NB. This report below is a catch-up report for Mon 4 Apr 2016 (a week ago).

For the latest report (Mon 11 Apr 2016) please click here.

Good day!

This is a catch-up report, which I'm writing on Sun 10 Apr 2016. We don't want gaps in the sequence of reports, and a number of readers have asked me specifically to look at Sepura (LON:SEPU) which warned on profits on 4 Apr, so here goes.

Sepura (LON:SEPU)

Share price: 120p (down 39% on the week)

No. shares: 184.4m

Market cap: £221.3m

I last reported on this Cambridge-based maker of special radios for emergency services & others, here on 22 Oct 2015. Without wishing to sound too self-congratulatory, I foresaw the main risks with this share in that report - namely lumpy order intake, and excessive debt, which have given rise to a profit warning on 4 Apr 2016, just after the financial year ended 1 Apr 2016.

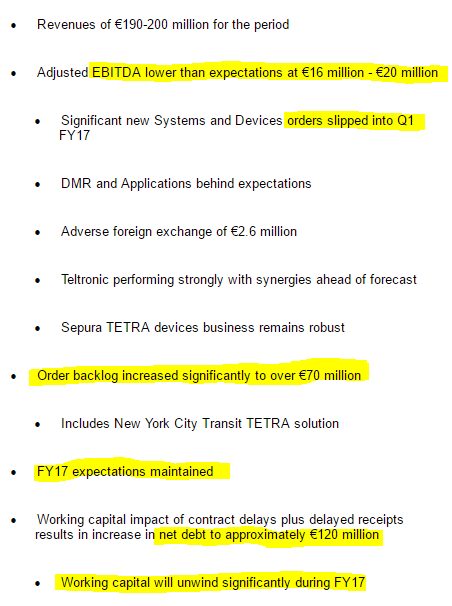

Profit warning - the presentation of this statement is very good, with a summary in bullet points, then more detail below. Here are the bullet points (with my wonky highlighting for the key points);

So the main issue is apparently that two orders did not close by the year end date, but are expected to close "early in FY 2017" (FY = financial year ending in 2017, i.e. y/e 1 Apr 2017).In that case, surely the forecasts for FY2017 would be increasing, not remaining static? So that doesn't particularly stack up, to my mind.

When I see order delays, but no increase to subsequent year forecasts, it usually means that the order delays are symptomatic of deeper inadequate demand. Also, order delays are very often order cancellations - but the customer hasn't yet told the supplier that is the case. So there's a heightened risk that there could be a second profit warning from Sepura in FY2017, in my view.

The company has a fundamental problem, and this has been the case for years, that its orders are lumpy & difficult to predict. Delays are frequent, as quite a lot are public sector, where bureaucracy & budget constraints can cause long delays or cancellations. For this reason, I feel Sepura shares should be on quite a low PER, to reflect considerable uncertainty over profits.

Forecasts - one broker has cut the FY2016 EPS forecast by a colossal 58%, from E13.0c to E5.4c (i.e. 5.4 Euro cents). That's pretty horrendous. Although the same broker is maintaining its FY2017 forecast at the EBITDA level, but reducing EPS by 12% (from E15.9c to E14.0c) to take into account higher forecast bank interest charges.

Valuation - the PER should be low, because Supura has a lot of bank debt, which is now problematic bank debt, see below.

If we assume that the company will achieve the E14c forecast for FY2017, then the figures work out like this: converting E14c in sterling at E1 = £0.81, gives 11.3p. At a share price currently of 120p, the PER for the new year just started, is 10.6 - seems reasonable.

Net debt - whilst the PER might seem reasonable at first sight, bear in mind that net debt of E120m is £97.2m, which is 52.7p per share, which is now looking much too high.

Therefore there are 3 issues - firstly that the valuation needs to be adjusted for a likely equity fundraising - which means that the PER really should be very low at this point in time.

