Good morning from Paul & Graham!

Today's report is now finished.

Small Caps Podcast - went up on Saturday morning. I really enjoy doing these, so it's not a chore. However, typing it up is a chore, so I've decided to drop that - apologies for any inconvenience, but the current workload is so intense, something had to go. Seeing as most of the podcast is summarising the shares we covered during the week, all the info (apart from the short markets/macro bit) is already on my SCVR summary spreadsheet, so it felt like duplication typing up the podcasts, and it's a good 2-3 hours work typing, which I could do without at the weekends! I hope you don't mind.

This week I flagged 2 mystery shares (my best ideas during the week, just for Stockopedia subscribers), and have left a comment here in the comments section of Friday's SCVR to reveal them, and why I picked them. Also bear in mind that, unusually, I own both these shares personally (intended holding period: 1+ year, but dependent on future newsflow), so there will inevitably be bias, which there always is when anyone talks about shares they hold personally.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul's Section:

Inspired (LON:INSE)

9.15p (Friday’s close) - mkt cap £89m

Inspired (AIM: INSE), a leading technology enabled service provider supporting businesses in their drive to net zero, controlling energy costs and managing their response to climate change, announces a trading update for the financial year ended 31 December 2022.

Strong full year trading performance, an improved cash position and confident outlook

An annoyingly vague self-description above, that doesn’t really explain what the company actually does.

Today’s update reads well - key points being -

Positive H2 momentum

Strong overall trading for FY 12/2022

Revenue of £88m is 10% ahead of market exps, and up 30% on 2021

Adj EBITDA of £21m is “in line with market expectations” (I’m wondering why it’s not ahead, given that revenues are 10% ahead?)

Net debt reduced, as expected, to £37m (very different from the misleading headline which says “improved cash position”!)

Strong demand for energy services, due to energy crisis, so it looks as if INSE is likely to be in a sweet spot, for now.

It says cashflow is strong, but the interim results reveal that it capitalises a lot of costs into intangibles, so I’d want to make my own assessment of real cashflows.

ESG activities “gain traction” with revenues up 175% on LY.

Outlook - says it’s confident for 2023.

"With a sales pipeline that is at record levels, and a notable acceleration in Optimisation and strong growth in our ESG practice we are increasingly demonstrating that we are the market leading solution at a market leading price point, and therefore we are confident of future success."

My opinion - this update sounds positive, but is only in line with market expectations, so shouldn’t really be price-sensitive.

The StockReport shows attractive PER (6.5x) and divi yield (4.2%) stats, so I’ve done a bit more digging into the accounts - which did not go well. The balance sheet is threadbare, with negative NTAV, worryingly high receivables, and too much debt for my taste. Cashflow isn’t great, once capitalised intangibles are taken into account. Note also £10m of contingent consideration is within current liabilities, so that’s either a lot of cash to pay out, or dilution from share issuance.

We’ve seen problems with listed energy consultants in the past, therefore I would be wary of getting involved with anything in this sector, so it’s not for me.

