Good morning!

The news is terribly boring today, so I think I might just do a quick round-up of my personal portfolio, to show what went right and what went wrong in 2018.

Of course, nothing below should be construed as "tips" or "advice" - I make plenty of mistakes.

For context:

- the FTSE All-Share Total Return Index is down 9.5%

- the FTSE AIM All-Share Total Return Index is down 18%.

(Total return is measured from 29th December 2017 to last night's close, and includes the beneficial effect of dividends.)

Volvere (LON:VLE)

- Total return: 22%

- Share price: 1050p

- Market cap: £33 million

- StockRank: 97

Still my largest holding (16% of the portfolio) and I remain happy to leave it in the portfolio. CEO Jonathan Lander was good enough to come to Mello London this year and explain how this investment vehicle works to a large gathering of private investors.

The cash balance is worth perhaps £33 million after £6 million of buybacks, i.e. it's capitalised at around cash value with two businesses thrown in for free. One of these, a bakery, is of a substantial size and could move the needle again for Volvere if its performance improves and/or it is disposed.

Please note that the stock is illiquid and only suited for long-term holders. The major uncertainty around it now is how the massive cash pile will be used - it's a bet on management's ability to continue their fine track record.

Burberry (LON:BRBY)

- Total return: -1%

- Share price: 1720p

- Market cap: £7.1 billion

- StockRank: 85

I've had a long-term love affair with this company, first buying into it back in 2012. I traded in and out of it a few times, but my current holding has been in the portfolio since January 2016.

I think it's a highly attractive and perhaps a timeless brand. It is 11% of my portfolio.

The important thing to remember is that British perceptions matter less than Asian perceptions of it. The big spenders, even in the British stores, are Asian tourists.

Top-line revenue growth has admittedly slowed down (adjusted revenue +4% in the latest H1 report), so the focus has shifted to cost savings under new CEO Marco Gobetti and a new creative vision under Chief Creative Officer Riccardo Tisci.

Both of these key employees are Italian and both have significant experience at French fashion house Givenchy, owned by LVMH.

Long-term, I expect Burberry to be acquired by LVMH - market cap £115 billion - and would be more than happy to exchange my Burberry shares for LMVH shares (at a suitable premium, of course!)

H & T (LON:HAT)

- Total return: -18%

- Share price: 262.5p

- Market cap: £99 million

- StockRank: 87

Sitting at 7% of my portfolio, this is another important holding.

The share price fall this year has been a surprise for me. As far as I'm concerned, the company is doing fine. Profits and dividends have progressed, and there is little evidence of any fundamental change to the marketplace - H&T remains Britain's #1 pawnbroker. I suppose there are lingering worries over future regulations and lawsuits with respect to financial products such as H&T's personal loans.

The stock is trading at a 12-month forward rolling PE ratio of 7.6x according to Stockopedia, and yields nearly 5%.

It's worth noting that the gold price has a positive correlation with H&T's performance. Gold in Sterling has appreciated by 5% over the past six months.

So it has been tempting to buy more H&T, but I already own plenty of it.

PCF (LON:PCF)

- Total return: +27%

- Share price: 36.5p

- Market cap: £78 million

- StockRank: 50

Another solid financial stock, I didn't expect the share price to make such rapid gains but will not complain that it did. It accounts for 7% of my portfolio, as a result.

PCF is a rapidly growing online bank and lender with expertise in car finance for individuals and vehicle/equipment finance for businesses.

It is approaching the "moment of truth" when the initial lending portfolio target will be achieved and investors will be looking to see significant increases in return on equity. FY 2018 saw ROE improve from 8.7% to 10.3%, but there is potential for much larger increases on top of that in the year ahead, depending on execution and macro conditions.

Net assets were £42 million at year-end, so the market cap of c. £80 million seems fair.

