Good morning!

Lots of trading updates today, so I will prioritise the companies I'm familiar with and which are most heavily requested in the comments.

I'm planning to start with:

- H & T (LON:HAT)

- SysGroup (LON:SYS)1

- Avingtrans (LON:AVG)

- Mothercare (LON:MTC)

Regards,

Graham

(Please note that I own shares in H&T)

H & T (LON:HAT)

- Share price: 338p (+3.5%)

- No. of shares: 37.4 million

- Market cap: £126 million

Another positive update from this pawnbroking group which I have held in my portfolio since 2013.

Profit before tax for the full year will be ahead of current market expectations.

The Group has delivered another good performance in its lending operations. The pledge book increased 11.6% to £46.1m (31 December 2016: £41.3m) as a result of the higher gold price, the concession format and an increase in loans on quality watches. The Personal Loans book has increased by 94.7% to £18.3m (31 December 2016: £9.4m) as a result of the expansion in our longer term, lower interest rate loan product.

Like its smaller rival Ramsdens Holdings (LON:RFX), H&T realised there were major opportunities in products related to pawnbroking. As you can see, its personal loans offering has taken off very well. I'm hoping to see it keep growing in size and maybe even start to rival the pawnbroking pledge book in the years to come.

Jewellery retailing is reportedly also going well, including through the development of click-and-collect online sales.

Finally, the outlook statement is confident. CEO comment: "Demand for our products remains strong and we look forward to the future with confidence."

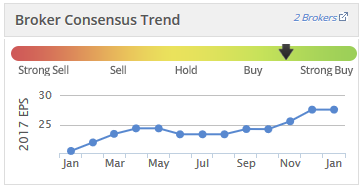

You can see for yourself the evolution of H&T's earnings forecasts over the past year:

The updated EPS forecast now is likely to be pushing 30p, based on increasing another 7-8% from here.

Checking some gold/GBP charts, the average price of gold in 2017 was indeed materially stronger compared to 2016.

H&T has a lot more going for it, though, than just the price of gold.

The personal loan product (see here) is very competitive for that segment of the market which has been shut out by the banks. Daily bank overdraft fees can also have a huge implied APR, something which is easily overlooked!

Increased lending on quality watches is also worth a mention. When a customer presents an item to pawn, H&T has a facility which lets it send high-definition images of the item from the store back to central office, where jewellery experts determine its value. Expertise in watches is an important part of the company's overall offering.

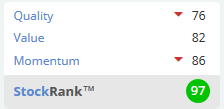

The StockRank is still excellent:

Funnily enough, I agree that Quality is not especially strong for H&T. It's essentially a financial firm, and it's never going to compound in value to generate exponentially larger returns, like some rare stocks can do.

But it is the undisputed leader in its sector, its management is highly competent as demonstrated by how they have navigated through both benign and difficult macro conditions, and it has discovered some exciting growth opportunities, particularly in personal lending.

On top of all that, thanks to the improved performance, the stock remains quite cheap on conventional valuation metrics, trading at a PE ratio of just 11x.

What else can I say, except that I'm a happy holder.

SysGroup (LON:SYS)1

- Share price: 320p (-17%)

- No. of shares: 12.4 million

- Market cap: £40 million

Yet another blow to shareholders from this market research/brand consultancy.

We've been covering it for a while here. Concerns have been plentiful:

- The rebranding from "Brainjuicer". It had a quirky, unique name. It changed this to a more generic name where it didn't own the .com domain. They are the brand experts, not me, but I preferred the original name!

- Very little visibility on sales. The company has been completely honest about this.

- As a people business, potential vulnerability to staff costs taking a big bite into profitability. In H1 2017, expenses rose due to staff costs. This unfortunately coincided with a 9% reduction in gross profit, producing a 70% decline in net income.

Today's announcement sees things getting worse:

Q3 trading continued to be worse than anticipated and, subject to its normal lack of revenue visibility, the Company now anticipates Gross Profit for the year to 31 March 2018 will be around 20% less than the prior year.

As the year has progressed, the Company has taken steps to reduce overhead cost growth. After overhead growth of 8% in H1 (with investment in headcount growth in the US and the Advertising Agency), we anticipate overhead growth over the year as a whole in low to mid single digits. On this basis the Company expects Profit before Tax for the full year to be a little over break-even (2016/17: £6.3m).

There has been a dramatic mismatch this year between the company's hiring plans and the business which actually came through the door, resulting in this collapse in profitability and now an attempted reversal of the trajectory in cost growth.

Profit before tax in H1 was £0.85 million. If the full-year result is "a little over breakeven", it says to me that the company is currently loss-making.

It's a remarkable change in fortunes for a company which had one of the most consistent track records in profitability over the past 10 years.

Checking the interim results, the company said the following:

Were the gross profit decline seen in H1 to be repeated in H2, then our profit before tax for the full year would decline by 50% to 60% (2016/17: £6.3m).

