Good morning, it's Paul & Jack here with the SCVR for Monday. Today's report is now finished.

Agenda -

Paul's Section:

French Connection (LON:FCCN) (I hold) - finally we get a reasonable exit from this problematic fashion brand. Founder Stephen Marks (unanimously with the board) has agreed a 30p cash takeover bid from 2nd largest shareholder led consortium. Not an amazing price, but it's 3-times the level before the announcement of bid talks, and 10 times the pandemic low in March 2020. So overall, I'm happy with this.

Cake Box Holdings (LON:CBOX) - another positive update from this fast-growing franchise cake retail business. However, it's only in line with FY expectations, so shouldn't move the price much really. I'm really impressed with this company, and it deserves a premium rating.

Renewi (LON:RWI) - another positive update from this European recycling group. Heavily indebted, but that doesn't seem to be causing any problems. Looks potentially interesting, although I don't understand this sector, so don't have a strong view either way.

Castings (LON:CGS) - It's a profit warning, but no guidance provided. Tough Q2 (July-Sept) is entirely predictable, given that its main customers (heavy truck manufacturers) are experiencing semiconductor shortages, hence have cut production considerably. Fabulous balance sheet, and divis are being at least maintained. Demand is likely to return in due course, so I don't think long-term holders have anything at all to worry about, given the financial strength of the business. Not cheap enough to make me want to buy though.

Jack's section:

Cerillion (LON:CER) - short but positive update. FY revenue slightly ahead and adjusted profit significantly ahead. Higher mix of license revenue is increasing margins. The shares appear expensive but the momentum is hard to argue with and the outlook remains positive so there could be further to run on a multi-year view.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to cover trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul's Section

French Connection (LON:FCCN)

24p (Friday’s close) - mkt cap £23m

At long last we have the end game.

It’s a 30p cash takeover bid for FCCN, by its second largest shareholder, Apinder Singh (who bought Sports Direct’s former stake), who has experience in the rag trade, and property interests. Singh has teamed up with a consortium, to buy FCCN. This looks to be mainly funded by Gordon Brothers.

This 30p bid approach was announced recently, but I don’t think many people (including myself) took it seriously. The stumbling block was thought to be founder (in 1972!) Stephen Marks, with his c.40% stake.

We got it wrong, because amazingly, Marks has agreed to the bid, so it looks set to go ahead, unless someone else comes along at the 11th hour with a higher bid.

Current trading - there's a trading update in Section 8 of today's announcement. It's a mixed bag, with some areas improving, but issues with supply chain (as for everyone), and worries about possible pandemic issues continuing. No numbers given, so I can't take that any further. We'll get more detail when interim results are published soon, in mid-October.

Shareholders who have agreed - 43.6% (Marks & family) have given irrevocable undertakings to support the deal, plus Singh's 25.4%, totals 69.0%. It needs a special resolution (75%) at a general meeting to authorise the deal, so it looks settled, and highly likely to go ahead.

Effective before end Q4 2021.

Stephen Marks says -

The price we have negotiated is at a significant premium to the share price prior to the commencement of the Offer Period and demonstrates the potential offered by the French Connection brand. The French Connection Board is unanimous in recommending the Acquisition to shareholders.

That’s fair enough. Nobody can argue that they haven’t explored every option, as the company has been up for sale for a long time. Anyone interested would surely have made themselves known by now. Hence this 30p bid looks like the only game in town, or at least the highest priced.

Bear in mind that FCCN shares hit a low of c.3p at the start fo the pandemic, so it’s 10-bagged on that low, hardly a disaster! My average buy price is about 11.5p, so that works out very well indeed. I thought it would sell for a lot more, but it’s only worth what anyone is prepared to pay.

The share price had crept up to about 10p before the bid was announced, as you can see from the chart below. So this is a decent premium on what the stock market was prepared to pay for this company once the pandemic began.

I won’t revisit all the issues the company faced, as I’ve bored myself (and probably you too!) to tears writing about this one. It’s all in the archive for newer subscribers here.

My opinion - relieved! I was hoping for 50p+, but there’s an opportunity cost to waiting forever, tying up capital that could be used on other things (many of which are starting to look attractively priced now). Hence the timing is very helpful.

It’s always difficult to decide whether to sell some or all in the market, when a takeover bid is announced. I’ll wait and see what the share price does, and might sell half if offered an attractive price. The balance, I’ll vote in favour, and take the 30p, to put an end to a frustrating, but ultimately decently profitable investment.

