Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

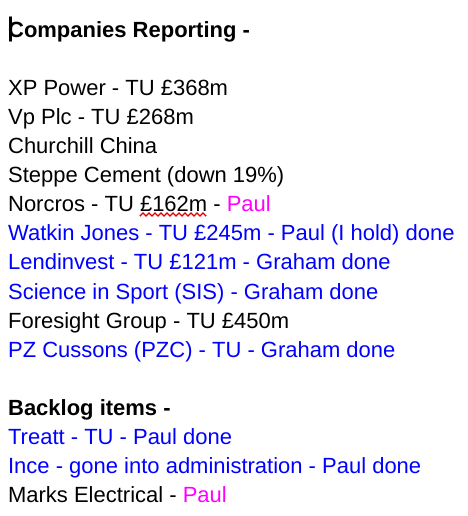

This is what we're going to attempt to cover today - making good progress at 09:00, so time for a tea break before tackling some more on the list. I'll also check the top % movers table, to see if there's anything interesting going on that is not on ze list -

Summaries of main sections

(more detail below)

Treatt (LON:TET) - H1 TU - up 6% to 622p y’day (£375m) - Paul - AMBER

H1 trading is strong, in line with expectations. Outlook section hints at possible upgrades later this year. I like the company, but my main concern remains the lofty valuation, discussed in more detail below.

Watkin Jones (LON:WJG) - H1 TU - down 3% to 93p (£239m) - Paul (I hold) - GREEN

Seems reassuring about H1 and the outlook. Although a project in Exeter has been hit by unexpected costs, due to a contractor going bust - it would have been helpful to give some idea of the size of this impact, which is missing. Heavy H2 weighting, as previously indicated. It's good value, I think, with a nice lower risk business model (forward selling developments before construction starts).

Science in Sport (LON:SIS) - Strategic review concludes / TU - up 6% to 9p (market cap £16m) - Graham - AMBER

The strategic review is over; The growth plan will continue with emphasis on profitability. Margins should improve but quality shareholder returns are far from certain.

PZ Cussons (LON:PZC) - TU - up 4% to 195.4p (market cap £838m) - Graham - AMBER

I’m on the fence between Green and Amber with this. Full-year profits are trending at least in line with expectations, helped by currencies, as inflation continues to get passed onto customers.

Lendinvest (LON:LINV) - full-year TU in line with expectations - up 1% to 87.5p (market cap £122m) - Graham - AMBER

Reassuring update that this property platform and investor is on track to report expected profitability. Superficially cheap but highly leveraged property play.

Marks Electrical (LON:MRK) - FY 3/2023 TU -

Quick comments

(no additional detail below)

Ince (LON:INCE) - a wipe-out for shareholders of this legal/accountancy group. It announced yesterday afternoon that a major creditor was withdrawing support, so it has no choice but to appoint an administrator. Hence shares suspended, and almost certainly worth nothing. We’ve been strenuously warning SCVR readers away from this share for years, so I very much hope nobody here was caught on this one. It’s staggering how inept many accountants seem to be at managing their own affairs - this being the latest in a series of disastrous listed firms of this type. I remember joking with Ric Traynor, the boss of Begbies Traynor (LON:BEG) a few years ago, that his firm seemed to be (at the time) the only one that hadn’t gone bust, and he agreed, calling BEG the last man standing in its field of listed rivals. That was before FRP listed, which has done OK so far.

INCE going under reinforces my resolve to completely avoid all of these people businesses where there’s an inherent conflict between fee earners and outside shareholders. INCE seems to have been staggeringly badly run - see our archive here for the whole sorry INCE tale.

Paul’s Section:

Treatt (LON:TET)

622p (up 6% yesterday)

Market cap £375m

Treatt, the manufacturer and supplier of a diverse and sustainable portfolio of natural extracts and ingredients for the beverage, flavour and fragrance industries, announces the following trading update for the half year ended 31 March 2023 (the "Period").

The current financial year is FY 9/2023.

I keep a close eye on this company, as it’s always intrigued me. Our last review was here in Jan 2023, when it said Q1 (Oct-Dec 2022) was trading in line with expectations.

