Good morning! I’m back home after a truly fantastic week which culminated in the Mello 2018 conference in Derby. Congratulations to all the organisers of this event, particularly David. I can only imagine how much work was involved behind the scenes.

Monday morning news is plentiful:

- J Sainsbury (LON:SBRY) - full-year results, plus a proposed combination with ASDA (owned by US:WMT)

- UP Global Sourcing Holdings (LON:UPGS) - interim results

- Luceco (LON:LUCE) - final results

- World Careers Network (LON:WOR) - half year results

We also have trading updates from:

- Redstoneconnect (LON:REDS)

- Sanderson (LON:SND)

Edit; I elected to cover Image Scan Holdings (LON:IGE), instead of World Careers Network (LON:WOR), in response to a reader suggestion.

J Sainsbury (LON:SBRY)

- Share price: 310p (+15%)

- No. of shares: 2189 million

- Market cap: 6,786 million

Combination of J Sainsbury & ASDA

Results highlights look fine, overall. And the profit expectation for 2018/2019 is in line with expectations.

Underlying profit before tax increases by 1.4% to £589 million. Guidance for next year is £629 million.

Incidentally, these (unaudited) results are for the 52 weeks ending 10 March. We should reward companies who report in a prompt manner - much better than being kept in the dark for several months.

Despite the positives, note that return on capital employed has fallen slightly, from 8.8% to 8.4%, by the company's own measurements.

By Stockopedia's measurement, return on capital is lower than this:

Supermarkets don't seem to have a great track record when it comes to generating attractive returns on capital.

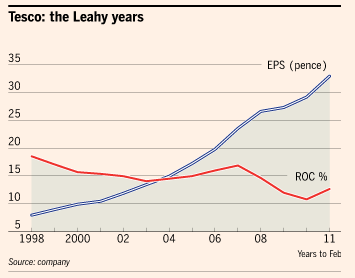

One of Terry Smith's best articles, in my opinion, was written in 2014 for the Financial Times on the subject of Tesco (LON:TSCO), and why he would never own shares in it. He includes the following chart:

This return on capital metric can be measured in different ways, but one thing is clear: neither Tesco nor Sainbury have been doing particularly well on this measure. According to Stocko numbers, Tesco is currently running at an ROC of about 7%.

SBRY is not a small-cap, and I don't have any particular interest in buying its shares, so in the context of the SCVR, I'm not motivated to research this in much more detail.

But I do think it's relevant for small-caps which might be suppliers to supermarkets. It's bearish news for them, as the concentration of their customers is likely to increase even more (and therefore their customers' buying power will also increase).

The deal is expected to generate at least £500 million of synergies, of which £350 million is forecast to be generated "predominantly from access to better harmonised buying terms", i.e. getting more favourable deals from suppliers. Food manufacturers in general may find things a little tougher (e.g. I have an interest in Shire Foods through £VLE).

As for the Sainsbury/ASDA combo, it will be targeting:

Low double-digit return on invested capital (inclusive of implementation costs) in the second full financial year following completion

Not bad, but I think we can find better businesses than this to invest in.

UP Global Sourcing Holdings (LON:UPGS)

- Share price: 37.9p (+5%)

- No. of shares: 82 million

- Market cap: £31 million

This share price has tanked horribly since IPO. I'd be surprised if IPO investors didn't feel like they had been mugged:

It's an Oldham-based distributor of cheap consumer brands.

In February, on the back of the latest profit warning, I said that it was arguably in value territory at a share price of 33p. This seemed to finally reflect the company's limited pricing power (its products sell at just a small premium to retailers' own-brand products), and the low rating gave a potentially attractive risk:reward.

Trading for the financial year 2018 (ending July) is in line with (reduced) expectations.

The company's economic commentary is extraordinarily bearish, given that we still aren't in recession. Imagine how companies like this will report if/when a recession hits?

The decline reflects the much tougher trading environment for general merchandise in the UK, with wage inflation running behind general inflation. Discretionary spend has been under pressure and consumer confidence has therefore been lower than it has been for some time. As a consequence non-food sales have declined as consumers have prioritised food purchases.

The gross margin is flat at c. 22%, which helps to quantify the very limited pricing power of the company's products.

