Good morning, it's Paul & Jack here with the SCVR for Thursday.

Timing - update at 13:52 - I've got 2 more companies that I want to cover TTG, and LUCE, so estimated finish time 16:00.

Update at 16:32 - today's report is now finished.

Agenda -

Paul's Section:

Alumasc (LON:ALU) (I hold) - ahead of expectations update for this building products group. Looks good, but beware the pension scheme cash outflows, which partly explains why the PER is low. That said, the better the business performs, the less of an issue the pension scheme becomes.

Best Of The Best (LON:BOTB) (I hold) - an in line trading update for FY 04/2021. A stunning increase in EPS from 37.5p last year, to 125.2p forecast for the year just ended. The PER of 22 is either very cheap (if growth continues), fairly priced, or expensive (if growth goes into reverse). Get out your crystal balls!

Tt Electronics (LON:TTG) (I hold) - a solid trading update (towards upper end). Seems a decent business, at a reasonable valuation. Planning for double-digit operating margins with restructuring in the pipeline. Order book good. Cost pressures mentioned, as with many companies at the moment.

Luceco (LON:LUCE) - strong H1 trading update.

Jack's Section:

DX Group (LON:DX.) - stronger than expected trading and on track to significantly exceed adjusted PBT forecasts; 300 new vehicles recently acquired and 12 new depots announced

Eurocell (LON:ECEL) - improved full year expectations and market share gains, but cost inflation becoming a concern

Ten Lifestyle (LON:TENG) - Covid disruption hits these half year results and the outlook remains uncertain

.

Paul’s Section

Alumasc (LON:ALU)

(I hold)

218p (pre market open) - mkt cap £79m

Alumasc, the premium building products, systems, and solutions Group, today provides a trading update for the ten months ended 30 April 2021.

Strong last four months' performance

- All businesses performing well

- Cost-savings of £2.4m last year have improved margins this year

- Govt policies are helping support housing market

- Raw materials & shipping costs rising in recent months, being managed to maintain margins in the medium term (implies some short term margin impact maybe?)

CEO comment -

The great potential for the Group is starting to be realised with a strong continuation of the good performance seen in H1

Overall trading - is strong -

As a consequence of the continued strong momentum, the Board now expects that Alumasc's results for the year will be ahead of its previous expectations.

My opinion - I last reported here on 5 Feb 2021, on Alumasc’s very strong interim results. The share has gone up a lot since then (like most other shares in cyclical sectors). Hence an ahead of expectations update today justifies that price move up.

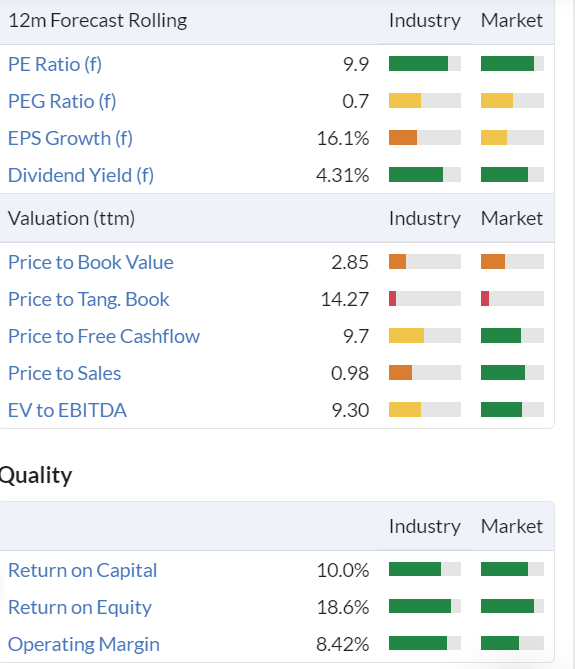

Many thanks to Finncap for an update this morning, it’s raising EPS by 9% to 21.7p, giving a PER of 10. That’s good value, but don’t forget to adjust for the pension scheme cash outflows, which will curtail the valuation somewhat.

Overall, this looks a very nice business, improving performance, generating decent margins, I like it.

A nice combination of value, and quality here -

.

.

.

Best Of The Best (LON:BOTB)

(I hold)

2775p (down c.11%, at 11:42) - mkt cap £260m

Best of the Best PLC, (LSE: BOTB) the online organiser of weekly competitions to win cars and other lifestyle prizes, is pleased to provide the following trading update for the 12 months ended 30 April 2021 (the "Period").

I always laugh when I see an ordinary word in quote marks & brackets, because it means a lawyer has probably spent a few minutes lightly editing the statement, and probably charged a couple of grand for the privilege!

Today’s update is in line -

The Board is pleased to confirm that revenues and profits before tax delivered in the Period are expected to be in line with market expectations, which were most recently increased in March 2021.