This share always looks expensive, but the bull argument is that all its larger competitors are also expensive (on high PERs). Plus TET has built a new factory, which will double capacity once it’s fully online - I’m more convinced by the second point, but not the first! Just because other investors are overpaying for an asset, doesn’t convince me to follow their lead. Although it could make TET a takeover target from a highly rated industry giant.

So to be bullish on TET, I think by implication you’re expecting it to out-perform broker forecasts, which so far it hasn’t. Indeed forecasts have come down a fair bit -

Turning to yesterday’s H1 trading update, this all looks reassuring -

Nothing of concern there, but only in line with expectations again, which I don’t think is good enough, considering the shares are rated at 28x broker consensus earnings estimate for FY 9/2023. But the market was happy with it, as the share price rose 6% yesterday.

There’s lots more detail in the announcement, but nothing of any earth-shattering importance.

I’m particularly keen to learn more about expansion plans, with the new factory now up & running. It says this -

After substantial investment in our people and production facilities in the past 18 months to support the Group's next phase of expansion, we do not anticipate any significant increase in administrative expenses in the short to medium term, above the normal rate of inflation. The group headcount has reduced by 6% since September 2022 with the benefits of relocating to our new UK facility beginning to show the expected efficiencies.

Debt - isn’t a problem anyway, but it’s set to reduce further -

The Group has decades of experience managing raw material price movements which are impacted, not only by general inflation, but also by specific supply and demand factors such as climatic conditions. We anticipate a further reduction in net debt in H2 in line with market expectations.

I wonder if the widely reported recent falls in food prices will help boost TET’s future profit margins, or if customers will seek discounts to reflect lower costs?

Outlook - this is the best bit, and the way I read this, it sounds as if they’re warming us up ("at this stage") for a possible beat against expectations in Q3 or Q4 -

The Group has started FY23 strongly and we have good confidence in Treatt's proposition and its ability to deliver top line growth, supported by positive market dynamics.

Q2 momentum was particularly encouraging and we enter H2 with a strong order book and conversion of sales pipeline.

At this stage, we expect to report full year profit before tax and exceptional items in line with the Board's expectations.

Diary date - 9 May for H1 results to 31 March. That’s a prompt reporting schedule, which I like - it usually means the financial controls are good, if the accounts department can report promptly. Or they’re just winging it, with estimates ;-)

Paul’s opinion - much the same as I always say for this company - it’s a nice business, and improving now that it has a spangly new factory. H1 figures and outlook both seem pretty good.

However, that solid performance seems priced-in to the shares already. I could cope with PERs over 20 in the zero-interest rate world, but not any more. This share should probably be on a PER of 15-20 in my opinion. So at 28x current year, and only an in line update yesterday, it’s difficult to see any immediate upside here.

With raw ingredients now falling in price apparently, and good demand, then the real PER could be much lower of course, once it’s put out an ahead of expectations update later this year, which is slightly hinted at, in the outlook section. Trouble is again, the share price is already anticipating that.

Longer term, it seems to be in a nice sector, and if TET can drive up utilisation of the new factory (potentially doubling volumes) then I can see a nice long-term story developing.

In conclusion then, I’m positive about the company, but the high valuation means on balance it has to be a neutral overall view, AMBER.

There's been a fair bit of progress made in the last 5-years, but the share price hasn't really achieved that much at this point overall, and dividends have been paltry, since there's not been any free cashflow as the heavy capex programme (now largely complete) has consumed the cash generated. I do wonder, is this company really as high quality as everyone seems to think? I'm only asking the question, don't shoot the messenger! It's not obvious from the historic numbers anyway.

Also note the StockRank has plunged, and is now low - with Stocko's algorithms currently viewing this as expensive, and not very good quality -

Watkin Jones (LON:WJG) (Paul holds)

93.2p (down 3% at 08:20)

Market cap £239m

This covers the 6 months to end March 2023, being H1 of FY 9/2023.

Watkin Jones has an interesting, differentiated business model. It builds mainly student accommodation (but also build to let is increasing), but crucially these developments are forward-sold to institutional buyers, before they’ve been built. So WJG has very little risk, other than cost over-runs, which have tended not to be an issue historically.