It will be quite a relief not having to churn out the same, tired, points about this business in any more SCVRs! But ultimately, it's been a good outcome for anyone who bought in the last 18 months or so, and not a disaster for anyone who bought in the last 3 years. Which in the circumstances, where many larger & ostensibly more successful competitors have gone bust (e.g. Arcadia & Debenhams) is a lot better than it might have been.

.

Cake Box Holdings (LON:CBOX)

355p (up 6%, at 08:18) - mkt cap £142m

Cake Box Holdings plc, the specialist retailer of fresh cream cakes, today announces its half year trading update for the six months ended 30 September 2021.

Continued trading momentum

The tone & statistics in this H1 update sound positive, but the conclusion is only in line with full year expectations, not a beat -

As a result of this strong performance, the Group is confident of making further progress over the second half and meeting full year expectations.

Although maybe this makes upgrades later this year more likely?

More detail -

H1 revenues £16.4m, up 91% on H1 LY (not a valid comparison though, as H1 LY saw worst impact from lockdown 1)

(Note that revenues are small because it’s a franchise business, so CBOX earns fees from the franchisees, rather than seeing the shops revenues, which don’t appear in CBOX’s accounts).

Revenues for the 4 months to 30 Sept 2021 are also provided, in order to give a more meaningful comparison with last year (i.e. shops open in both 2021 & 2020 periods) up 50% (this benefits from new store openings)

Like-for-like (LFL) store sales is a more meaningful comparison, up +13.3% which could be for the 4 month, or 6 month period, it’s not clear. I do wish companies would just put data in a table for clarity, not do it in a wordy fashion, which is often ambiguous, and difficult to take in, as this is.

Online delivery channels doing well (up 68% - but this doesn’t seem to be LFL, so would be inflated by new store openings).

New stores - 20 new franchised stores opened in H1, which is a rapid pace of expansion - showing the benefits of a franchise model. 3 stores closed in H1 (no details given). Total now 174 + 19 kiosks.

Pipeline - 62 deposits held for new franchise stores - impressive.

New products launched, received well.

Net cash of £4.2m at 30 Sept 2021.

Diary date - mid-Nov 2021, for interims to 30 Sept 2021.

Robust supply chain (worth noting, at a time when so many retailers/eCommerce businesses are struggling to import goods from the Far East, a UK-based cake baker looks an attractive investment proposition)

Expanding IT capabilities.

My opinion - we like CBOX here at the SCVR. Its business model is now well-proven, and it performed strikingly well during the pandemic.

The current valuation is warm, at 24.2 times forecast earnings. However, I feel the premium is deserved, as it’s a convincing, and quite rapid, roll-out. The franchise model also de-risks things largely for CBOX shareholders.

Conclusion - rather expensive (not eye-wateringly so, though), but probably worth it, based on strong performance to date, and rapid roll-out (meaning more growth in profits is on the way).

The CEO came across really well in a webinar earlier this year. He’s exactly what I look for - a passionate, hands-on entrepreneur.

Am kicking myself for not having tucked away some of these shares into my SIPP, but never mind. Maybe it needs some time to consolidate, after a very good run in the last year?

Note that it pays a c.2% dividend, which is unusual for a fast-growing retail roll out - made possible since the franchisees bear the capex cost.

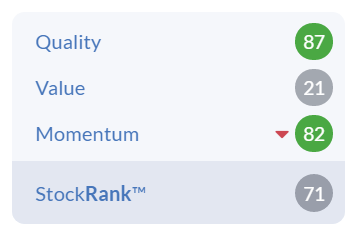

As usual, the StockRank sums things up well - high quality, with good momentum, but not cheap -

.

.

Renewi (LON:RWI)

639p (up 7% at 10:07) - mkt cap £512m

Renewi plc (LSE: RWI), the leading international waste-to-product company, announces its trading update for the six months ended 30 September 2021 and materially upgrades its expectations for the year ending 31 March 2022.

Performance and outlook materially ahead of the Board's expectations

This share has done really well in the last year, roughly tripling since the lows in Oct 2020, when the vaccine-inspired "everything rally" started. Many shares have more recently succumbed to profit-taking, and inflation/supply chain worries, but not so with Renewi, which has remained strong - up another 7% today on this positive update.

Here are my notes from 11 Mar 2021, when Renewi issued a positive “significantly ahead” trading update for FY 03/2021.

Today’s H1 update (FY 03/2022) - better than expected trading, due to -

- Increased volumes

- Improved recyclate prices

- Ongoing cost management

Revenues (first 5 months, LFL basis) - up >10% on LY, and +7% on pre-covid year.

Divisional performance is provided in detail, which I won’t cover as I have nothing to add to it.

