Good morning! It's Paul & Jack here with you - we really are going back to the 1970s - an energy crisis, rampant inflation, a jubilee, and now a 3-day week! ;-)

Agenda -

Paul's section:

De La Rue (LON:DLAR) (I hold) - interesting results from last week, which I looked at over the weekend. Performance for FY 3/2022 was in line with (lowered) expectations. Wobbly outlook comments though, so guidance lowered for FY 3/2023 to flat vs last year. Could be another mild profit warning on the cards too, maybe? My view, is the bad news & uncertainty are all in the price, which looks really good value for longer term investors. who can cope with share price volatility.

Countryside Partnerships (LON:CSP) - I take a look at a takeover bid approach from a US hedge fund, at a 31% premium. The potential bidder has announced directly to the market, because CSP management apparently refused to engage, and did not inform the market that it had received an approach. That is clearly wrong, and the takeover rules need to be changed. I wonder if takeover approaches are a sign that UK shares may now be too low in some sectors?

Oxford Metrics (LON:OMG) - many thanks to readers for flagging up a cracking disposal price achieved by OMG for its smaller division. Once that deal completes, then more than half OMG's price will be net cash. Plus a decently profitable, growing remaining Vicon business. This share looks very interesting.

Comptoir (LON:COM) - see reader comments section below, where I gave a quick view on COM..

Jack's section:

Speedy Hire (LON:SDY) - share price has nearly halved from the post-Covid highs, which seems a little harsh given the fairly buoyant trading conditions. Activity continues to pick up. Clearly there are macro concerns weighing heavily on cyclical stocks and these must still be considered, but if economic activity is not heavily disrupted in the years ahead then there is scope for the shares to recover.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section

De La Rue (LON:DLAR) (I hold)

96.3p

Market cap £188m

Background - FY 3/2022 results - this is a backlog item from last week, which I didn’t get round to looking at, because the results were quite complicated and needed a few hours to work through, which I did yesterday evening.

The background with DLAR is that it was a serial disappointer, performing badly in the years up to the start of the pandemic. A big pension deficit, and too much debt, saw it come close to going bust in the early part of the pandemic. An equity refinancing was done, restoring DLAR’s finances, but almost doubling the share count from c.114m to 195.2m now.

On a more positive note, a turnaround plan under CEO Clive Vacher (since Oct 2019) has been stripping out a lot of cost, and problem divisions have been disposed of. Other legacy issues (e.g. an SFO investigation) also seem to have been dealt with.

Looking at this year’s announcements, here are the key ones -

24 Jan 2022 - Profit warning. Operating profit guidance lowered from £45-47m, to £36-40m - so a mild profit warning only. Reasons given: Covid (employee absences) & disruption, supply chain problems (e.g. chips & other raw materials), cost inflation.

3 Mar 2022 - positive update on pension deficit. Agreed schedule of cash deficit recovery payments reduced by £57m saving by March 2029.

7 Apr 2022 - Trading update - adj operating profit in line with market expectations. Net debt slightly lower than £75m expectation.

25 May 2022 (see below) - at lower end of guidance, and FY 3/2023 guidance lowered.

So a bit disappointing, but hardly a disaster. To my mind the longer term fundamentals don’t justify this very weak share price movement -

.

Full Year Results (FY 3/2022)

Here are my notes on the key points -

Adj operating profit £36.4m (bottom end of Jan 2022 guidance of £36-40m)

Continuing operations (excluding a disposal) saw profit up 30% on LY

2 remaining divisions, currency (profit up 20% on LY), and Authentication (profit up 44% on LY) - so actually a pretty good performance, albeit expectations were set too high initially.

Net debt comfortably within bank covenants, and market expectations.

Adj basic EPS (continuing ops): 13.0p (vs 14.7p LY) - down due to larger number of shares in issue. PER only 7.2

Outlook - this is the disappointing bit, it’s another mild profit warning -

- More headwinds

- Substantial degree of uncertainty

- Additional net £5m of supply chain costs

- Disruption may impact revenues

- Guidance: FY 3/2023 likely to be “broadly flat”vs FY 3/2022, and H2 weighted.

