Good morning, it's just Paul here with the SCVR for Monday.

Today's report is now finished.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to cover trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research) - don't blame us if you buy something that doesn't work out. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Agenda -

Paul's section:

Nightcap (LON:NGHT) - trading update buried in a new site announcement. Trading well. Read-across for other hospitality companies maybe?

Mccoll's Retail (LON:MCLS) - capital raising being considered. The perils of a weak balance sheet, with too much debt (combined with a marginal business).

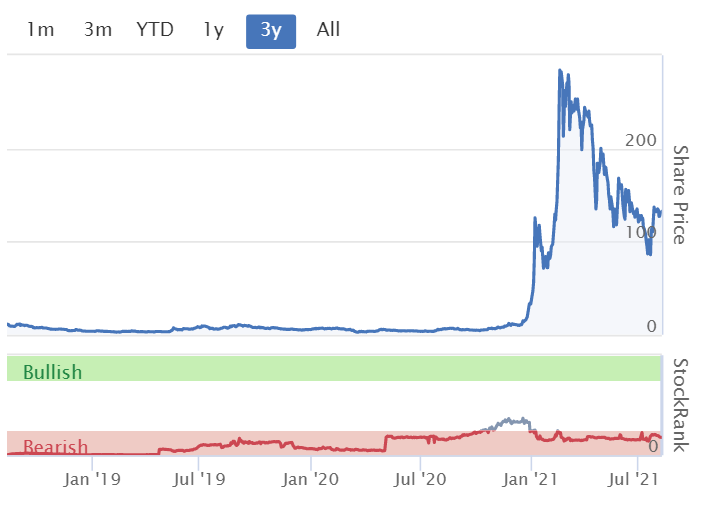

Argo Blockchain (LON:ARB) - impressive interim results from this blockchain miner. Short sellers launch an attack on the company.

Smartspace Software (LON:SMRT) - trading update from this small software company. A little bit too early stage for me.

H & T (LON:HAT) - solid H1 numbers despite the pandemic. Amazingly strong balance sheet. Positive outlook. Looks good!

Nightcap (LON:NGHT)

21.5p (Friday’s close) - mkt cap £40m

This is a chain of bars run by Sarah Willingham (CEO) of Dragon’s Den TV fame.

A new site in Bristol is to be opened before the end of 2021.

Five other sites are in “legal negotiations” - ambiguous, does that mean they’ve signed heads of terms, or not?

Trading update - is slipped into this RNS, it really should have been included in the title, as it’s so easy to miss otherwise.

The Company's bars have continued to trade well ahead of management's expectations since the relaxation of the UK Government's Covid restrictions on 19 July 2021 and the Company has put in place procedures to ensure that all of its bars remain open and appropriately staffed throughout.

Its large bar in Birmingham is doing particularly well.

My opinion - this positive update (but no figures given) comes after a very strong update on 8 June, which I reported on here. My guess is that the +53% sales uplift (on 2019 comps) for the first 3 weeks of re-opening has probably moderated somewhat since. Maybe that’s why no figure is provided today? Although it's not a full trading update today.

NGHT raised £10m in a placing at 23p for expansion.

Does it have anything distinctive to justify its premium valuation? Not really, it just looks like any other chain of bars to me, hence I wouldn’t pay the current high valuation for novelty as a new listing (same opinion as Various Eateries (LON:VARE) ).

We get a lot more bangs for our buck with Revolution Bars (LON:RBG) (I hold) shares in my opinion, and late night bars are really much of a much-ness, so I think buying shares in the cheaper one (RBG) makes more sense.

It's interesting to see from the chart below, how NGHT shares got an initial large surge on its listing in Jan 2021, but has since moved largely in step with RBG.

.

Mccoll's Retail (LON:MCLS)

35p - mkt cap £40m

Sky News often seems to get advance notice of impending deals, and it reported on Sunday that McColl’s is seeking to raise £30m in fresh equity, partly to repay debt, and the rest for apparently re-branding some of its convenience stores as Morrisons.

With a discount, this could end up maybe doubling the number of shares in issue, so hefty dilution.

Sky also says that McColl’s CEO was likely to invest a 7-figure sum, which would be impressive, if true.