Creightons (LON:CRL)

- Total return: -8% (but my total return was positive since I bought it in February, March and June at average c. 24p)

- Share price: 30.5p

- Market cap: £19 million

- StockRank: 53

This cosmetics manufacturer and brand owner had a "good" profit warning in February, stating that demand from its business customers had outpaced the capacity at its factories.

This caused some short-term margin issues, and a profit warning. The share price weakened and I was pleased at the opportunity to build a holding in a good company that I had my eye on for a while. It is now 6% of my portfolio.

Results have been good since then. H1 numbers in November saw revenues up 33.5% and PBT up 44.4%. There aren't any public forecasts for the company but the Chairman's H1 statement was very promising for 2019 prospects: a high-speed bottle filling line is in operation and a high-speed tube filling line should now be operational, too - resulting in 20 - 25% increases in capacity. So it should be full steam ahead for Creighton's.

Those are my top 5 holdings, worth 48% of my portfolio excluding cash. It is pleasing that I have no particular reason to sell any of them, and plan to continue holding all of them.

Let's now consider some of my more noteworthy failures this year, which were sources of poor performance.

- British American Tobacco (LON:BATS) - minus 46% (3% of my portfolio)

BAT was rocked by news of a possible ban of menthol cigarettes in the USA - this could wipe out up to 25% of its profits.

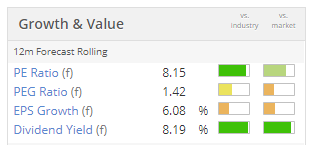

While that news was undoubtedly very negative, the share price reaction has been vicious. The stock is trading at a forward P/E ratio of just 8x and a dividend yield of 8%:

I am holding on because I do currently expect the company to survive: net debt/adjusted EBITDA is perhaps 4x, and should reduce. When it's not being regulated against, earnings are highly predictable.

With respect to the US ban, it's possible that it may not be implemented for several years, and even after implementation, BAT could provide substitute products.

Research by WHO suggests that by 2025, only 10% of smokers will be from the Americas (down from 12% in 2015), and this trend should continue. BAT will continue to be active globally.

Lesson learned? I took a chance on a heavily regulated industry with political vulnerabilities, and it hasn't worked out so far.

Record (LON:REC) - minus 23% (3% of my portfolio)

A niche provider of currency management services to corporates, the news from Record has been pretty flat and uninspiring over the course of the year. Margins have been under pressure from increased competition in currency hedging products.

I continue to hold it for a little bit of income (dividend yield is over 7%) and because I trust that management have great integrity and are well aligned with other shareholdeers.

It also enjoys downside protection from its strong balance sheet, with tons of cash and plenty of shareholders' equity.

Ultimately, however, my conviction in its merits as a long-term hold is not too high - so it might be sold over the next 12 months.

Lesson learned? I was too focused on balance sheet strength and good governance, and not demanding enough about the company's competitive position and growth prospects.

- DP Eurasia NV (LON:DPEU) - minus 51% (1% of my portfolio).

This has been battered over the Turkish Lira depreciation and political concerns in Turkey. In hindsight, I should have waited longer before opening a position in this share (or not bothered opening a position in the first place).

On the other hand, the company appears to be doing OK operationally, so I'm happy to hold onto it for the time being.

Lesson learned? I took a chance on a company operating abroad, in emerging markets, and have been battered by political problems and currency volatility.

- United Carpets (LON:UCG) - minus 36% (I no longer have a position)

This is a share I ditched recently, as discussed in an SCVR earlier this month.

It was the last remaining share from my "deep value" portfolio, and I've realised that deep value is not a strategy I wish to pursue any more. I want companies with brands, intellectual property or dominant market positions which are difficult to compete against.

Unfortunately, I don't think that any carpet company has that sort of advantage, and so I no longer want to own shares in UCG. Carpets, windows and doors - I won't invest in this sector ever again.

Lesson learned? I made a deep value investment on the basis of a very cheap earnings multiple, but the unattractive characteristics of the company's industry made themselves felt.

