Good morning, it's Paul here with Thursday's SCVR.

Estimated timings - there's lots to cover in detail today, so I'm carrying on until about 4:30 pm.

Edit at 15:58 - today's report is now finished.

Please see the header above, for the announcements today which have caught my eye, in the small caps space.

.

Topps Tiles (LON:TPT)

Share price: 50p (up 16% today, at 09:21)

No. shares: 195.0m

Market cap: £97.5m

Topps Tiles Plc (the "Group"), the UK's leading tile specialist, announces a trading update for the six week period ended 8 August 2020.

Checking my previous notes, I reported here on 1 July 2020, on a positive Q3 (Apr-Jun) update, plus a good performance in the first week of re-opening stores (LFL sales down only 5.4%).

Today's update has a summary at the start (becoming increasingly popular, probably dreamed up by the PRs!), saying;

Robust like-for-like growth; modest pre-tax profits now expected for FY20; well-positioned to strengthen market position...

Remember that these summaries will be cherry-picking the best bits usually, so need to be initially treated with scepticism. EDIT: having looked through the whole update, I'm happy to withdraw this general point - in this case, the summary is accurate. End of edit.

LFL sales in Q4 (July-Sept 2020) to date - this looks excellent;

Retail trading over the first six weeks of our final quarter has been robust, with like for like retail revenues growing by 15.5% year-on-year.

It's not clear whether the above includes online sales, or not. So I queried this with the company's advisers, who have just called me back to confirm that the above LFL figure does include both stores and online sales.

Online sales have moderated once the stores re-opened;

While online sales have moderated from the peaks seen in April and May they remain above previous levels, leveraging the Group's recent online investments.

A reduction in online sales is to be expected, once stores re-open, so that's not a problem.

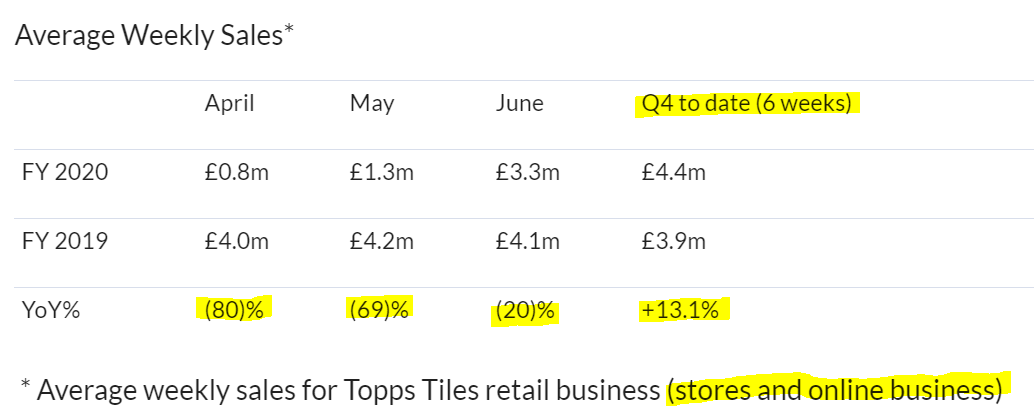

Average weekly sales - excellent transparency here, I wish all companies would present current trading information in such a clear format. The trend looks very good here, from a severe downturn when lockdown began, to now trading ahead of prior year with stores re-opened. There must be pent-up demand now being satisfied, which is good to see;

.

.

Note that the table above does combine stores, and online sales.

Stores now operating normally, staff returned from furlough.

Commercial division - subdued, but starting to improve. Subjectively, the tone sounds less enthusiastic about this division than previously.

Order book "significantly ahead of the prior year"

Guidance - good to see transparency here as well, instead of the usual it's too uncertain to give any guidance, which other companies are still trotting out;

... the Board now expects that the Group will generate a modest level of adjusted profit before tax2 for the 52 weeks ended 26 September 2020.

