Good morning, it's Roland here with today's small-cap report.

The RNS feed is pretty quiet today, so I've taken a look at a few smaller and lesser-covered stocks.

Today's report is now finished (10.20).

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

Main section - summary

Hercules Site Services (LON:HERC) , 36p (unch at 09.00) (£23m) - H1 results, in line - Roland - RED

Strong revenue growth at this contracting business, but poor cash flow, low margins and rising debt. The balance of risk and reward doesn't look attractive to me at current levels.

Quick comments

Getech (LON:GTC)

Up 3% to 13.7p (£9m) - FY results - Roland - AMBER

Getech used to provide geological data to oil and gas companies, but is evolving into a broader business with a focus on clean energy. I’ve always thought that this company’s intellectual property should have some value, but its performance has been disappointing for a long time.

Today’s full-year results cover calendar 2022. They show revenue up 18.6% to £5.1m and management report a record order book of £4.6m. But while the group’s cash balance remains positive at £4.3m, revenue of £5.1m was still significantly below the group’s cost base of £7.9m. The business reports an after-tax loss of £2.8m for 2022.

The operating commentary does suggest some positive developments. There was a 42% year-on-year increase in the number of subscriptions sold, with new services launched to help customers locate copper, gold, cobalt and helium. Getech also won its largest minerals contract to date, worth $900k.

The company is also continuing to invest in its wholly-owned subsidiary H2 Green, which is aiming to build a hydrogen fuelling network in Scotland. H2 Green is being chaired by Dr Graham Cooley, whose previous job was as CEO of hydrogen firm ITM Power (LON:ITM).

Getech saw cash outflows of £1.6m last year, so does not seem in immediate danger of a crash crunch. The group also has a freehold building its hoping to sell, which could provide further liquidity.

Roland's view: I continue to think there could be some value here, but given the group’s long record of losses I see this as a special situation that would require in-depth research and understanding of the group’s operations.

Itaconix (LON:ITX)

Unchanged at 5.1p (£34m) - FY22 results, in line - Roland - RED

Itaconix is a new business to me. The company describes itself as an “innovator in sustainable plant-based polymers used to decarbonise everyday consumer products”. According to the CEO commentary, his aim is to build a high-margin specialty ingredients business.

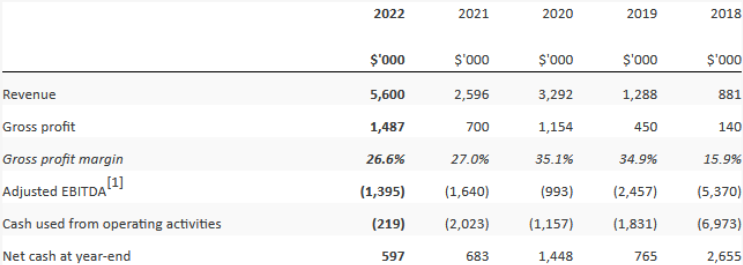

Today’s results cover the 2022 calendar year. Trading results over the last five years suggest some progress has been made in this time:

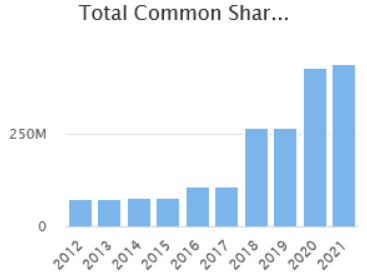

However, the company has been listed since 2012 and long-term shareholders have suffered significant dilution:

Sure enough, Itaconix has been tapping shareholders for cash again recently, with a $12.7m placing in February this year (not yet reflected above).

However, last year’s performance does not provide me with much hope that the business will become profitable in the near future.

Revenue rose by 116% to $5.6m in 2022, while gross profit increased by 112% to $1.5m. Unfortunately, the adjusted pre-tax loss for the year was nearly unchanged, at $(1.8m) (2021: $(2.0m)).

Operationally, management says that last year’s growth was driven by “success in the cleaning segment”.

As a result, the group’s commercial base has expanded. Its products are now found in “over 145 different consumer brands and in major retailers” in Europe and the US. Sixteen families of patents have now been filed.

An updated note from house broker FinnCap is available on Research Tree. FinnCap has left its forecast for an EBITDA loss of $0.7m in 2023 unchanged, but has nudged down its forecasts to show another loss in 2024. EBITDA breakeven is not expected until 2025.

Roland’s view: Itaconix business appears to be delivering strong revenue growth, but its operating expenses continue to rise sharply. Any prospect of real, cash-generative profit appears to be several years in the future, at best.

If you believe the company has some valuable, proprietary intellectual property, then Itaconix could be worth further research. But for me, the shares are too speculative and impossible to value at this time.

Roland's section

Hercules Site Services (LON:HERC)

Share price: 36p (unch. at 09.00)

Market cap: £23m

Roland's view - RED

This AIM-listed company floated in February 2022 and appears to be a manpower agency providing skilled labour and equipment hire to large construction companies.

Hercules’ share price performance so far has been decidedly middling, but this business has founder management with a big shareholding and substantial revenues. I thought it might be worth taking a look at today’s results to provide an initial marker in our coverage.

The big share price slide at the end of February appears to have been triggered by a discounted £1.7m placing to provide working capital funds to support growth. Slightly ominous, in my view, but let’s keep an open mind and take a look at today’s results.

Operating highlights: founder-CEO Brusk Korkmaz says a number of new projects with major clients have scaled up during the first half of the year:

The number of operatives working on HS2 Phase 1 has increased from 180 to 400 over the last year

Now supplying labour to Taylor Woodrow at the Exxon-Mobil oil refinery expansion in Fawley, near Southampton

New clients included Amey and SGN Ltd

A training portal project has become revenue generative

Mr Korkmaz is also bullish about the outlook for the remainder of the year:

Further investment in people and procedures in H1 2023 has prepared the business for expected growth in the second half of the year ("H2 2023"), particularly labour supply and suction excavator services.