Secondly, there is greatly heightened risk, especially now that the company has breached its banking covenants (probably the net debt to EBITDA one). The banks (I think there are 2) are being co-operative at the moment, having waived the year-end covenant breach. However, banks usually do this not through the goodness of their hearts, but in order to give a listed company more time to put together an equity fundraising which will get the bank's risk back down to levels they are comfortable with. A fundraising to get the bank off the hook is a bad fundraising. Whereas raising money to finance a decent acquisition, is a good fundraising.

Therefore I think we have to work on the assumption that a discounted Placing, which may or may not have an Open Offer attached, is now a very high likelihood. It's often the case that private investors are mostly, or completely frozen out of such fundraisings, whereas the Institutions are allocated the cheap shares, and collectively get to decide what price it's done at.

Therefore, in this type of situation, private investors are at an enormous disadvantage - we don't know what's happening in terms of a fundraising, yet the shares remain trading - so creating a false market really. Also we possibly won't be given access to any cheap shares that are dished out, to get the bank off the hook. So why on earth would we want to buy shares in the open market now, with so much uncertainty?

This situation is a perfect example of why I avoid highly indebted companies - if something goes wrong, the consequences can be catastrophic. The best type of shares to invest in, the way I see it, are well-financed companies which can brush off a profit warning without needing to worry about bank covenants, and potential insolvency.

High levels of debt are not a good thing, at companies with unpredictable sales & profits, like this one. We've seen recently at Ubisense (LON:UBI) and Stanley Gibbons (LON:SGI) what happens when a company with bank debt runs into trading difficulties - the rescue fundraising comes at a cost - namely diluting away existing shareholders by issuing lots of new shares at a very low price. Debt can be highly destructive to shareholder value in this way.

Mind you, with Sepura, the company does say that working capital will unwind in H1 of FY2017 - as inventories which have built up for the 2 delayed orders, are (hopefully) sold, and debtors turn into cash. So if the bank sees this sequence of events indeed happening, then they might be more relaxed about things, possibly?

Bear in mind also, that even when banks are co-operative, this comes at a cost - so they will probably jack up the interest rate charged, plus probably a hefty fee for waiving the covenants. Banks are not charities, and they will demand their pound of flesh for continued support - which brokers seem to be anticipating, with hefty increases in the finance cost line of their forecasts.

Dividends - brokers seem to be assuming that divis will continue to be paid. I don't. In this type of situation, the divis should definitely be suspended for the time being, until the company's finances are straightened out. To continue paying divis whilst in breach of bank covenants, would be downright reckless. Cash needs to be retained within the business, until its balance sheet is sorted out.

My opinion - this is fundamentally quite a good company in my view, and it remains profitable. However, there is considerable uncertainty right now over its capital structure, which is too weak.

Therefore, I feel more bad news is likely - probably a discounted fundraising, and a dividend cut. If you're an Institution, it's easy - you can email the house broker & tell them to give you a call if a Placing is happening. Then you just wait for the call, to buy some cheap new shares.

For private investors though, there will be no such call. We'll just see the share price continue to fall, as a bit of insider trading goes on, from people intending to flip their placing shares, or other people opening speculative shorts with a view to closing them using cheap shares in a future placing. Then the RNS comes out, giving details of a done deal to raise more equity at a lower price.

For this reason, I cannot see any sense in private investors buying any share where there is a clear, and pressing need to raise more equity, as in this case. It's just throwing money down the drain. Far better to wait until the financing deal is done, then pick up some shares cheaper, knowing that the finances are sorted out.

Of course it may not pan out like that. Sometimes companies do respect pre-emption rights, and do a Rights Issue - but the trouble is, these are slow, and very expensive to do. So I can see the attractions of a quick, and relatively cheap (in terms of fees) Placing instead.

I'll look at Sepura again, once it has sorted out its weak financial position, but for me at the moment, it's not one I would consider. Why take the risk?

