Good morning! Stocks on my radar so far today, guided by your suggestions, are:

- Zoo Digital (LON:ZOO)

- MySale (LON:MYSL)

- Ergomed (LON:ERGO)

- GRC International (LON:GRC) (new ticker)

- Orchard Funding (LON:ORCH)

1:30pm: Edited this list in response to reader requests.

Berkshire Hathaway ($BRK.B)

(Please note that I have an indirect interest in Berkshire Hathaway)

I finally got around to reading the Berkshire Hathaway annual letter to shareholders this weekend (it had been released the previous weekend). You can find it at this link.

The full dissection of this letter and the accompanying results would be worthy of an article in its own right, but the most important metric is perhaps the $116 billion in cash and short-term T-Bills held by Berkshire at year-end 2017. That is very significant, even for a company with $700 billion in assets and $350 billion in equity. Cash and T-Bills have increased from $86 billion a year ago.

The reason for this is that Buffett, Munger & Co. are in a mode of maximum caution, warning that valuations are high and that exuberance is irrational. The only stock they seem to have bought much of over the past year is Apple ($AAPL) - and they did buy lots of it, about $14 billion worth.

Even for those of us far away from the US and trading in small-caps rather than Buffett's big-caps, I think it pays to be aware of general conditions. And it can be very painful holding cash in your portfolio, when there are lots of interesting stocks you want to buy. But if it's good enough for Warren, then it's good enough for me.

Zoo Digital (LON:ZOO)

- Share price: 77p (+12%)

- No. of shares: 74 million

- Market cap: £57 million

A nice update from this digital agency:

The Company is pleased to announce that growth has continued into the second half of the financial year with full year revenue expected to be at least $28m (year ended 31 March 2017: $16.5m). Adjusted EBITDA* for the full year is expected to be ahead of market expectations and at least $2.3m (2017: $1.8m).

The company specialises in localising TV/movie content for particular audiences, and this upgrade has been driven by its subtitling and dubbing services.

I covered Zoo at its H1 report and was quite sceptical of the valuation attached to it, also noting a lack of balance sheet strength.

Continued positive trading has improved that side of things, as gross cash increases to $2.2 million (versus $0.7 million at March 2017). It will still be carrying some debt on a net basis, but the overall picture should have improved..

The company's innovation in dubbing also sounds quite interesting:

ZOO's planned technology developments include the application of machine learning to streamline the dubbing process for TV and film entertainment content, for which the Company has recently been awarded an R&D grant from Innovate UK, the Government-funded agency. This funding will support collaboration with a speech and hearing research group at the University of Sheffield and is expected to deliver capabilities that will improve the quality and speed of production for lip-sync dubbing projects.

Lower margins: eagle-eyed readers will note that the adjusted EBITDA margin implied by the numbers quoted above has fallen from 11% to 8%. Brokers reckon that this weakness is temporary and is associated with ensuring that new services are being delivered properly.

My opinion: Having covered it in some detail at the interims, I'm impressed by its continued progress. While I think of it as being mostly in the business of hiring freelancers to do its translation work, it's also clearly trying to be as innovative, efficient and hi-tech as possible.

That said, I still think it has a lot of work to do, to justify the current valuation. This is another stock where shareholders are paying in advance for growth - nothing wrong with that, if you're able to make money doing it! And these shares have 7-bagged over the past year.

MySale (LON:MYSL)

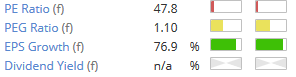

- Share price: 112.75p (+3%)

- No. of shares: 154 million

- Market cap: £174 million

This is the online clothes retailer whose share price has never quite managed to recover from the initial profit warning after IPO. Its plans have evolved over time, aided by its very large cash balance, giving it the flexibility to change course.

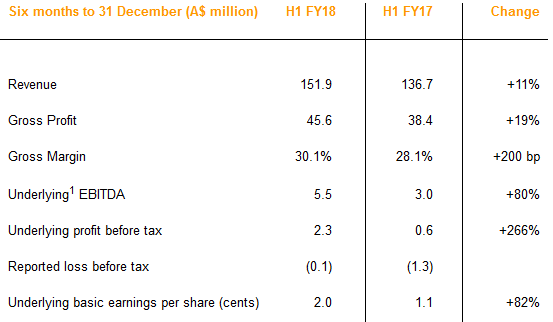

We already knew that revenues would be up 11% and underlying EBITDA up 80%, so these numbers aren't really news. It reports in Australian dollars:

You'll note that there was an ultimate loss before tax- the company almost made it to breakeven on a reported basis.

The operational highlights show the active customer base is up 12%, about the same as revenue growth. Average order value increased slightly to A$87.

Overall, there are plenty of interesting tidbits in today's results. The company has created its own proprietary payments solution, letting its customers "buy now, pay later". Selling to shoppers on credit can be a highly lucrative activity, as demonstrated by Next (LON:NXT) (in which I own shares).

A little bit of googling shows me the OurPay terms and conditions - it's an installment plan, enabling customers to pay for their basket in four payments over 56 days. There is no interest charged to customers, but if it helps with conversion rates and basket sizes, as claimed by MySale, then it's to be welcomed. It's being used for 17% of orders now.