It gave detailed guidance at the start of 2023, saying that a softer H1 was expected as margins tighten. However, it seemed upbeat about the future, saying that institutional investors were coming back into the market, after a hiatus caused by the mini budget, and rising interest rates.

Rents to the end occupiers are rising strongly, hence there is still appeal to this niche, although building margins are likely to be trimmed somewhat from the days of zero interest rates.

I watched the company’s last investor webinar, and was impressed with how the very experienced team at WJG seemed to be on top of all the issues, and very open about softer margins expected in H1, so hopefully no surprises. That’s why I’ve continued to hold a small position in this share personally, for the recovery potential with little risk, and the nice divis are a bonus too.

Costs of remedying buildings following stricter rules after Grenfell are a downside risk though, and the provision has already been increased considerably. What’s the betting further increases happen? Quite high I’d say, but obviously safety comes first, but somebody (shareholders) have to pay for it.

Here’s the main body of today’s update for H1, which I think is self-explanatory.

I wish companies wouldn’t use abbreviations, or at least put an asterisk to a footnote explaining what they are.

PBSA is - purpose built student accommodation.

BTR - is build to rent.

My only other complaint is that I would have liked a rough indication of the financial cost of point 1, the contractor going bust.

Other than that, everything else looks fine, even encouraging.

Paul’s opinion - looks fine to me, so I’m happy to continue holding a small position with a medium term view, and might load up when the interims come out, as we could get a dip when relatively poor (expected) H1 figures are issued. So I’d like to keep some powder dry for that eventuality, to buy any dip.

Longer term, I think this share has lots of recovery potential, without all the risks that you have to take with other property investments.

So it gets a thumbs up from me, as good value - I think the share price has been overly beaten down with the sector generally, providing a buying opportunity for us, hopefully, if we’re patient.

I'm generally now switching from 3-year to 5-year charts, because the 3-years are losing the initial covid impact, which is important for perspective (as the March 2020 lows show the key turning point price, where investors stopped selling, and became net buyers) - then of course the everything rally that started when the vaccines were authorised in Oct 2020 -

Marks Electrical (LON:MRK)

88p

Market cap £92m

I last looked at this online retailer of electrical products here in Jan 2023, when it issued an in line Q3 trading update, with YTD revenues up 22%. I baulked at the 98p share price suggesting it had got a bit ahead of itself at 19x forward earnings.

This update came out yesterday -

Marks Electrical Group plc ("Marks Electrical" or "the Group"), a fast-growing online electrical retailer, provides a trading update for its fourth quarter ended 31 March 2023 ("the period" or "Q4-23"), ahead of announcing its Full Year Results for the 12 months ended 31 March 2023 on 14 June 2023.

The company’s view of its own performance is -

Continued revenue growth, with margin expansion and strong cash conversion

Q4 revenue growth was very similar to previously, at +20% vs last year (LY).

The total revenue for FY 3/2023 is £97.8m, and growth for FY 3/2023 vs LY is an impressive +21.5% - that’s well above inflation, so indicates volume, as well as price growth.

Gained market share.

Gross margin rose in H2 (as expected).

Full year adj EBITDA: above £7.5m (Canaccord says consensus was £7.3m, so this is a modest beat)

Closing net cash of £10.0m, thanks to working capital improvements.

Quite a long way down the announcement, it seems to be saying that results are ahead of expectations - surely that good news should have been right at the top within highlights, and in the headline? -

After an improvement in profitability in the third quarter, we continued this trajectory with improvements in gross margin and operational leverage, allowing us to exceed our full year targets on profit and cash conversion, even as we grow market share.

Outlook - a “positive start to April”.

Valuation - many thanks to Canaccord for its update note on Research Tree. It increases FY 3/2023 to 4.7p - note this is still down on 5.0p LY, so we mustn’t get carried away here.

At 88p per share, that gives us a PER of 18.7x, which for me is still a bit too rich.

