Good morning from Paul & Graham!

Today's report is now finished.

Very very busy for news today, so we're doing lots of smaller sections again, to cover as much ground as possible. Please feel free to add your own comments too, especially if you spot something good that we haven't noticed, explaining why it's good.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

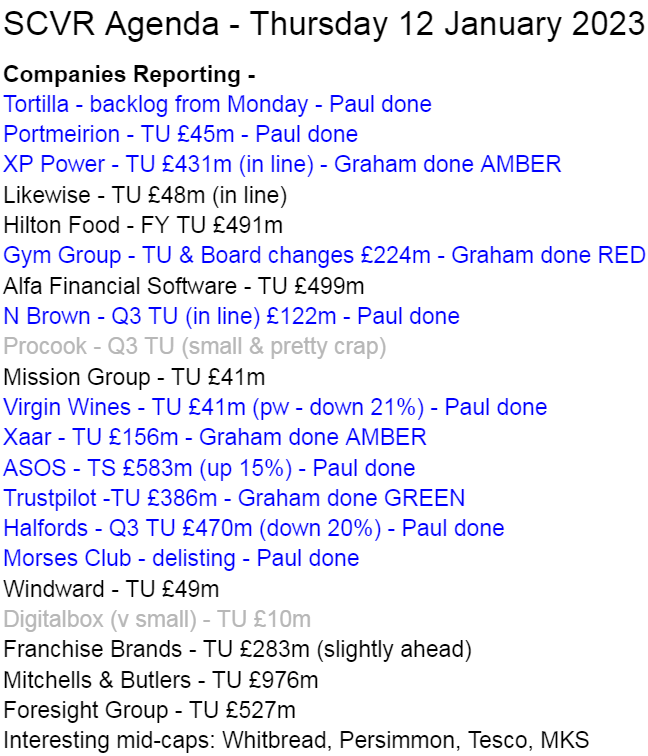

Agenda

An absolute avalanche of news today - here's our initial agenda, we'll try to work through as much of this list as we can. Also we'll pick up on the big % movers at about 9am, and prioritise accordingly.

Here's the final list, showing what we did & didn't manage to cover. I think we caught all the main stories today (in terms of price moves) -

Paul's Section:

Tortilla Mexican Grill (LON:MEX) - 101p - mkt cap £39m

Trading update on Mon 9 Jan said FY 12/2022 performance in line with market expectations (footnote: £58.4m revenues, adj EBITDA £4.0m). H1 was £2.5m adj EBITDA, so H2 must be lower at £1.5m. Decent growth from site roll-out, and acquisition of Chilango. Impressive LFL revenue performance at +16.4% vs 2019 - it needs to be at this sort of level to absorb all the extra costs. Although note it was +19% in H1. Says it can self-fund further new sites, and good deals available. Confident in outlook.

My opinion - I’m warming to MEX shares, and mystery shopped it again this week - the food is always good, and fairly priced, and healthy-ish compared with other fast food. But beware the £4m EBITDA number - it’s only really trading around breakeven, once you include depreciation and interest costs. Incredibly difficult sector, so I wouldn’t chase this share price too high. Although I see MEX as a long-term winner, likely to expand into a decent-sized national chain, if management can stay in control, which isn’t easy. Overall then, I'll give it a thumbs up due to the growth potential, and solid trading in a tough macro situation. (no section below)

N Brown (LON:BWNG) - 27p pre market - mkt cap £123m

Trading update - Q3 (ish) update says trading to end Dec 22 was “solid”. In line with market consensus outlook for FY 2/2023. Expecting market to be soft in FY 2/2024. Emphasises strong balance sheet (which is true, and the mkt cap is at a deep discount to NTAV - pretty much the only positive thing about this share). As we mentioned recently, the legal dispute with Allianz has been settled, but at a heavy cost of £49.5m. Seems to have ample liquidity, providing banks are comfortable with the big securitised loan.

My opinion - I don’t like the business model, and on current forecasts, it’s only trading around breakeven. No divis forecast either. The bull case is that the huge discount to NTAV might narrow, and self-help measures could see a turnaround (no sign of that happening yet though, with forecasts repeatedly falling). Also chance that controlling family might take it private. Could be a rebound trade in this current slightly mad market? (no section below)

Portmeirion (LON:PMP) - 323p pre market - mkt cap £45m

FY 12/2022 Trading Update - strong H2, with Christmas trading ahead of expectations. H2 is where almost all the profit is made historically. Revised guidance - revenues £110m (4% ahead of both guidance, and LY). PBT guided in line with market expectations, and 10% ahead of LY, has also exceeded pre-covid 2019 level. Pity they couldn’t just give a number, as I’m struggling to reconcile those statements. FY 12/2021 was £7.2m headline PBT, so this implies about £8.0m for FY 12/2022. That’s about 45p EPS, which is what the StockReport shows (EDIT: now confirmed these numbers to a note just out from Singers). So a PER of 7.2 - which looks very cheap. Energy costs are hedged into Q1 2024.

