Update - Paul - AMBER

We haven’t covered this share for about 18 months, so let’s have a recap, seeing as the shares are up 8% on today’s update.

Blancco Technology Group (AIM: BLTG), the industry standard in data erasure and mobile lifecycle solutions, announces the following trading update for the year ended 30 June 2023 ("FY2023").

Full Year Results expected to be above market expectations with broad-based growth across all geographies

Strong performance in H1 continued in H2.

Growth drivers are sustainability, and governance.

Revenue above market expectations (no numbers provided).

Operating profit “comfortably higher than current forecasts”.

High level of repeat revenues, and new business wins.

Well placed for continued growth.

That all sounds good to me, although it would have been nice to have some numbers, even if only estimates, or a range.

Any broker updates to quantify things? No, there’s nothing at the moment on Research Tree.

Balance sheet - I recall there were issues in the past, but its last balance sheet at end 12/2022 looks adequate, only £6m NTAV, or £10m if I ignore deferred tax, but this type of business is capital-light, so that’s enough, no concerns over the balance sheet.

Cashflow looks superficially good, but it capitalises a lot of development spend (£2.5m in H1, almost half of the £5.3m adj operating cashflow). So real world cashflow is not very good for the market cap size.

Paul’s opinion - it’s good that trading is ahead of expectations. Stockopedia is showing 8.0p adj EPS, so if it’s ahead of that, maybe 9p? That would give us a PER of 18.7x, which I can’t get excited about as a value share.

Is it a growth share? Well, revenues have improved in recent years, and it seems to now be making genuine profits.

Hence this share now boils down to whether you think it is on a sustainable growth trajectory that could see profits rise, and hence be good for the share price. That would need a lot of additional research, so I don’t have a view on it. Overall, with rather aggressive accounting, lots of capitalisation and adjustments, I’m not keen, so will just go neutral on it, AMBER.

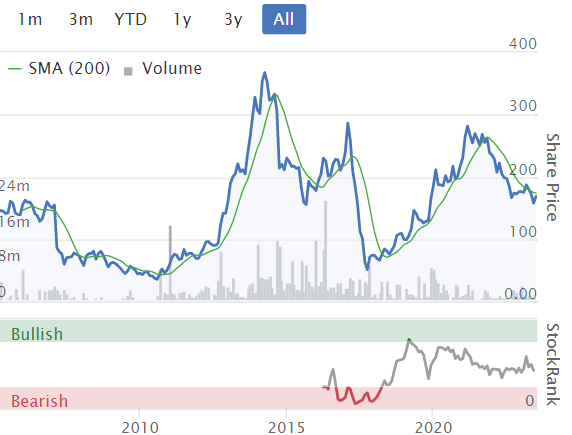

A rather erratic share price chart. I think this group used to be called something else (was it Regenersis?), and refurbished old phones, but that didn't work out, so it morphed into BLTG (after the former Directors had banked multiple millions in share sales a few months before a profit warning).

Graham’s Section:

Science in Sport (LON:SIS)

Share price: 13p (pre-suspension)

Market cap: £22 million

Ominous news here for shareholders, as the shares have been suspended:

Science in Sport plc (AIM: SIS), the premium performance nutrition company serving elite athletes, sports enthusiasts, and the active lifestyle community, announces that it has not been able to publish its audited financial statements for the year ended 31 December 2022 by the six month deadline as final sign off from the auditors is still outstanding.

They reassure that the audited statements are expected “imminently”, and the suspension can be lifted then.

However, this isn’t normal for a well-run company. If I was a shareholder here, I’d be very disappointed by the failure to follow a simple deadline. Even if the suspension is lifted tomorrow, why did it have to come to this? Six months is plenty of time to get your accounts sorted, especially for small companies!

By the way, any shareholders with strong attention to detail were given a warning that this might happen. Last Thursday, the company did publish preliminary results at 7am, but it issued a replacement three and a half hours later.

The replacement said (I’ve added the bold):

The following sentence has been deleted from note 1 of the Notes to the Consolidated Financial Statements for the full year results announcement released on 29 June 2023 at 7.00 am with RNS number 3025E as the results are unaudited: "The auditors' report on the statutory accounts for the year ended 31 December 2022 and the year ended 31 December 2021 is unqualified, does not draw attention to any matters by way of emphasis, and does not contain any statement under section 498 of the Companies Act 2006."

It’s normal for interim (i.e. half-year) results to be unaudited, but full-year results are supposed to be audited.

For example, here is what one of my favourite companies, H & T (LON:HAT) , said in its results statement for FY December 2022 (published back in early March). I’ve added the emphasis:

The financial information has been abridged from the audited financial statements for the year ended 31 December 2022.

