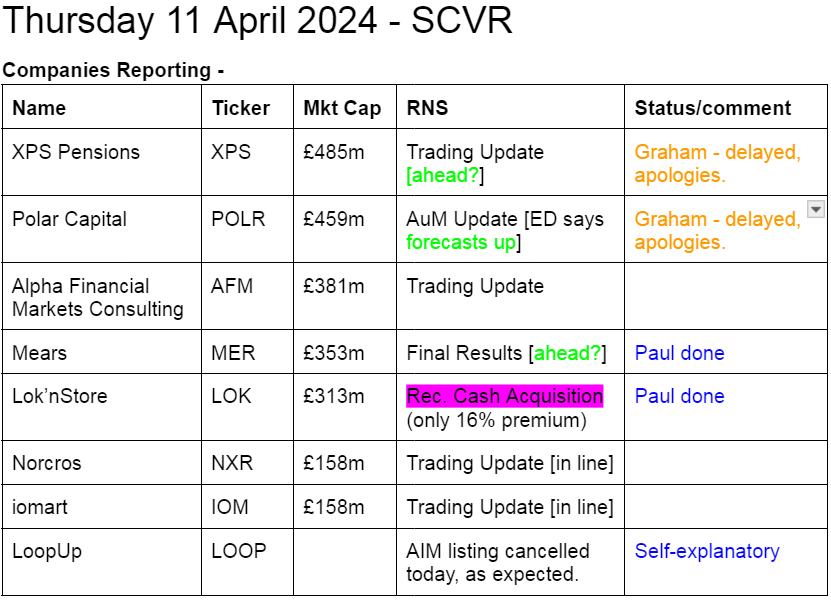

Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Other mid-morning movers (with news)

Corero Network Security (LON:CNS) - up 14% to 12.0p (£61m) - $1.8m Contract Win - Paul - AMBER

We’ve not looked at CNS for two years, it does cyber-security software to stop denial of service attacks. I'm not sure if it's selling proprietary software, or reselling other companies' software? There has been a flurry of positive newsflow this year. Fundamentals aren’t great - it’s traded around breakeven for several years, including unimpressive results for FY 12/2023. Outlook on 27/3/2024 indicated a "strong start" to 2024, and a good pipeline. But the company also described 2023 results as “strong”, which they weren’t (a small loss before tax). Last balance sheet at Dec 2023 looks OK, with adequate net cash of £5.2m, and NTAV of c.£3m. So I don’t think it will need to raise any more cash. Paul’s view - could be worth a look, although £61m mkt cap for a company with no track record of consistent profitability, is looking a tall order. If it genuinely has a leading DDoS product, then obviously the demand and market globally would be enormous. Hence it’s worth sector experts taking a look, I’d say.

Summaries of main sections

Speedy Hire (LON:SDY) - 25.75p (£132m) - Year End Trading Update - Paul - BLACK (profit warning) - AMBER/GREEN on fundamentals.

Another profit warning from this accident-prone equipment hire company. Blames many external factors, but I'm concerned a lot of the problems are probably more internal. New contract wins might help FY 3/2025 numbers, but broker cuts forecasts for both years. Sound balance sheet (shares trade at a discount to NTAV)and cyclical recovery hopes mean I'll edge up my opinion from amber, to AMBER/GREEN, despite the problems.

Ultimate Products (LON:ULTP) - 149p (£133m) - Interim Results [in line] & Share Buyback - Paul - GREEN

Flat profits, despite some customer destocking. Outlook for FY 7/2024 is in line with expectations, with nice clear reporting. Modest valuation of PER 9.6x. Strong quality metrics. Owner-managed business, which we like usually. Generous divis & share buybacks starting. Looks a good business, modestly priced still.

