Good morning from Paul (I'm back at work now) and Graham.

Mello Monday is tonight, starting at 17:00. There are 3 interesting companies reporting, that we've reported on here recently. Also a session on ChatGPT, and finally a panel discussion on the disastrous delisting of iEnergizer (LON:IBPO) so all very topical & interesting I think.

Delistings

Again this topic rears its ugly head. We often flag this here in the SCVRs as a sudden and brutal way that shareholder value can be destroyed, at least for small shareholders like us. I expect the tiniest companies, that have effectively failed in their business models, to delist, and frankly good riddance - I'd happily see several hundred micro caps disappear, and we largely ignore most of the obviously rubbish ones here at the SCVRs anyway. However, last week shocked everyone with a much larger company, iEnergizer (LON:IBPO) (over £500m market cap before the announcement, a lot less now), and highly profitable & dividend paying, suddenly announcing it was intending to delist, and it's a done deal given the CEO controls it with an 83% shareholding.

I was discussing IBPO with some investor friends over the weekend, and for me the conclusion is to reinforce my policy of not investing in any company where one individual has such extreme shareholder dominance (83% held by Anil Aggarwal). Or at least I would never invest in any AIM-listed company where such a ridiculous share ownership structure exists, because AIM has inadequate controls over the behaviour of a dominant shareholders. AIM allows companies to float with a clearly inadquate free float, and also allows the dominant shareholder to de-list any time they like, if they're above 75%, or can get there with the agreement of others. Surely we need a new rule to require at least 50% free float before companies are allowed to list on AIM? And maybe we should copy other international markets, where a dominant shareholder is restricted from voting in a delisting? Companies need to be forced to commit to a listing, even if it ceases to be convenient for a controlling shareholder.

However, this idea conflicts with my preference (following a lot of very successful investors) for family-run and controlled companies, which are often very good performers long-term. It was pointed out to me that both VP (LON:VP.) and Goodwin (LON:GDWN) are excellent companies, but have dominant individual or family shareholders. So does it boil down to whether or not we trust a dominant shareholder? VP & GDWN are however fully listed, not on AIM, so perhaps a full listing provides more protection? I haven't looked up the relevant rules, so if any readers are up to speed on the differences between a full listing, and an AIM listing, with regard to delisting, then please leave a comment.

Were there any warning signs at IBPO? Not really. It's been listed since 2010, and other than recent NED resignations, the dominant shareholder appears to have acted fairly (as far as I can tell) towards outside shareholders - with modest salaries & no share options I believe, and no dilution, it's had 190m shares in issue for the last 6 years, shown on the StockReport. So this delisting news appears to have come out of the blue, as a bombshell.

I also have a policy of not investing in AIM companies that operate overseas, as that has historically been a disaster area - with many overseas fraudsters deliberately choosing AIM to rip-off UK investors, since there won't be any consequences. Hence all the Chinese frauds on AIM - almost all of those that listed were blatant frauds. No capital punishment for fleecing UK investors though, they probably got a round of applause in China!

Which brings us back to IBPO. It doesn't look to me as if the 83% shareholder has done anything untoward. He's given it 13 years as a listed company on AIM, and has now decided the costs/hassle outweigh the benefits. In conclusion, I think the onus is on AIM to tighten its rules in this area - it must not allow dominant shareholders to list a tiny sliver of the equity and then delist whenever they like. As for us? It's just caveat emptor. Nobody is forced to buy any share, and personally I wouldn't go anywhere near any AIM share with a massively dominant controlling party/parties. IBPO just reinforces the importance of having this kind of rule governing our portfolios. Hindsight eh! Although we do tend to flag up if we see a very dominant controlling party in these SCVRs, and we'll redouble our efforts on that score, and ask readers to also flag any similar situations when they crop up here, so that we can all make informed decisions, being aware of the risks.

EDIT: Graham has also added his thoughts on delistings & takeover bids in his section below on Mind Gym (LON:MIND)

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Summaries

(with more detail in main sections below)

Medica (LON:MGP) - up 33% to 212p (£269m) - Paul - GREEN

An interesting company, has received a cash takeover bid at 33% premium, from IK Investment Partners (private equity). I consider below whether it’s enough to seal the deal? (maybe not, with only 20% support). This seems a good company, pity to see it potentially disappearing into private hands.

Mind Gym (LON:MIND) - up 0.8% to 64p (£64m) - Graham - AMBER -

Trading Update - in line. This corporate training provider is pleased with a strong H2 performance. All broker PBT estimates are unchanged. Has disappointed since the 2018 IPO, but at this valuation it’s more interesting than ever.

