Good morning, it's Paul here.

Given that markets are quiet, I'll be approaching things in a leisurely fashion today, so estimated time of completion is 17:00. Sorry, that didn't work out as planned. Let's try again.

I see that the retired head of Next, Sir David Jones, has died. It's not for me to cast judgement on his career, other than to say that his autobiography is a fascinating read, very highly recommended. It details not only the turnaround of Next, when it had came close to going bust. More memorably, the book explains his battle to continue his business career, whilst suffering from Parkinson's Disease, it's quite astonishing the adversity that he overcame.

BigDish (LON:DISH)

Share price: 1.23p

No. shares: 349.0m

Market cap: £4.3m

(at the time of writing, I hold a long position in this share)

We can't go into a new decade with a backlog of things for me to write about, so I'll get this section finished (am writing this on new year's eve, evening).

BigDish Plc (LON: DISH), a food technology company that operates a yield management platform for restaurants, is pleased to announce its half-yearly report for the period ended 30 September 2019.

Background - I came across this company in early 2019. It floated, with a full listing (i.e. not AIM listing) in Aug 2018, at 5p per share, then steadily drifted down. The concept is that it's a dining app, which enables restaurants to offer highly targeted discounts, at times of day when they would normally be empty or almost empty. Restaurants have to offer 50% and 25% off discounts on all food, but require customers to pay full price for drinks. Unlike almost other dining discount schemes, BigDish is free for customers, and enables restaurants to precisely control, in real time, what offers, and how many covers can claim the offers. When they're gone, they're gone.

I thought to myself, this sounds an interesting concept, I'll read the admission document on lazy Sunday afternoon. The app was operating in Bournemouth, and coincidentally I had moved to Bournemouth in 2017, so decided to download the all, and try it out.

I found the app absolutely brilliant. There were about 50 decent quality restaurants set up on the site, and using the app achieved superb discounts, on good food. I liked it so much, that I ended up dining out 2 or 3 times a week, at low cost. Everywhere I visited, I chatted to the staff about the app, and most of them really liked it.

Even though the published financial figures were rubbish, I decided to take a stake in the company at an average price of about 2p.

Much to my surprise, the share price then roughly doubled, and then slipped back down. Then a much bigger surge happened in May 2019, as you can see below - by June 2019 I was feeling pretty happy about life, with a nice £6-figure profit on my holding.

The low point in Jan 2019 is about 1.5p, the high point in May 2019 is about 9.5p.

I remember thinking at the time, that the price was getting a bit toppy for a blue sky stock, but somehow convinced myself that it could continue rising to about 12-15p, at which point I would be happy to sell some or all. What a mistake that was. In fact, I would say that my failing to sell into the huge price spike in DISH was my biggest investing mistake of 2019.

I'd had concerns about how rampy the newsflow from the company was, with OTT gushing trading updates, saying how exciting the future was. Plus it kept putting out rampy short videos & commissioned research. All of which made me nervous.

I met the Chairman, who comes across well, but again a bit over-excitable. At one meeting I recall him saying something like, "Forget things like revenue, and profit. This is all about the opportunity for data...". Later in the meeting he asked me what I thought private investors would want to hear, and I replied, "Pretty much the opposite of everything you just said!" Or maybe I just thought that, and replied with something more diplomatic, I can't recall exactly.

On 6 June 2019 the company announced a placing raising £2.1m, at an excellent price of 7.2p. I thought that should put a floor under the share price at around that level. It didn't.

Results for FY 03/2019 were published, via a link to the company's own website. That's a strange way of doing it, I thought. Reading the results, I could see why the company didn't want to make it easy to read them. The revenue was minimal, not a huge surprise, as the company was only just launching a nationwide roll-out.

Of major concern, was that the cash position at 03/2019 was not comfortable, as the company had told investors. In fact, they had been almost out of cash at the balance sheet date. Sure, the placing since had fixed that, but it left a bad taste, and I think a lot of people must have decided to bail out, as this is what happened to the share price next. All the way back down, and to new lows, recently touching 1.0p

I can understand why most investors probably wouldn't want to touch this share. Although personally, I feel that it overshot on the upside in May 2019, and may have now overshot on the downside. Hence recently I've been buying more.

The main reason for optimism, is that the business model has recently been improved. It began a nationwide roll-out, by recruiting 10 territory managers. Only 2 of them delivered decent levels of restaurant recruitment (Brighton is one which has grown rapidly). Swift action has been taken to restructure, with the 8 unsuccessful territory managers having been let go recently.

Instead the company has shifted to a telesales model. This has recently begun, and should start to kick in nicely in Jan 2020 - prime time for restaurants to be seeking methods of getting bums on seats in the quiet post-Xmas period.

This is the most important recent RNS regarding the new CEO, with highly relevant telesales experience. Telesales is a much cheaper, and more effective way of recruiting restaurants. I think it's likely that this should achieve much better results than "boots on the ground". Hence we could be in for a series of positive updates in the spring of 2020, showing much faster restaurant recruitment. I think that could be the driver for at least a partial recovery in share price. Hence why I've been buying more shares at recent lows.

Another interesting angle on this, is that growth company investors are valuing this type of company at much higher valuations that the stock market. Look at how a US family office were happy to fund it at 7.2p.

Interim results - are absolutely terrible. Revenue was only £11k! Pathetic really.

Cash was £1.3m, and cash burn means that it's likely to run out of cash in Q3 2020, as stated in the interim results statement.

Therefore, buying/holding this share at the moment, is a gamble that it can refinance again later in 2020. So I see this share as binary - it's either going to run out of cash & go bust, or it'll refinance later this year on the back of decent growth in restaurant numbers (my money is on the latter).

My opinion - I see this as potentially a multi-bagger. Although it could also be a complete wipe out, if it is not able to refinance later in 2020.

I keep coming back to how good the app is - it works very well, and saves customers lots of money, whilst delivering what restaurants want - customers at tables, instead of an empty restaurant. I've watched how restaurants put the BigDish customers in the window seats, so that people passing by, notice that there are already people in there, eating. I've watched how passers by do a double take, then walk back and look at the menu. The best way of attracting other full price customers, is to have people already in the restaurant, making it look busy at the start of the evening.

Therefore this stock is my favourite highly speculative share for 2020. Definitely not for widows or orphans though.

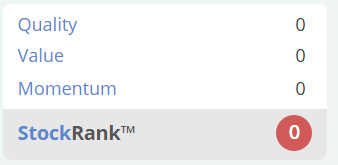

Stockopedia has no time for shares like this, and it scores a big fat zero on the StockRanks!

I like it when StockRanks warn us like this - highly speculative shares like DISH are usually disastrous investments. However, the odd one delivers great results.

There was no other interesting news out on 30 Dec 2019.

Sorry this report was late, but I got there in the end. It's just like that occasionally.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.