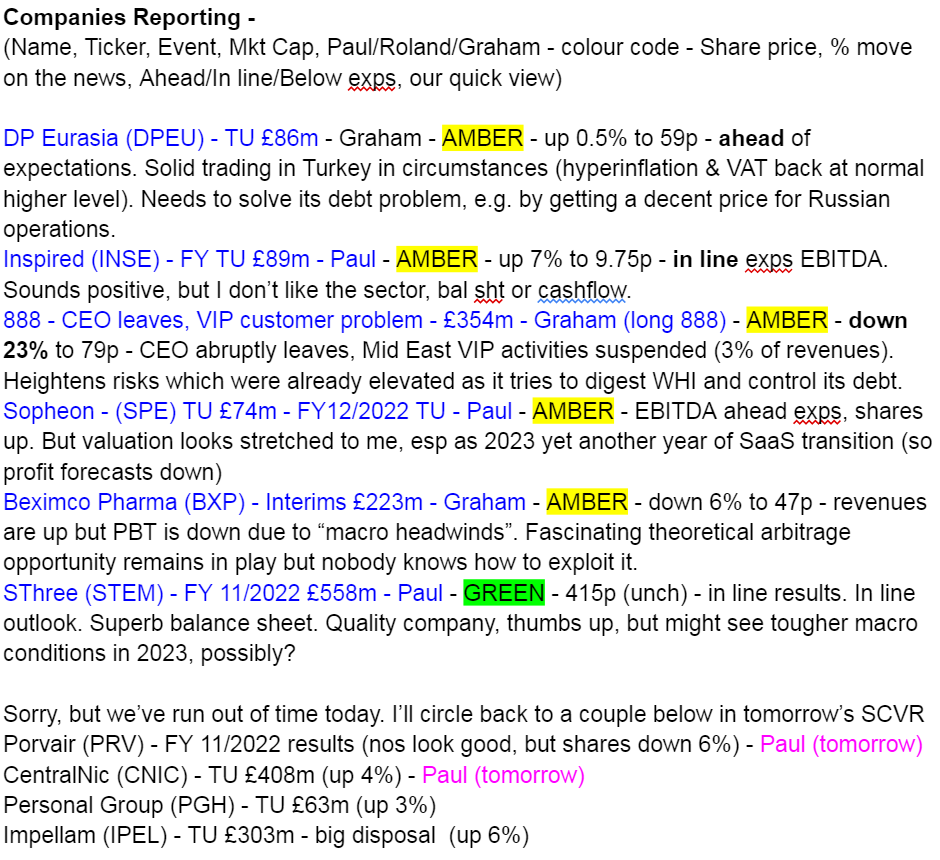

Note that it's coming up on a shorting screen, but I wouldn't take this as gospel, more something to check out, as a potential warning -

Sopheon (LON:SPE)

692p (up 11% at 10:02) - mkt cap £74m

Sopheon, the international provider of software and services for Innovation Management, is pleased to provide the following trading update for the year ended 31 December 2022.

FY 12/2022 revenues - in line with market expectations, at $36.5m (up 6% on LY)

Would have been “comfortably exceed” revenues at constant currency.

ARR (annualised recurring revenues) up 18% to $24.3m at end 2022

Revenue visibility for 2023 is strong, at $28m

Adj EBITDA c.$7m (up from $6m in 2021) - “comfortably exceeding market expectations”, and note this is after a $1.6m writedown.

“Careful cost management” is flagged as one reason for higher than expected EBITDA.

Net cash healthy at $21m, down $3m vs LY, reasons given sound sensible, so no cause for alarm -

A large part of this reduction reflects a fall in the Dollar value of Euro and Sterling cash deposits due to currency movements, the extended payment terms for the US Navy contract announced in July, as well as the impact of acquisition payments.

Operational update section sounds interesting, with 2 acquisitions having expanded its addressable market by $2bn! Although I usually disregard addressable market stats as pie in the sky.

Transition to SaaS (recurring fees instead of one-off licences) is being accelerated, which it points out will -

“slow revenue and profit development in 2023, but should accelerate ARR growth - delivering traction and more predictable growth in subsequent years, with a higher quality of revenue.”

Investors should be familiar with this argument, but it does mean putting up with years of lacklustre growth, as the SaaS transition grinds on. The trade-off is that the likelihood of volatile earnings, and profit warnings, should gradually recede.

Broker updates - as we know, adj EBITDA isn’t real profit, especially at software companies which capitalise development spend, which SPE does.

Finncap kindly lets us see its spreadsheet, which converts $6.8m of adj EBITDA into just $2.6m of adj PBT. Good job I checked! This is 20.2c EPS which converts into 16.3p EPS, so a PER of 42x - so you’re being asked to pay a lot up-front for earnings growth that hasn’t happened yet.

Forecast for FY 12/2023 is a reduction in adj PBT to £1.1m, US cents 7.0 EPS = 5.6 pence = PER of 124x (not a typo!)

This doesn’t look at all appealing to me. So investors must be imagining that these numbers can be thrashed. Finncap caters for them too, with a more aggressive FY 12/2024 forecast of £3.0m adj PBT, and 24.4c, or 20p EPS = PER 35x

My opinion - it’s too expensive, for where the company has currently got to.