The share price now looks like it probably reflects this. Profit for the six-month period falls out at £3.1 million, or £2.7 million if you include losses on hedging instruments (due to the rising pound, I guess).

The balance sheet seems strong enough - a positive equity position worth £6.75 million, not using too many fixed assets. Borrowings are used to finance invoices and imports - fair enough.

Overall, my stance is unchanged. I think this has fallen to levels where shareholders can potentially do well. For a variety of reasons, including low visibility, it's never going to be a super high-quality investment. But maybe the share price more than fully compensates for this now?

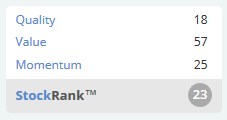

Stockopedia computers recognise good value:

Luceco (LON:LUCE)

- Share price: 66.8p (unch.)

- No. of shares: 160.8 million

- Market cap: £107 million

This LED lighting business is another IPO which has proved disappointing for investors so far. It is down nearly 50% from its IPO in October 2016:

In December, the shares fell 42% in a single day when the company reported falling margins and that it had failed to value its inventories correctly. The financial controller resigned.

The CEO had sold shares in the weeks prior to this announcement, and the CFO fell on his sword shortly after (in February).

So there has been a major loss of trust in this company as far as shareholders are concerned, and the share price shows that its reputation among investors has not recovered yet. The Chairman understands this and apologies:

Your Board is sorry that our performance has not met the high standards that we have set ourselves and I would like to thank our shareholders for their patience whilst we take the necessary steps now to build a better future for Luceco.

Value metrics demonstrate the loss of trust:

Today's results are much lower than prior expectations, and much worse even than the guidance the company gave in December.

But if you didn't know what the previous expectations had been, you might think today's results were quite good. Note that gross margins have eroded, instead of strengthened as had previously been forecast - this is the key area of weakness and is a function of exchange rates and commodity rates. The company suffers when Renminbi and copper go up.

The company says today that "the potential margins achievable in our business have not changed".

Some of the highlights are as follows:

- Group revenue increased by 25.4% to £167.6m (2016: £133.7m). 21.7% on a constant currency1 basis

- Gross margin 28.9% (20162: 30.3%)

- Operating profit increased by 19.3% to £14.2m (20162: £11.9m)

We need to take into account net debt of £36.7 million, e.g. by adding this figure on to the market cap to use an enterprise value of £144 million. We can compare this with the (pre-interest, pre-taxes) operating profit number, to get a valuation multiple of c. 10x earnings.

My view

Again, I think this is interesting at current levels (although I also said this at 130p, so perhaps I shouldn't be listened to).

One thing that Luceco deserves credit for is that it has always been very precise about targets (even if it has tended to miss those targets so far), and it has taken dramatic steps to fix the errors which led to the accounting errors. Its disclosures in relation to these errors have also been admirably detailed.

The major issue is:

Inventory was incorrectly valued. Specifically, the amount of overhead absorbed into inventory in accordance with the Group's accounting policy was incorrectly calculated.

The errors arose due to a "manual and complex process environment", in which changing currency exchange rates and commodity prices and their effects on inventory costs weren't being taken into account properly.

And if you aren't valuing your inventory correctly, then you aren't calculating your profits correctly.

The new CFO has been hired from Ferguson (LON:FERG). The company is trying to rebuild credibility. Is it too soon for investors to trust again?

Personally, I won't be investing just yet. The level of uncertainty surrounding it is still a bit too high for me. I'm also a long-term bull on the value of Chinese currency, so I think cost pressures might continue to rise.

That's just me. I can understand why others might view this situation as safe enough to have a flutter, taking into account the strong top-line growth and the share price sitting at much lower levels compared to when the company came to market.

Image Scan Holdings (LON:IGE)

- Share price: 6.6p (+13%)

- No. of shares: 136 million

- Market cap: £9 million

I want to put a standard disclaimer here - micro caps are particularly risky, due to spread and liquidity considerations. So tread carefully! This is just below our traditional £10 million cut-off.

Paul has covered this stock several times before - see the archives for a complete list of related articles.

It trades as 3DX-RAY, with the following description:

3DX-RAY supplies a range of portable, rapid deployment and static security solutions to the security sector worldwide including Government and private security organisations.

Today's results are slightly better than we could have expected. We get a small profit instead of the small loss which had been forecast.

