Good morning, it's Paul & Jack here with the SCVR for Thursday.

Agenda -

Paul's Section:

Parsley Box (LON:MEAL) - placing & open offer, at 20p per share. Directors & associates are stumping up £4.1m of £5.9m placing, an impressive commitment. Trouble is, so far the business model has been a cash burning failure. Is that likely to change? Revised strategy looks more about survival than growth, so I see lots of risk and little upside. Hence best avoided I reckon.

Focusrite (LON:TUNE) - an in line trading update for H1. Share price overshot last year, and like many small caps, has corrected sharply this year. Is it a bargain now? Not really, but the valuation of PER 20 seems justified for a good quality business.

Boohoo (LON:BOO) (I hold) - back by popular demand, as it's almost a small cap again after a disastrous sector-wide de-rating in the last year. Today's FY 2/2022 update is (surprisingly) in line with (lowered) expectations. This looks a turning point to me.

Jack's section:

Finncap (LON:FCAP) - full year revenue to exceed the top end of its £45m-£50m guidance. No word on distribution of profits. The shares are very illiquid, but they also look cheap given how well the group is performing. Market conditions could turn of course, in which case you’d have to expect some volatility.

Forterra (LON:FORT) - FY results slightly ahead of expectations, despite previous upgrades. The shares have fallen along with the rest of the market but the results are good and the valuation undemanding, so it could be worth taking a closer look at these levels. The company notes rising costs but is pushing through price increases.

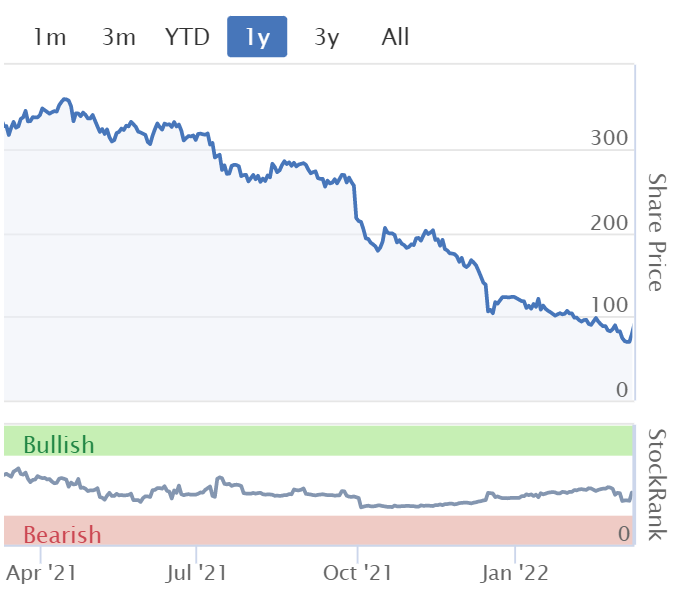

James Fisher And Sons (LON:FSJ) - not a company I’ve followed before, but one with a long operating history. Things have gone badly over the past couple of years and the share price has collapsed, so being cautious. There could be value given the lack of equity dilution and it might be worth monitoring on that basis, but debt is quite high, the results are poor, and the long term strategy has yet to be properly defined. I'm curious to see how the situation develops but the risks are considerable.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

Parsley Box (LON:MEAL)

18p per share (yesterday’s close)

No. shares: 42.3m (before placing) + 29.5m (placing) = 71.8m (plus open offer)

Market cap (after placing): £12.9m

No surprises at this equity fundraising being needed, as it was flagged a while back, following disastrous performance & cash burn in 2021. What is surprising today, is that the fundraising is being done at 20p, and not much lower. The other surprise, is that of the £5.9m being raised, £4.2m is coming from Directors and associates. There’s nothing like burning your own cash, to focus your mind on getting value for money from that expenditure. This could have been much worse - without Director participation, I reckon any fundraising, if possible at all, would have been in single digits of pence, because the company’s position is now so weak - a failing business model, and a bearish stock market backdrop.

What went wrong?

Outsourced supply chain fell over last autumn/winter, causing shortages of inventories

Marketing spending reduced, causing new customers to stall

Current trading - little meaningful detail provided.