Outlook - cautious about macro, but expecting improved margins from efficiency gains. Margin target (long-term) is c.13%.

My opinion - thumbs up, this looks dirt cheap, and is overdue a strong bounce I think. (no section below). One of my top picks for 2023.

Halfords (LON:HFD) - 173p (down 20% at 08:28) - mkt cap £378m

Around £94m wiped off Halfords market cap first thing today. Q3 update for FY 3/2023. Strong sales in motoring, but softer than expected in cycling, and tyres. Struggling to recruit 1,000 more technicians (mechanics) for autocentres. Revised guidance: underlying PBT £50-60m for FY 3/2023. The last update on 23 Nov 2022 guided “at the lower end of our £65m to £75m range”, so this looks a 15-20% profit cut today.

My opinion - Halfords seems quite a good business, albeit low margin, and has diversified into car servicing & repairs. After today’s fall, the valuations is probably about right, so I can’t see any reason to get involved here. It could do well when the economy recovers and consumers feel more flush, but in the meantime it looks as if discretionary spend is being cut back. Overall, I'm neutral - amber on my spreadsheet.

ASOS (LON:ASC) - 673p (up 15% at 09:05) - mkt cap £674m

Has the long-awaited rebound started in the bombed out fashion eCommerce sector, or is this a dead cat bounce?

Trading Statement - is the 4 months to 31 Dec 2022, of FY 8/2023.

This sounds good -

Confident in outlook, with significant improvement in profitability and cash generation expected in H2 FY23

Q1 revenue down 4% vs LY. Reckons it can make profit improvements of >£300m, more than offsetting inflationary headwinds & higher returns rate. FY guidance is cash outflow of £(100)m to zero range - doesn’t seem very good, despite the upbeat commentary. Expecting an H1 loss, with significant improvement in H2. Stock write-off was previously c.£90m, now increased to c.£130m, buried in footnote 2. Low gross margin of 42.9%, and only 36.1% after including stock write-off. Says this will improve, it needs to! So the H1 numbers are likely to look awful, but we're served jam tomorrow for H2 & beyond.

My opinion - I’ve heard for years that Asos grew exponentially fast, but was a shambles internally - as people, systems, processes, didn’t change with the growth. Today’s indication of £300m+ cost-savings and profit improvements shows that they’re at last taking decisive action to make this a profitable business (it’s never really made any sustainable free cashflow [just a blip in the pandemic], and has never paid divis). Massive £4bn revenues means that every 1% of extra margin puts c.£40m onto the bottom line. Gross margin has always been far too low at Asos. Reduction in costs could further improve profits. So I can see there’s a decent opportunity here, it could be an interesting trade, but it's too early to judge whether it will make a good long-term investment or not.

Morses Club (LON:MCL)

Announces it’s to de-list. It says the listing is not economic, as doesn’t provide access to fresh funds, and inadequate liquidity. Hopes to keep going with private funds. Down 65% as I type this. It’s been a basket case for a while, so I don’t suppose it will be missed.

Distil (LON:DIS)

Another nano cap that's dropped 43% this morning on a hopeless update for FY 3/2023. Revenues will be "significantly below market expectations", and a EBITDA loss of £(0.6)m, in line with previous guidance. It's only got £277k cash left from a £3.2m fundraise in Aug 2021, so looks like another fundraise is needed (if possible at all) or a delisting is the next most likely step. I'll be steering clear of this one, for sure.

Virgin Wines UK (LON:VINO) - down 26% to 54p at 11:44 - mkt cap £30m

Trading Update - for H1 (6m to Dec 2022) has disappointed, causing shares to give up most of the recent rather indiscriminate small caps market rebound.

Profit warning today due to various operational problems, including new warehouse computer system disrupting/delaying dispatches, and problems with couriers. It also incurred extra costs to deal with the problems. H1 revenue fell £6.8m (down 17% on LY) to £33.7m. About half due to operational problems, the other half just reduced demand, presumably as some customers cut back.

FY 6/2023 guidance revised to £63m revenues, EBITDA margin 4-5%. Cash position is fine.

My opinion - disappointing, but not disastrous. Revised PBT forecast (Liberum) is only £1.8m for FY 6/2023, down from £5.3m LY. It’s fundamentally a nice little business, that should be fine long-term. Although shares likely to languish for a while I’d say, so I can’t get excited about it for now. Hence I’m neutral. The strong balance sheet means there’s not much risk here, and it remains profitable at a lower level, so sitting tight for the long-term recovery is probably just as sensible as ditching it and moving on. Your money, your choice.