Given the unique conditions created by covid-19, I think to still be able to generate a small profit for the year, is pretty impressive. Bear in mind though, that this is only possible because of Govt support measures - particularly furlough, and business rates waiver. Without that taxpayer support, we'd probably be looking at a thumping loss for the year.

Liquidity - very good, but boosted by stretching creditors no doubt, plus the sale & leaseback which we already knew about. Times of crisis demonstrate so well how owning freeholds gives companies a get out of jail free card. Such property can be sold outright, or a sale & leaseback, thus generating significant cash when it's most needed. I'm a huge fan of companies with freehold property - it de-risks investments, and is often ignored in valuation, meaning investors get a substantial asset thrown in for free. It's also a signal of prudent management. You often find freeholds in family-run, or owner-managed listed companies, which is a theme we've been discussing here recently. A key lesson from this crisis is that prudently funded, owner-managed businesses, don't go bust, and probably don't have to raise any fresh equity at a low share price. Unlike many companies with hired hands running things, taking risks in order to achieve their share options targets.

The combination of strong trading and receipt of the proceeds from the sale and lease back of the Group's head office and warehouse buildings at Enderby in June, have had a material impact on the Group's liquidity position. The Group currently has c.£9 million of net cash and available cash headroom of £58 million within its financing facilities.

That's good, but it's disappointing to see that Topps has not disclosed what short term cashflow benefit it has received from stretching creditors, e.g. taxes in particular. It's misleading to trumpet lots of liquidity, but not tell us how much has occurred due to one-off & temporary measures, such as VAT deferral. This should be disclosed either way - whether companies have taken advantage of tax deferral, or not. This is the one key omission, in an otherwise excellent update.

My opinion - this looks a really good update, in tough times.

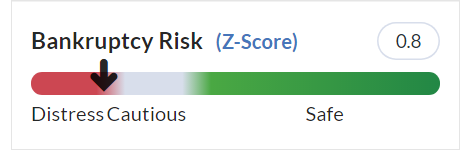

Note that the Z-score (a key thing to check, on every company's StockReport) is showing a poor result. However, the computers don't know about the large freehold property sale & leaseback, hence this should update to a more positive figure, next time results are published. Therefore, it's safe to ignore this warning.

.

There's an updated broker note available on Research Tree, which makes interesting reading. Note that previously the analyst had pencilled in a loss of £4m for FY 09/2020, but has today raised that to a profit of £2.2m - a big forecast improvement, which justifies a decent move up in the share price today. Future years forecasts are also raised significantly.

Overall then, this is a good day for TPT shareholders - an excellent update, and decently improved prospects. So it gets a thumbs up from me. Unfortunately, I had to ditch my spread bet on this share a little while ago, due to a margin call on something else, so I've missed out on this decent rise today. Am toying with the idea of buying back in.

Given strong current trading, risk:reward looks good to me. I doubt it would be likely to revisit previous lows. Although the big unknown is covid & a possible second wave. Based on what happened last time, DIY type businesses are one of the least likely to be closed down, so the risk here looks much lower than say for pubs/restaurants.

.

.

Tribal (LON:TRB)

Share price: 65.5p (up 15% today, at 09:20)

No. shares: 205.7m

Market cap: £134.7m

I've moved this announcement up the running order, because the share price has risen strongly this morning, so there might be something interesting going on.

This is an education-focused business, providing software & services for universities & schools, worldwide.