Revolution Bars (LON:RBG) - up 38% to 1.65p at 12:55- Interim Results & Fundraise/Restructuring - Paul - RED

Complicated restructuring required, and a £12.5m fundraise conditional on court approval of CVA (or similar). High risk until conditions have been met. It's ditching the loss-making sites, but also looking around for better offers with a FSP having started. Bank is writing off £3m of debt, in return for warrants that kick in if share price gets to 4.0p, which would be a terrific outcome for anyone putting in fresh money at 1.0p. Luke Johnson to become Chairman, and is investing £3m. Still high risk, as the fundraise could yet fall through, as it doesn't complete until Sept 2024.

Centaur Media (LON:CAU) - Up 29% y’day to 51.5p (£76m) - Possible Offer - Paul - PINK (bid approach)

No details provided on price, but CAU says it's received a "highly preliminary expression of interest" from a secretive Dutch private equity firm, which specialises in buy & build deals. Seems to be another example of dominant major shareholders seeking liquidity and an exit by encouraging private equity to buy out listed companies.

Lok'n Store (LON:LOK) - up 17% to 1,120p (£369m) - Recommended Takeover Bid - Paul - PINK (bid approach)

LOK receives & agrees a takeover approach from larger European rival Shurgard. Directors holding 19% have agreed it, so we can be sure it's a fair deal. LOK shares have done very well over the years, but the shares didn't look attractive on valuation or quality measures. There we go.

Mears (LON:MER) - up 1% to 366p (£356m) - FY 12/2023 Results - Paul - AMBER/GREEN

Strong results for FY 12/2023, which look ahead of broker consensus for EPS. No profit growth expected in 2024 though. Strong cashflows allow it to pay divis and do large share buybacks. Good company, but shares have risen a lot in the last 6 months, and seem fairly priced now I think, hence I've eased off from green to AMBER/GREEN.

Paul's Section:

Speedy Hire (LON:SDY)

25.75p (£132m) - Year End Trading Update - Paul - BLACK (profit warning) - AMBER/GREEN on fundamentals.

Speedy Hire, the UK's leading tools and equipment hire services company, operating across the construction, infrastructure and industrial markets, today provides an update on the Group's trading performance for the year ended 31 March 2024 ("FY2024").

We last looked at SDY on its profit warning here on 30/1/2024. A variety of problems caused a 35% drop in broker forecast earnings for FY 3/2024. I wondered at the time if there might be a buying opportunity on the way, since I didn’t have any worries about solvency, and the divis had been attractive. Cyclical upturn on the way, maybe?

What’s the latest for this FY 3/2024 trading update?

Revenue down 5% on LY, at £420m.

Blames -

- Challenging market backdrop,

- wider macroeconomic uncertainty,

- underperformance from regional base,

- reduction in wholesale fuel prices,

- warmer winter affecting seasonal products,

- cost inflation and softer demand faced by construction sector.

Any positives? >£40m annualised revenues from new business in multi-year contracts, which should benefit FY 3/2025 onwards. Secured “with continued pricing discipline”.

Outlook - light on details, as is the whole update -

The momentum from securing major opportunities and progressing operational efficiencies, positions the Group well to benefit from the anticipated recovery of the wider macroeconomic environment during the second half of FY2025.

As a result, while the Group expects to report results for the year towards the lower end of the Board's expectations, it is encouraged by the commercial progress in the business and the outlook for FY2025 given the recent contract wins.

What is the range of the Board’s expectations? It would have been helpful to tell us.

Cashflow/debt -

The Group has remained highly focused on working capital management and expects to deliver free cash flow2 in excess of £20m, with net debt3 reducing by year-end to c.£102m, within our target leverage range.

Again, what is the target leverage range? Why not tell us? I see this bank debt has risen from £89.6m reported on 30/9/2023.

Transformation strategy - they’ve given it a name, “Velocity” - sounds like that’s been inspired by watching The Apprentice! Says the costs of this are “significant” and will be adjusted out in the year end accounts.

I already had the impression that SDY is badly run, and has poor internal controls. I got that impression from when it lost all that scaffolding (£20m-worth) in early 2023. An equipment hire company that loses that much kit is not something I would invest in, transformation plan or not.

