Good morning, it's Paul here with the SCVR for Thursday.

No lengthy preamble today, as I was too tired last night to write up anything, and lacked inspiration on topics.

Estimated time of completion: 1pm

Edit at 13:04 - today's report is now finished.

It all looks really boring today, so I'll try not to let my lack of motivation show! In fact, it is worth putting in the effort ploughing through lots of apparently boring companies, as occasionally a nugget of gold is unearthed.

Coronavirus update

Reported cases in China have shot up overnight. The website I follow (after I verified it's from a trustworthy source, essential these days in the era of fake noooz) showed a jump to 60,332 cases (59,807 in China) this morning. 24 hours earlier it was showing c.45k cases. Although the 15k jump overnight could be due to changes in how the numbers are being calculated in China. It's been previously reported that the Chinese were under-stating cases, by reclassifying some outside of the reported numbers. Plus of course there could be any number of milder cases where people don't seek any medical help at all.

Edit: the BBC website confirms that the way cases are being reported in China has indeed been changed, hence the big jump overnight. It also points out that this has thrown trend analysis into chaos. End of edit.

I'm conscious of the fact that we're talking about a situation with horrible human consequences. Please take that as a given in the discussions here, nobody needs reminding of that, I'm sure we're all concerned. We have to focus here on the impact to businesses, and shares, because that's the topic here. It's probably the biggest single risk factor to markets & the economy right now.

The overnight jump in cases, even if it's due to a recalculation of the numbers, clearly moves this issue up the priority list, and has slightly dented futures overnight.

I remain of the view that markets seem far too sanguine about coronavirus, and it could cause a lot more disruption than is currently factored in. Particularly in the US, where amazingly markets are hitting new highs. They must just see the virus outbreak as a temporary & remote issue that doesn't affect them. I'm not sure that is correct, but time will tell.

It seems to me that this is probably a time to be cautious. After all, equities are generally expensive, some very expensive, yet there is a serious risk to health, and hence economic activity, globally. To my mind, that makes risk:reward look adverse. Hence I think it's possibly too soon to go bargain hunting for shares which have been hit by coronavirus fears.

Flowtech Fluidpower (LON:FLO)

Share price: 101p (up c.4%, at 08:55)

No. shares: 61.2m

Market cap: £61.8m

Trading update & restructuring activities

London: Thursday, 13 February 2020: AIM listed specialist technical fluid power products supplier Flowtech Fluidpower (LSE: symbol FLO), is pleased to announce the following unaudited update on its performance for the year ended 31 December 2019 and to the period up to this announcement

No surprises here, as the company warned on 2019 profits on 14 Jan 2020. I covered that here, and note that it hit the share price by 20% on the day, to 101.5p. Today's price is slightly lower, at 97p, no bounce as yet. Edit: while I was writing this section, the share price has started rising, so I've amended the header above. End of edit.

Re-reading my previous notes, the key issue here is whether recovery in 2020 is going to happen, or if the deterioration in trading from H1 to H2 in 2019 is setting the scene for further weakness in 2020?

I've checked through the numbers given today for 2019, and they're all at, or very close to, what was guided in the update on 14 Jan 2020, therefore no issues in the numbers, which are;

- FY 12/2019 revenues £112.5m

- Underlying PBT £9.0m (8% margin - not bad for a distribution business)

- Net debt £16.6m

Fairly decent numbers there, it's still a nicely profitable business, despite the profit warning.

Can any readers who know this sector well, explain what this means below, as I have no idea what "cyclical services associated to our OEM business" means!

As the year progressed, we saw a significant slowdown in some of our key end markets, most particularly cyclical services associated to our OEM business, which culminated in the profit downgrade of 14 January 2020.

Restructuring - cost-cutting was mentioned in the last update. More details are provided today, which looks like a strategy of centralising warehousing & dispatch into fewer, more efficient sites. Cost savings of £1.6m are indicated, at a cash cost (exceptional presumably?) of £1.8m (of which £0.5m has already been incurred in 2019). That all sounds sensible. After all, a payback of just over one year, is a very good return. That's providing the cost cutting actually delivers the intended savings, which is not always the case.

This bit sounds interesting - it sounds like there's plenty more scope for further cost savings;

Importantly, we believe there is further scope for significant cost savings, particularly in warehousing, our procurement activity (where we expect to take the number of suppliers down from over 1,000 to around 500), and the centralising of certain back office functions.

We might question why management allowed the business to be inefficient in the first place? It grew by acquisition, so it makes sense to me that cost-savings could then be achieved by combining acquired businesses, and making efficiency gains. That's a good reason for an acquisition strategy.

