McColl's Retail (LON:MCLS)

- Share price: 280p (-3%)

- No. of shares: 115 million

- Market cap: £323 million

Q4 and Full Year Trading Update

This is a chain of newspaper and convenience stores which has been listed since 2014.

I've tended to be a bit sceptical of it, because it screams "no economic moat" to me.

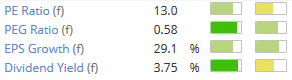

The PE multiple afforded to it by investors has generally been on the lower end of the scale, and that remains the case today. But to be honest, this PE ratio still looks possibly on the generous side to me:

This year, it has been integrating 298 stores acquired from the Co-op, which bring the total estate to over 1,600 now, most of these being convenience stores rather than newsagents.

Because of that acquisition, the headline growth numbers aren't too important here. What matters is like-for-like sales, which are up 0.1% for the full-year, i.e. effectively unchanged.

Q4 LFLs were down 0.4% due to category mix and unfavourable weather. Weather had been a positive factor earlier in the year, so maybe the full-year result is neutral weather-wise?

Either way, it adds up to an in line with expectations update for the full year.

And the plan for next year is to continue refreshing its convenience stores with the goal of selling more of the higher-margin categories (food rather than newspapers and cigarettes).

My opinion

I'm not sure why this has re-rated so strongly this year, but clearly investors approve of the Co-op acquisition, and it has been executed well so far.

That deal was mostly financed by debt, which stood at £111 million (net) at the interim results.

With the company being significantly more leveraged than it was before, I would have put it on lower valuation multiples than it enjoyed before, to take into account the increased risk.

This is a fiercely competitive sector. Indeed, McColl's announces today that one of its main suppliers has gone bust as of last week.

I don't know the specific circumstances of that company, but if a huge supplier has been squeezed to the point where it can no longer continue, it's a bad omen in terms of McColl's being able to defend its own thin margins for the long-term. Alternative arrangements will have to be made, with a supplier who gets paid enough to make an economic return.

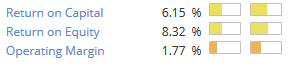

The quality statistics are roughly what you'd expect from a company with no moat:

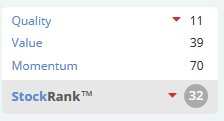

So I'm going to dissent from the high StockRank in this instance.

MySale (LON:MYSL)

- Share price: 107.5p (-0.7%)

- No. of shares: 154 million

- Market cap: £166 million

This is an online fashion retailer primarily serving Australia/New Zealand. It sends gear which is out of season in one part of the world, over to another part of the world where it is in-season. We've covered it plenty of times before, so perhaps that's old news to you!

This is an update for the first five or so months of the financial year. It is in line with expectations.

"The current financial year has started well. Revenue growth has accelerated versus last year, gross margins are increasing and we continue to carefully control our cost base. This is delivering good growth in underlying profitability, in line with management's expectations.

The company's broker, up until a couple of months ago, was forecasting AUD $11.5 million in EBITDA for the financial year ending in June 2018, up from $8.7 million in 2017. I guess that forecast is still in force, then. Revenues are set to grow 15% to c. AUD $309 million.

The eventual net income result will remain insignificant compared to today's market cap. This stock remains firmly in "growth" valuation territory.

It does have a strong net cash position, so has the time and flexibility to carry out its plans, so long as it's operating close to breakeven.

As mentioned before, its plans have changed quite a bit from the 226p IPO.

My opinion

Overall, it's quite an interesting company. It's doing something a little bit different than we normally see from retail stocks. Whether that will ever convert into serious profitability is open to debate.

It seems like it's either going to fail or succeed spectacularly, without much prospect of anything in between. At its current size or smaller, it's worth very little. It needs to get big enough so that its sheer size can overpower the fact that its gross margins are low and there are significant central costs.

The forecast top line growth is 15% this year and 10% next year. Even though those increases will hopefully contribute to much larger percentage increases in EBITDA, I normally think of growth stocks growing their top line by at least 20%.

So I probably wouldn't have the patience to hold this for the time required, from now, for it to evolve into a highly profitable business. But I'll keep it on the watchlist until I become capable of forecasting when that might be!

The StockRanks don't like it, as you might expect. It doesn't currently have the standard features of something you'd want to bet on. So anybody capable of predicting it growing into a successful size, has a massive opportunity here.

Toys

I tweeted about this first thing this morning, and maybe it's worth a mention here.

November was apparently a "disastrous" month for toy sales in the UK, helping to compound the sense of foreboding in the retail sector.

We now officially have a casualty, as Toys R Us will shut at least 26 stores. It currently operates 84.

We already knew that its USA parent was bankrupt, but there was hope and a belief that the UK operations would not be seriously affected.

Character (LON:CCT) is down 2.3% and the tiddler Tandem (LON:TND) (which I used to own shares in) is down 8%.

With the disruption and the oversupply which this is going to cause, on top of the weak trading for this Christmas season, I would see a lot of downside risk facing this year's earnings for Character.

It's probably still a sound bet in the long-term, though, the way I see it. I'll greedily hold out for a better buying opportunity than it currently offers.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.