Has this progress translated into an improved financial performance?

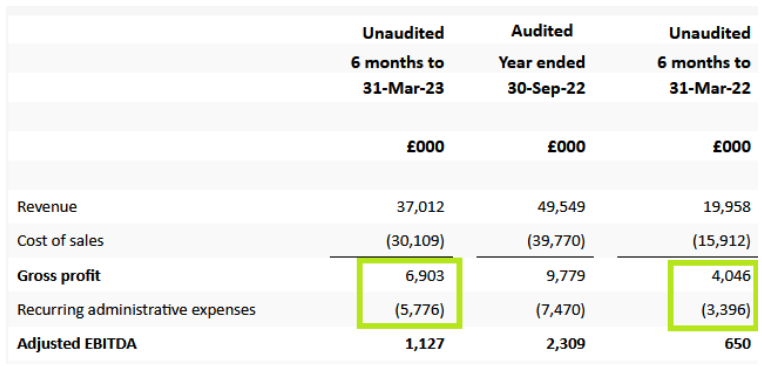

Financial highlights: these interim results cover the six months to 31 March 2023 and appear to show strong growth. Here the main highlights:

Revenue up by 85% to £37.0m

Gross profit up by 71% to £6.9m

Adjusted EBITDA up by 83% to £1.1m

Interim dividend of 0.6p declared (H1 2022: 0.6p)

Declaring a dividend so soon after raising money to fund working capital suggests to me that management must be confident the cash performance of the business will improve.

Unfortunately, I don’t see much evidence of this in today’s results:

operating profit for the period was £331k (H1 22: loss of £213k)

operating cash outflow of £30k for the period (H1 2022: £2.1m outflow)

net financial debt rose to £6.1m (H1 2022: £1.5m) - I assume this includes the benefit of February’s £1.7m placing

Hercules has expanded its equipment hire fleet as well as its labour operations over the last year. But my impression is that much of the firm’s equipment is leased.

My guess is that the cash outflows relate to the need for the company to fund worker’s wages on (perhaps) a weekly basis, while only receiving payment from its clients on much longer terms.

The balance sheet shows average receivables of c.£18m during H1, set against £37m of revenue. That seems to imply that it’s taking Hercules nearly 180 days to get paid by its customers.

However, the company says it’s performance is normally H2 weighted. Checking last year’s accounts gives me a days receivable figure of 96 days, so perhaps that’s a more representative picture.

Even so, these figures suggest to me that this business could continue to struggle with cash flow as it expands.

Profitability: one other problem I can see is that Hercules’ profit margins appear to be very slim.

Most of the group’s revenue is simply the pass-through cost of wages. So I think a more meaningful measure of operating margin is to divide operating profit by gross profit (approximately equivalent to fee income). This gives me a margin of about 5%.

A quick check of some other listed recruiters suggests they generate equivalent margins of 15%-20%. While this isn’t an exact comparison, it suggests to me that Hercules could either lack scale or lack pricing power.

The group’s growth doesn’t (yet) seem to be delivering economies of scale, either. Last year’s 71% increase in gross profit was mirrored by a 70% increase in “recurring administrative expenses”:

Outlook: it’s possible that some of these metrics will improve during the second half of the year. Hercules expects to report a stronger performance during the second half of the year and says full-year performance is expected to be in line with expectations.

Market conditions are said to remain strong, with “continued buoyancy” in the infrastructure and construction sectors.

House broker SP Angel is forecasting adjusted EBITDA of £3.5m for the full year (available on Research Tree).

This doesn’t seem to map onto the consensus earnings estimate of 9p shown in Stockopedia – my sums suggest a figure of c.0.9p is probably more likely. I think there might be a glitch in the data here.

My estimate would put Hercules shares on a forecast P/E of 40, falling to a P/E of 15 in FY24. That seems pretty strong to me, for a low-margin business with negative cash flow.

Roland’s view: Hercules’ chief executive Brusk Korkmaz founded the company in 2008 and has built it into a £50m+ turnover operation. The business has clearly generated some profitable growth and positive cash flow at some points during its history.

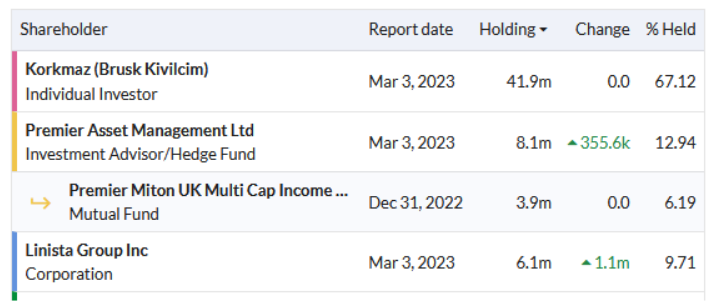

Kvorkmaz still has a 67% shareholding, so presumably he is motivated to successfully expand the business.

However, my initial inspection suggests that this company suffers from all the traditional problems associated with construction contracting business, such as poor cash flow and low margins.

Net debt has risen sharply despite a placing earlier this year. I don’t think dividends are appropriate without some evidence the group is generating free cash flow.

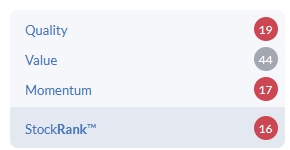

I haven’t researched this business in detail, so I may be missing something. But based on today’s interim results, I can’t see any good reason to want to own these shares. Stockopedia's algorithms appear to share my cautious view:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.