- Markets remain strong, and improved market position.

- Risk from manufacturing in Sri Lanka (currently unstable economic/political)

Dividends - none at the moment, forecast to resume this year (FY 3/2023)

Broker forecasts heavily reduced - good, as I want the bad news in the price, not relying on overly optimistic broker forecasts, still the case with many other shares -

.

Risks, but also significant opportunities for FY 3/2023

DLAR is sole printer of banknotes for Bank of England, therefore I wonder if this limits the prospect of a takeover bid? Presumably BoE could block bidders?

Heavy capex of £26.9m in FY 3/2022 - programme of expanding & modernising its factories is more than half done. This reinforces the potential for future debt reduction & divis.

Bank facilities of £275m look excessively large. Mature in Dec 2023. Only c.£75m net debt.

Key bank covenant is net debt:EBITDA. Actual is 1.46x, limit is 3.0x - looks fine to me.

Going concern note - useful info. Stress test - downside model still “just” meets covenants.

Note minority interests make up almost 10% of profit, but this is taken into account in EPS.

Balance sheet has benefitted from improvement in pension scheme, but the £31.6m pension asset shown on balance sheet seems nonsensical, because it still needs £15m p.a. In deficit recovery cash injections, so a liability should be showing, not an asset! Pension scheme accounting is just so bad, the rules are madness, and don't reflect commercial reality at all!

Balance sheet - NAV £161.8m. Take off £37.5m intangibles, also remove the spurious £31.6m pension asset, gets to NTAV of £92.7m, which I think is OK.

Receivables of £89m seem high - why?

Note that gross L/T debt is £92.6m, so DLAR does rely on bank funding, which would be a downside risk if trading deteriorated badly.

Cashflow statement - £35.5m positive operating cashflow (similar to LY) is good.

Although adverse working capital movements £17.2m FY 3/2022, and £39.8m FY 3/2021 - seems to be mainly due to payables reducing sharply. Possibly normalising working capital, after previously being financially stressed before fundraise, I’m guessing? Certainly a query over cashflow, could do with more explanation from mgt.

Capex is quite high, at £19.6m (similar LY), because factories are being modernised.

Note also £8.8m of intangibles capitalised.

My opinion - I think a lot of progress has been made at turning around DLAR, and it’s now a simplified, and decently profitable business.

That’s not yet showing through in cashflow, but once the modernising & expansion programme has been completed, then it should be able to pay divis in future, and should have increased capacity, and be more efficient. So clear potential upside there.

Cost headwinds aren’t helping the short term, but that’s why the shares have more than halved in the last year, which I think looks an over-reaction to the downside. The market seems so short-term focused, but we're buying all future earnings, not just this year's! That's where the buying opportunities are - buying shares now at prices that are beaten down due to short-term headwinds, but which should perform better in future.

DLAR is joining my increasing list of shares where I think the current price represents a medium term opportunity to double or triple our money, if things pan out reasonably well. We can’t predict the future with any certainty, which is why it makes sense to diversify portfolios.

I’ve no idea where DLAR shares are likely to bottom out in the short term, and it wouldn’t surprise me if there’s another mild profit warning later this year, which is almost hinted at in the outlook commentary, and the H2 commentary, plus well-known macro factors.

I’m happy holding DLAR, as I think risk:reward looks good. If we get positive news on contract wins, then that could propel this share much higher. If it struggles to win contracts, and costs/disruption worsen, then it could slip lower. Long term though, the valuation looks attractive to me, for investors who can live with short term uncertainty.

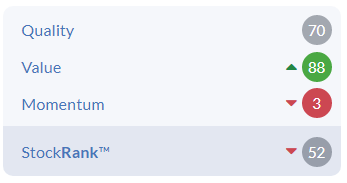

The StockRank is interesting, with high quality and value, but pulled down into the middle ground by a terrible momentum score -

.