Lok'n Store (LON:LOK) - down 0.2% to 870p (£262m) - Graham - AMBER -

H1 results come out as expected and with a confident outlook statement for the year ahead. Higher rates have hurt property valuations but this remains an impressive founder-led business. Probably priced right.

Checkit (LON:CKT) - 28p (unchanged) (£30m) - Graham - RED -

H1 results are published which look in line with previously raised expectations. ARR is £11.5m and cash is £15m after around £9m was burned during the year. Potential for high rewards but these ones usually don’t work out.

Quick(ish) Comments

I’m struggling to get back up to speed today, after a week off, so let’s do some short sections to finish off -

Spectra Systems (LON:SPSY)

Down 13% to 160p - Paul - GREEN

News of the seemingly abrupt resignation of its CFO. No replacement has been found as yet, but the financial controller is stepping up to cover. I don’t have any particular insights over this, although as the 13% drop in share price today shows, some investors react negatively to CFOs in particular suddenly resigning. SPSY is a previous mystery share in my (Paul) podcast, so I have a favourable view of the company. Let’s hope nothing untoward is going on behind the scenes to trigger the CFO’s departure. I tend not to ask companies for more colour, as usually they just tell you any old garbage, to shut you up. After all, if something is wrong, they're not going to tell us, are they?!

Card Factory (LON:CARD)

Up 8% to 110.4p - Paul - GREEN

publication of accounts is delayed, announced today, moving from 25 April, to 3 May 2023. The reason? KPMG need more time to complete the audit, but it is stressed that this is routine, and a standard audit. Is this a concern to me? Actually not, because we’re seeing plenty of perfectly good companies say they need more time to complete audits - the accountancy firms are apparently short-staffed, presumably as the pandemic would have disrupted & delayed the usual flow of new graduate trainees each year? Don’t get me wrong, it’s not a good thing, but I’d say it’s understandable, providing we’re being told the complete truth of course. I see CARD as being a truthful company, so I’m not worried.

Why is the share price up today then? It’s because the slipped in a positive upward move in guidance for FY 1/2023, again. It’s now saying £463.4m revenues, and PBT of £52m+. Ignore EBITDA, as that’s a nonsense number of £112m.

This compares favourably with previous guidance (TU of 10 Jan 2023) of £48m PBT. So it looks as if the CFO has found an additional £4m profit down the back of the sofa after the year end - remember this audit adjustments, not improved trading. This suggests to me that policy on provisions, etc, could be nicely conservative. All good CFOs keep a bit of extra profit tucked away (creditors on the balance sheet), which can be released to the P&L as profit, to deliver a post year-end flourish! (or to cover up any mistakes that are identified during the audit sometimes! I’m speaking from experience here!). A lot of CFOs cheerfully admit they don't really understand IFRS 16, so adjustments there could boost or trim actual audited results.

Paul’s opinion - CARD is performing really well, and I’m delighted I included it in my runners-up watchlist for 2023 - where it’s the top-performing share, up 36% year-to-date. This list was 12 value/garp shares that almost made it onto my top 20 list here. They’re beating the small caps indices nicely, so as long as that remains the case, I’ll keep putting in the link here!!! ;-) If it all goes quiet, you’ll know something ghastly has happened to one of my picks! So far so good anyway.

I think CARD shareholders are on to a winner here. The finances are not completely sorted out yet, but that pales into insignificance given the strength of the P&L, and cash generation. Weak balance sheets are only a concern when those other measures are poor.

CentralNic (LON:CNIC)

Down 6% to 115p (£330m) - Paul - AMBER (almost red)

Q1 update today shows continued growth, and sounds upbeat saying, “the Directors remain confident that the Group will continue to trade at least in line with current market expectations.”

We’re told that a partnership with Microsoft is good news. Also something about ChatGPT.

Paul’s view - I’ve just reviewed the FY 12/2022 accounts, which we didn’t report on here previously. I just don’t like the numbers at all. In particular, how massive EBITDA actually turns into a negative lower down, at the profit after tax level. So all the profit above ($86m EBITDA) disappears by the time you reach the bottom. That scares me off, as I like clean accounts with no funnies, not a valuation that’s all based on adjustments.

Also the balance sheet is awful, with very big negative NTAV. Lots of cash, but lots more debt, so even though year end net debt seems reasonable, it looks window-dressed to me.

Staggering growth, but are profits sustainable? What happens when cookies are phased out? Tiny dividend yield suggests there isn’t much genuine cash generation to me.