Balance sheet - this has been one of my main concerns in the past, so this section is music to my ears;

2019 was a year in which great emphasis was placed on working capital and net debt management. Despite the disappointing trading outcome, net debt reduced by £3.3m, after paying c.£2.6m in earn out considerations relating to historic acquisition activity.

A combination of strong operational cash flow, the absence of any further payments of deferred consideration, and the continued focus on working capital, should see our net debt reduce again in 2020 and 2021.

That's excellent. It also gives me comfort that the group can continue paying generous divis, which I questioned in the past.

Outlook - we've previously been warned that H1 2020 would be soft, so no surprises here.

Isn't it refreshing to read a company statement where they just tell it like it is? This is impressive clarity and sensibly guiding investors to take a cautious view of the short term. I wish all companies would report like this.

The actions we are taking to reduce costs, and the investments we have made in our central platform will continue to strengthen and streamline the operating efficiency of the Company. At this stage, we expect revenue for the full year 2020 to be down by low single digit percentage points, with a weak first half largely offset by a return to growth in the second, leaving underlying profit at a similar level to 2019.

A return to revenue growth in 2021, coupled with further planned cost savings, should deliver significant leverage to both margins and profit.

There's always the danger that H2 won't recover as planned.

Dividends - policy unchanged, final divi will be up 5% on last year. The yield is stand-out, at almost 7%. I'm gaining some confidence that this might be sustainable, because of the focus on cost savings & working capital.

My opinion - I'm very impressed with how this statement has been couched. It comes across as straightforward, tell it like it is - which is always the best approach in the long run. Honesty is the best policy! Congratulations to the company, and its advisers (Zeus, finncap, and Tooley Street Comms). I think investors appreciate straightforward guidance, as it builds trust, hence making investors more likely to buy the shares.

Overall, I give FLO a thumbs up, it's growing on me.

Despite current soft trading, management seem to be doing all the right things. A period of soft trading can actually be helpful, if it's temporary, as that prods management into stripping out inefficiencies that were tolerated in the good times perhaps. Post-restructuring, there should be a more efficient platform for future growth. More acquisitions would probably follow, once everything has been sorted out, and debt reduced.

.

Domino's Pizza (LON:DOM) &

Possible read across to Dp Poland (LON:DPP) ?

Proposed disposal of Norweigan business

I mention this, because it details the terms today of DOM's exit from the consistently loss-making Norway operations, via a sale of DOM's 71% stake, to the minority shareholders.

Dominos Norway made an underlying loss of £6.6m in FY 12/2018.

Sweden is also mentioned, DOM seems to be taking full control of this as part of the transaction, but I found the announcement rather complicated, and not clearly explained, so I might have got that bit wrong.

This bit could be of relevance to Dp Poland (LON:DPP)

The Transaction follows the announcement of 17 October 2019 regarding the Group's intention to exit its directly operated international operations in an orderly manner, and find more suitable owners for these businesses.

To my mind, that seems to remove the possibility that Domino's Pizza (LON:DOM) might bid for Dp Poland (LON:DPP) - the independent & separately listed loss-making Polish operation, which I frequently criticise here for its dismal financial performance over many years.

It's interesting that Domino's couldn't make its operations work financially in Norway either, which apparently consumes the highest number of pizzas per capita, of any country in the world.

I don't see a positive outcome for DPP - it's incapable of generating any profit, so what's the point in it existing? DPP's equity is likely to end up being worth zero, in my view. Unless there is a significant turnaround in performance, which has been elusive over the last 10 years.

Today's news re Norway reinforces the fact that Dominos just doesn't work in some countries.

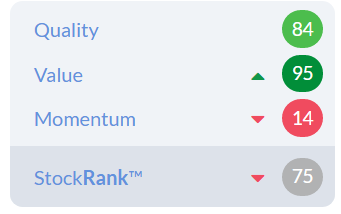

Accesso Technology (LON:ACSO)

Share price: 482.5p (up 10%, at 09:34)

No. shares: 27.6m

Market cap: £133.2m

RCS - Positive momentum with renewals and new contracts

This is an "RNS Reach" announcement - i.e. it's non-regulatory. RNS Reach announcements are marketing messages, so should not really be price sensitive. Today's 10% price rise suggests that some investors might have mistakenly taken this to be a positive trading update, which it isn't.

It starts by saying;

accesso Technology Group plc (AIM: ACSO), the premier technology solutions provider to leisure, entertainment and cultural markets, saw positive momentum in 2019 with several noteworthy customer renewals and 43 new or expanded ticketing contracts.