A £1m order was reported as having been cancelled in February, triggering an approx. 40% share price fall.

The shares have recovered now, for good reason. The Executive Chairman describes the outcome:

In February we announced we had accepted the cancellation of a £1m contract for portable X-ray systems. I am pleased to report that a cancellation agreement has been reached with the customer and compensation payment has been received. Furthermore, all the units manufactured for this order have now been sold to other customers.

In terms of financial impact, the cancelled order was set to deliver £0.5 million in revenue during the half-year period reported today. If it had not been cancelled, we could have expected higher margins and more accessory sales - a tail of accessories has been left behind.

To be fair to the company, it lists customer concentration risk as the very first business risk in its strategic report, when you read the 2017 annual report.

Drilling into this report, you find that 53% of FY 2017's sales were made to two customers, up from 48% of sales to the top two customers in FY 2016.

So although the company reports today that it is pursuing initiatives to make it "less dependent on individual product lines or customers", this looks like it will remain the key risk facing the company in the medium-term.

Investing in a company which relies on so few customers is beyond my risk tolerance, so it's not for me. But clearly there will be excellent returns available if it does succeed in growing revenues from the current level. Maybe if you can discover particular insights into its products and the markets it serves (anti-terrorism, vehicle inspection), it could be worth a look.

The algorithms are unimpressed at the moment, calling it a Value Trap.

Redstoneconnect (LON:REDS)

- Share price: 89p (+6%)

- No. of shares: 21 million

- Market cap: £18.5 million

Another in line with expectations update from this smart buildings/managed services provider.

The Company expects to report revenues of over £47 million, adjusted EBITDA* of approximately £3.2 million, and adjusted profit before tax** of approximately £2.4 million in line with market expectations.

This follows on from a nice update in January:

"Having successfully deployed our solutions in some of the smartest buildings and spaces in Europe, our team is now optimally placed to support a growing number of customers as they seek to understand how the implementation of smart software can significantly improve both the utilisation of their real estate and the working environment for their employees."

It's all very busy and encouraging, and I'm surprised to see how far the shares have fallen over the past year. The products and the clients all sound very impressive.

I wonder if it might be a very labour-intensive business? The adjusted EBITDA margin reported above is less than 7%, suggesting that it might be.

I've just pulled open the 2017 annual report. £16.4 million of staff costs are reported, accounting for 39% of sales. This confirms my suspicion.

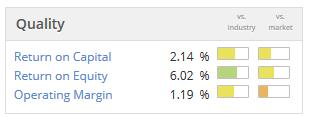

Quality metrics are good for the industry, but below-average compared to the market as a whole:

The forecast PE ratio is only 6.3x (according to Stocko). This is yet another stock of questionable quality which has suffered a significant de-rating. Perhaps the market has become a lot more discriminating, where it suspects lower quality? But at some point, it must become vulnerable to a takeover/go-private deal.

Last year, the company made a capital reduction to enable it to pay dividends and/or buy back its own shares. Maybe that could be the catalyst to spark more interest among investors to hold this one.

Sanderson (LON:SND)

- Share price: 93.5p (+6%)

- No. of shares: 60 million

- Market cap: £56 million

This is a software company providing industry-specific solutions to a range of sectors.

Checking my prior notes, I last covered Sanderson when it made a large (£12 million) acquisition late last year. At the time, I had a positive impression of prospects. Customer concentration was material but perhaps at an acceptable level - the biggest customer accounted for 12% of sales.

Today's update is nice. Key points:

- The acquired business has "made a good start"

- Trading results are "slightly ahead of management's expectations with revenue and profit growing by over 30%".

Helpfully, Sanderson also reports comparable "like-for-like" growth rates, excluding the acquisition. Organic sales are about flat, up from £10.9 to £11 million. Like-for-like operating profit is up 10% (efficiency gains) and the like-for-like order book is up 15%.

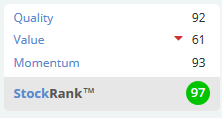

I'll refrain from any further analysis until we get more detailed results (due on 23 May), but for now I maintain my positive impression of the company and would suggest that it is worthy of additional research. The StockRank is a mighty 97.

That's it for today!

There is a lot more to be said in debriefing after Mello, but I will take a break from writing for now.

Catch up with you again later in the week.

Best,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.