It all mounts up to too many question marks, and a business model I don’t understand. Hence for me personally, it’s an avoid, but that’s just what suits me - you may understand it better, and be more bullish. The low PER is certainly superficially attractive. Good luck whatever you decide!

Paul's Section:

Medica (LON:MGP)

Recommended cash offer at 212p - £269m valuation

This share cropped up in a very interesting podcast with Ken Wooton, on Citywire, here - well worth a listen. I recall listening to it 2-3 weeks ago, as I’ve been catching up on my podcast backlog of listens, and being struck by what an interesting theme he’s identified - buying structural growth companies at modest valuations, as these are not only good investments, but also areas where private equity are looking for takeover bid candidates. He specifically mentioned Medica as an under-priced structural growth company. I got back to my holiday flat, did some research, and noted down Medica on my pad with green highlighter as “LOOKS QUITE GOOD”. Wootton pointed out that similar companies had been bought by private equity at up to twice Medica’s current valuation. My only concern was that deals done in 2021-2 might have been at over-valuations?

Today’s 33% premium, at 212p looks a fair, but not excessive bid.

It only has 20% support so far, and note that management has negligible shareholdings. So I suspect this bid might have to be raised to persuade enough shareholders to back it?

The quandary for private investors is whether to hold out for a better price, risking the loss of the bid premium if the bid falls through.

Paul’s opinion - in this case, if I held (unfortunately I didn’t buy any, but was tempted), I wouldn’t be selling any in the market at this stage. I think a higher bid looks a fairly decent possibility, given the quality of the company, and that I don’t think the bid from IK Investment Partners is generous enough at 212p. Medica share price peaked at more than 212p about 6 years ago, when the company was only about a third of its current revenue & profitability. So this bid looks to be opportunistic, trying to take advantage of depressed public market valuations right now.

Overall, I like the theme of finding undervalued structural growth companies - it’s a good way to invest, and is likely to see takeover bids, as private equity tend to look in that area (whereas they seem uninterested in cheap, ex-growth value shares).

I did mention Medica in a recent podcast this month actually, but can’t remember which episode. Pity we didn’t put anything much into the SCVRs about it though, I was limbering up to report on it at the next results.

What do holders think? Are you tempted to sell up now for a nice profit, or sit tight for a better bid? Or prepared to forego the 32% bid premium (or some of it anyway) if this bid falls through?

Once again, it’s a pity to see private equity picking off the higher quality companies, and all too often leaving us with the dross!

Graham’s Section:

Mind Gym (LON:MIND)

Share price: 64p (+0.8%)

Market cap: £64m

This is a “global provider of human capital and business improvement solutions”. In simple English, it’s a corporate training company.

This morning we have a full-year update for FY March 2023.

Key points:

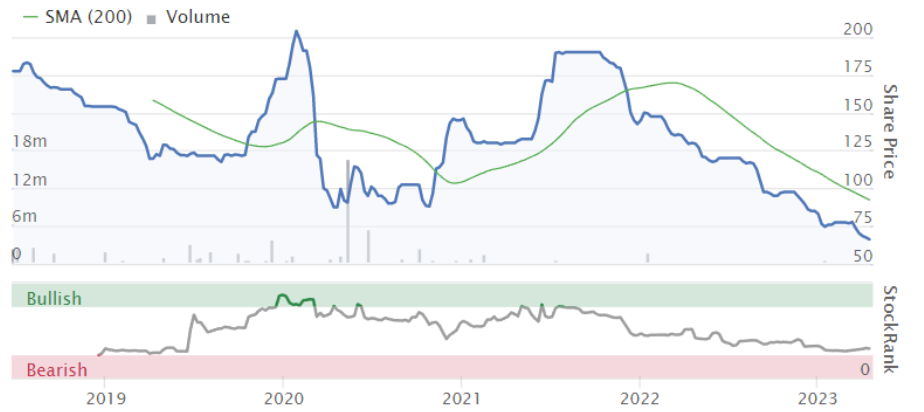

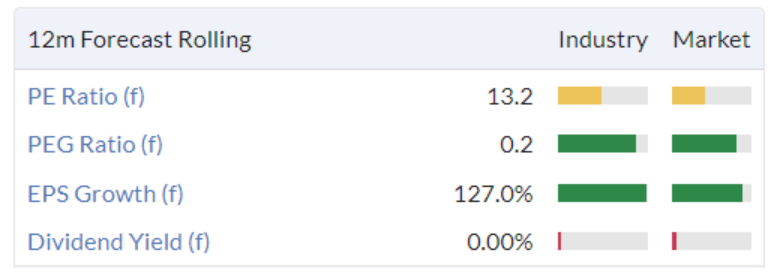

Revenues in excess of £54.7m, up 12% (but only up 4% at constant FX).