Takeover Bids

This is a key area of interest. We’ve had a lot of takeover deals in the UK market, so I’ve been wondering if more bearish stock market conditions this year might stimulate increased bid activity (grab them when they’re cheap), or whether potential buyers would run for cover due to macro worries?

There’s a very interesting announcement today from Inclusive Capital Partners LP (ICP), based in California. This says that ICP has approached UK-listed Countryside Partnerships (LON:CSP) (£1.2bn market cap) twice, with a view to negotiating a takeover offer. ICP says it already owns 9.2% of CSP.

ICP says that CSP refused to engage in discussions, or provide access to due diligence information. Hence CIP issuing its own stock market announcement today about a potential deal, going direct to shareholders in CSP.

ICP pointedly says this, and I strongly agree - shareholders must be informed if a bid approach is received from a credible party -

The In-Cap team believes that Countryside shareholders deserve the opportunity to decide on the merits of any offer, and that if an approach is made in good faith, the Countryside Board should act in the interests of its shareholders by engaging with the potential offeror and not deny its shareholders this opportunity.

The current takeover rules seem ridiculous, in that companies are not required to inform their owners (shareholders) if a bid approach is made. Lord Lee tried to do something about this, but the Takeover Panel just swatted away the concerns which many investors expressed to them. For some bizarre reason, they seem to think confidentiality matters more than the owners of the company being informed that there's been a takeover approach! They seem completely out of touch. Companies only have to announce an approach if it's leaked to the media. That's just ludicrous.

I think this also creates a false market in the shares - given that key price sensitive information (a bidder sniffing around) has not been disclosed to shareholders or the market as a whole. Imagine how you would feel if you had just sold your shares, only to find out shortly afterwards that the company had already received a bid approach at a 31% premium to your selling price. That is a false market, and it needs to be addressed.

ICP even gives an indicative price for its possible bid - 295p in cash - a 31% premium to Friday’s closing price - not bad. Or some kind of paper alternative, called “Rollover Securities”.

I’ve been trying to find how much money ICP has, this website suggests it has $1.3bn funds under management, which is not enough to buy CSP with cash. Maybe ICP has lined up some new funding, but I can’t see any reference to how the deal is to be funded in its announcement (but only skim-read it, so might have missed it).

CSP doesn’t seem to have yet issued a response to ICP’s announcement, but I can imagine what it’s likely to say - opportunistic, undervalues the company, shareholders should take no action.

Anyway, this looks an interesting situation to follow, despite it being a bit too big for our reports here.

It reinforces my view that the UK stock market could now be too cheap in small to mid caps, in some sectors, having overshot on the downside. The problem with sitting on the sidelines, in cash, is that we could miss out on takeover bids.

Let’s see how many more takeover approaches happen. The more that crop up, then the higher my conviction would get that share prices are now too low, for investors with longer term perspectives.

We’ve looked briefly at CSP before here, when it warned on profits twice. Also Roland has written about it in his Stock In Focus series. Here’s the discussion page for CSP.

.

Oxford Metrics (LON:OMG)

99.6p (up 27% at 11:53)

Market cap £127m

Talking of deals, OMG has today announced a disposal for a remarkable price of £52m, for a small, and barely profitable (only just broken into profit) Yotta division.

Today’s 27% rise in share price has increased the market cap by £27m. Yet I reckon many investors probably would have attributed little value to Yotta, and almost certainly nowhere near its £52m sale price.

Thanks to the following subscribers who have all posted useful comments below re OMG - jesseowens, SundayTrader, MrContrarian, proffittpar, and BrilliantLeader.

I think you’re all correct, and OMG could still be good value, even after the 27% share price rise today. Presumably there might be some costs with this disposal, and I’m not sure if OMG will have to pay tax on the profit on disposal? So OMG might end up with say £40-50m in cash from the deal. It already had £23m in net cash in the last accounts at end FY 9/2021. I've checked the balance sheet, and that £23m net cash is proper, surplus cash.