Broker update - many thanks to Liberum for updating us with revised numbers. This follows the previous pattern, where SDY seems to sound reasonably relaxed about performance, but the broker quietly slashes forecast. Liberum lowers FY 3/2024 again, from 3.2p to 2.7p. the macro position hasn't significantly worsened in the last 3-4 months, so I see these problems as home-grown by SDY.

Next year forecast EPS is also slashed from 4.7p to 4.0p. What's the betting they won't hit that number either?

Balance sheet - last reported at 30/9/2024 had NAV of £182m, less intangibles of £24m, gives us NTAV of £158m. That’s assuming they haven’t lost any more scaffolding. The interim results did say no further equipment was missing in the latest stock counts, and processes had been improved.

I like to look at loan to value (LTV) wit hire companies. SDY has a hire fleet of £200m within fixed assets, and £91m borrowings in long-term creditors. That looks OK to me.

So it’s a reasonably decent balance sheet, and the market cap is lower than NTAV. That should provide strong downside protection for investors.

Paul’s opinion - there’s no avoiding the reality that SDY seems poorly managed, and a low quality business that doesn’t earn much of a return on its assets.

However, with the shares having now fallen to a discount to NTAV, and the prospect of a cyclical upturn in demand for its equipment hire as the economy begins a cyclical recovery, I’m tempted to take a bit of a risk here and up our stance from amber to AMBER/GREEN.

Note that the share price collapse came when we were well into the pandemic, in mid-2021, similar to many other small caps, but a fall of this extent has also been due to poor company performance -

Ultimate Products (LON:ULTP)

149p (£133m) - Interim Results & Share Buyback - Paul - GREEN

Ultimate Products, the owner of a number of leading homeware brands including Salter (the UK's oldest houseware brand, est.1760) and Beldray (est.1872), announces its interim results for the six months ended 31 January 2024.

Company’s headline -

Trading in line with market expectations*

* Consensus market expectations for the financial year ending 31 July 2024 are revenues of £166.7m, adjusted EBITDA of £21.5m and adjusted EPS of 15.6p

Great clarity there, so we can immediately see the valuation: share price of 149p, divided by expected adj EPS (FY 7/2024) of 15.6p = PER 9.6x - looks good value.

Adj H1 profit is up c.2% to £9.6m, despite revenues being down 4%, blamed on some supermarket customers de-stocking.

There’s a very good progression of key numbers here -

Readers seem to think we should emphasise quality metrics (esp ROCE) here more often, which is a fair point. These are excellent for ULTP -

Although I’m not sure how many investors would see this as a quality business, since it’s just importing small consumer products from China. I’m very wary of all companies that have stuff made cheaply in China, then sell it for good margins in the UK (and other Western countries). That’s because the Chinese seem to have realised they can cut out the middlemen and sell direct to Western consumers. Anyway, you can decide for yourself if, and how much of a threat that might be.

Dividends are generous, with a yield of c.5.7%

Balance sheet - there’s a striking reduction in net bank debt, from £19.4m (Jan 2023) to £8.0m (Jan 2024). Although a lot of that has come from a big c.£10m fall in receivables in the last year.

NAV is £50m, less intangibles of £37m, gives an OK NTAV of £13m. We could eliminate the deferred tax of £7m (usually related to goodwill) which would make adj NTAV c.£20m. It’s OK rather than particularly strong overall.

Cashflow statement - looks very good, it’s generating plenty of cash, and using it to pay down bank debt, and fund generous divis.

Share buyback of around £1m per quarter is planned, up to c.10% of the total issued shares.

Paul’s opinion - I like it. Last time on 13/2/204 I was GREEN, and these latest figures confirm my favourable opinion. It also talks about considerably increasing revenues in Europe, from a new showroom in Paris. The focus is now more on branded products, which seems to be working. It’s an owner-managed business too, which is usually a good thing.