Another interesting piece of news is the company's move into buying its own inventories, rather than merely acting as the go-between for a buyer and a 3rd-party brand. Own-buy inventory is now 20% of online sales, helping to boost gross margins.

Outlook - the positive outlook statement is reiterated:

Following a record first half the Board is confident in the Group's strategic progress and notwithstanding continued investment into customer acquisition, technology and service, anticipates that underlying EBITDA for the year will be at least at the top end of market expectations.

My opinion - there is a lot to like about this half-year report. The net cash balance has managed to hold up around A$8 million despite significant investment in inventories and a further A$3.8 million spent developing its own in-house software. It's making progress on several fronts.

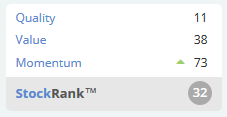

The StockRanks don't like it, and it's not hard to imagine why. At the end of the day, the company has produced very little in terms of profit yet. I suspect it will produce healthy profits in future, but the algorithms aren't going to be impressed until there is stronger evidence than what we've seen so far:

Ergomed (LON:ERGO)

- Share price: 194p (-7%)

- No. of shares: 45 million

- Market cap: £87 million

Trading update and notice of results

This is a pharmaceutical company we haven't covered before. It has issued a profit warning today in relation to the 2017 full-year results which will be published later this month.

There is an explanation for issuing such a late profit warning:

The Board of Ergomed has only just become aware of these adjustments as the Company has finalised its 2017 accounts in preparation for the year-end audit, which itself was delayed as the Company implemented a new finance system earlier this year.

The adjustments themselves don't sound particularly worrying, arising from FX translation and from the faster-than-anticipated completion of a Phase II trial. Guidance for 2018 is unchanged.

So I don't think I would have marked the shares down today, or at least not by as much as 7%.

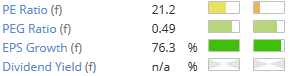

The company has a large Service division which is experiencing strong growth in its revenue and order book, and I think this stock could be worth another look. EPS is forecast to break higher:

GRC International (LON:GRC)

- Share price: 87.5p (+25%)

- No. of shares: 57 million

- Market cap: £50 million

Admission to AIM, First Day of Dealings

On Friday, I noted that IntegraFin Holdings (LON:IHP) shares had managed to increase by a third compared to their IPO price, having been listed for less than a week.

GRC International (LON:GRC) (GRC International Group) isn't far behind, its own shares up by 25% today, its first day of dealings.

The FTSE might be more than 10% off its January highs, but these stocks give an impression of euphoria in the IPO market!

GRC is "the one-stop shop for cyber security and data compliance products and services". It has been tipped to do well in part thanks to the previous successes of its Chairman at RWS Holdings (LON:RWS) and Learning Technologies (LON:LTG). Before that, he was CEO for many years at Wolters Kluwer UK. The GRC CEO also has an impressive bio.

It was founded in 2005 and is still at a fairly early stage, but growing strongly:

The Group has grown strongly over the last two years with revenues for the year ended 31 March 2017 of £6.83 million (2016: £4.85 million) and profit before tax of £0.71 million (2016: £0.17 million).

It's important to note that the company is primarily in the business of consultancy and training, though it also publishes books and software on its areas of expertise.

Cyber security is a hot sector these days, so it will probably continue to enjoy strong top-line momentum. I will maintain my usual caution in relation to consultancies/professional service companies.

Orchard Funding (LON:ORCH)

- Share price: 103.5p (+2.5%)

- No. of shares: 21 million

- Market cap: £22 million

This is a specialised financial company, financing insurance premiums and professional fees for accounting firms, small businesses and professionals. It operates through Bexhill and Orchard Funding Ltd.

Loans are short-term in nature, averaging ten months.

Interestingly, the company has been hoping to get a bank licence (I wrote last week about the benefits of a bank licence for PCF (LON:PCF), in which I hold shares). But Orchard doesn't provide any new information about this today.

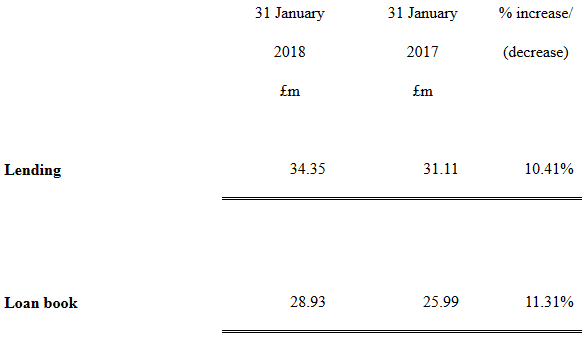

Trading for the six months ended January 2018 was in line with expectations. Lending and loan book figures are as follows, continuing to improve following the 30% increase in loans made during FY 2017:

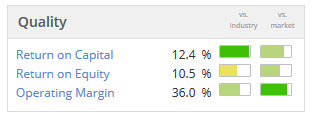

ROE is in the region of 10% - 11%, rising gradually:

My opinion: at about 1.6x book value, one could argue that this is somewhat on the expensive side for a small lender with an ROE in this range. It is showing encouraging levels of growth, however, so on balance the valuation is probably reasonable. If stronger evidence appears to prove that it can get a banking licence, that could be the catalyst the shares need to shoot higher.

Ok, that's all from me today. Thanks for dropping by!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.