Investors have to weigh up whether you’re prepared to pay a highish price tag, to reflect the strong organic growth, and the fairly good profit margins in a highly competitive sector - which suggests to me that MRK is the most efficient operator in this sector as it’s beating margins made by £AO. and much larger Currys (LON:CURY) (which has a diabolical balance sheet, by the way). Actually, despite being the smallest of those 3 electrical retailers, I’d say that MRK is by far the lowest risk. CURY is dangerously reliant on credit from suppliers, and has a large, negative NTAV. AO has a lot of on balance sheet risk from extended warranties.

MRK is free of both those significant problems. I also like its one-site, own logistics & distribution model, which seems more efficient.

Paul’s opinion - a thumbs up for the business, but I’m not comfortable with the current valuation, which for me, is too high for this type of business.

Hence purely due to valuation, I’ll have to go for AMBER. Although I would be happy to snap up a few of these shares the next time the market throws a panic & people start selling. It looks a fundamentally good, growing, entrepreneurial business.

If you watch any of the webinars from MRK, you’ll get a master class from the founder on how to run an efficient business. Actually, I think I’m talking myself into buying some MRK shares!! This should do well long-term, I reckon.

There's a lovely high StockRank too -

Graham’s Section:

Science in Sport (LON:SIS)

Share price: 9p (+6%)

Market cap: £16m

I reviewed the merits of this stock at the time of its February trading update here.

This morning, we have news that the strategic review announced last September is finally over. Here is the conclusion:

…the Board has concluded that shareholders' interests are best served by seeking to maximise value through focusing on accelerating the profitable growth of the business under an ambitious growth and efficiency plan that is currently delivering in line with management's expectations.

I interpret this as saying that there will be no major change in direction.

However, when we look at the “key drivers” for the decision, we find that three of the four bullet points emphasise the company’s prospects for improved profitability. Perhaps the company is getting serious about the need to stop bleeding money, year in and year out?

The company believes that its two brands - PhD and Science in Sport - have “significant differentiation and superiority”, and can “attract new users and retain loyalty”.

Its new manufacturing, distribution and warehousing facility in Blackburn is now complete: “The cost benefits of the facility, now being delivered, are expected to provide operational leverage and expansion capacity over the foreseeable future for continued operationally leveraged global growth.”

It says that it has a “comprehensive profitable growth plan”, but I don’t think it gives too much away about the specifics of this plan.

It points to growth in the overall sports nutrition market, it points to its distribution partner Flywheel Digital, and it points to its sponsorship of the Shanghai Marathon.

The most compelling argument it makes, in my view, is the argument that manufacturing its own bars in the Blackburn facility will improve its margins. Although I have more to say about that below.

In summary, the strategic review has concluded without any of the fireworks or dramatic decisions that may have seemed possible at the outset. The company will continue on its current path, but perhaps with a greater emphasis on bottom-line profitability?

Trading update - there is a “good start” to 2023. Q1 revenue is £15.6m, up 2.3%.

And some evidence of improved margins:

Q1 trading contribution margin was 20.9% (FY22 13.7%), delivering a significant improvement over the comparative period, because of the implementation of the growth plan. Overheads were in line with management expectations.

Graham’s view

I’m hopeful that this stock might finally come good and deliver on its promises. I also note that it remains very cheap on a price/sales basis. But we mustn’t get too carried away.

Actually, I can explain in a mathematical way why investors should not get overly excited by the fact that SIS has increased its margins by bringing its production in-house.

Here’s a well-known formula for return on equity::

These are the three major levers for increasing a company’s ROE.

When a company starts doing manufacturing work that it previously outsourced, its margins will improve because it no longer has to pay the profit margin for the outsourced manufacturer that it’s no longer using.

However, this comes at a price in the form of a higher asset base. The company now has to own and maintain all of the necessary manufacturing equipment. All else being equal, we should assume that return on assets, the second lever of ROE, will decrease.

What this means is that we can’t say for certain that ROE will improve. We can reasonably expect that the profit margin will improve and that return on assets will deteriorate, but we don’t know for sure what will happen to ROE. It will depend on which factor outweighs the other.

In other words, SIS still has everything to prove when it comes to the profitability of its current strategic direction.