Graham's Section:

Trustpilot (LON:TRST) (£386m pre-market) [quick comment] - I covered Trustpilot’s interims in some detail here. Today it updates the market with news that adjusted EBITDA for FY 2022 was ahead of expectations. Revenues of $149m look to me below expectations ($153m) after a huge currency headwind that reduced revenue growth by c. 10%. Huge dollar strength in 2022, on the back of hawkish Federal Reserve policies, will have made Trustpilot’s non-dollar earnings less valuable. However, the company’s revenue growth at constant exchange rates was in line with expectations and additionally they have adjusted their costs lower in response to the economic environment. Or in their own words, “given the uncertain market backdrop we have actively managed our business to deliver operating leverage in H2”.

I remain a fan of the story here. Trustpilot has a huge warchest of $73.5m in net cash, has seen annual recurring revenue growth of 20% (using constant exchange rates) to $162m, and enjoys a 100% net dollar retention rate - this means that there is no loss of business from the existing customer base. The valuation has increased since the last time we mentioned this, with the cash-adjusted price to sales ratio rising from 2x to 2.5x (using ARR as the measure of the sales). So it’s not as cheap as it was the last time we looked at it, but I still find it interesting at this level.

One final point is that the former CEO of Future Plc is now the Chair Designate at Trustpilot - hopefully she has learned from some previous investor relations difficulties.

Xaar (LON:XAR) (£137m) (-13%) [quick comment] - this inkjet technology share has spent many years in the doldrums after briefly making it into the FTSE-250 back in 2013. Since then, financial results have been erratic and it looks like 2023 could be another year to forget for the company’s shareholders. Performance in 2022 was at least “on track”: revenues of c. £74m (up from £59m), including organic growth of 9% plus acquisitions. But according to analyst estimates, Xaar’s adjusted profits for 2022 will be minimal (around £1m).

A factory reorganisation should help in 2023, and there are no problems reported from recent acquisitions. The company’s current difficulties instead relate to “uncertainty in China, which is expected to continue in the short term as Covid cases increase. At this stage it remains unclear when normal levels of business will return.” Analysts at Progressive have slashed their adjusted PBT estimate for 2023 from £4.4m to just £2.5m. Perhaps the reopening of China can reverse this bad news? But the truth is that Chinese demand for Xaar’s products has always been volatile and unpredictable. Ultimately, I doubt whether anyone can predict this company’s fortunes. And it doesn’t have the balance sheet it used to have, with its cash balance now only around £9m.

GYM (LON:GYM) (£218m) (-4%) [quick comment] - this low-cost gym operator has decided that it agrees with the views expressed in the SCVR, and has decided to slow the pace at which it opens new sites (see our November article here). Instead of opening 25-30 sites in 2023, it now expects to only open 20 new sites. Total site numbers are currently 229 and personally, I would be fine with site openings falling to the single digits at this point. My reasoning is that the company has a rising net debt level of £76m (this excludes rents) and I fear they may regret funding a roll-out in a year or two when their energy hedges expire and as consumer behaviour remains unpredictable. Gym memberships are of course one of the easiest things for consumers to cut in a cost-of-living crisis. A like-for-like comparison of revenues at mature sites versus 2019 shows that GYM’s site revenues are still only at 90% of pre-Covid levels, and it looks like the post-Covid recovery bounce is now over. Work-from-home/hybrid working has left some of their more mature sites without the local footfall they need to make a full recovery.

Remember that like-for-like revenues need to increase, just for the company to keep pace with inflation. The company reports that January member acquisition is in line with expectations, and they do plan to self-fund their site openings this year (i.e. without any need for further shareholder dilution). But they will do so without their current CEO, who is stepping down, and they are now searching for someone to fill that role. I can’t help the feeling that this change reflects a realisation that prior growth plans were too ambitious. With uncertainty around future leadership and an indebted balance sheet, I would be inclined to avoid these shares for now.

XP Power (LON:XPP) (£430m) (+2%) [quick comment] - 2022 adjusted operating profits will be in the middle of the range of market expectations (£41 - £46m, so I guess that’s £43.5m). This developer and manufacturer of power components had a dreadful H1 but thankfully reports that H2 performance “improved significantly”. The full-year revenue performance is up 5% organically at constant exchange rates.

Looking ahead, order intake has been soft in Q4 compared to last year but the company is still happy with the overall size of the order book and claims to have good visibility for 2023, particularly in H1. The cash performance has been very poor, due to a lawsuit the company lost in the United States, and net debt is now £152m. Inventories are also still draining more cash than expected, and the company has received covenant flexibility from lenders - a red flag that the company is under some financial stress (though it claims it will be able to stay well inside the new covenants). Based on its long prior track record of success, I think investors can probably still have faith in this company, despite the various problems it has had in 2022. Deleveraging needs to be its top priority in the short-term.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.