It would have helped if the update had included a footnote, specifying what market expectations are. This saves time for all of us reading the update, and avoids any confusion, especially for people who don’t have access to the figures.

Many thanks to Finncap which has issued an update note today (available on Research Tree, or through Finncap’s own portal - although I think we should support RT because it’s such a useful service, and great to have everything in one place).

This reiterates forecasts as follows:

FY 04/2021: 125.2p (PER of 22.2)

FY 04/2022: 143.1p (PER of 19.4)

FY 04/2023: 165.5p (PER of 16.8)

Those PERs look strikingly cheap to me, given the track record of explosive profit growth this year, and last year:

.

Given that we’ve had an astonishing series of out-performance from BOTB, at some point the forecasts were going to be up with events.

So it shouldn’t come as a surprise that hugely upwardly revised forecasts have been achieved. Maybe some people hoped for further blow out out-performance? I must admit I was quietly hoping that the company might even smash the newly upped forecasts! But that's just being greedy.

Still, looking at the PERs above, the valuation is really very modest, if this year’s astonishingly good performance is sustainable. Imagine if it’s the start of a multi-year explosion in earnings?

My opinion - what the market seems to be telling us, is that it’s not sure whether the huge surge in EPS this year to 125.2p, from 37.5p last year, is permanent, structural growth, or whether it’s a one-off boost from lockdowns. Management have said that the growth began before the pandemic, and carried on when lockdowns were released last summer. So they believe this is the business taking off, irrespective of the pandemic/lockdowns.

The critical factor seems to be effective online marketing strategies, which are pulling in punters not just from the UK, but internationally. Customers are sticky too, as I know - I’ve recycled some of my special divis from BOTB into buying tickets for the weekly competitions! Even though I don’t really want a supercar (been there, done that, got the speeding tickets!), it’s just fun to play.

Another factor is that management sold a hefty slug of their own shares at £24 recently, which surprised a lot of us, giving quite a big discount to the then market price. I was very pleased to see that highly respected Slater Investments took a big slug of the secondary placing, and now owns 9.1%. Management still own about half the company, which is a ton of skin in the game still, so I have no problem at all with them wanting to take some money off the table. After all, what’s the point in being rich, if you can’t actually do anything with the money, because it’s all tied up in one share certificate? After 20 years of slogging away, they deserve to see the benefit of their hard work, in my opinion, and good luck to them. It might have been partly driven by worries about CGT rising in future too, possibly, but I’m guessing there.

If the growth continues, then this share is dirt cheap. If growth stalls, then the share is probably fairly priced. If growth turns negative, and FY 04/2021 turns out to be a one-off good year, then the stock is expensive.

I can’t predict the future, so can only make an educated guess. I think the stock is good value, and believe that further growth is likely.

It’s still extremely illiquid, so moves of c.10% should be seen as normal. It only takes a tiny amount of buying/selling to move the price. I usually keep a bit of cash on the sidelines to nip in on down days and buy more of the most illiquid stocks I hold, like this one.

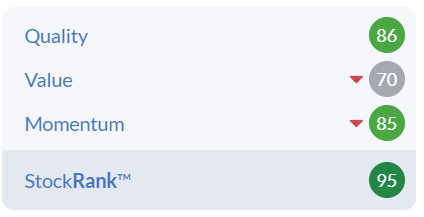

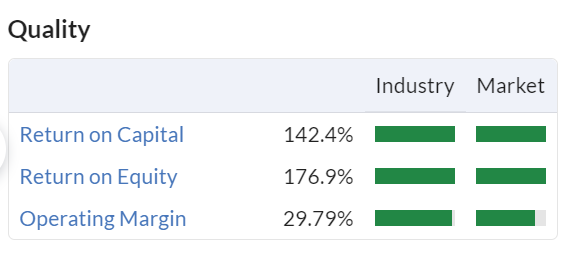

Just look at these quality scores - this is almost a unique business -

.

Tt Electronics (LON:TTG)

(I hold)

248p (up 2%, at 15:07) - mkt cap £433m

AGM vote - there was a significant (22.5%) vote against the remuneration report. I don’t know the specifics of the case, but generally am delighted to see that institutional shareholders are beginning to flex their muscles over ESG, including executive remuneration. This has been a long-running scandal, that passive shareholders have allowed management of many companies to absolutely plunder companies for their own personal benefit, often without any justification. Let’s hope times are (at long last) changing.

TTG says it will engage further with major shareholders to better understand their concerns. Good.

Trading Update -

TT Electronics (the "Group"), a global provider of engineered electronics for performance critical applications, publishes this trading update for the four months to the end of April 2021, ahead of the AGM taking place later today.