I do think that its brands are impressive and that the stock has potential, but I’m not ready to give it the thumbs up just yet.

Also, while this is unconfirmed, I expect that the company’s current cash position is quite weak. There has been no update on this but the amount raised in the most recent placing was not enough to settle its last-reported net debt position. Another factor to be aware of.

PZ Cussons (LON:PZC)

Share price: 195.4p (+4%)

Market cap: £838m

Let’s take another look at this FTSE-250 member. I also wrote a few words about it in February.

Here is today’s Q3 update, with expected full-year profits “at least in line with expectations”:

Like-for-like revenue growth 6.2% for the quarter (in line with expectations), or 6.1% year-to-date.

“Europe and the Americas region back to strong revenue growth and with significantly improved margin” - like-for-like revenue growth here was 9.9% for Q3, much improved on prior quarters.

Strategic progress with “Must Win” brands, including dishwasher products and baby lotions.

Once again, it is price/mix movements that are driving the revenue growth, rather than volumes. In an inflationary environment, we have to remember that successful companies are going to pass on input cost increases and that this doesn’t necessarily represent “real” growth.

Reading further down the report, to the outlook statement, I see that there is a 3-4% currency benefit from translating foreign operations, and this is boosting expected full-year profits. Perhaps the company isn’t really outperforming by much at all, if you exclude that tailwind?

Graham’s view

I don’t think this trading update changes things so I’ll wrap up my comments on it quickly. The bottom line is that I still consider this to be a fine company and I wouldn’t mind owning a few shares in it. Performance does need to tick up a little, so I’m on the fence between Green and Amber:

Lendinvest (LON:LINV)

Share price: 87.5p (+1%)

Market cap: £122m

This is a full-year update from Lendinvest, which describes itself as “the UK’s leading platform for mortgages”.

You may recall that it issued a profit warning back in October 2022, when it repriced its products and reduced its lending appetite, in the midst of rising interest rates, falling property prices and mortgage market disruption.

Today’s update is reassuringly in line with expectations, so the company should report PBT of c. £14.3m for FY March 2023.

The sharp slowdown in H2 (the period from September to March) is evident from the figures below:

Platform assets under management grew 6.4% in H2 and 20.5% in the year, and now stand at £2.6 billion.

Total funds under management grew 4.8% in H2 and 45.2% in the year, and now stand at £3.6 billion.

Headroom: the company has an additional £1 billion in headroom to lend to its borrowers, “when market conditions improve”.

New product: the company now has a Residential Mortgage product, supported by £300m from Lloyds Bank, for “borrowers with multiple sources of income, the self-employed and small-business owners”. Sounds great - I know that mortgage applications for self-employed people can be quite complicated!

Excerpt from the CEO comment:

Our technology enables us to continue developing disruptive new solutions in existing and new parts of the mortgage market, giving us a competitive edge with brokers and borrowers and helping us to continue to attract diverse sources of capital.

Current trading/outlook includes some important observations on the housing market:

More than 1.4 million households in the UK are facing the prospect of interest rate rises when they renew their fixed rate mortgages in 2023. We have seen a shift, with an increase in borrowers opting for tracker mortgages which provide greater flexibility to remortgage if rates reduce. Some of our commercial borrowers are seeing the weaker property market as a buying opportunity and in March we recorded our highest ever level of applications for bridging loans.

Estimates - a broker note from finnCap indicates that the FY 2023 revenue estimate has been revised lower, but all other estimates are unchanged (including FY 2024 estimates).

Graham’s view

This stock provides an easy way to bet on the housing market. If you think that buy-to-let, property development and other property projects will have a fair wind over the next few years, then Lendinvest might be a good way to express that view.

Personally, I can see that this stock is cheap relative to earnings, but I also see significant risks here:

Balance sheet net assets were only £60m in September 2022, after the fair value of buy-to-let loans saw a whopping £80m+ reduction in fair value.

The fair value of these loans will continue to fluctuate in accordance with interest rates, so hopefully you can see why I don’t think these shares are a slam-dunk buy at their current level. Leverage is very significant here and you really have to have a view on the direction of the property market - otherwise, this stock offers no margin of safety.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.