Therefore the current net cash position could be c.£75m, with a possible tax bill (??), does anyone know re tax?

It all depends what they do next with that cash. Mgt talks about M&A, and increased R&D spending.

I like the sound of its 5-year plan to drive more rapid growth.

OMG pays divis already too.

The ongoing business, called Vicon, performed very well in FY 9/2022, producing £6.8m adj PBT (up from £4.8m LY).

A trading update for the AGM on 9 Feb 2022 sounds confident about the current year (in line, H2 weighting as in previous years), saying -

Vicon subsidiary continues to experience high demand, holding unprecedented levels of orders-in-hand, while we continue to manage the short term market-wide supply chain challenges.

My opinion - from a quick review, I think this share could have further upside.

The downside risk is obviously that management blow the cash pile on buying something bad, but they’ve got a good long-term track record, and haven’t let previous cash piles burn a hole in their pockets.

Overall, a thumbs up from me, and I’d be tempted to buy any dips from here.

.

.

Jack's section

Speedy Hire (LON:SDY)

Share price: 47.4p (+3.49%)

Shares in issue: 510,539,044

Market cap: £242m

Final results for the year to 31 March 2022

This is a tools and equipment hire services company. As a cyclical, the share price has come under pressure recently despite trading itself making a good recovery.

As a result, the share price now looks fairly cheap across several metrics.

Results:

- Revenue +16.3% to £381.7m,

- Adjusted operating profit +50.2% to £32.6m,

- Adjusted profit before tax +72% to £30.1m,

- Adjusted earnings per share +58.2% to 4.24p,

- Dividend +57.1% to 2.2p,

- Net debt has more than doubled from £33.2m to £67.5m.

Staying on valuation for a second, that 2.2p dividend equates to a 4.8% yield set to increase to 2.37p next year. Obviously people are concerned about the prospects going forward, with inflation and rising interest rates, so there is a reason for the current share price.

But, for now, the signs continue to look good with hire up 17.9% (H1: 31.8%; H2: 6.8%), increased market activity, and new contracts and renewals (including key customers Costain, the Home Office, MGroup and Redrow Homes). Asset utilisation has improved to 57.0% of an enlarged hire fleet.

Speedy Hire is also investing in a Retail business in partnership with B&Q, now in 36 stores and on diy.com. An interesting initiative that could help drive organic growth.

Current trading

We see momentum accelerating in 2023 as hire rates improve further, ESG and service drive more share gains and the B&Q initiative gathers momentum.

Underlying revenue is up c8% so far in FY2023, with volume growth and pricing initiatives more than offsetting inflationary cost pressures. Key end markets are expected to deliver growth through higher demand and volume, ‘particularly from major infrastructure and energy projects including HS2 and nuclear’.

Balance sheet

The F-Score of 8/9 gives some reassurance that things are heading in the right direction. Cash and facility headroom is down from £142.3m to £110.8m following a ‘significant’ investment in hire fleet of £68.4m to satisfy customer demand. The growth in fleet size makes the higher utilisation rates even more encouraging.

Speedy Hire also started a share buyback programme of up to £30m in January.

Conclusion

Whether or not the shares are now good value depends in part on how well economies can handle a probable regime change in inflation and interest rates. Speedy Hire has significantly underperformed the rest of the market in recent times despite fairly robust trading. I think the shares look cheap enough to warrant a closer look at the stock.

But there’s no doubt the momentum and sentiment is poor, much poorer than the picture management itself is painting. It’s hard to identify the bottom in these cases but if you’re less concerned by the technicals of the share price chart, then there is the makings of a contrarian investment case here.

The market outlook sounds positive having made it through Covid lockdowns with minimal equity dilution, so the group remains well placed to capitalise on a pick up in activity, which seems to be the case now. Worth spending a bit more time on at these levels, in my view.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.