That was at the end of October.

For the company to now be saying that the full-year result will be close to breakeven, suggests a very bad lurch lower in financial performance over the past quarter.

What would concern me now is that if the company will have to reduce headcount, this will result in large severance payments, further reducing profitability in the short-term.

Of course, it's also possible that the company will make a speedy recovery, and that can't be entirely ruled out. It talks today about a new advertising product which it is selling to existing corporate clients, and which it hopes will generate more stability to revenues going forward.

But shareholders are right to be concerned. When news of difficulties in H1 first emerged, a more competitive market was cited as one of the reasons for the slowdown in sales. Every trading update since then is consistent with the idea that this company has lost its mojo and that competitors have caught up with its product offering!

It does have a strong balance sheet, with £4.6 million, so at least there is no question for now about it being in financial distress.

I tend to steer away from "people businesses" these days, but I'll continue to keep an eye on this, for signs of potential recovery. It's still conceivable that this year has been a particularly unlucky one.

As the company said in the interim results:

Whilst [the] variability in individual clients or markets can be marked, the positives and negatives have historically tended broadly to offset each other, and our results in aggregate in any 6 month reporting period have appeared more predictable and stable than in fact they are. Our order book and pipeline can change quickly, both for better or for worse.

Avingtrans (LON:AVG)

- Share price: 202.5p (+4%)

- No. of shares: 31 million

- Market cap: £63 million

Pre-close trading update and notice of results

This is an engineering technology group which recently took over Hayward Tyler (LON:HAYT) in an all-share deal. So the share count is a lot larger now, and the company a lot bigger, making prior-year comparisons difficult.

We shouldn't complain about that, as these complicated situations can sometimes make for good buying opportunities, if we are willing to do the work to understand them!

Performance so far this year is in line with expectations.

The key financial performance indicators of revenue, gross margin and EBITDA are all tracking the Board's expectations and the Company continues to secure new business in generally improving market conditions. A number of notable contracts were secured in the period, worth almost £7m in total...

Avingtrans had last-reported net cash of £26 million, while Hayward Tyler had net debt of £22 million at its last annual results as an independent company.

The combination of the two companies, therefore, has enabled Hayward Tyler to pay off its more expensive sources of funding, and also to renew its more attractive facilities, putting it back on a stable financial footing.

This is along with the other standard efficiencies you get from a larger listed company. Cost savings have been realised, as anticipated.

Therefore, the Board is pleased to report that the opportunities for the long term profitable growth of the enlarged Avingtrans group as presented by the acquisition are as expected.

I've just been reminding myself about the rationale originally presented for the deal. The idea was that the enlarged group, including Hayward Tyler (which designs and manufactures specialist motors and pumps) would become a leader in the nuclear power and gas sectors.

Hayward Tyler has a long history stretching back to the 19th century, and had a record order book when financial difficulties pushed it into the arms of Avingtrans.

The group is forecast to earn adjusted PBT of £2.1 million in the year ending May 2018, rising to £3.4 million the following year.

That's still not cheap on a PE basis, but it's worth bearing in mind that a decent chunk of spare cash might be left, depending on how much is being used to pay off Hayward Tyler's debts. This could enable a further acquisition in due course.

Overall, therefore, this looks interesting. I still don't feel sufficiently fluent with the story to buy the shares personally, but will continue to study it.

Mothercare (LON:MTC)

- Share price: 45.5p (-27%)

- No. of shares: 171 million

- Market cap: £78 million

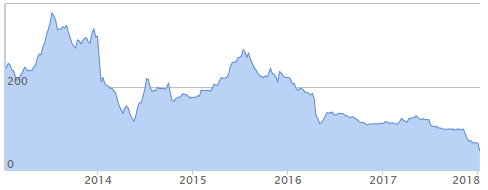

This is a high-profile casualty of the decline in high street footfall. This chart tells the story of the past five years:

It wants to be "the leading global retailer for parents and young children", but the format isn't working as parents are clearly preferring to migrate to the Amazon Baby Store (external link).

And if the old, high street retail format doesn't work, it's not as simple as just setting up a website and enjoying online growth instead. You still need to match the cost efficiencies of Amazon.

Anyway, these results are worrying to say the least. For the 12-week Christmas period, UK like-for-like (LFL) retail sales are down 7.2%, and even UK online sales are down 6.9%.

However, as Paul has previously pointed out and as the company re-iterates in today's footnotes, sales on iPads in its stores are included in Mothercare's online sales. "Online" should really just include website sales.

With store closures taken into account, total UK sales are down 11%.

International retail sales also misfired, down 3%.

It strikes me that the company is striving to protect a brand that most parents don't care about:

In our UK business, we took a conscious decision to remain at full price to protect our brand positioning prior to Christmas but to then discount more heavily in the end of season sale. We have subsequently seen good progress with strong sell through rates on Autumn Winter clearance lines albeit these carry lower margins and will lead to a further reduction in full year margin as a result.