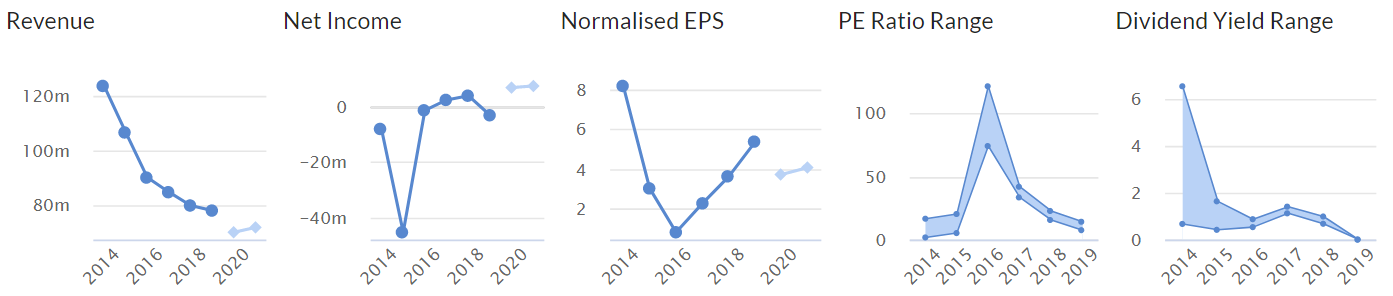

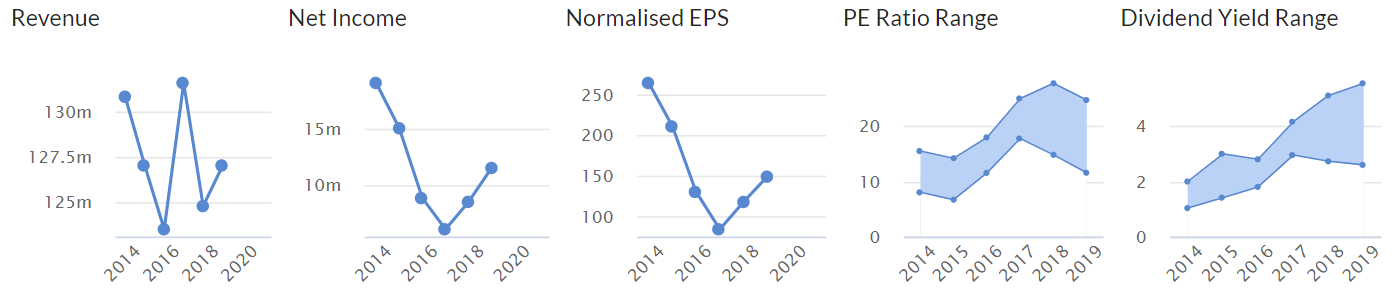

Historically its performance has been erratic, and unimpressive, as you can see from the Stockopedia graphical history (my starting point for looking at every company);

.

.

This has been reflected in a disappointing share price performance, over the last 10 years - it's pretty much back to where it was 10 years ago, and there have only been modest dividends over this period too.

.

.

Still, the way I look at things, the past doesn't matter, shares are all about the future. Therefore a company with a disappointing track record, could start off from a base price that is too cheap, if good things begin happening (e.g. restructuring under new mgt). That's why it's worth looking at everything with an open mind.

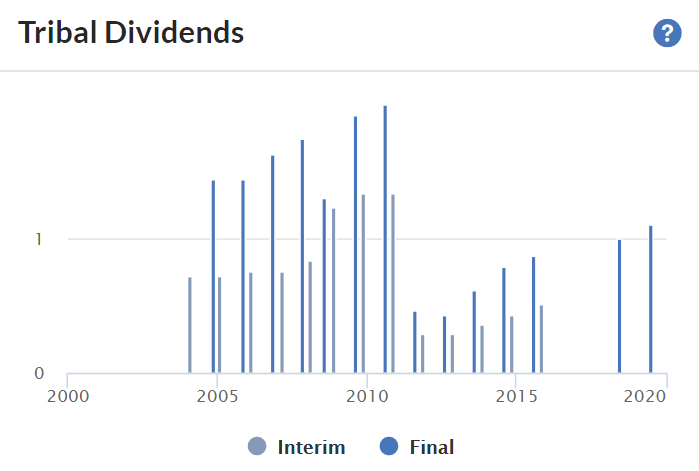

As you can see below, divis were reduced downwards in 2010, and have only been small since - not a good sign, as this seems to suggest a business which has struggled to generate cashflow over the long term;

.

.