Revolution Bars (LON:RBG)

Up 37% to 1.65p at 12:56 - Interim Results & Fundraise/Restructuring - Paul - RED

Fundraise - to issue up to 1,251m new shares at 1.0p each (existing shares: 230m), to raise up to £12.5m (before costs), and £11.6m after costs.

Of this fundraise, most of it has already been committed: £3.0m Luke Johnson, £3.0m Robus, and £3.5m from 3 existing shareholders.

Restructuring - plan is to exit leases on 18 sites, rent reductions on a further 14 sites, and other cost savings, saving £3.8m in year 1. Sounds like a CVA type of arrangement, and the detail says the restructuring plan needs a 75% creditor vote, which sounds a lot like a CVA, although that term is not specifically mentioned. The fundraise is conditional on the court sanctioning its CVA.

Luke Johnson to join board as a NED, and then Chairman later.

Nat West has (unusually) agreed to write off £4m of existing debt, and defer interest payments est. at £2.2m. It is also suspending the key covenant until April 2025. In return Nat West will get c.150m warrants for new shares, exercisable at just 0.1p per share, but only if the share price exceeds 4.0p.

Shares were suspended on 2/4/2024, and the H1 results statement says -

“the Company has requested that trading in its ordinary shares on AIM be restored with effect from 7.30 a.m. on 11 April 2024.”

Launch of formal sale process - running in parallel with the fundraise & restructuring proposals, to see if a better offer can be found - but remember that a better offer may be for the bank & creditors interests, which may not necessarily be in the interests of shareholders. Note that companies in financial distress start using the term “stakeholders” instead of shareholders for this reason.

Interim results - to 12/2023 show an IAS17 (the most relevant measure) loss before tax of £(2.1)m. Net bank debt was £20m. Outlook statement says trading is challenging, but in line with expectations. Going concern material uncertainty again. Revolution is the problem brand, with de Cuba and Peach Pubs performing better.

Paul’s opinion - wow this is complicated. Hopefully I’ve captured the main points above. Overall then, court approval of the CVA looks the first essential step. Placing monies are only received by the company if this is approved. Then the company restructures, closing the loss-making sites. It should then have a viable business, having ditched the problem (mainly Revolution branded) sites. Although it also talks about refurbishing remaining sites in future, which of course will be expensive.

Existing small shareholders have to decide whether or not to take up the Open Offer entitlements.

The new share count will be almost 1.5bn, so the share price is unlikely to have more than a penny or two upside, even if everything goes well.

Having created this mess by maxing out the bank borrowings to buy Peach Pubs, I wonder why new equity backers haven’t had a complete clear-out of the Board?

I imagine there’s likely to be very brisk two-way trading in RBG shares once they come back from suspension today (caused by late interim accounts which have now been published). I think it’s still very high risk, and this is now the third fundraise, which will mean the share count up by about 30x from pre-pandemic. That said, history doesn’t matter to new buyers of the shares now. If it goes from 1.0p to 2.0p, new buyers will have made a 100% gain.

Personally I’m not tempted to dabble here, as it’s been a stressful share for me historically, with big losses (and big gains from trading the dips heavily before). You could argue that with smart investors piling in a decent slug of new money at 1.0p, then they must have concluded risk:reward is favourable at that level. Clearing out all the loss-making sites, just before a potential consumer recovery, might be a good move that brings a competitive advantage maybe? Tricky one.

UPDATE at 12:56 - the market clearly likes this announcement, with a big % increase this morning to 1.65p - already a hefty 65% premium to the proposed fundraise at 1.0p. If that sticks, it should mean full take-up of the open offer. Although there's also a temptation for people to lock in profits for unissued shares through eg opening a short CFD, if it's possible to get a borrow. Given that, if this deal happens, then the share count would be c.1.5bn, then the new market cap would be about £25m at the current 1.65p, and you've also still got insolvency risk, or equity wipe-out risk if someone else comes along and offers to buy out the bank, and take control that way, or subverts the CVA in some other way? Hence it's for risk-takers only at this stage, but it looks like so far anyway, the bet has paid off! Good luck to holders.