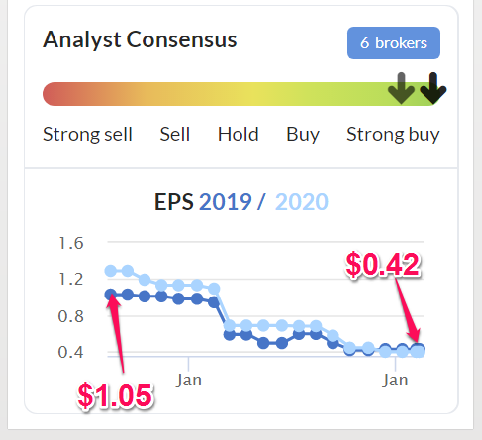

That's very nice, but if it was such a good year, why did broker consensus earnings expectations more than halve in 2019? Note also how brokers gradually reduced 2020 forecasts even more, from a premium, to a slight deficit on 2019 forecasts;

.

It goes on to mention some client names, and client loyalty, cross-selling, but again, it's not reflected in the numbers, is it?

I don't like positive commentary, when the facts have been deteriorating. It strikes me as dishonest & manipulative.

The CEO, Steve Brown, says;

"Our range of products continue to deliver powerful business results for our clients around the globe, paired with highly personalized service and support from our exceptional staff. These contract wins and renewals reaffirm the strength of our product offerings, underscore the confidence our customers have in our solutions, and start us off with forward momentum in 2020."

My opinion - Accesso has always looked an interesting company, dominating its niche. The big drawback, is that it's never really made any proper profits/cashflow. Also, the company put itself up for sale, after some bid approaches, and nothing came of it. The inevitable conclusion is that possible buyers ran their slide rules over it, and were not prepared to pay a premium price, despite the share price having crashed heavily.

The problem with this, is that we don't have adequate information to assess the value of the company. It might be that bidders made indicative bids, but the price wasn't high enough for management to recommend it to shareholders? Or the bids might have been non-existent, or below the current share price? This is crucial information, which management is withholding from us. Therefore, we can't sensibly value this share without that key information.

Instead of today's puff piece, I would have preferred a statement from the company telling us, "We received indicative bid interest at xxx-yyy p, but after consulting major shareholders, decided not to proceed with a sale". Something along those lines, which would allow us to benchmark the value of the business to bid interest levels.

I've added key events to the 2-year chart below;

.

It would have made an amazing trade on 23 Jan 2020, well done to anyone who caught the falling knife at that specific point, as you'd be up by over 50% today. With so many uncertainties surrounding the value of the company, I'd be tempted to bank the profit if I'd nipped in around the 300p level.

That said, on the long term chart, the recent bounce is barely a blip.

How likely is to regain the previous 3000p highs? It looks very unlikely to me, as nobody wanted to buy it at a much lower price, once the sale process was underway. But who can say? Strange things can happen. As mentioned yesterday, there are vast amounts of cash swilling around at VC/PE funds, often willing to pay crazy valuations for tech companies. It's possible that one of them might target Accesso in future.

Another thing to consider with ACSO, is whether the large amount of payroll that it classifies as R&D, is genuine R&D, and likely to generate a decent future return? There's a well known argument for investing in companies that spend heavily on R&D, as they can often generate excellent long-term returns from that spending.

I honestly cannot make up my mind on Accesso. The bull argument sounds quite good at today's more realistic valuation. But on the other hand, a protracted & failed sale process tells me that there's perhaps nothing much here of interest. Who knows? I don't have enough information to form a view.

** Breaking news! **

Haynes Publishing (LON:HYNS)

Recommended cash offer at 700p - a whopping 62% premium.

Hearty congratulations to shareholders here, you can borrow my bunting, this is a marvellous result.

Frenkel Topping (LON:FEN)

Share price: 41.5p (down 9%, at 11:07)

No. shares: 75.6m

Market cap: 31.4m

End of bid talks & trading update

There are 2 announcements this morning;

Harwood Capital got in first, at 07:00, saying that it does not intend to bid for Frenkel Topping (bid talks were announced on 28 Jan 2020). It reserves its rights, if someone else decides to bid, which is boilerplate stuff in announcements like this.

At 07:01, Frenkel confirms that discussion with Harwood were held, but have now been terminated. This announcement also includes a trading update, as follows;

- FY 12/2019 results in line with expectations.

- Assets under management increased 15% to £897.9m

- Revenues to exceed £8.5m (Stocko shows forecast of £8.6m)

- Robust start to 2020, record month for new business since 2010, substantial AuM mandates won, new income from expert witness work

- Company positioned favourably for 2020

Directorspeak -

"We have made significant progress in the last two years and delivered excellent results; with AUM at a record high and a healthy pipeline of new business wins, we are strongly positioned to continue delivering further growth and value for our shareholders. The Board has a fiduciary duty to look at any serious interests in the business and it is a testament to the company and its achievements that we received this interest."