2021 performance - modest revenue growth of 5%, and huge loss of £(7.1)m adj EBITDA, the main culprit being excessive (and clearly ineffective) marketing spending of £8.0m, which was greater than gross profit!

Balance sheet - now weak, with only £1.1m NAV, hence without further funding the business would have probably gone bust in 2022.

New strategy -

- Driving growth from existing customers.

- Fewer, but higher quality new customers (so presumably much reduced marketing spend)

- Moving to a new lead supplier.

My opinion - MEAL lives to fight another day. I’m impressed Directors (and associates) are putting up the bulk of the new money, and at a very fair price I’d say.

Trouble is, so far the business model has been a failure. The new strategy means it’s likely to remain a small business, struggling to replace customer churn.

The elephant in the room, is that the product is such poor quality, hence of limited appeal. I’ve mystery shopped it several times, trying lots of different products, and they’re mostly very disappointing, although a few items were quite good. It makes far more sense to order cheaper, more generous, & better quality frozen ready meals from a supermarket. There might be a small niche for people who have to have ambient temperature product though.

.

.

Focusrite (LON:TUNE)

1010p (up 1% at 08:55) - market cap £590m

We like TUNE here at the SCVR, it seems a good quality company, run by an owner/manager, and has made a series of seemingly good acquisitions. The trouble is, it got so expensive last year, that put it out of range for me personally, in valuation terms.

As you can see below, the chart has followed a familiar pattern of so many small caps - an excessive bull run in 2021, then more recently a sharp correction. I wonder is this now a more attractively-priced entry point? Let’s find out.

.

Focusrite plc (AIM: TUNE), the global music and audio products company supplying hardware and software used by professional and amateur musicians and the entertainment industry, is pleased to give the following update on current trading for the financial year ending 31 August 2022 ('FY22').

H1 is in line with Board expectations for revenues, profit, and cash.

Demand has remained strong

H1 revenues £91m (down on £95.3m, last year’s exceptional performance)

Last year comparatives will ease in H2

Supply chains (component shortages, freight cost) causing gross margins to reduce in short term, actions taken to address this

Sales to Russia/Belarus/Ukraine suspended - “very small”

Net cash of £17.8m at 28 Feb 2022

Planned increase in inventories

Full year guidance -

The Board is confident that the Group is on course to meet its full year expectations and will give more detailed guidance at the time of the announcement of the H1 2022 results on 26 April 2022.

Forecasts - as you can see below, there have been a series of profit upgrades, so it’s all the more impressive that the company is trading in line with more demanding targets.

If we value the company on c.50p EPS, then it all depends what PER you think it justifies, especially now that we’re in a market which has scrubbed off a lot of very high PERs for companies perceived as being exciting and growth-orientated.

The current share price of c.1000p is a PER of about 20, which feels about right to me, maybe slightly on the warm side, in this more bearish market?

.

My opinion - there are so many bargains around at the moment, that paying a PER of 20 for TUNE doesn’t seem sufficiently attractive to me, to persuade me to buy.

However, it does seem a more rational, and reasonable valuation than the excessive peak hit last year, where even bulls on the company must admit that they chased it too high.

As usual the StockRanks explain things with great clarity - a very high quality business, but still not cheap. Although overall, a StockRank of 58 is leaning towards the positive side.

.

Boohoo (LON:BOO) (I hold)

91.7p (up 16% at 10:18) - market cap £1,162m

I wasn’t going to comment here on BOO, but reader comments & thumbs ups suggest that as it’s come down so much that it’s not far above our usual £700m limit, that we could bend the rules and comment here on BOO.

Boohoo provides an update for the three and twelve months ended 28 February 2022.

Boohoo is an expanding stable of fashion eCommerce brands, about 15 of them in total now -

[Source: Boohoo website]

Key points from today’s year end FY 2/2022 trading update -

Q4 net sales +7%

Full year net sales +14% - in line with (lowered) expectations

Higher returns rate, due to product mix changing back to going out clothes

UK continues to trade strongly

International - under-performing, blamed on supply chain, particularly outbound freight, which is expensive & slow (esp. transatlantic flights) - broker notes say a US distribution centre will sort this out in 2023 - so possible resumption of overseas growth in the pipeline?

