Hi, it's Paul here, I'm on duty this week.

Estimated timings - I intend starting fairly early, and finish time will depend on how much news there is to report on. Update at 11:21 - OK that didn't work out as planned. I'm on the case now, please see the list of shares I'll be reporting on in the title above. Estimated completion time: 3pm. Update at 15:07 - I'm still plugging away, most of the report is now done, but I'll add a bit more. So probably finishing about 15:30. Update at 15:19 - today's report is now finished.

Fireangel Safety Technology (LON:FA.)

Share price: 9.75p (down 24% today, at 11:26)

No. shares: 75.9m

Market cap: £7.4m

Trading update (profit warning)

FireAngel (AIM: FA.), one of Europe's leading developers and suppliers of home safety products, announces an update on trading for the year ending 31 December 2019.

This company makes smoke alarms. It has been incredibly accident-prone in recent years, with multiple seemingly self-inflicted wounds.

Revised guidance for 2019 is given today by the company;

Revenue for the year ending 31 December 2019 is now expected to be below previous market expectations in the range £44.5 million to £45.0 million and the Company's underlying operating result, before the impact of the change to straight line amortisation previously described in the Company's interim results announcement released on 24 September 2019, is expected to be a loss in the range £2.6 million to £2.9 million. This is based on exchange rates as at the date of this announcement.

I can't find any recent broker notes. However the consensus forecast shown on Stockopedia is negative, at -£2.74m (this is after tax). Not dissimilar from the revised figure quoted by the company today.

What's gone wrong? - rather lame excuses in some cases, but at least plenty of detail is given;

- Sales growth of c.20% has "stressed the company's processes from production right through to customer fulfilment" - does that sound like a well-managed company? No.

- Repeatedly losing small amounts of revenue & margin

- Sales mix in Q4 worse than expected

- Additional costs to re-work some stock lines

- Costly air freight charges to meet deliveries

- Strengthening sterling

Outlook - significant opportunity to increase its gross margin higher.

2020 profit guidance reduced to £0.5m, or £4.4m EBITDA (a meaningless figure, due to capitalised development spend).

R&D strategy being focused on higher margin products.

Directorspeak - can be safely ignored, given the historic inability to provide accurate forward guidance.

Balance sheet - nothing is said about this today, but looking back to the most recent figures, its balance sheet was actually not too bad at 30 June 2019. HSBC very cleverly must have encouraged/forced the company to do a fundraising in early 2019, which paid off the revolving credit facility. Instead the company now uses an invoice discounting facility. That probably saved the day, given how performance has undershot forecasts.

I think the company could survive, if it is able to operate around breakeven in future. If there are any further significant losses in future, then going concern could become a major issue here.

My opinion - I feel management has zero credibility, after a catalogue of failure, and having burned through a previously large cash pile.

However, with the market cap now down to only £7.4m, then if they do get things even halfway back on track, punters could see a profit from the current bombed out level. Looking at the two-year chart below, that's probably what people thought all the way down from 200p+ to now sub-10p.

Are the chances of recovery any more realistic now, than they were? There might be a chance of a takeover bid too, maybe?

Buying at this level could result in a 100% loss, so this share is purely for punters prepared to take that risk, at this stage. It feels like a binary outcome is likely - either a multibagger if they get the business back on track, possibly a takeover bid, but the most likely outcome seems to be a gradual grinding down to eventual insolvency. Let's hope that for shareholders, and employees sake, management pull their fingers out, and improve performance.

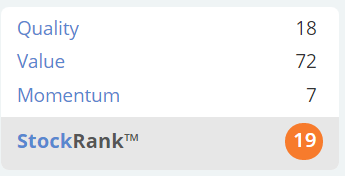

Stockopedia's computers also deliver a negative view: "Value Trap" classification, and a very poor StockRank;

Angling Direct (LON:ANG)

Share price: 69p (up c.5% today, at 12:09)

No. shares: 64.6m

Market cap: £44.6m

Angling Direct plc (AIM: ANG.L), the UK's largest and fastest growing fishing tackle and equipment retailer...

This company operates a mix of online sales, and from physical stores - the total now having just increased to 33 sites.

Black Friday trading has been good, with profit up 49.5% vs last year, due to limiting discounts to 10% on core product ranges. Presumably that means larger discounts were offered for non-core products?

Overall trading is in line, so this RNS shouldn't really have moved the share price;

The Company continues to trade in line with market expectations and management is confident that it will continue to deliver growth through the second half of the year.

Note that the financial year end is 31 January.

Valuation - this type of share is difficult to value, because it's not yet making any profit - hence PER doesn't work.