My opinion - I've not looked at it in detail, but remember meeting old management at a function several years ago, and thinking that it looks an interesting niche fund manager.

A positive trading update today, coinciding with ending of bid interest, means that arguably this might be a good time to nip in and buy a few shares? On the other hand, having looked over it, Harwood deciding not to bid, does rather suggest the upside might be limited. Harwood (Christopher Mills) are very shrewd, and don't like over-paying for anything. Whilst I very much respect their stock-picking abilities, Harwood tend to grab the upside for themselves, with low-ball takeover bids, thus pushing out private investors when they buy into something cheap. That limits the upside on shares where they have an interest.

Filta Group (LON:FLTA)

Share price: 167.5p (up 20%, at 11:53, only 19k shares traded so far)

No. shares: 29.1m

Market cap: £48.7m

Filta Group Holdings plc (AIM: FLTA), a provider of fryer management and other services to commercial kitchens, provides its trading update (unaudited) for the financial year ended 31 December 2019.

I've moved this up the running order, as the share price has reacted very favourably to today's update - albeit on a tiny number of trades printed so far today. There might be bigger trades reported at the end of the day (or later) of course, as beyond a certain size, trades can be delayed - e.g. if say a market maker is working a large buy or sell order in the background. That's why it doesn't pay to obsess over what the printed trades are in real time - as you're only seeing part of the jigsaw.

Today's update starts off with specific numbers;

The Company expects to report adjusted EBITDA* for the full year in the order of £3.2 million on turnover of approximately £25 million.

* Adjusted EBITDA represents earnings before interest, taxes, depreciation, amortisation, acquisition related costs and share based payment expense

Why can't they just report underlying EPS, as that's the easiest figure for me to compare with broker consensus forecast? They're creating extra work for me, by reporting EBITDA. I've now got to calculate how that compares to forecast. Actually, there isn't time to do that today, and as there are no broker updates available to me, I'll have to park this until the results come out on 21 April 2020.

Outlook for 2020 - sounds good - this must be what has pushed up the share price this morning;

Although still early in the new year, we are seeing strong interest from potential franchisees in North America, where we have added two new franchises and completed one resale, and in Europe we have added one new franchise each in Germany and Switzerland, which will drive higher revenues in the year ahead.

This, together with the good progress made in the final quarter of 2019 in both reducing costs and improving productivity in the UK, gives the Board confidence that Filta will deliver a much-improved performance in 2020.

That sounds really good actually. I like expansion into the USA, because it's such a massive market, with GDP something like 7 times the UK.

Acquisition of Watbio - see the RNS for more detail, but the quick version is that there were problems with a large acquisition, which are now being sorted out. That should be good for future performance.

My opinion - this share looks interesting, and subscribers might want to take a closer look.

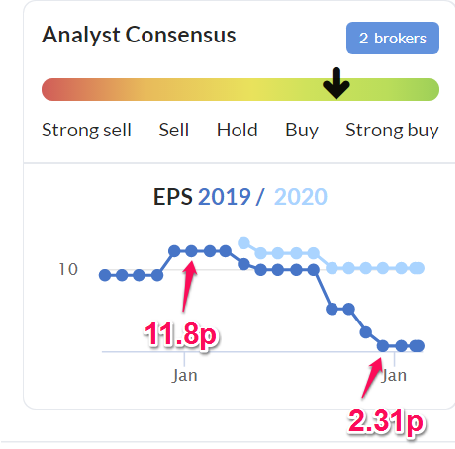

However, I would caution that today's perky sounding update does rather gloss over the sheer extent of the downgrades in 2019, see the usual handy little Stocko graph;

.

Clearly then, at c.168p per share, the price is already factoring in a huge recovery in earnings in 2020.

I'm keen to take a closer look, when the 2019 numbers come out, but it doesn't look particularly interesting as an immediate purchase, due to the turnaround good news already being baked into the current share price.

The concept looks quite interesting - a "where there's muck there's brass" type of share! Also, getting franchisees to do the hard grind, looks a smart move. Franchise businesses should split out the profits made from the initial franchise sales, and operational profits. Investors can end up getting a nasty shock with franchise businesses, because sometimes once growth stops, it can turn out that recurring profits were not very high at all. The real money-maker can sometimes be selling the franchises. Hence why the split is essential info.

A couple of quickies to finish off with;

Keystone Law (LON:KEYS)

Has published an in line update for 2019.

Share price is down nearly 6% today.

Why on earth is the forward PER so high, at 37.4? That looks crackers to me, for a people business. Even one with a very impressive track record of growth.

Do any readers understand why the price has gone so high over the last year?

That's it for today!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.