EBITDA of £125m achieved, in line with guidance - this is a very positive surprise to me, as the share price collapse seemed to suggest more bad news was inevitable.

My opinion - delighted with this update, as I was convinced more bad news was imminent.

2 revised broker notes out today suggest c.5p EPS for FY 2/2022 - make no mistake, that’s a poor outcome, well down on last year, and breaking the trend of years of uninterrupted strong earnings growth. But that’s why the share price has tanked. At c.90p, and 5p EPS, the (no historic) PER is only 18 - you could argue that’s justified, as EPS has dropped. Or you could argue that one-off external, fixable problems with supply chains have affected everyone, and should ease later in 2022. It depends entirely how you see things.

Brokers are pencilling in 6-7p EPS for the new year. Given that there’s a lot of growth from new brands, and new product launches (e.g. the lucrative beauty market), and good reasons to expect expensive & slow outbound air freight to become cheaper as flights normalise, then I’m prepared to hang my hat on 6-7p EPS, and for me a PER of 20 is justified because I think this will be a much bigger business in 5 years’ time, which has always been my investment rationale. That comes to my own current valuation of 120-140p as things stand now. Hence at 90p, I’m happy to buy more. I think this looks like a turning point in the downward share price trend, as it looks to have considerably overshot on the downside. You may agree or disagree, happy to hear all rational views.

I think the balance sheet is fine, with £86m forecast net cash, and the new substantial freehold Soho office providing protection if extra cash were ever needed (e.g. sale & leaseback).

The historic share price movement has been a disaster for me, but that doesn’t matter, because we can’t change it, but can learn lessons from it. All that matters to me now, is what the future holds, and these numbers suggest to me BOO is currently undervalued, hence I’m comfortable buying more.

There’s also the issue that this has been an enthusiastically shorted share, so with positive news out, there could be a rush to close those shorts, helping the rebound in share price.

Rumours from a usually good source (Betaville) suggest that the founders might take it private. I think that has some credibility. After all, why go through the rigours of being a listed company, if nobody is interested, and the rating is low?

Finally, competitive pressures are intense, especially from Chinese direct to consumer operators. For that reason, I think it makes sense to forget about BOO mgt’s 10% target EBITDA, and instead assume a lower 6-8% margin might be more applicable in future, giving them scope to remain competitive in product pricing, special offers, and marketing spend. That’s what the broker forecasts are now based on, so they look achievable.

.

.

Jack's section

Finncap (LON:FCAP)

Share price: 29.84p (+12.6%)

Shares in issue: 179,802,609

Market cap: £53.7m

Trading update for the year to 31 December 2021

FinnCap’s stock is very illiquid - the StockReport suggests around just £2k can be reliably bought or sold at market prices, and this comes across in the share price chart.

While that means the shares can shoot up, it also means that, given the past few months, the stock has actually fallen considerably - by about 41% from the high back in April 2021. The result is a valuation that seems modest if the group can continue to grow.

Today, the company reports that full year revenues should exceed the top end of its £45-£50m guidance range. The group’s CEO says that the group is well placed to deliver ‘record’ revenue in FY22.

Conclusion

It’s an exceedingly brief update, three sentences long, so there’s not much to interpret. FinnCap has obviously traded well though and appears to be confident of a good performance in 2022. At the current valuation, it is worth looking into for those that don’t mind the lack of liquidity, but that illiquidity does of course present its own risks.

That valuation also reflects concern over the durability of these results. It’s rare these days to see a company whose forecast PER is less than the forecast dividend yield. It does suggest to me that the stock is potentially cheap, but I suspect that in order for the share price to really kick on, it will need to convince people that it is growing not just due to favourable conditions, but also because it is gaining meaningful market share.

FinnCap has a healthy net cash position, so it’s got optionality and funding as it looks to grow.

It’s also worth noting that the company only guides on revenue, so no indication yet of how much of profits will flow to shareholders rather than employees.