The financial information set out above does not constitute the Company's statutory accounts for the years ended 31 December 2022 or 2021 but is derived from those accounts.

As you can see, by early March, H&T already had audited financial statement for the year ended December 2022.

Indeed, many large PLCs get audited numbers out with lightning speed. There is no excuse for small companies to struggle with the deadline.

Graham’s view

The numbers published by SIS last week were poor, with a loss at the EBITDA level. The company says it does expect to be EBITDA positive in H1 2023 (a period that has already finished). They say “momentum is building” in terms of revenue growth, but we are in an inflationary environment and the company has spent big on a new Blackburn facility, so revenue should be growing.

I also note that net debt reached nearly £11m despite the company raising £5m from new share issuance.

While I came to a neutral conclusion when I looked at SIS earlier this year, I would be actively avoiding it after the announcements of the past week. So this share gets the thumbs down from me today.

CentralNic (LON:CNIC)

Share price: 118.06p (+2%)

Market cap: £334m ($415m)

Paul normally covers this one and I strongly recommend that you dig into the archives for more of the background into this stock.

In its own words, it is “the global internet company that derives recurring revenue from privacy-safe, AI-based customer journeys that help online consumers make informed choices”.

Today it is increasing its buyback programme by £30m (from only £4m).

The reason given is succinct:

The Board considers the Buyback Programme to be in the best interests of all shareholders, given the cash generative nature of the business. It reflects the Group's renewed capital allocation policy geared towards greater returns to shareholders.

Centralnic will spend up to £34m and it will buy up to a maximum of 28.9 million shares (corresponding to 10% of the company).

I note that at the current share price (118p), 28.9 million shares would cost almost exactly £34m - so the company is saying that it would buy the maximum number of shares allowed at the current share price.

Graham’s view

I love a good buyback, but is this a good one?

According to the most recent quarterly report, the company was carrying net debt of $49 million. A good buyback is typically associated with a cash-rich business that has run out of productive uses for its enormous cash balance.

It’s atypical to see a large buyback from an indebted, rapidly growing technology company. One would imagine that a company like this has many possible productive uses for its cash, besides paying down its debt.

As for whether or not they can afford it, I note that quarterly cash generation in Q1 was $6m. Add back in the cost of buybacks and acquisitions, and real quarterly cash generation was maybe in the region of $12m.

With a market cap of just over $400m equivalent, I can understand why they might think they are undervalued at that level.

Here are some of the value metrics:

For a company that reports in US dollars and publishes quarterly numbers, I can only assume that they consider themselves to be undervalued relative to US-based peers.

Personally, I am biased towards seeing debt reduction before buybacks, so it’s difficult for me to get fully on board with their decision to expand the buyback programme. Therefore I’m going to sit on the fence with this one for now.

Porvair (LON:PRV)

Share price: 664p (+5%)

Market cap: £308m

Porvair plc ("Porvair" or "the Group"), the specialist filtration, laboratory and environmental technology group, announces its interim results for the six months ended 31 May 2023

I was impressed by this company when I looked at it in April, but I stayed neutral due to its valuation.

The shares are up 10% since then, suggesting that I was too cautious perhaps? Valuation naturally remains on the rich end of the spectrum:

Here are some of the highlights from today’s interim results:

Revenue +10% to £90.6m, up 5% on a constant currency basis.

Operating profit +16% to £11.7m

Cash balance is nearly £20m.

CEO comment: he remarks proudly on this “record set of results… despite inconsistency of demand across markets served".

"Looking ahead, while noting that inconsistent order patterns pose risks to forecasting, the Board expects the Group's full year result to be ahead of that for 2022. The aggregate Group order book, which has been at record levels for much of 2023, remains high. Porvair's long-term earnings record is supported by established global trends…”

The company reiterates its strategy and its long-term record, both of which I commented on last time.

The only major weak spot in the results came at the “Laboratory” division, where revenues fell 6%.

Here are the comments on what happened: de-stocking and normalisation of lead-times.

De-stocking of laboratory consumables from the second quarter affected Porvair Sciences, where lead-times have now fallen to more normal levels. This helps levels of customer service and inventory turns, but challenges manufacturing efficiency. In the plants affected, cost-reduction programmes have been undertaken to balance changing order patterns.

As outlined in the results announcement in January, the Board anticipated this de-stocking cycle and does not see any fundamental changes in the underlying growth drivers of the Laboratory division, in which investment continues.

Graham’s view

I don’t see any reason to change my view on this one, so my stance is unchanged. It appears to be a well-run company, and it may be priced about right. I’d be uncomfortable paying an earnings multiple much higher than it has already achieved.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.