Good morning, it's Paul here. I'll be writing all of this week's reports.

Graham posted an excellent end of year portfolio review of 2018 here. It's well worth a read, if you haven't seen it. The format is great - looking at winners & losers, and what he has learned from each.

I might do something similar next week, but am holding fire until then, because my (by far) 2 largest positions are both reporting imminently. Sosandar (LON:SOS) is my main holding, intended for the very long term, and is reporting on peak Q3 (Oct-Dec 2018) trading around Wed-Thu this week. That's the normal reporting schedule, if you look back at its previous updates. We already know that autumn trading has been good, as the company has said so, in recent results meetings & presentations.

Revolution Bars (LON:RBG) is my second largest holding, and its peers (Stonegate, and others) have reported very strong trading in Dec 2018. Particularly in town/city centres, and at the premium end (cocktails, etc), which is right in RBG's sweet spot. So we should hear positive news from them on Monday next week. The wild card is potential for takeover approaches to resurface. A competitor (Stonegate) offered 203p cash for it some time ago, so there's very obvious value now the share price is half that level.

I regard a lot of recent share price plunges as being spurious, and providing some excellent buying opportunities. However, only if accompanied by a positive, recent trading update. Profit warnings also seem to be, very selectively, providing some remarkable buying opportunities - if you can time purchases with skill.

There are some very good rebounds underway from recent disappointing updates too - e.g. ASOS (LON:ASC) and Superdry (LON:SDRY) , both up strongly in percentage times from recent lows, although both still miles below previous highs.

So, interesting times, especially for traders. Less so for buy & hold types like me (I hardly do any trading these days, having decided there's not much point - as gains seemed to net off against losses, thus making it a stressful waste of time!)

Tracsis (LON:TRCS)

Long-standing CEO, John McArthur has decided to stand down, from the group he created. Tracsis floated in 2007 at 40p. Shareholders have enjoyed a remarkable 15-bagger since then to date, under John's stewardship. What a terrific track record - and proof that, if financial discipline & skill are used, then a buy & build can work very well - without using debt, either.

John has also been a fantastic CEO from the point of view of private investors. He's been happy to meet us, at events like Mello and ShareSoc. I even managed to drag him down to Brighton, to give an illuminating talk about AIM, to a small investor event that I organised, years ago.

Stockopedia members were even able to ask him questions directly in the comments section to these reports, and he replied to them all. Why can't all companies be that open & engaged with private investors? It's PIs who create the market liquidity, and set the share price, so failing to interact with us is a glaring oversight by many companies, and their city-focused advisers.

The share price of Tracsis has barely moved today, which I suppose is good, but might be slightly galling for the outgoing CEO! The main reasons may be that it's been handled rather well;

- A new CEO, with relevant experience is simultaneously announced today, and

- John McArthur is staying on in an advisory role, concentrating on M&A - which is where he's added the most value historically I would say. So in a sense, it's business as usual, just with a new operational CEO

I don't see anything untoward or worrisome in this announcement, and confirmed that hunch with a brief chat with John this morning. So three cheers for an outstanding outgoing CEO who has done a fine job at Tracsis, and has been a good friend to the PI community along the way. Incidentally, I've made it clear that we want to be kept informed about what he decides to do next!

Churchill China (LON:CHH)

Share price: 1040p (up 10.6% today, at 11:25)

No. shares: 10.96m

Market cap: £114.0m

Churchill China plc (AIM: CHH), the manufacturer of innovative performance ceramic products serving hospitality markets worldwide, is pleased to announce the following trading update for the year to 31 December 2018.

This looks good, although the reporting is too vague for me to be able to quantify things;

We have made substantial progress against our strategic objectives in 2018 and have enjoyed a strong finish to the year.

Revenue growth in export markets remained strong across the year.

Our performance in the UK improved in the second half of the year.

As a result the Board now expects that operating performance will be ahead of current market estimates.

What do we reckon the upside might be? 5-10% perhaps? If so, why couldn't the company have just told us the range of upside - accepting that it needs to be a range, because the company will obviously need to allow for any audit adjustments that might arise between now and publication of the results on 27 March 2019.

We should hopefully soon get an update note from N+1 Singer, on Research Tree.

Lack of liquidity - this is the biggest problem with CHH shares. I like the company, but can't see any point in trying to build a position, as the market is so illiquid.

Currently, the quoted market price is 1000p bid, 1080p offer. As we know, the system is bent, so the quoted prices are not the real prices in small caps. Querying with my broker, the real prices right now are actually: 1004p to sell (but only in 2,500 shares maximum), and 1052p to buy (only in 1,000 shares size).

To summarise then, the quoted bid/offer spread is 7.4%, and the actual bid/offer spread is 4.6% - diabolical, and very bad, respectively!

Therefore the only way to deal in this share would be to leave an order (at your maximum price) with your broker, maybe for a few days, and hope you get a fill.

My opinion - this is an excellent company, with a great track record. There doesn't seem to be any sign of it struggling with the downturn in the hospitality sector. Plates get smashed, so restaurants have to buy more.