It's really all about whether you think, several years in future, this would be likely to be a larger & more profitable business? Plus, whether you're prepared to tie up your money for several years, to wait and see, with no dividend income whilst you wait (hence an opportunity cost).

Balance sheet - is excellent, with £13.2m net cash, almost a third of the market cap.

My opinion - given the very strong balance sheet, ANG looks fully funded to expand further. It seems to have a "roll up" strategy to buy up small angling businesses. Providing its paying modest prices for them, then that could work.

Note that competitor Fishing Republic went under, and was I believe bought by JD Sports. Looking at its website, Fishing Republic seems to be becoming a more serious competitor now that it has the financial backing of JD Sports. Note that new stores have been opened by FR in Milton Keynes, Central Manchester, Doncaster & Rotherham. One of the pictures shows Fishing Republic within an existing milletts store (outdoor clothing & equipment), which seems an ideal fit for fishing paraphernalia.

Fishing Republic's website says that it is not currently taking online orders, due to a website upgrade. Perhaps that might have helped ANG do well over Black Friday, if FR's website was not taking orders then?

The competitive threat from JD Sports looks to be very serious, which puts me off investing in ANG.

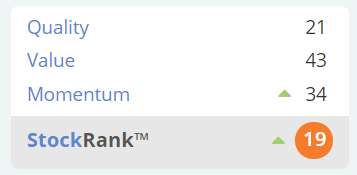

Stockopedia throws a bucket of cold, slimy, live maggots over us, with a low StockRank for Angling Direct;

Amino Technologies (LON:AMO)

Share price: 105p (up slightly today)

No. shares: 76.0m

Market cap: £79.8m

Trading update & board changes

Amino, the technology provider for modern TV experiences, announces a trading update for the year ended 30 November 2019 ("FY 2019").

I won't spend too long on this, as it's just in line;

The Group expects to report trading performance in line with market expectations.

Cash position & acquisition - this previously cash-rich company has spent its cash pile on an acquisition;

...net cash position of $1.4m at 30 November 2019 (30 November 2018: $20.3m) reflecting the impact of the 24i acquisition and dividend payments.

The way I look at things, this could make the previously big dividends less reliable, since there's no longer substantial cash cover to pay big divis. Therefore, I'd want to see clear evidence that the acquisition of 24i was a good decision, otherwise the shares would be less attractive than before.

The house broker points out that the net cash figure above implies strong free cashflow for the year, of $8.5m.

A new bank facility of $15m has been agreed, for 3 years.

There's another announcement today here, which is a non-regulatory one, talking about a contract win that combines Amino's product with the 24i's product. No figures are given, so I cannot assess how important this is.

Valuation - the forward PER is low for a technology company, at only 9.8.

Dividend yield of 7% looks great, but as mentioned above, is no longer supported by a big cash pile, so could come under threat perhaps?

My opinion - the valuation metrics look attractive. Therefore, I think this company looks worth a closer look. I don't have any opinion on its prospects, as I know nothing about its industry. I suppose the reason for its low valuation, might be that set top boxes could be seen as old hat, with younger people perhaps just streaming TV directly onto their tablets & phones?

In terms of the figures, it looks attractively valued.As with all shares, it's up to you to decide what the company's future potential could be like, I just report on the figures!

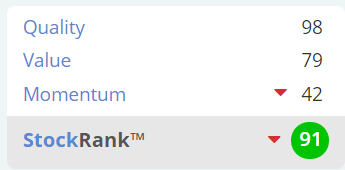

Stocko loves it:

Hardide (LON:HDD)

Share price: 62p (up c.2% today, at 14:37)

No. shares: 49.1m (taken from most recent "Holding in company" RNS)

Market cap: £30.4m

Hardide plc (AIM: HDD), the developer and provider of advanced surface coating technology, announces its preliminary results for the year ended 30 September 2019.