H2 saw stronger growth than H1.

PBT “broadly in line with expectations”.

“Broadly in line” usually signifies a slight miss, but in this case the company’s broker has left its PBT estimates for every year unchanged.

These PBT estimates are £2.9m in FY 2023, £6.8m in FY 2024, and £7.9m in FY 2025.

Net cash at year-end was £7.6m, slightly ahead of expectations, and it has an undrawn £10m debt facility.

The Board are “confident” and describe performance as “robust”:

The significant framework agreements won in H1 FY23 contributed to Group performance in H2 FY23. The second half also saw the award of a large framework agreement with a global automotive manufacturer, which is initially expected to deliver at least £2m over the next 18 months. Revenues from these framework contracts are expected to continue into FY24 and beyond.

Graham’s view

Given the events of the past week, it may be worth reminding everyone that this company has a majority shareholder in the form of the CEO, and the free float is very limited when you exclude the top holders:

For me, the question of a majority shareholder comes down to specific questions around who that shareholder is, their intentions and their abilities.

When I’ve been involved in companies that are majority owned by one individual, I’ve made a lot of effort to understand that person. Ideally, if it’s possible, I’d like to meet them.

There’s also the question of the company itself, separate from that individual, and the nature of my investment in it. Was I planning or hoping to sell my holding in it soon? If not, how important is the stock market listing?

Yes, liquidity is very valuable, but sometimes it’s not the most critical factor. There can be worse fates in life than owning shares in a private company! Especially if the risk surrounding the investment has already been managed through diversification, through not using too much leverage, etc.

For me, the most important factors are a) is the company still an attractive investment (whether it’s public or private), and b) do I still trust and like the people making the decisions, even after they make the decision to delist?

Sadly, there are many instances where poor-quality companies make the decision to delist because they’ve simply failed to make sufficient use of their listing, and now they can’t justify the expenses associated with it. These ones are often close to insolvency.

There are other instances where opportunistic majority shareholders use the stock market to sell an overpriced slice of their business in an IPO. They delist some time later, when the hype has died down and there is no further point to the listing.

But again, I would reiterate that the fundamental problems here are not the delistings per se. The problems are that the stocks were overvalued or worthless in the first place!

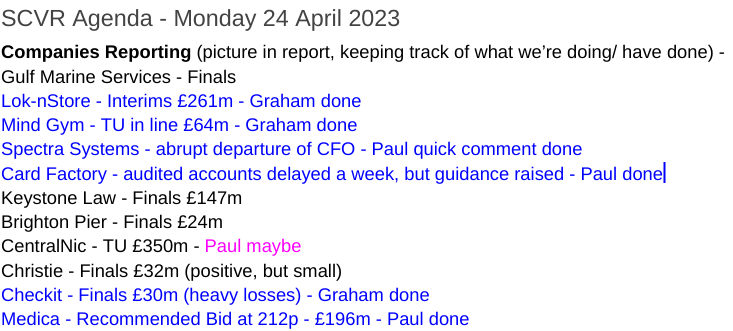

Let’s turn back to Mind Gym (LON:MIND) and remind ourselves of the state of play. It IPO’d in 2018 at a float price of 146p:

The shares are therefore down by over 50% in five years. Prior to Covid, they paid a few dividends, but not enough to write home about.

My rule is to assume that IPO valuations tend to be at least double fair value. With these shares down by more than half, I’m more open to the idea that they are approaching a reasonable number.

The P/E ratio has come back to a reasonable level:

If it does hit the PBT estimates I mentioned above, then I believe we can start to think about it as a value stock.

Long-term revenue growth has been solid, despite a Covid interruption: from £37m in 2018 to £55m in 2023.

Browsing their corporate website, I am impressed by how they sell their training services - in a very modern and “scientific” way. I am also bullish on the general outlook for corporate training as a sector, although I’m unsure as to how to predict the winners in the sector.

On balance, I’m (Graham) going to stay neutral on this stock. It does look to have some interesting features, and is probably better value than it has ever been before. So it could be worth reviewing in greater detail.

Lok'n Store (LON:LOK)

Share price: 870p (-0.2%)

Market cap: £262m

I covered most of the bases surrounding this stock in February. That was at the time of an H1 update.