Christie (LON:CTG)

Share price: 119p

No. shares: 26.5m

Market cap: £31.5m

Results y/e 31 Dec 2015 - the Chairman provides a nice clear summary of the company's results;

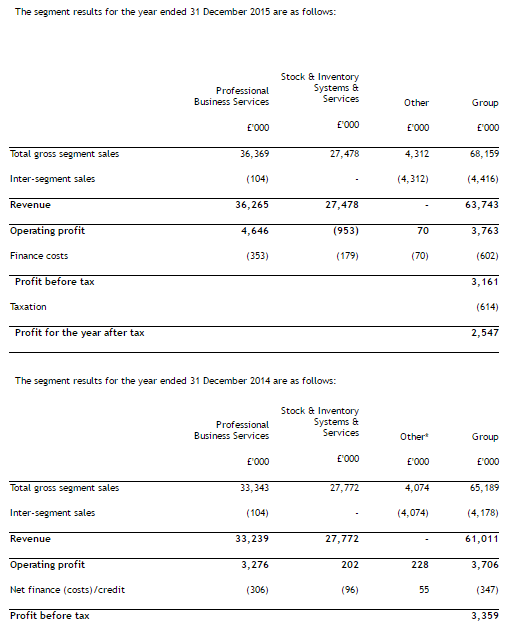

I am pleased to report an increased revenue of £63.7m (2014: £61.0m) and a marginally increased operating profit of £3.8m (2014: £3.7m). A strong performance in our Professional Business Services division offset a very difficult year in retail stocktaking which I referred to at the time of the release of our interim results. Earnings per share increased by 4.2% to 9.73p per share (2014: 9.34p).

So unremarkable results overall. The PER is 12.2, which looks about right to me, but I'll dig a bit deeper to see if there's turnaround potential from the under-performing division.

Divisional analysis - it's always worth checking to see what the divisional analysis table says (if there is one). It's usually one of the first notes to the accounts, after the section containing the P&L, Bal Sheet & Cashflow statements.

In this case, it's quite revealing;

Note that the PBS division improved its profit considerably from £3.3m in 2014 to £4.6m in 2015. Going in the opposite direction, is the S&ISS division, which moved from a negligible profit of £202k in 2014, to a hefty loss of £953k in 2015. This raises the question, why don't they just sell it, or shut it down? No wonder retailers like using Christie to do their stocktaking, if they're doing it below cost!

Moreover, stocktakers are not paid well, and with labour costs making up about two thirds of revenues, then I would say Christie is probably likely to be facing upward cost pressures. So again, if there are headwinds on costs for a division that is already losing money, then why keep it operating?

Although the company sounds relaxed about staffing;

Staffing became a lot more stable in 2015 and we are finding it easier to recruit high calibre people. Today's digital natives are adept at accessing multiple sources of information to acquire salient details. These are precisely the kinds of skills Christie people use every day.

Further comments on the problems in the stocktaking division don't exactly fill me with confidence, although the loss-making contracts which won't be renewed does offer some hope perhaps:

Whilst using our renowned technology, this is a people intensive service. We rely heavily on people in the field to undertake our counts. There have been 3 percent increases in the minimum wage for two years in a row and 2015 also saw the start of auto-enrolment for pensions. These have led to higher staffing costs.

So I'm right to be concerned about wages costs in future, as the big cumulative increases in Living Wage between now and 2020 are going to make things worse.

Our retail customers were already under margin pressure. Some have been more willing to buy a wider range of services. The problems principally relate to a handful of low margin contracts which will not be renewed on current terms.

It's a pity that Christie did not quantify the extent of losses on the low margin contracts, how quickly those losses can be eradicated, and if there will be any associated costs.

Our focus now is on reorganising the business to reduce our central costs, and to find technological solutions that can improve operational efficiency. We are in the process of rebuilding a solid foundation to ensure that this evolves into a profitable business in 2017 and beyond.

To be blunt, it strikes me that the stock-taking business is not worth having. It's currently loss-making, facing increased cost pressures in years to come, and is likely therefore to only make modest profits, if they can get it back into profit at all. What's the point? The PBS division is growing & making a decent profit margin, so bundling it together with a loss-making stocktaking business just destroys shareholder value overall, in my view.

Balance sheet - not great. The stand-out item is the £12.0m pension deficit. Note that there is some bank debt, but it's largely offset by cash - which usually happens because companies window-dress for the year-end, collecting in as much cash as possible for the balance sheet date, which then unwinds afterwards.