Centaur Media (LON:CAU)

Up 29% y’day to 51.5p (£76m) - Possible Offer - Paul - PINK (bid approach)

Centaur is an international provider of business information, training and specialist consultancy within the marketing and legal professions…

Issued during market hours yesterday at 12:53, CAU stated -

“Recent media speculation” re a bid approach.

Has received “a highly preliminary expression of interest from Waterland Private Equity Instruments B.V.” re a proposed acquisition.

No price is mentioned.

Board remains confident in its growth strategy.

Doing a bit of googling, Waterland is described as a secretive private equity firm based in Holland, which has raised billions for various funds specialising in buy & build acquisitions. CAU seems quite a small acquisition relative to the multi-billion funds it seems to raise.

FY 12/2023 results were published on 13/3/2024, and look pretty good, with a 62% rise in adj diluted EPS to 4.2p = PER 12.3x at 51.5p/share.

Balance sheet at 31/12/2023 only had NTAV of about zero, but it had £9.5m in net cash because customers pay up-front (reflected by £8.4m deferred income creditor).

Paul’s opinion - I’ve not looked at CAU since a quick review in Mar 2023, when I thought it looked priced about right at 53p (very similar to the current price, post 29% bid premium). Although a quick look at FY 12/2023 results have improved my view of the company, since profit increased strongly.

Harwood Capital is the largest shareholder at 29.9%, plus Aberforth with 23.9%, makes this look like another situation where big shareholders might have pressed management to sell up to private equity in order to give them an exit at a premium maybe?

CAU is up for sale now, publicly, so let’s see what happens next.

The share price hasn’t gone anywhere in 20 years, although it’s been a good dividend payer in its time as a listed company.

Lok'n Store (LON:LOK)

Up 17% to 1,120p (£369m) - Recommended Takeover Bid - Paul - PINK

Bidder - Shurgard Self Storage Ltd (large European self-storage property company)

Type - recommended cash offer

Price - 1,110p cash

Premium - 15.9% to last night’s close. Although the share price chart makes it look as if the news might have leaked and some insider dealing might have happened, as a 10% rise in share price occurred in the week before this announcement. So that’s more like a 30% premium to the share price on 5/4/2024 (before the sharp upward move began).

It’s a 2% premium to the previous all-time high in Jan 2022.

Shurgard (nothing to do with the famous horse) is a larger listed competitor in Europe - here’s a snapshot of its StockReport below (I’m lucky enough to have use of the international version of Stockopedia) - as you can see, its market cap is almost 10x that of LOK, and it’s a trade buyer, operating self-storage facilities in Europe. It also has 41 sites in London, according to its website. So acquiring LOK seems a quick route to expanding further in the UK, since LOK has a wider spread of sites in the UK, and only 3 (just) inside the M25, according to LOK’s website..

Is it a fair price? Directors at LOK support the deal, holding 19% of the company, which tells me it’s a good deal for LOL shareholders. Owner-managers don’t agree a deal unless it’s good. The blurb says that the valuation is 27.1x adj EBITDA for FY 7/2023, and a 12.5% premium to adj NAV. That looks quite a punchy valuation in current circumstances.

Paul’s opinion - this looks a decent deal, and I imagine it’s likely to be agreed by shareholders, since owner/management have backed it with their 19%.

I’ve never really focused on LOK shares, which is a pity as it’s been a superb long-term success, roughly 30-bagging from the 2009 low, when the world seemed to be coming to an end in the financial crisis.

When we have looked at LOK, we’ve tended to think it looked too expensive, both on a high PER, a premium to book value, and with low ROCE, so no particularly obvious appeal to the share.