The average number of shares, shown on the StockReport, sees an increase in several stages, from 131m, to 205.7m, since 2014. I seem to recall it got into a mess financially, possibly through making duff acquisitions, and came close to going bust at some stage.

Today's results - are for H1, being the 6 months to 30 June 2020.

H1 revenues £38.2m, down 5.4% on H1 LY

Adjusted profit before tax of £6.4m, is up a bit on H1 LY (£6.2m)

Adjustments are shown in note 5 - the company classifies quite a lot of things are adjustments, and these are material to profits, being £1.7m this time, and £1.9m last time (H1 figures), so a bit of scepticism needed here perhaps? If companies do a lot of adjustments to profits, then I tend to value the business on a lower PER than I would for completely clean accounts with no adjustments.

Balance sheet - is weak, but that doesn't always matter for software companies with strong, long-term recurring revenues, and up-front payments by customers. Hence I'm just reporting the facts, not ringing an alarm bell.

NAV: £37.0m, less intangibles of £48.0m = NTAV is negative, at £(11.0)m. I don't usually invest in companies with negative NTAV, unless they're exceptionally cash generative.

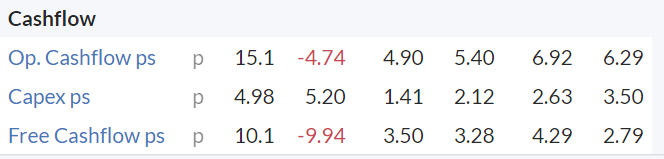

The Stockopedia summary shows that it has generated cash in the last 4 years (this table runs from 2014 to 2019 calendar years), with an increasing amount spent on capex. Capex is mainly capitalised development spending. The cashflow statements are quite complicated though, as they include acquisitions, drawing and paying down loans, etc.

.

Remember that Tribal had an expensive legal dispute with a software provider a year or two ago, which cost it close to £10m. So it seems a bit accident prone. I'm not convinced that acquisitions have added much value either.

Outlook - the figures look resilient, given the disruption caused by covid. Software businesses, with strong recurring revenues, serving mostly public sector bodies (less likelihood of bad debts) has been a good place to take cover during this crisis.

There's also a positive outlook comment (probably the main reason for people buying the share today);

The Group expects results in the current year to be slightly ahead of market expectations for Revenue and Adjusted EBITDA, and ahead for Adjusted EBITA.

Sales pipeline is positive - cloud, CRM, and mobile products are mentioned as generating customer interest.

Sales cycle lengthened - due to uncertainty over student numbers (covid impact/uncertainty)

My opinion - I'm neutral on this one.

Positives - resilient figures, good recurring revenues, sticky customer base, products sound relevant (cloud, etc), good current year outlook.

Negatives - weak balance sheet, poor long-term track record, customer budgets constrained, sales cycle lengthening.

.

Goodwin (LON:GDWN)

Share price: 3115p (down 2.4% today, at 10:26)

No. shares: 7.36m

Market cap: £229.3m

Goodwin PLC today announces its preliminary results for the year ended 30th April 2020.

BUSINESS MODEL

The Group's focus is on manufacturing within two sectors, mechanical engineering and refractory engineering, and through this division of our manufacturing activities, our overseas business facilities and our global sales and marketing activities, the Group benefits from market diversity. Further details of our business and products are shown on our website www.goodwin.co.uk

.

What an interesting share! I've gone through all the figures & narrative, and several general things strike me;

- No adjustments to the figures (so they're probably presented stated prudently)

- Balanced commentary, comes across as trustworthy, not rampy

- Obvious that this is a well-managed group

- Long-standing history - a family-managed/owned business that happens to have a listing, so external shareholders are along for the ride here, as you can see from the major shareholders & Directors info, with Richard Goodwin having a dominant stake;

.

.