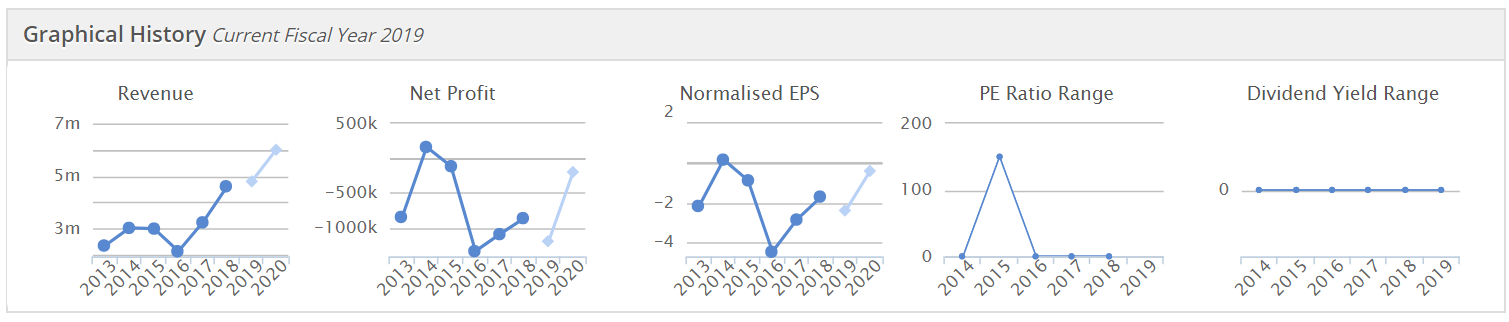

This tiny company has be around for a long time, having listed on AIM in 2005. It has intrigued me, as the product looks promising (special treatment to harden components, e.g. for aerospace), and the client list has looked very impressive. So clearly the product works, and the upside case would be all about scaling up with major contracts. That hasn't happened as yet, although as you can see, revenues (but not profits) have shown some growth, but are still small;

Therefore, it would be fair to consider this a jam tomorrow share, given that ambitious £30m market cap for a loss-making company that doesn't pay divis.

Figures today look lacklustre to me, in the context of the £30m mkt cap.

- Revenues up only 10% to £5.1m

- Gross profit unchanged at £2.4m (margin down from 52% to 48%)

- Operating loss of £1.2m (worse than £918k loss LY)

Balance sheet looks solid. Net cash of about £4.6m. Share capital + Share premium accounts have gone up (in reserves section), hence it must have done an equity fundraising during the year.

Quite a bit spent on capex, at £1.1m. Would they need to spend more on capex if a large order were to be won? Ah yes, here's the fundraising shown on the cashflow statement at £3.6m net proceeds from issue of ordinary share capital.

Outlook comments need to be good, to support the £30m mkt cap. Is this good enough?

The start to the new financial year has been strong and the Board is confident of continued revenue growth and business diversification in the coming year. The Board expects gross profit margins to remain at levels comparable to the second half of FY2019.

The project to relocate the business to a new site is on-track and we are looking forward to operating from the facility in autumn 2020 and to the increase in capacity this will provide. This move will enhance efficiency and open up new business opportunities, as well as presenting a modern facility to our blue-chip customer base and investors. The costs of the project are being monitored closely and are expected to be borne in the current financial year. The Board aims to ensure that the asset base of the Group matches its needs for the future and will invest further to deliver this.

The new facility bit interests me. Thinking back, another engineering company, £ABDP saw expansion in its facilities put a rocket under the share price a few years ago. Could the same sort of thing happen here? I've no idea, that would need a lot more research to find out. There would need to be clear evidence that HDD is turning away business, as it can't cope with demand, to really get me interested.

There's some interesting stuff in the commentary of today's RNS, about potential new orders, e.g. from Airbus suppliers.

My opinion - potentially interesting, for people prepared to have a punt on something that seems to be permanently promising jam tomorrow. One or more major new orders could be transformative. The other key issue to look into would be IP protection. Gross margin of around 50% suggests that HDD does have some pricing power. That gives decent operational gearing if & when they win some decent-sized orders.

Winning some bigger orders, is what this share needs. Without that, the market cap looks too high & could fall as investors get tired of continued modest performance. If it does win some major orders, then it could be a multi-bagger. Unfortuantely, I have no idea which is the most likely outcome! That's up to you to decide.

Trakm8 Holdings (LON:TRAK)

Share price: 21.25p (down c.5% today)

No. shares: 50.0m

Market cap: £10.6m

Trakm8 Holdings plc (AIM: TRAK), the global telematics and data insight provider, announces its unaudited results for the six months ended 30 September 2019

I won't waste much time on this. I've had a quick skim of the figures published today, and the balance sheet looks very stretched. A continuously loss-making company, with net debt of £6m, looks like a recipe for disaster.

It's holding out the prospect of an improved H2, but if that doesn't happen, then I reckon an emergency fundraising could be necessary. The holders of its debt must be worried. Shareholders should be very worried.

Overall, the debt on its balance sheet makes this very high risk. I wouldn't touch it, unless/until the balance sheet is restructured to eliminate the debt. Even then, why get involved at all, given that TrakM8 seems to struggle to make any profit. This is in a sector where there are rich rewards to be had - e.g. look at Quartix Holdings (LON:QTX) for a highly profitable & cash generative business, which turns away insurance telematics business because it isn't worth having.

That's it for today. See you in the morning!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.