I completely get the argument that current profits are suppressed by moving customers, new and old, onto SaaS, which foregoes up-front licence fees in return for spreading the revenue over a longer time period. However, the trouble with that, is it leaves a business that hardly makes any money in 2023, and you have to hope that it can keep winning more business than it loses, to become profitable in 2024 and beyond.

I’m struggling with the concept, and the valuation.

Patient investors might do well in the long run though, but looking at the numbers dispassionately, this looks like a business running hard to stand still. So you can view it either way really. Therefore I’ll just say I’m neutral, so amber on this one for now, whilst recognising there is a fairly good bull case that’s not coming through in the numbers yet.

People chased the valuation too high in the last two bull runs (2019 and 2021), so I’d be reluctant to follow that route again now. Pity the bid/offer spread is so ludicrously wide too. That lack of market liquidity begs the question, how do institutions exit if they decide to sell?

SThree (LON:STEM)

414p (unchanged) - mkt cap £558m

Final Results - FY 11/2022

SThree plc (‘SThree’ or the ‘Group’), the only global specialist talent partner focused on roles in Science, Technology, Engineering and Mathematics (STEM), today announces its financial results for the year ended 30 November 2022.

Record profit performance up 24% driven by continued demand for flexible STEM talent and well-established strategy

No adjustments to the 2022 results, hence the missing column.

Excellent results, as expected, with £1.64bn revenues, and £77.0m PBT (up 28%)

EPS 41.0p - giving a PER of 10.1x

Total divis 16.0p - yield of 3.9%

Net cash £65.4m

Balance sheet - lovely, as usual! £200m NTAV (which gets a £7.1m boost from forex), and loads of working capital: current assets £430m (including £66m cash), current liabilities £244m, giving £186m surplus, and a current ratio of 1.76x

There’s no long-term debt either, with only £26m non-current liabilities, mainly lease liabilities.

So this is a bulletproof, sleep soundly at night in any market conditions type of balance sheet!

Cashflow statement - working capital again absorbed cash.

Also note the cashflow used by the employee benefit trust is hefty, at £9.9m, which is about two-thirds of the amount paid to shareholders in divis of £14.65m. I think this £9.9m cost goes through reserves, rather than through the P&L as a cost (see note 11). So that would need double-checking, as it could mean profits are effectively being over-stated, if this indirect employee remuneration is not being recorded as a cost? I’ve lodged a query with the company, so will report back on any further info gleaned on this point.

Outlook - this quote below sounds consistent with what STEM said last time (some softening in Q4, but overall pretty upbeat about the medium to long term) -

As we enter the new financial year, trading continues to track in line with expectations, supported by a healthy contract orderbook. The macro landscape remains consistent with the softer conditions seen toward the end of the year. However, our global reach combined with a specialist niche focus in structural STEM disciplines is underpinned by a proven resilient business model and a robust balance sheet. This provides us with a strong position from which to pursue our unique opportunity over the medium to long term."

Note below that the 2023 forecasts have slightly crossed under the 2020 forecast/actual. I’d prefer 2023 forecasts to keep going downwards, to build in more of a safety margin, in case macro conditions bite harder as 2023 progresses.

My opinion - similar conclusion to last time - namely that I think this is an excellent company, reasonably priced. It should do well long-term, I reckon. Thumbs up.

However, I’m a little worried that macro conditions could cause a tougher year in 2023 for earnings. For that reason, it looks possibly priced about right in the short term.

It’s on my watchlist, as something to buy for the long-term, if it plunges on a profit warning later in 2023. That may not happen of course, it could continue trading in line with expectations, and has good visibility, since it's mainly contractors working on projects, not one-off recruitment fees.

Stockopedia loves it, see the StockRank jammed near maximum.

There's probably nice upside on this share, when the economy improves.

Investor briefing - STEM is doing a webinar at 13:00 today, and says it will be recorded & published afterwards. The topic is the company’s “technological improvement programme”.

Graham’s Section:

DP Eurasia NV (LON:DPEU)

Share price: 58.7p (pre-market)

Market cap: £85m

It’s strange to see this one reporting its Russian operations as “discontinued” - for years, Russia was seen as its most exciting growth opportunity, But the political (and military) situation has now made that untenable.