Churchill is very good at product development. I invested in a restaurant in 2016, which turned out to be a very quick way of squandering a lot of money (note to readers, if you're ever tempted to invest in pubs or restaurants, I've got one word for you: DON'T!!!). We (or rather, I) paid for a lot of very nice Churchill products. The feeling was that they're very competitive on both designs/fashion, and not bad on price.

As an aside, I also paid for some lovely, premium cutlery (not sure of the supplier). The theory being that customers then perceive the food as higher quality, so will pay more. The theory omitted to note that, once some customers have eaten a meal with nice cutlery, they believe that ownership of the cutlery has transferred to them, taking it home as a memento. Supplies depleted rather quickly unfortunately.

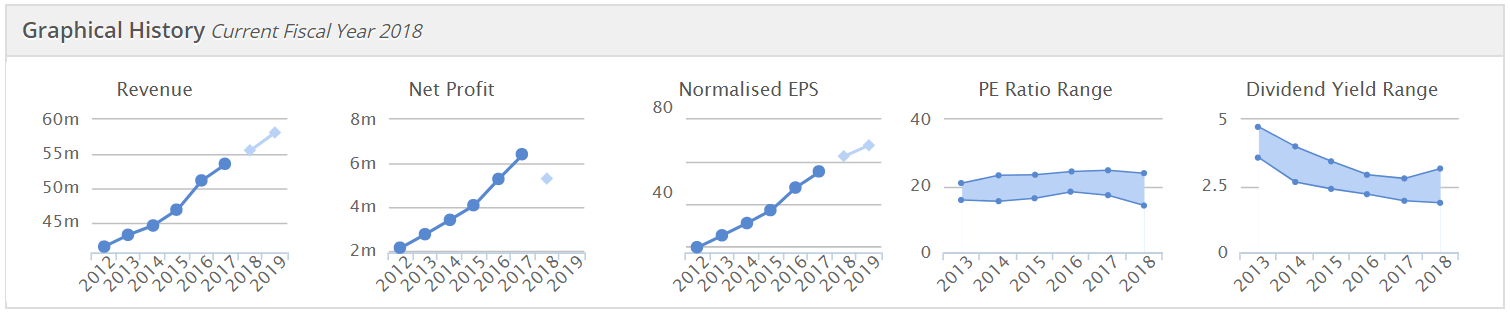

Going back to Churchill, how about this for an excellent track record?

The valuation looks reasonable to me, for the first time in ages. It all depends on what your macro view is though. If you think a cyclical downturn is on the way, and/or that exports might suffer due to the dreaded "B-word", then it might not seem quite so attractive to you.

My view is positive overall, but it's not liquid enough for me to want to get involved.

UP Global Sourcing Holdings (LON:UPGS)

Share price: 44.5p (up 12.8% today, at 12:51)

No. shares: 82.2m

Market cap: £36.6m

Ultimate Products, the owner, manager, designer and developer of an extensive range of value-focused consumer goods brands, announces the following unscheduled trading update.

This is a positive update, relating to the year ending 31 July 2019;

The positive momentum that the Group referenced in its FY18 results, announced on 6 November 2018, has continued.

There has been stronger than expected revenue growth across each of its four strategic pillars (i.e. discounters, UK supermarkets, online platforms, and international customers), with international business continuing to account for a larger share.

As a result, and notwithstanding the higher overhead costs associated with servicing the increased revenue, the Group now anticipates that its EBITDA performance in FY19 will be above the market's current expectations.

Why does it mention EBITDA? Memo to the City - EBITDA is NOT PROFIT!

Nevertheless, this sounds a positive update.

My opinion - I don't really have one, as this type of business doesn't interest me.

If you are interested though, this appears to be a good value share, with a low forecast PER, and a high dividend yield.

My reservations are that its financial performance seems quite variable, with a big profit warning in autumn 2017. Does it have much sustainable competitive advantage? Probably not, which is why the shares are cheap on value metrics.

Still, after this positive update, it's a better investment today than it was yesterday.

Eagle Eye Solutions (LON:EYE)

Share price: 101p (up 4.4% today, at 13:11)

No. shares: 25.4m

Market cap: £25.7m

Contract win

Eagle Eye, a leading SaaS technology company that allows businesses to create a real-time connection with their customers through digital promotion and loyalty services, is delighted to announce a new five-year contract with Waitrose Limited ("Waitrose & Partners").

I don't normally mention contract win announcements. However, in this case, EYE is on my watchlist as something I might buy in future, so want to keep my notes here up-to-date, for easier reference in future.

There's also a trading update buried in today's contract win announcement;

The Company continues to trade in-line with the Board's expectations.

This contract follows on from existing work with John Lewis Partnership. So clearly by rolling it out to Waitrose too, the customer must be happy.

My opinion - I'm keeping a watching brief on this one. It looks potentially interesting, and has a great client list.

On the downside, it's still loss-making, although not horrendously.

The share price has come down a lot in the last year, along with many other smaller, more speculative shares. It's not far off getting into the sort of price range where I might consider dipping in my toe.

Gotta dash for a meeting now! See you tomorrow.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.