The stock looks cheap and the company is trading well, so it might appeal to some, but the lack of liquidity will remain a concern for others. The shares have probably fallen too far over the past couple of weeks though.

I think FinnCap plays a useful role for private investors and it seems to have a growing presence in the area, so perhaps there is something in the strategy that can ensure underlying growth beyond more transient market conditions. It’s probably a market that could do with some disruption.

Forterra (LON:FORT)

Share price: 225p (+0.67%)

Shares in issue: 226,488,861

Market cap: £509.6m

Final results for the year to 31 December 2021

A familiar share price chart regarding the past couple of months:

Forterra is a UK manufacturer of essential clay and concrete building products. It says its position in its market is unique, it’s been around for decades, and ‘wherever you are in Britain, you won't be far from a building with a Forterra product within its fabric’.

FY results are ‘slightly ahead’ of expectations.

- Revenue is up 26.9% to £370.4m,

- EBITDA is up 85.8% thanks to revenue performance and EBITDA margin up from 13% to 19%,

- Operating profit +160% to £54m,

- Earnings per share +165% to 17.5p,

- Cash flow from operations +48.8% to £81.2m

- Net cash (ex leases) is up from £16m to £40m, and the total dividend has jumped from 2.8p to 9.9p.

That values the stock at around 13.1x FY21 earnings with a yield of 4.3%. Forterra targets a dividend payout ratio of 55%.

Full year brick sales volumes were 33% ahead year-on-year and 1% ahead on 2019. H2 cost inflation was not fully recovered, meaning margins are lower than 2019 although significant double digit price increases are planned in the coming months.

Construction of the new Desford brick factory remains on track with commissioning due end 2022. This will deliver a 22% increase in brick production output from 2025 and an anticipated incremental £25m of EBITDA (guidance was previously for £15m). That upgrade results from higher selling prices and reduced performance at the old factory.

There’s plenty more organic investment. A total of £27m is being spent on the Wilnecote brick factory refurbishment, and the group announces a ‘highly cost-effective’ £12m investment to manufacture clay brick slips at the Accrington factory.

It sounds as though Forterra has a number of additional capital allocation options, with an ‘attractive pipeline of organic investment projects in place each offering compelling returns’. The group is also targeting bolt-on acquisitions and has initiated a £40m share buyback programme, with £5.5m returned to date.

Outlook

Market conditions remain highly supportive with continued demand for new housing and constrained UK manufacturing capacity driving brick imports to record levels, despite increasing macro-economic uncertainty and supply chain pressures which have created a higher interest rate environment

The order books are strong, supported by robust customer sentiment and an ongoing housing shortage. Meanwhile, price increases should recover margin in the year ahead.

All in all, this looks very positive.

Conclusion

The valuation is modest and the update is good, so the market could be presenting an opportunity here.

Forterra could be a ‘baby with the bathwater’ situation, there’s enough of them around at the moment. Operationally, the company is doing well and is investing in further growth initiatives. The dividend is increased, net cash is healthy, and the company is buying back shares. It also looks as though the group is confident of its pricing power going forwards.

Clearly there are macro concerns, and fortunes are tied to house construction, but there is good long term demand here and the government is committed to increasing volumes. The shares are only slightly above lockdown levels but I would argue that the outlook has improved since then.

This looks like a solid, cash generative company, reflected in the Quality Rank of 87.

James Fisher And Sons (LON:FSJ)

Share price: 382.5p (-23.35%)

Shares in issue: 50,340,948

Market cap: £192.6m

Full year results to 31 December 2021

Shares are down c23% this morning, having lost around three quarters of their value since 2019.

Revenue is down 4.7% to £494.1m, but reduced margins mean adjusted operating profit is down 30.9% to £28m and adjusted earnings per share are down 58.2% to 20p. Statutory results are far worse: an operating loss of £20.7m and diluted earnings per share of -55.2p.

The adjusted results exclude £48.7m at the operating profit level and £86.5m at the earnings per share level. Material figures.