Leverage - sounds OK here, but it looked pretty awful last time I looked at the balance sheet. Although note this company is unusual in that it raises cheap, green bonds, to fund itself, a big advantage, and could be a reason for investors tolerating a higher level of debt than would otherwise be prudent -

Cash performance in the first half continued to be strong, with tightly controlled working capital and replacement capital expenditure. Leverage will remain below 2.0x net debt to EBITDA at the half year.

Outlook -

The strong performance in the first half and positive trading outlook have led the Board to materially increase its expectations for the full year ending 31 March 2022. Longer term, the transition to increased recycling will continue to support our business model. The sustainability agenda and the potential for a "green recovery" supported by the EU and national governments will present further attractive opportunities for Renewi to convert waste into a wider range of high-quality secondary materials.

My opinion - if you understand the sector, and believe profits are sustainable, then this share could be worth looking into more closely. That was my conclusion back in March 2021 too.

Stockopedia likes Renewi, with some attractive green valuation bars below, and remember forecasts are going to increase after today’s update.

High StockRank too, although the quality rank is lowish. Overall, looks interesting.

.

.

.

Castings (LON:CGS)

342p (down c.4%, at 11:30) - mkt cap £148m

Preamble - Jack reviewed Castings here in August, when it issued a mixed AGM statement. The company mainly makes specialised parts, in small batches, for mostly European automotive sector (trucks). Hence it’s no surprise that it’s suffered delayed orders, raw materials price increases, supply chain difficulties, etc. - all widely known factors.

That’s presumably why the share price is down about 20% from its peak in July. Supply chain issues are obviously just temporary, for all companies, but we don’t know how temporary. I’m still looking at these dips as potential buying opportunities though, for long-term investors, who don’t mind riding out periods of volatility.

What’s the latest? Today, Castings says -

Castings PLC announces a trading update in respect of the six months ended 30 September 2021.

This is self-explanatory -

The underlying demand for heavy trucks (70% of group revenue) remains very strong and this is reflected in the forward schedules that our OEM customers are providing. However, the current conversion rate of forward schedules to actual sales is significantly below what we would normally expect; raw material shortages (particularly in respect of semiconductors) are preventing the OEMs building trucks at the rate required to satisfy the high demand. In recent weeks, OEMs have reacted at relatively short notice by operating reduced shifts and even closing facilities.

Q2 (July-Sept) revenues & profits have been negatively impacted (no figures provided).

Not possible to forecast when supply chains restrictions will ease.

Margins under pressure from continuing raw materials price rises.

Inventories increased, to satisfy demand increases when they appear.

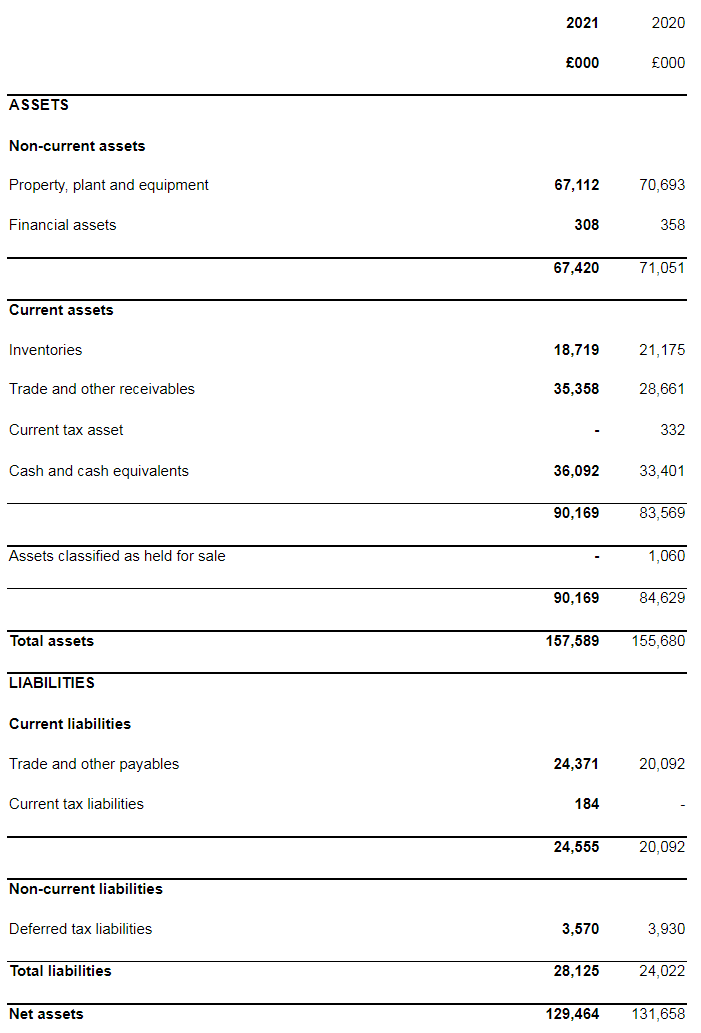

Strong balance sheet still (it’s very strong actually!)