Today we have the corresponding H1 results for the period to January 2023.

This company operates in a niche with exciting growth prospects, has an excellent track record of growth and profitability, and is led by a committed founder-CEO with a 17% shareholding, so I think it’s worth keeping an eye on.

As a reminder, the key points about the H1 performance are:

Same-store occupied space +2.6%

Pricing up 9.2% per square foot

Same-store revenues +11.2% (even better than reported in the update?)

All of this is good and confirms the strong demand for the company’s storage space, but then adjusted operating profits come in at £5.24m, which is actually down 9.3%.

We can explain the fall in operating profits like this.

Firstly, despite the strong growth in same-store revenues, total revenues only grew by a few percentage points. This is due to the disposal of sites (a strategy that keeps the company’s gearing levels very low).

Secondly, we have an increase in operating costs, probably a large chunk of which is just general inflation. The net result is that adjusted EBITDA falls slightly, from £8m to £7.9m.

Then we have a slightly higher depreciation charge and a slightly higher charge relating to share-based compensation.

So in the end, we get a fall in adjusted operating profits.

Movement in property valuation: the company reports the change in property valuations “below the line”, i.e. in a separate section below the main part of the income statement.

For H1, they have reduced the fair value of their property portfolio by £16.1m, to reflect higher interest rates.

As a result, the valuation of freeholds and leaseholds is now £261m. Add in sites in development and the entire property portfolio is thought to be worth just below £300m (pre-tax - significant tax liabilities would be triggered on disposal!)

The balance sheet has limited gearing for a company of this type and the company calculates its LTV as 8.9%. The average cost of debt during the period was 4.13%.

Adjusted NAV per share is £9.15, down from £9.72 six months previously.

If you include the potential cost of deferred taxes that would be triggered in a liquidation, NAV per share is much lower at c. £6.45 (my own calculation).

Outlook

Early trading in a new Bedford store is “excellent”:

This underpins our confidence that our pipeline of new stores will add further to sales and earnings growth. We are managing the current cost increases and expect the rate of growth of costs to recede in the medium term… Our robust margins, strong balance sheet and flexible business model enables Lok'nStore to confidently look through the current external market turbulence.

Three other stores are opening this year, and the total pipeline will grow trading space by 32.5%. Sounds good.

Graham's view

I think that if this company went “on sale” it could make for a very nice buy-and-hold investment candidate.

At its current level, however, it’s trading near its adjusted NAV per share and at a significant premium to its actual NAV per share.

I still prefer it to many other property-related stocks, but the pricing reflects its quality.

If the shares were to drift lower for another year or two, I would get more interested:

Checkit (LON:CKT)

Share price: 28p (unch.)

Market cap: £30m

This “intelligent operations platform for the deskless worker” says that its FY January 2023 results are ahead of expectations. However, it already announced that it was ahead of expectations in February, and the numbers haven’t changed since then.

Annualised recurring revenue is now £11.5m, having grown by 28%.

The phrase “path to profitability” is mentioned nine times in today’s results statements. The operating loss in FY 2023 is £12.4m, up from £8.5m in the prior year, and the cash burn was in the ballpark of £9m.

Cash at the year-end was £15m, so the clock is ticking on its path to profitability.

Outlook

FY24 has started well, with continued sales momentum in line with the Board's expectations. We continue to execute against our growth strategy and develop our technology, while progressing further operating efficiencies and accelerating our path to profitability.

The Board expects to meet market expectations for FY24 and remains confident that the Group is well positioned to deliver strong, sustainable organic growth in the years ahead.

Looking for more detail on how it’s going to achieve profitability, I find the following:

…we have weighed our growth ambitions with an increased emphasis on cost efficiency, as we execute an accelerated path to profitability. This is demonstrated by an increased gross margin of 63% (FY22: 54%), as well as operational cost savings across the business. Our cash burn peaked in H1 and has reduced by 17% in H2.

Graham's view

The ARR multiple (market cap divided by ARR) is pushing 3x, which is not an outrageous price to pay if you think this is a high-quality technology business.

Or if you’re willing to deduct cash from the market cap and use the enterprise value instead, then the ARR multiple is much lower. I do think that the cash balance could help to support this company’s market cap in the short-term. But I don’t have confidence that the cash balance is going to last, so I would use market cap rather than enterprise value when calculating earnings multiples.

Overall, this one has the appearance of a long-odds bet where the most likely outcome is another year, maybe two, of high cash burn. High risk, with the potential for high reward, but it gets the thumbs down from me.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.