Results FY 04/2020 - here are my notes covering the key points;

- Revenues up 14% to £145m

- Pre-tax profit down 26% to £12.1m - why profit is down is not explained in full, but negatives mentioned include: covid impact in Q4 ("stalled our progress"), USA/China trade frictions, customer disputes with 2 contracts

- EPS (diluted) of 103.3p (down from 149.6p LY) - PER of 30.2 - looks expensive, but remember Goodwin doesn't adjust its EPS, so on a comparable basis to other companies, the PER would probably be somewhat lower

- Dividend reduced 15% to 81.71p - yielding 2.6% (not bad, for a sustainable divi) - sends a strong signal that covid has not done serious damage to the business, and buoyed by strong order book

"Current workload" (similar to order book, presumably) is high, at £183m, up 11% on prior year end;

Armed with this workload, the Group retains a high degree of confidence in the future versus the looming uncertainty for many businesses this coming year.

Bank facilities tendered out, switched to Santandar, on better terms. Took out £30m Govt CCFF loan, as an "insurance policy". Borrowing facilities look ample to me, so no concerns here.

Changing auditor after using KPMG for 56 years!

Reduced previous dependence on oil & gas sector, more diversified now, both in sectors and internationally

Balance sheet - looks good. NAV: £109.6m, less intangibles of £24.7m, gives NTAV of a healthy £84.9m

Receivables look under good control, at £24.5m

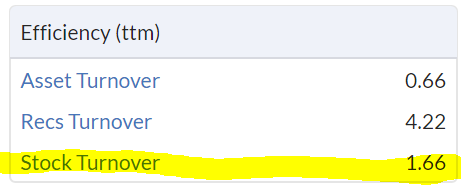

Inventories seem high at £44.9m. Jack recently pointed out that the StockReports here have some handy tools to check if receivables and inventories are reasonable. I'd never even noticed they were there! Here are the relevant figures for Goodwin, which confirms that inventories turn over very slowly indeed. Maybe they have to keep a high number of stock lines on hand? It just seems odd that a company which clearly keeps a tight rein on its receivables book, has so much inventories kicking about (NB these are historic numbers below now, which should update in a few days when these latest results feed through);

.

.