Cash generative in H1, pre payment of dividend

Dividends - despite uncertainty, mgt intends at least maintaining interim & final divis

Diary date - 12 Nov 2021, for interims to 30 Sept.

My opinion - as with practically all the profit warnings we’re seeing at the moment, it’s caused by external factors - supply chain bottlenecks, inflation, and (in some cases, not mentioned with Castings, labour shortages & inflation). That's very different to profit warnings caused by internal problems, or competitive weaknesses, etc.

This is so well-flagged, and so widespread, that no investor should be surprised, hence if you’re worried about supply chains, why are you holding this (or other) shares still?

The fact that Castings has only dropped 4% today is very encouraging. Castings is ludicrously well financed, so can easily afford to keep the divis flowing, which it specifically confirms today. A reliable yield, in a year that is likely to be fairly poor, of over 4% is not to be sniffed at.

Then in due course, demand will bounce back, and maybe Castings will even be able to raise prices, if its products experience excess, catch up demand, as seems likely given the strong demand mentioned from buyers of trucks.

Overall, it’s not cheap enough for me to want to buy any, but will keep it on my watch list.

The main bear point, aside from likely poor results this year due to supply chain issues, is that the longer term performance of the business hasn’t been that great. Specifically, it looks ex-growth, so would need, say a decent acquisition to generate more excitement.

Finally, just look at the last reported balance sheet (as at 31 March 2021) below. It’s wonderful! Shareholders in this company can sleep very soundly at night, regardless of trading conditions.

.

Jack’s section

Cerillion (LON:CER)

Share price: 785p (pre-open)

Shares in issue: 29,513,474

Market cap: £231.7m

Cerillion provides billing, charging, and customer relationship management (CRM) software solutions, mostly to the telecommunications sector but also to other industry sectors, including finance and utilities.

It was founded in 1999 after a management buyout from Logica. At that point, the experienced management team identified ‘a clear gap in the market for a product vendor able to provide a full suite of telecoms software modules’. Whereas many competitors have grown their product suite via acquisition, Cerillion offers a more organically developed, integrated solution.

The resulting software-as-a-service (SaaS) business has grown to more than 90 customer installations in over 40 countries, and its share price has recently shot up as it finds these services increasingly in demand.

Cerillion entered the second half of the financial year with a record level of new orders and a record back order book. New orders included two of the largest contracts secured to date.

Revenue for the financial year is now expected to be slightly ahead of current consensus market forecasts.

Adjusted profit before tax is expected to be significantly higher than current consensus market forecasts, due to a higher proportion of term licence sales. Net cash at 30 September 2021 is expected to close at approximately £13.0m (30 September 2020: £7.7m).

This positive momentum has been flagged a couple of times recently, hence the run up in share price.

Cerillion has a strong pipeline of new business opportunities from both existing and prospective new customers and remains well-positioned as it enters the new financial year.

The opening of a new office in Bulgaria in September 2021 will support the company's continuing growth and is expected to expand quickly to become a new strategic base.

More detailed full year results will be released on 22 November 2021.

Conclusion

It’s a short update, but another positive one. At current levels, the shares don’t look cheap but what’s important here is the current growth trajectory and the size of the addressable market.

Both of these look good for the company, so even the current all-time high doesn’t necessarily mean the opportunity has gone here. It’s a well-managed, reliably profitable company with sticky revenues, whose products appear to be gaining traction.

The higher proportion of term license is driving margin expansion (license revenue is higher gross margin than services, close to 100% compared to less than 70%). Previously the business has reported gross margins in the low to mid-seventies but it looks like this could be beaten as the company secures larger value contracts at bigger service providers.

Cerillion’s credibility with larger customers is improving and driving higher contract values. This is accelerating revenue and margin expansion.

So all in all it seems as though the journey is far from over here and a higher valuation is fully justified. Current earnings forecasts will need to be updated. For FY21 presently they are at about 18p. Assuming 21p, which is probably conservative (but hard to say for sure on the information given), that would value the company at 37.4x FY21 earnings.

Perhaps a shade too expensive, but that depends on what full year earnings will actually be and, on a medium term view, quibbling over the share price multiple today could be a mistake if you are confident of Cerillion’s prospects.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.