Management references pandemic disruption, but also ‘markets not recovering at expected rates, and an underestimation of the headwinds faced by some of the businesses’, which doesn’t inspire confidence. UK lockdown affected the first half, but project delays and provisions further affected H2. Further provisions are required against asset carrying values due to the prolonged impact of reduced profitability.

Group CEO Eoghan O'Lionaird comments:

In June 2021, we outlined a roadmap to achieve our objective of greater than 10% operating profit margin and greater than 15% return on capital employed. This roadmap is based on three phases: "Reset, Reinforce and Realise". Throughout the year we continued to execute the Reset and Reinforce phases to create the foundations for sustainable profitable growth.

Having sold Paladin and two of our businesses, during 2022 we will continue to optimise our portfolio to focus on businesses where we have a competitive advantage, strong growth prospects and attractive returns. The internal change agenda will continue at pace. We are executing several self-help initiatives, focusing on operational and commercial excellence, including a LEAN programme, to improve the underlying performance of the Group.

Future direction

With a backdrop of ever-increasing focus on climate change, and the acceleration of an energy transition to a low carbon economy, the oil and gas services industry is likely to decline over the long-term. However, it will take time for the required global low carbon energy infrastructure to be developed.

… As the pace of the energy transition towards sustainable energy sources accelerates, we are equally focused on accelerating our own transition, as new opportunities emerge for our well-established and fast-developing services supporting the growth of renewable energy.

Management sees opportunities primarily in offshore wind and the responsible decommissioning of redundant oil and gas assets. The group adds:

We are well-positioned in these fast-emerging sectors, where the Group can combine its traditional oil and gas-oriented subsea capabilities with newer, renewable-energy specific solutions, such as the installation, monitoring and management of high voltage cabling in offshore wind, and the provision of bubble curtains that protect sea life from the noise impact of pile driving during the construction of the wind farms.

Conclusion

It sounds like it’s still relatively early in this reset strategy, too early for me as I don’t know the company or its markets, and so I’m not well placed to form a firm view on its prospects. There’s a lot yet to be thrashed out by management.

The key strategic challenge for the Company over the next decade is in defining the optimal approach to address the energy transition, capitalising on the many opportunities that are available in renewables whilst enabling our customers to make their own transitions in a financially and environmentally responsible manner. It is a challenge on which our management team is keenly focused and will continue to define with more precision as the shape of the energy transition becomes clearer.

So a turnaround is required and being enacted, but the actual long term strategy has yet to be properly articulated, as far as I can see.

James Fisher has been around for a long time though, and I hope it can find a new footing.

The last two years have been among the most challenging that the Company has experienced in its 175-year history. The Board is committed to delivering a successful turnaround of the James Fisher Group and believes that the steps it is taking strategically, operationally, and financially are in the best long-term interests of all stakeholders.

There is value in a company with a long heritage (and the expertise and relationships developed over that time), but markets change, companies do go bust, and new management teams are capable of quickly wrecking decades of good work. So the long operating history is comforting to a degree, but what’s far more important is where James Fisher is heading.

The line from management about ‘underestimating headwinds’ is concerning, but I do also credit them for communicating that to shareholders rather than spinning it positively or burying it further down the update.

I want to know more about what management’s plan is for sustainable profitable growth though. Turnarounds take time and it seems like there is work left to do before management can provide investors with a firmer handle on the group’s prospects.

But the markets identified are potentially attractive, so I’m curious enough to monitor the group’s progress from here. There’s not been any equity dilution for a long time, and the company previously had a solid history of profitability.

The dividend track record was also very good.

It’s had a torrid run - three profit warnings in FY21 and down again today. I’m sure the pandemic has had a big impact, but it also feels as though something more fundamental has gone wrong. These results are bad, but I also note that net debt has come down slightly, from £198.1m to £185.6m - although reduced EBITDA means that the net debt : EBITDA ratio is an uncomfortably high 2.9x (up from 2.8x, with covenants requiring less than 3.5x).

It’s probably worth investigating a little further as a high risk, high reward turnaround play given the lack of dilution, but I wouldn’t go any further than that yet as I think the risks are considerable and it’s perfectly possible that things get worse before anything gets better.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.