Another recent development here has been the use of the accounting standard known as“IAS 29” - Financial Reporting in Hyperinflationary Economies. Inflation in Turkey is currently running at 64% and as you can imagine, this makes financial reporting somewhat complicated.

That is the context in which we get today’s full-year trading update for 2022, that is ahead of expectations. Here are the highlights I’ve picked out:

Number of stores 859 (up from 817 in 2021).

Group system sales from continuing operations +1.5%, after accounting for hyperinflation (note that 95% of these sales are in Turkey).

On a like-for-like basis, group system sales from continuing operations are down 5.6%, again after accounting for hyperinflation.

It’s the like-for-like comparison that really matters to me, as it is not distorted by the contribution of new stores.

The company says that their performance in Turkey was “good” when you consider that 2021 included a temporary VAT reduction of 7 percentage points.

Russia - even though Russia is described as a “discontinued operation”, and “work on a potential transaction is ongoing”, we still don’t know when DPEU will get these 159 stores off their books.

Liquidity - the company has cash of TRY 368 million (£16m) and an undrawn bank facility of TRY 225 million (£10m).

This implies good headroom but the company is likely to still have a significant net debt position (at the interim results, net debt was £47m). Perhaps the sale of the Russian operations can help it to deleverage?

CEO comment:

"Trading momentum sustained into the final months of the year, as we continued to implement our targeted action plan in reaction to and in order to overcome macro factors largely outside of our control. As a result, we anticipate adjusted EBITDA(8) for 2022 will come ahead of current market expectations…

Given our strong pipeline and sustained franchisee interest, we remain confident that 2023 will be another solid year for network expansion.

Estimates

Liberum has increased its 2022 adj. EBITDA forecast by 8% to TRY 353 million (£15m), but has not yet provided estimates based on IAS 29 (i.e. after accounting for hyperinflation).

My view

Financial success at this company always feels like it is just around the corner.

As it does have a large and mature presence in Turkey, I can’t help the feeling that it should be able to turn a profit here at some point. The current strategy of selling mini-pizzas for $1 doesn’t encourage me too much, but I do think that in the absence of hyperinflation and with a healthy Turkish economy, DPEU could eventually do well.

In the short-term, I should remind readers that DPEU has needed covenant waivers from its Russian bank. A deal could be announced tomorrow that would sell the Russian operations and solve the debt problem, but I don’t think that betting on these events is a sensible investment strategy. So I would avoid these shares for now.

888 Holdings (LON:888)

Share price: 79p (-23%)

Market cap: £354m

Disclosure: I (Graham) have a long position in 888.

This is a share I’ve held through thick and thin. It reached a high of almost 500p in 2021, and is now well and truly in the doldrums:

It issued a trading update earlier this month which left me feeling optimistic. Its main challenge currently is to find the minimum of £100m of promised synergies from its merger with William Hill International (the non-US parts of William Hill), so that it might start to attack the £1.8 billion of gross debt that it’s carrying.

Only this weekend, I was looking at some comparisons with Entain (LON:ENT) and Flutter Entertainment (LON:FLTR) and observed some enormous disparities. Even before today’s share price fall, the market was not giving 888 a “normal” rating for its sector - probably because of worries over its excessive debt load.

(When I bought into this, it had a very strong financial position - but it used that to take over William Hill, an aggressive move which may ultimately prove to be its downfall. It’s too easy to say in hindsight, but I should have simply sold when the WHI deal was announced)

Today brings no fewer than three RNS announcements from 888. None of them are particularly long, so this shouldn’t take long.

1. Directorate Change

888 (LSE: 888) announces that Itai Pazner, Chief Executive Officer and Executive Director, is immediately leaving office as CEO and as a Director.

This isn’t what we like to see, as shareholders - an immediate departure without any proper succession planning. The Chairman (Lord Mendelsohn) thanks him for his long service to the company. But we were counting on Mr.Pazner to integrate WHI and take us to the promised land of synergies and deleveraging. What’s going on?

RNS number two may possibly contain a clue…?