Other shares which have done poorly, but which I don't consider to represent an investment failure:

- IG Group (LON:IGG) - minus 14.5% (5% of my portfolio)

I'm happy with the performance of this spread betting and CFD group, so the mark-to-market loss in 2018 doesn't bother me.

My entry point was back in January 2017, and I intend to hold for the long-term.

Effects of compliance with ESMA rules are the key point of uncertainty. As the #1 CFD provider, I expect IG to find that its competitive position is as strong as ever.

- Park (LON:PARK) - minus 12% (3% of my portfolio)

Little has changed at this gift voucher group.

Its H1 result saw reduced seasonal operating losses, though the H2 result may have deteriorated if the retail sector has experienced the bloobath many are now predicting. HMV has gone into administration and others could soon follow.

Park sits apart from the retailers themselves, offering services to them and their customers without any physical presence or indeed much physical equipment at all (return on capital is 145%).

So while Park would much prefer if the retail segment was strong, it doesn't hurt in the same way that the retailers themselves do. It has been profitable every year since 2002.

- Distil (LON:DIS) - minus 11% (though my entry point was in July 2018, so my unrealised loss is smaller than this) (3% of my portfolio)

News has only been positive from this small developer of spirits brands. No reason for me to take any action or fret about the share price.

- Next (LON:NXT) - minus 7% (3% of my portfolio)

Managing the transition to online very well and with a clear plan to close its retail estate if necessary. Happy to continue holding.

Conclusion

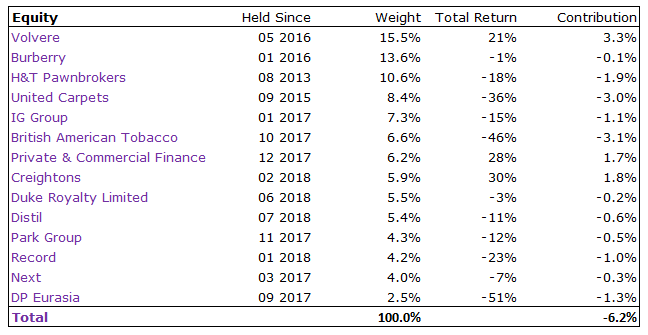

To estimate my equity performance for the year, I've taken a weighted average of the performance of all of these shares and also Duke Royalty (LON:DUKE) (held since June 2018).

For the purposes of this exercise, I will exclude from the calculation:

- my fixed income investments (IS SHRT DUR HY CRP BD USD (DIST) ETF (LON:SDHG) and Ranger Direct Lending Fund (LON:RDL) )

- shares added to the portfolio in November and December (which haven't made a material impact anway)

- some short-term, net profitable trades in Inland Homes (LON:INL) and GAME Digital (LON:GMD).

Multiplying the total return of my equities by their weight in the portfolio at the start of the year, I am left with a total return for 2018 of minus 6.2%.

It's not what I would have hoped for, but when the markets are down by 9.5% (All-Share) and 18% (AIM), it is satisfactory.

Personally, I would be satisfied if I beat the FTSE All-Share by just a few percentage points each year. Over many years, these points compound higher and can produce a fine result.

My calculation looks like this. They are ordered according to their size at the beginning of the year (or whenever I bought them):

Looking forward, valuations across the board have taken a bath, so our expected returns in 2019/2020 are that much higher.

My new year resolution is to avoid making the same mistakes again - in particular, I feel that the the types of losses suffered in United Carpets (LON:UCG), DP Eurasia NV (LON:DPEU) and Record (LON:REC) were silly and can be avoided in future. I will be moving up the quality spectrum with future investments, that is for sure.

Regardless of whether you feel you had a good year or a bad year, I hope that it has been fun, educational and worthwhile. This is a long-term sport so it's important to keep the right perspective, either way.

For me, it has been a wonderful year of learning and networking. I know that I'm not alone, heading into 2019 with a lot of exciting investments and ideas and with new friends to share the journey with.

Thanks for sharing it with us.

All the best

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.