I had lunch with some very successful self-made investors yesterday, and they’ve switched most of their money into property companies this year, where they tell me there’s (selectively, as always) terrific value. So if you know what you’re doing, then I think focusing on REITs and other property companies could be a lucrative theme. Although there are obvious risks, the main one being to ensure that borrowings are under control, and that balance sheet values are realistic (many commercial property values have plunged since interest rates rose). We might well see more property companies implode under excessive debt, as I’m told is happening in China.

Another worry is environmental costs of upgrading old buildings, which I’m told could be ruinous for some UK property companies, so that needs careful checking.

Going out at an all-time high, what a great result!

Mears (LON:MER)

Up 1% to 366p (£356m) - FY 12/2023 Results - Paul - AMBER/GREEN

Mears Group PLC, the leading provider of services to the Housing sector in the UK, announces its preliminary financial results for the year ended 31 December 2023 ("FY23").

Headline numbers look good - and it’s fantastic to see MER reporting average daily net cash - this needs to become the standard, as cash on one day (year end) can be meaningless as it’s so easily manipulated -

At 366p/share that gives a 2023 PER of 11.7x, which looks a sensible valuation for this type of business.

Stockopedia shows a broker consensus of 28.8p adj EPS, so assuming the numbers are calculated on a comparable basis, this looks like a beat against forecast. There are no broker notes available on Research Tree, which is something MER needs to address.

Outlook - doesn’t inspire, with profits in 2024 expected to be flat -

Mears has made a strong start to 2024. The Board continues to anticipate a reduction in management-led revenues as the elevated activity level seen across FY23 normalises, although the timing remains uncertain. Adjusted profit before tax in FY24 is expected to be of a similar quantum to FY23…

The Board believe that the Group is well-positioned for the future and is pleased that the strong trading momentum built in 2023 has continued into 2024."

Average daily net cash of £76.5m is 21% of the market cap. So there is an argument for adjusting out the cash in our valuation measures. Although remember that you would then need to also adjust out the £4.4m (see note 5) of “interest income from short-term deposits”, which is almost 10% of total profit before tax.

Further down it mentions a lower average daily net cash figure, it sounds as if the share buybacks might be responsible for the difference? -

The Group reported a net cash position of £109.1m on 31 December 2023, but the Directors believe that the average daily net cash, after adjusting for the full year impact of the share buybacks, averaged £50m during 2023, provides a better indication of the underlying position and is a better indicator of the Group's liquidity.

Balance sheet overall is strong, with £69m NTAV. Note there are particularly large entries relating to leases. There’s a £20m pension surplus - is it a real surplus? It seems to be, according to note 26. I can’t see any reference to deficit recovery payments.

Cashflow statement looks impressive. £136m after tax cash inflow looks amazing, but note that a lot of this disappears further down with £48m “discharge of lease liabilities”. Overall though, Mears managed to self-fund £25m capex, pay £11.8m in divis (total 10.95p), and do a huge buyback of £38m of its own shares - so the share count has fallen from c.113m in 2022 to just 97.6m shares in issue now. After all those cash outflows, it still ended the year with £15m more can than at the start. So this looks a very nicely cash generative business.

Note 21 is a bit worrying, with a £14.5m charge to the P&L in 2023 for onerous contract, legal, and other provisions. This needs further investigation, and would be good to ask management how these problems have arisen, and how they can be prevented in future.

Paul’s opinion - this looks good, with some very positive aspects, mainly how cash generative it’s been, and with meaningful share buybacks that should be beneficial for both EPS and DPS. The trouble is, the outlook statement doesn’t envisage any further growth in profit in 2024, which means that the PER of about 12 is probably about right, unless something changes for the better.

We’ve noted before that MER is doing particularly well thanks to “Asylum Seeker” housing contracts, thus it’s not clear how long, or at what level, those profits will continue?

Given that MER shares have risen from 250p to 350p in the last 6 months, then I’ll take my foot off the gas a bit, and ease back my view from green to AMBER/GREEN - so still positive, but less of an obvious bargain than it was last autumn is my conclusion today.

Shares hitting a 5-year high, and note the very high StockRank -

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.