2. Suspension of 888 VIP customers in some markets

Following an internal compliance review, it has come to light that certain best practices have not been followed in regard to KYC (Know Your Client) and AML (Anti-Money Laundering) processes for 888 VIP customers in the Middle East region. While further internal investigations are underway, the Board has taken the decision to suspend VIP customer accounts in the region, effective immediately. The Board currently estimates that the impact is less than 3% of Group revenues, should the suspensions remain in place.

Oh dear. The regulatory environment is already a major issue when it comes to profitability in this sector. If certain Middle East VIP customers are found to be unsavoury types, using 888 for unsavoury purposes, it’s not going to make things any better. Plus there is the loss of 3% of (high margin) revenues.

Lord Mendelsohn says:

We will be uncompromising in our approach to compliance as we build a strong and sustainable business.

One area of concern at 888 has been the imminent departure of its CFO. To lose its CEO as well would be too much - thankfully, we also get RNS number three:

3. Directorate Change - Update

888 (LSE: 888) announces that further to the announcement on 13 January 2023, the Board and Yariv Dafna, Chief Financial Officer and Executive Director, have agreed that he will remain in his posts until the end of 2023, rather than stepping down on 31 March 2023.

Small mercies!

My view

The share price is down by over 20% today, from what I already believed was a cheap level, though I acknowledge that there are serious risks at play here.

The primary risk, in my mind, has been the debt load. Annual interest costs are running at c. £130m. About 60% of the debt has been fixed for three years, but there is an element of floating debt and after three years, certain hedges will expire leaving the company exposed to whatever rates prevail at that time. Clearly, debt reduction must be a priority.

But today’s news heightens another two risks. Firstly, management disruption - the loss of the longstanding CEO, and a CFO who is waiting to leave, create a risk that belief in the WHI integration and synergy plan might falter.

On top of that, we have regulatory risk - might 888 be on the hook for penalties and tighter restrictions on how they do business, as a result of how they dealt with Middle Eastern VIPs?

Therefore, even if the temporary loss of these VIPs reduces revenue by only 3%, I can understand the loss of investor confidence expressed in today’s share price fall.

Therefore, I can’t take a bullish stance on these shares. I still believe they are “cheap”, but the risks are significant and probably beyond what most investors would be willing to tolerate (for good reasons).

888 was worth 4% of my portfolio. After today’s news, it is only worth 3%. That’s the price of my stubbornness - but at least my position sizing was reasonable!

Beximco Pharmaceuticals (LON:BXP)

Share price: 47p (-6%)

Market cap: £223m

We don’t regularly cover this one but I thought I’d take a quick look.

This company is based in Bangladesh and reports in Bangladeshi currency. Normally that would make it uninvestable for a lot of UK-based investors. However, this one has been listed on the LSE since 2005 and has paid dividends every year since 2015, which to me suggests that it is more trustworthy than the typical foreign company listed in the UK.

It’s a manufacturer of generic drugs and pharmaceutical ingredients, and today reports its H1 results (for the period to December):

Net sales +16% to £164m equivalent.

PBT down 15% £22m equivalent.

MD comment:

“While we have continued to see macroeconomic headwinds impact our bottom line, another period of double-digit revenue growth is testament to the underlying progress of the business. We have launched seven new products in Bangladesh and received a further 12 new registrations internationally. We remain focused on our commitment to delivering high-quality, affordable medicines…”

My view

The most interesting aspect of this stock for me is the long-running theoretical arbitrage opportunity between the London-listed shares (technically they are “depositary receipts”, not shares) and the Dhaka-listed (Bangladeshi) shares.

The shares in Dhaka trade at 148.20 BDT, equivalent to £1.13, an enormous premium to the price in London.

However, over many years, nobody has figured out how to make the arbitrage work, as the London shares and the Dhaka shares aren’t fungible or convertible to each other.

Short-selling the Dhaka shares while also simultaneously buying the London shares makes sense rationally, but there are logistical difficulties and besides, how long might it take for the prices to converge? People have been talking about this topic for nearly a decade!

I am curious to see if the pricing of these depositary receipts in London ever makes sense. Relative to the Dhaka price, the London shares are certainly a bargain:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.