Response to media reporting - McColl’s updates us this morning, confirming that it is “exploring options” to raise capital, to strengthen its balance sheet and roll-out more Morrisons Daily store conversions.

My opinion - it’s not a good business, and has a terrible balance sheet with worryingly high debt. Hence dilution was only a matter of time, which I’ve been pointing out here for years.

Probably the best shareholders can hope for here, is that someone buys it for strategic reasons. Would anyone want it though? Morrisons might be an obvious buyer, as they could possibly strip out duplicated costs? Although they’re rather busy at the moment.

.

Argo Blockchain (LON:ARB)

129p (down 2%, at 08:40) - mkt cap £490m

Interim Results & Mining Update

Argo Blockchain, a global leader in cryptocurrency mining (LSE: ARB), is pleased to announce its results for the six months to 30 June 2021. Argo Blockchain plc is a global leader in cryptocurrency mining with one of the largest and most efficient operations powered by clean energy. The Company is headquartered in London, UK and its shares are listed on the Main Market of the London Stock Exchange under the ticker: ARB and on the OTCQX Best Market in the United States under the ticker: ARBKF.

I’ll try to look at the numbers dispassionately, which will be difficult because I am firmly of the view that cryptocurrencies are entirely a speculative frenzy, doomed to eventual collapse. If you disagree with me on that, then have a read (or re-read) of Kindleberger’s classic, “Manias, Panics, and Crashes”, for the historical perspective, which reminds us that speculative manias are very common throughout human history. Crypto ticks all the boxes.

On to ARB’s interim numbers -

- Revenues up 180% to £31.1m

- Pre-tax profit of £10.7m (strikingly higher than just £0.5m a year earlier)

- Mining margin of 81% - impressive

- Share based payment of $1.57m

- Bitcoins held on balance sheet: 1,268, at $43,700 each today = $55.4m

- Heavy capex of $29m, which all seems to be land & buildings (a 160 acre site in Texas, called the Helios project, for crypto mining using clean energy), which has not yet come online - this will increase capacity when it comes on line (first stage in H1 2022)

I won’t repeat all the commentary on operational activity, see the RNS if it interests you.

Outlook - an excerpt -

… These factors enabled the Group to manage its cash resources through a highly volatile pricing environment for Bitcoin, which impacted mining margins and difficulty rates across the sector for much of the period. As we move to an owned and operated model, we expect hosting costs to reduce and provide the potential to enhance margins further...

Balance sheet - looks OK, but obviously the volatile nature of crypto means the $31.9m “digital assets” in current assets is liable to gyrate all over the place, in an unpredictable manner.

My opinion - these are impressive numbers for H1, with a significant profit. The crux is obviously whether profits are sustainable. That depends entirely on what happens to the price of Bitcoin & other so-called cryptocurrencies.

Given that nobody knows what those prices will do, then it’s impossible to value this share.

If you think Bitcoin is going to the moon (why stop at the moon?!!) then this share could be of interest.

If like me, you think this is all a speculative mania, then this share could end up worth a fraction of the current price, just on a break-up value from a balance sheet liquidation (at least it has some property, so there’s value there, but nowhere near the market cap).

Definitely not for me, I’m just not interested in speculating on this kind of thing. Anything that creates vast wealth out of thin air, is inherently very risky, in my view, and probably a ticking bomb. Other people think cryptos are the future, whatever floats your boat. I don't feel the need to argue with anyone over this. I've got my view, and am steering clear of the whole thing, but other people can do whatever they like. Do remember though, it's not a profit until you've cashed out!

.

.

EDIT - my attention is drawn to an attack on ARB by short sellers, calling themselves Boatman Capital Research. Here's the link. Obviously I'm not endorsing or judging that report in any way, as I don't know anything about the attacker. You have to bear in mind that these type of reports are designed to create panic selling, so that the short sellers can make a fast buck by buying back their short position at a more advantageous price.

Smartspace Software (LON:SMRT)

150p (down 10%, at 09:47) - mkt cap £44m

SmartSpace Software Plc, (AIM:SMRT) the leading provider of 'Integrated Space Management Software' for smart buildings and commercial spaces - 'visitor reception, desks and meeting rooms', today provides an update on trading and the expected financial performance of the Group for the six month period ended 31 July 2021.