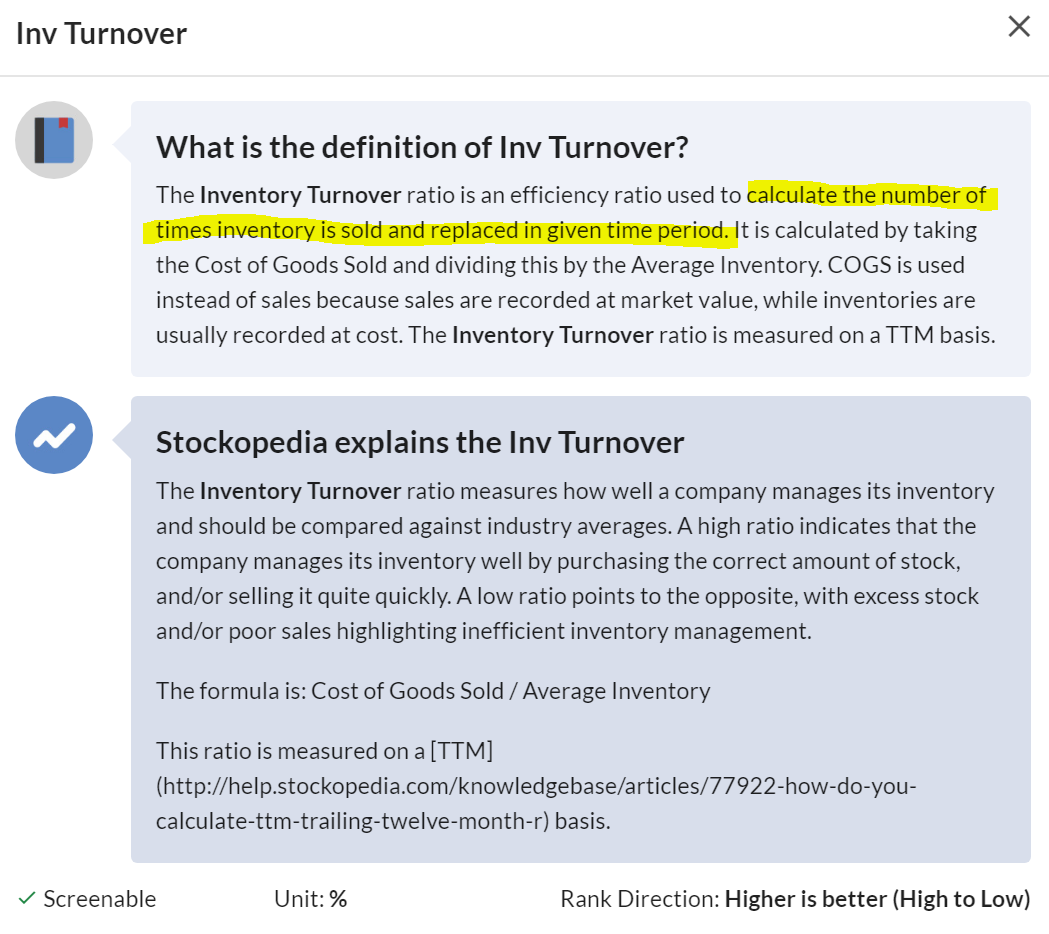

For anyone not familiar with this concept, here are the explanatory notes from Stockopedia;

.

.

Cashflow statement - I'm a great believer that cashflow statements should be really simple. Goodwin's is, as you would expect from what is clearly a conservatively run group, with prudent accounting.

It generates good operating cashflow, which is then spent on capex and dividends, and occasional acquisitions. That's it in a nutshell.

It all looks fine to me.

Outlook - as mentioned above, the strong order book means Goodwin is confident about the year ahead.

Other outlook comments are dispersed through the commentary, without a separate section.

Particularly upbeat comments about Goodwin Steel Castings, mentioning long term benefit from its nuclear waste containment boxes. Specialist alloys work for ships has few competitors.

Product development - sounds very interesting, with a number of new products ("major activities") launching this year,

My opinion - I very much like family-run/owned businesses like this. The valuation looks punchy, but probably isn't, if the figures were adjusted from super-conservative, to how everyone else presents them, with loads of adjustments!

However, taking off my rose-tinted glasses for a moment, the track record in recent years has been quite lacklustre. Maybe that's because the group has had to ween itself off dependence on oil & gas? EPS this year is only 103p, so over several years has fallen a lot. Meanwhile the PER has been going up. That means investors must be factoring in & are paying up-front for a considerable rise in future profits.

.

.

Overall, I don't doubt that this share is likely to be usefully higher in 10 years time, with a dependable flow of divis along the way. But is that exciting enough for me? Probably not.

Looking at the long-term chart, buy and hold forever isn't necessarily the right strategy. This chart is saying to me, sell the big moves up, then buy back cheaper at a later date.

.

.

Castings (LON:CGS)

Share price: 349p (down 1% today, at 14:57)

No. shares: 43.6m

Market cap: £152.2m

This is another very traditional company, similar in some ways to Goodwin (LON:GDWN) above.

The share price has barely moved today, so there's probably nothing price sensitive in it, i.e. unchanged outlook.

This relates to the financial year ending 31 March 2021;

As previously reported, the group experienced a significant fall in demand at the start of the financial year with approximately 80% of our workforce being placed on furlough leave under the Coronavirus Job Retention Scheme.

Summary of other points;

- 70% of revenues are from commercial vehicles sector

- Customers closed factories from end March, resumed (limited) production in May 2020

- April & May - dispatches down 80% on pre-covid level

- Demand since recovering, now down 40% on pre-covid level

- Demand expected to recover further, to 15% down (based on forward schedules)

- Don't know whether demand is catch-up, or sustainable

- Focus - conserving cash (balance sheet remains strong), improving productivity & profits

My opinion - results for the current year are likely to be poor, but does that matter to long-term investors?

