Good morning, it's Paul here.

There's not much company news today, so I'm taking it easy on timings. After covering the small amount of company news, I'll chat about some macro stuff. EDIT - it's just not working today, so I'm drawing a line under this report.

Today's report is now finished.

Revolution Bars (LON:RBG) (I hold a long position in this share)

This is one of my big 3 largest holdings, and I believe a fair number of subscribers here also hold. Today's RNS tells us that the trading update for the 26 weeks to 28 Dec 2019 will be published on 15 Jan 2020. The wording, and timings, are consistent with last year, so there is nothing to be deduced from this announcement. Interim results will be out on 26 Feb 2020.

Incidentally, I find it's useful to compare the wording of trading updates with the equivalent announcement the year before, as subtle changes in wording can sometimes be significant.

Gresham Technologies (LON:GHT)

Share price: 127p (up 4% today, at 11:42)

No. shares: 68.3m

Market cap: £86.7m

Gresham Technologies plc (LSE: "GHT", "Gresham", "Company" or the "Group"), the leading software and services company that specialises in providing solutions for data integrity and control, banking integration, payments and cash management, is pleased to provide the following trading update for the year ended 31 December 2019 ("FY2019").

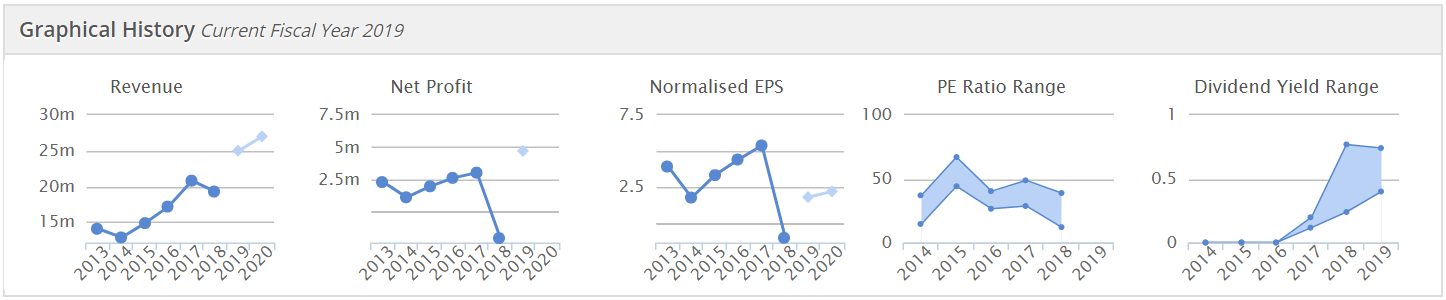

Background - I last looked at this company here on 4 July 2019, when it issued an upbeat interim trading update. The valuation struck me as very high - a PER of 82 for 2019, and 55 for 2020 forecast.

This share has historically had patches of extremely high valuation, especially in 2003-2005. It subsequently lose those gains.

The two year chart below shows 2 profit warnings (the vertical, red bars), but also a nice recovery in recent months - something we're seeing a lot of at the moment. Catching falling knives has worked well for a lot of shares in the last year, which just goes to show that every investing "rule" (e.g. never catch a falling knife) only works some of the time!

Turning to the longer term chart, you can see below how this share has been susceptible to spikes up in price, which have not been sustained. This could be seen as either a positive (i.e. every now and then the story gets investors excited, so it could happen again), or as a negative (i.e. speculative surges have fizzled out multiple times).

Over such a long period of time, as the above chart (1986 to now), no doubt the story has changed a lot, so may not be directly comparable to what the company is currently doing.

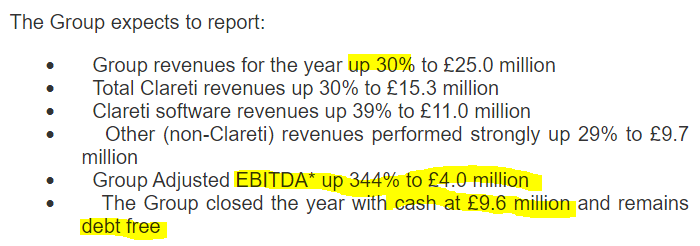

Trading update - today, here are the highlights, with some nice stuff in there;

Forecasts - there's a recent note from a high quality broker, available on Research Tree. This shows adj. EBITDA forecast at £3.7m, therefore today's result of £4.0m seems to be an earnings beat against expectations.