Protecting a brand makes sense in fashion, but does it make sense in baby products? I'm not so sure! I'd have guessed that most parents just want cheap prams and car seats which meet basic levels of safety!

So I don't see this company recapturing mass-market appeal. Maybe it would be better off deliberately targeting the much smaller niche of wealthy parents who are willing to pay up for a brand name and for in-store customer service, rather than pursuing its current strategy?

The company is loss-making and may not have all the time in the world to cut its costs. Besides a hefty pension deficit, its financial debt is growing, and now forecast to be £50 million at year-end in March:

We expect net debt at year-end of approximately £(50)m, and at this level we have sufficient liquidity and covenant headroom within our existing facilities.

Can we conclude from the above statement that net debt higher than £50 million might not allow for sufficient liquidity and covenant headroom?

Net debt was c. £38 million at H1, so it is set to have grown at c. £2 million per month during H2.

Last year, its facilities were increased to £67.5 million (£62.5 million revolver plus £5 million overdraft).

So my conclusion is that it will have £17.5 million of headroom at year-end. It will then face into the seasonally more difficult H1 period. On this basis, it's not hard to imagine the company needing to raise more equity in FY 2019. I would not choose to put any more money into this company with its current strategy, but hopefully it will be up to shareholders to decide!

Craneware (LON:CRW)

- Share price: 1598p (+4%)

- No. of shares: 27 million

- Market cap: £431 million

Trading Update and Significant Contract Win

Craneware is a successful company providing software to US hospitals.

This update confirms that management is confident in meeting market expectations for the full year, based on the first half which has just ended in December. The forecast on Stockopedia is for revenues to climb to $66 million, up 14%.

H1 revenue growth has been a little stronger than that, up 15%-18%, so given the "confidence" expressed today, maybe we can pencil in a potential earnings beat here?

We also read about a "significant contract win":

This contract is expected to deliver in excess of $16m of revenue over its initial five year term as Craneware's Value Cycle solutions are utilised by over 75 new facilities across the Network.

Note the "initial five year term". Craneware makes great play of its revenue visibility, and this is likely to be well-justified given the nature of its customers. Hospitals are sticky, much like the public sector (see £IDOX). Projects can last for years, and customers can easily stick around for a decade.

Quickly reviewing the Craneware service, it helps hospitals improve what it calls their "value cycle". This is described as follows:

It includes traditional RCM [GN note: revenue cycle management] components such as pricing, charge capture, claims performance and compliance, but also addresses additional dimensions, such as: quality of care, patient satisfaction and engagement, clinical outcomes, operational efficiency and risk management.

If it does what it says on the tin, this makes it a highly sophisticated offering. Perfect for the healthcare system in the US which is still majority-owned by private institutions and based on the private healthcare model.

Long-term, I wonder if Craneware could make inroads into the UK/European public hospital sector? Or are the differences in how they are operated too deep? It has previously described the NHS as a growth opportunity.

For now, this remains a highly-rated and high-performing growth stock. Valuation is about 40x on a PE basis, using figures for the year ending June 2018. On a "next 12 months" basis, Stockopedia puts the PE at about 36x.

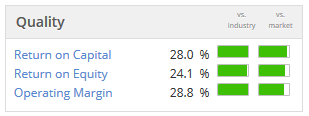

It has accumulated cash of $50 million, and the strength of the performance is illustrated by these quality statistics:

Conclusion - I'm struggling to come up with something less obvious than the fact that the shares are fully-valued at this price.

Checking the archives, I last covered Craneware a year ago, when the stock was trading at 1350p and the PE multiple was just over 30x. At the time, based on the company's terrific track record, I said "it would not surprise me at all if the current share price was a fair entry price".

With the shares now around 1600p, I wouldn't feel in any rush to buy into this. Valuation is now pushing the boundaries of credibility, even given the excellent company that it is. That said, long-term holders will feel justified in continuing to hold.

Touchstar (LON:TST)

- Share price: 76.5p (+13%)

- Share price: 6.3 million

- No. of shares: £5 million

I'm mentioning this tiddler for the sake of completeness, as it is probably too small for most of us to consider investing in.

It was formerly known as Belgravium Technologies, before changing its name in 2016.

The full-year adjusted profit after tax is forecast at £400k, in line with expectations.

This implies a significant improvement in H2, as the equivalent adjusted H1 figure was just £133k.

Note that the company was in fact loss-making in H1, due to some exceptional costs.

It also announces today that it has rolled out its retail software to the Sri Lankan Airlines fleet, while there has also been a positive development with its fleet management system being taken up by a new client.

The metrics are potentially cheap here if the momentum carries through into 2018, for those who are willing to buy into such small companies as this.

Thanks for dropping by. You'll be in Paul's capable hands tomorrow!

Cheers,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.