Any fall today needs to be seen in the context of a stellar run up since the lows c.16p in April 2020 - almost a 10-bagger. I’ve never really seen the attraction of this share, so clearly I must have missed something given its large re-rating in the last year or so.

Jack reviewed its unimpressive results for FY 01/2021 here, on 10 May 2021. Covid had an impact, but those results are a reminder that this is a very small business, still loss-making, and the £44m market cap rests entirely on expectations of considerable future growth.

Trading update today -

- Annualised recurring revenue (run-rate, i.e. forward-looking) is £3.8m, up 28% in the 6 month period - good growth, but still a very small number.

- H1 revenues of £2.5m (not much changed from H1 LY of £2.3m, but 63% is now recurring, 45% LY)

- SwipedOn software is the main product, others look very small (e.g. Space Connect) only £0.4m ARR

- Cash at 31 July 2021 of £3.4m (down £1.1m in 6 months)

- Covid & lockdowns still having an impact & uncertainty

- H2 expected to see stronger growth, as offices re-open

- Outlook - expecting growth in line with market expectations

My opinion - there’s much more detail in the announcement, but I’ve already decided it’s not for me. My main concerns are -

- Market cap is anticipating strong growth, asking us to pay >2 years up-front, ahead of those numbers actually being achieved, which seems a stretch to me.

- There must be numerous other companies in this sector, offering similar software products for managing meeting rooms, offices, etc.

Therefore I think this share rests entirely on being very confident that its products are the best, and are likely to achieve considerable growth. Personally I’m not keen on paying up-front for an outcome that is uncertain. So it’s a bit too early stage for me, but I’ll monitor it with interest in future. That said, when you do spot something special early on, the rewards can be great. Maybe that's already happened though?

.

H & T (LON:HAT)

293p (up 7%, at 10:21) - mkt cap £116m

CFO Appointment - Diane Giddy - formerly held senior roles in a large South African financial group called FirstRand.

H&T Group plc today announces its interim results for the six months ended 30 June 2021.

H&T is a pawnbroker, and high interest lender, and also retailing from its shops.

This 6 month period was impacted by store closures during lockdown. The prior year comparative would also have been impacted by lockdown 1. So I’m not sure how much value there is analysing these numbers, due to that disruption?

Key numbers -

- H1 revenue £51.9m

- Profit before tax £4.65m - seems decent, given disruption from lockdowns

- H1 EPS (diluted) 9.29p (was 10.2p H1 LY, and 32.1p last full year)

Balance sheet - absolutely fantastic - one of the strongest small caps I’ve seen. NAV is £135.9m. Deduct £21.6m in intangible assets, results in £114.3m in NTAV. That includes £32.5m in cash, with no borrowings. Bulletproof, in a word.

High cost personal loans - this activity seems to be winding down due to regulatory issues - I'm not sure if any fines are likely?

Forex will also have been impacted by restrictions on overseas travel - potential upside here in future?

Withdrawal of lenders creates an opportunity, with H&T saying it is “the clear market leader”.

Outlook - sounds good -

The business has positive trading momentum and a strong, debt free balance sheet. The momentum seen in May and June has continued into the third quarter, with further growth in the pledge book to £52.2m as at 31 July. Retail sales continue to outperform and we have seen a recent increase in FX volumes as overseas travel begins to recover.

Notwithstanding the ongoing uncertainties presented by the Covid - 19 pandemic, the Board believes there are highly attractive growth opportunities for the Group, including the potential for further market consolidation, and we view the future with optimism and excitement.

My opinion - no wonder the share price is up today. We get solid H1 profitability, despite lockdowns. The balance sheet is superb, and has a higher NTAV than the market cap, very unusual.

Also outlook comments seem positive. It sounds like there is scope for HAT to buy competitors, and it has the cash to do so.

Lots to like here, providing the company can safely navigate the regulatory minefield of high cost lending.

Looking at the long term chart below, it's basically gone sideways for 12 years, with a lot of volatility. So the main attraction of this share is the flow of divis.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.