This forecast translates into adj PBT of only £1.3m - see what I mean about EBITDA being a misleading number!? The reason being that Gresham capitalises c.£3m p.a. in development spending onto its balance sheet.

The equivalent forecast EPS for 2019 is 1.4p, so if we assume that actual might be about 10% ahead of that (since the adj EBITDA figure is almost 10% over forecast), then I make that actual EPS probably c.1.5p. At 127p that's an eye-watering PER of 85.

Although with high margin revenues growing at 30% p.a., then it wouldn't take long for operationally geared profits to rapidly reduce that PER in future. Hence a high PER is not necessarily a deal-breaker for me, if I think rapid growth is likely to continue. I'm assuming that growth is all organic, and not through acquisitions.

Doing a bit more digging on this, last year's accounts, in note 10, a disposal is outlined, which was expected to contribute £2m profit into the 2019 results. That's highly material, so I've checked it out in a bit more detail. The last interim results show a £1,985k gain on sale of discontinued activities, but this is shown at the bottom of the income statement. Therefore, the adjusted profit figure does not benefit from this one-off disposal profit, hence the adjusted profit numbers further up the income statement look OK.

There seem to have been some small acquisitions made along the way, which might flatter revenue growth. That would need checking out before making a purchase of these shares.

Balance sheet - software companies generally don't need a strong balance sheet, because customers pay up-front for services that are delivered later. This is the case here, in that the £9.6m net cash looks great, but at 31 Dec 2018, the current ratio was quite weak, at only 0.92.

NTAV was actually negative at 31 Dec 2018, at minus -£1.0m.

Therefore, we shouldn't run away with the idea that a nice pot of net cash means that the balance sheet is strong, as it isn't. But I don't see that as being a problem, due to the nature of this sector.

Outlook - it makes positive noises, but nothing specific.

EPS is forecast to rise to 2.1p in 2020. The PER would still be sky-high.

My opinion - as with so many highly rated shares, the share price performance can't really be predicted from crunching the numbers. It's all about the growth rate. If you think GHT has a fantastic product, which is likely to generate strong sales growth, then the shares could be worth a closer look.

My main reservation is that this company has been promising great things for many years, and not really delivered on the hype. Maybe it will be different this time? The growth track record isn't bad, but does it really justify such a high valuation? I don't know, so will steer clear. Probably one for sector experts only.

Altitude (LON:ALT)

Share price: 52p (up 8% today, at 14:54)

No. shares: 68.8m

Market cap: £35.8m

Major strategic alliance in North America

I'm covering this because there's nothing much else to cover today.

This share is on my watchlist - it was previously a sleepy micro cap, but reinvented itself in the last few years as an online marketplace for promotional goods in the USA. The idea is that the very fragmented market could be pulled together, using Altitude's software.

A lot of private investors got terribly excited about the potential upside, but growth rates have disappointed to date. Or put another way, the upside, and/or speed of upside were over-hyped by the company and its supporters. That puts a question mark over it, but plenty of highly successful growth companies have taken longer to achieve strong results than originally planned, so that doesn't necessarily put me off. Some of my best ever investments have been growth companies that had problems in the early stages.

As you can see from the 3-year chart, nobody really knows how to value this thing, and it's susceptible to speculative booms & busts. Look at the large spike 3 years ago, at the extreme left of this chart. I think a tip sheet called Small Company Share Watch was getting people over-excited about the upside potential then, IIRC.

Clearly we can see that something went badly wrong in Sep 2019, and to date the share has shown little sign of recovering from that - despite there being a widespread recovery in many shares in the last 3 months;

My opinion - Looking at today's announcement, it doesn't contain any figures, nor any indications of how much extra business this might generate for ALT. To me it is almost completely incomprehensible.

Given the company's track record of over-promising, I'm not minded to take much notice of this announcement. I'm sure it gives bulls something to get their teeth stuck into, but when companies disappoint, I find it best to hang back and wait for tangible proof of commercial success in the interim/annual results, rather than promises of great things in other announcements.

As mentioned before, I like a punt as much as anyone else, so do find myself tempted to pick up a few of these, purely as a speculative thing. The balance sheet looks OK.

Avation (LON:AVAP) - has put itself up for sale, and is in talks already with one interested party.

The Board of Avation announces today that it is undertaking a comprehensive review of the strategic options open to it in order to maximise value for shareholders. These options include merger and acquisition activity, an aircraft portfolio sale or review etc., as well as a potential sale of the Company through the commencement of a "formal sale process"

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.