So I tend to go with the gross debt figure, as being the typical position at most times in the year. The debt level is fine though overall, it's not a concern, in the context of a decent level of profitability.

Dividends - are OK, at a 2.4% yield. Worth having, but not a particular reason to buy this share.

My opinion - I can't get excited about this at all. The PBS division is trading well, but that looks to be cyclical - benefiting from corporate transactions by its clients. The stocktaking division just looks a rubbish business, and now it's significantly loss-making, needs to either be turned around, or disposed of. It's not adding any value to the group, although sometimes management like to retain a loss-making division if it means they can offer a complete range of services - although I sometimes suspect it's more that management don't want all the hassle of disposing of a previously core division.

Overall, there's nothing here to get me interested. What would change that, is if management set out a credible plan to dramatically improve performance in the stocktaking division. If that became decently profitable, then the shares would offer nice turnaround upside, potentially.

Also, as the pension deficit is a material problem, it's vital that potential shareholders properly understand the figures there, and the likely cash outgoings, and how they are accounted for. Remember that with interest rates likely to be very low for potentially many years to come now, then pension deficits are going to remain stubbornly long-standing problems, and probably won't melt away as interest rates normalise - because how can interest rates normalise? With so much debt all around, we seem to be in a new normal of ultra-cheap capital. Which will end in disaster eventually, but that could be decades away, who knows?

Belvoir Lettings (LON:BLV)

Share price: 109p (up 17.8% on the week)

No. shares: 30.5m

Market cap: £33.2m

Results y/e 31 Dec 2015 - this looks quite an interesting business - it operates through a franchising model, for lettings agencies.

Adj EPS rose from 5.6p in 2014, to 7.3p in 2015, so a good increase there.

At 109p the shares are on a PER multiple of 14.9.

Two acquisitions were made in 2015, totalling £6.4m in initial consideration, funded by placings.

Forecast EPS for 2016 is 8.2p, which would reduce the PER to 13.3

Dividends - the yield is wonderful, although only just covered by earnings. Interim and final divis were both 3.4p, giving 6.8p for the full year, a yield of 6.3%. Certainly a great reason to hold the shares, if it's maintained at that level. Although the trade-off could be more dilution from Placings, to fund further expansion?

My opinion - overall, I quite like it. Lettings is nice recurring business, although the risk is that franchisees might go bust, thus resulting in bad debts to Belvoir.

Government policy has shifted considerably in the last year against Buy-to-Let landlords, with a new 3% Stamp Duty surcharge, plus the deductibility of mortgage interest starting to be phased out. The Govt instead is subsidising people to buy their own homes, through the Help To Buy scheme. So I am worried that property may gradually shift from BTL landlords, back into owner-occupation. Although that is likely to be a very slow process, so probably not worth worrying about.

That said, a modern economy with less job security, arguably needs more of the workforce to rent, rather than buy, and hence be more flexible to move easily to where the jobs are. This is normal on the continent, where most people rent homes, particularly during the first half of their working lives.

So, even though Govt policy might have turned negative on BTL, there are still going to be millions of people privately renting, and plenty of private landlords. So I don't see Belvoir's franchisees struggling for business.

Therefore, good growth, and a reasonable valuation, plus an OK balance sheet, means that I am looking moderately positively towards this share. I've put it on my watchlist.

The outlook comments seem reasonably upbeat;

Early signs for 2016 are positive, with a strong pipeline of potential franchise owners and an increased pipeline of potential acquisitions. Franchisees are now beginning to reap the benefits of utilising property sales to not only increase their turnover but, more importantly, as a tool to fuel the underlying growth of their managed lettings portfolios, which in turn translates into MSF growth for the franchisor. With demand for rental properties increasing, a nationwide drive to increase housebuilding and a renewed interest in franchising, the key drivers behind our successful business model remain unchanged.

Also note that a reader here posted some interesting comments earlier this week about a similar company, MartinCo (LON:MCO) which also seems to be doing well at the moment. So that one might be worth a look too.

All done, and we're up to date now, ready for the new week.

Enjoy the rest of your weekend!

Regards, Paul.

(usual disclaimers apply)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.