Brexit is a risk too, as are second-wave covid lockdowns. Are its customers seeing a sustainable recovery, with maybe pent up demand from end users, or will the commercial vehicles sector remain depressed? These are the key issues that would determine whether buying/holding this share is a good move or not.

The balance sheet is not just strong, it's ridiculously strong! So there's zero chance of this business going bust, even in a worst case scenario, in my opinion. For example, the last balance sheet showed £83.6m current assets (including £33.4m cash), and current liabilities of only £20.1m. The only long-term liability is £3.9m deferred tax, whic h is safe to ignore. Even the pension fund is in surplus.

Overall, I see this as a special situation, and worth keeping on my watch list. I'd be interested in buying some if it sells off when the next results come out, but not at the moment. Could be a good long-term income (divis) share, given that the balance sheet is so strong, it should be able to continue paying divis. Who knows, there could be some distressed acquisition opportunities too?

.

A few quick comments to finish off with, as I'm also out of time.

Pennant International (LON:PEN)

36p (down 8%) - mkt cap £13.1m

Trading update - for H1 to 06/2020.

Covid restrictions continued to impact delivery of contracts.

H1 revenues expected to be £6.3m, and a very hefty (for size of company) loss of £2m (EBITA) - that's enough to make a nasty dent in the balance sheet. Plus there is another £0.9m or £0.5m in exceptionals (not clear from wording which it is).

Cost savings of £1m p.a. implemented. Board taking 20% pay cuts for H2.

Liquidity looks OK - had cash of £2m at period end, plus £4m undrawn overdraft. Not stated how much taxation and other creditors have been stretched, a key omission.

Outlook - says H2 performance should "improve significantly" in H2, and be profitable.

Healthy 3 year order book of £36m.

My opinion - I think this is a fundamentally sound company, which I've followed for years. Its performance has historically been too lumpy to interest me any more. The shares are horribly illiquid too. It's not clear to me why the share is listed. At some point, I imagine it might be bought by a larger group.

.

De La Rue (LON:DLAR)

Appointment of joint broker

This usually happens when a company is considering a fundraising. Yet DLAR has already done one quite recently. Maybe there's a bit institutional overhang that needs a bookbuild to get rid of? We saw that recently with something else, I can't remember the company name now.

DLAR has appointed Numis, to work alongside Investec. Both of these brokers show not the slightest interest in private investors. In fact, Numis are notorious for aggressively trying to exclude all PIs from any company meetings!

Given that DLAR is now a small cap, the company really needs to recognise that it needs at least one broker that understands how important PIs are, in creating liquidity, and setting the share price (which the smaller trades do). Having 2 brokers that haughtily ignore, indeed actively work against the interests of PIs, in restricting access to companies, and research notes, is just no good at all.

A far better structure, in my view, is to have one broker that understands the market, and the importance of PIs. FinnCap are particularly good at this, but other decent brokers also make their research available on Research Tree, such as Liberum, and N+1 Singer. Then maybe the bigger brokers, are better at fundraisings & placings? So how about having 2 brokers, one to focus on institutional holders, and the other to nurture liquidity through a focus on PIs and HNW individuals?

.

Premier Veterinary (LON:PVG)

De-listing - another dire AIM minnow bites the dust. In this case, it's making an acquisition, and de-listing at the same time.

The £5m mkt cap, large Director holdings, and permanently loss-making performance, with an apparently unviable business model, means I'm glad to see the back of this one.

The only surprise is that the share price hasn't dropped 50% today, which usually happens when companies de-list.

Its last balance sheet looked insolvent, so nobody in their right mind would be holding this share.

I'm mentioning it to remind everyone of the bigger risk of companies de-listing in current tough economic conditions. There must be lots of financially stretched micro caps, wondering why they are wasting £100-200k p.a. on a stock market listing. So do be careful, you don't want to get caught out in something that decides to de-list.

.

That's it for today, see you in the morning!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.