STRONG YEAR TO DATE TRADING

This sounds pleasing-

Trading in the first four months of the year has continued to strengthen with Group revenue 7% above last year on an organic¹ basis, building on the strong start made in the first two months of the year…

- Order book strong

- Mindful of supply chain shortages & logistics challenges

- Acquisition of Torotel in Nov 2020 is going well & expected to perform ahead of plan

- Site closures going ahead, to drive up margins

Overall trading -

… the Board now anticipates adjusted operating profit for the full year to be towards the upper end of market expectations2.

2Latest company compiled view of market expectations shows a consensus adjusted operating profit of £34.5m with a range of £33.6m to £35.4m

Thank you for the footnote, very helpful.

My opinion - looks a decent business, on a reasonable valuation. No mention of the covid-testing machines.

.

.

Luceco (LON:LUCE)

350p (up 6%, at 16:09) - mkt cap £562m

Luceco plc ("the Group" or "Luceco"), the manufacturer and distributor of wiring accessories, LED lighting and portable power products, is pleased to provide the following update on trading for the four months ended 30 April 2021…

Strong trading momentum continued into 2021

Strong demand, and soft prior year comparatives from lockdown 1

Cost inflation being dealt with well -

We have taken swift action to protect our margins from rapid, industry-wide inflation in raw material and freight prices and kept overheads under tight control.

H1 guidance - note the very strong profit margin, and profits doubled against the prior year soft comparative -

In light of the above, for the first half of 2021 ("H1 2021") we now expect revenue of approximately £105m and Adjusted Operating Profit of approximately £18m.

Order book good, but notes tougher H2 comparatives coming up

Broker update - many thanks to Liberum for crunching the numbers for us.

It forecasts 18.4p EPS for FY 12/2021, up 19% on last year. That’s a PER of 19 times - looks about right to me.

My opinion - this company has performed really well in the last year, with lots of positive updates. There’s talk of more M&A.

It’s particularly good to hear a company swat away cost inflation, saying they’ve taken swift action - which must mean raising selling prices. The high margins suggest it has pricing power.

All in all, everything looks very nice here, on fundamentals. The big rise in share price looks justified. Probably priced about right, in my opinion.

When a chart looks like this, further gains can sometimes be more difficult to come by.

.

.

Jack’s section

DX Group (LON:DX.)

Share price: 34.25p (pre-open)

Shares in issue: 573,682,000

Market cap: £196.49m

DX Group (LON:DX.) provides delivery services to business and residential addresses across the UK and Ireland.

The name comes from document exchange, which harks back to the group’s origins in 1975 as a Document Exchange service to the legal sector. Now, DX provides overnight delivery services of items like confidential documents, valuable packages, and large, awkward-to-handle freight, unsuitable for standard conveyors.

DX Freight comprises DX 1-Man, DX 2-Man and Logistics, and specialises in the delivery of irregular dimension and weight freight ("IDW").

DX Express comprises DX Secure Courier, DX Exchange and Mail, with a focus on the express delivery of parcels and documents.

The group has been loss-making for a few years now but the trailing twelve month (ttm) figures and broker forecasts suggest that DX is returning to profitability.

Even after a run up in the share price, DX generates annual revenue of £341.9m compared to a market cap of £196.5m, so depending on what sustainable profit margins look like there could be scope for a continued rerate. The forecast PEG is just 0.5x, and the company trades on 5x ttm free cash flow and 0.57x ttm sales.

Meanwhile, directors have been buying shares and the company has recently added another 300 new vehicles to its fleet, taking the total to 900, which suggests DX can see some growth opportunities ahead.

Lloyd Dunn (CEO) said at the time:

We have further investment planned across sites, technology and equipment, and with our aim to set market-leading customer service standards, DX is increasingly being recognised as the premier operator in its markets.

DX's trading performance has been stronger than expected.

Trading at DX Express has been in line with management expectations but revenue growth at DX Freight is now expected to be around £10m higher than previously anticipated.

This has been driven by significantly increased volumes, both from existing customers and through new customer wins.

As a result, the Board anticipates that DX will significantly exceed existing market expectations for adjusted profit before tax in the current financial year, with an associated improvement in operating cash flows. The board has consequently decided to repay government furlough payments totalling £0.6m.

Furthermore, the group is accelerating its plans to expand DX's delivery network by targeting the opening of 12 new depots over the next two years.

Conclusion

A further update is expected in mid-July 2021.

It’s hard to pick any holes in this update, brief as it is. Trading is ahead of expectations in Freight, momentum is strong, and the group is paying back what help it did receive over the lockdowns. The fleet has been expanded by 50% and the directors have been buying shares.

It all suggests to me that there is something worth investigating here.

The balance sheet is a concern, with the Z-Score flagging liquidity and liability issues.

Heading over to the balance sheet, it looks like the bulk of total ‘debt’ is in fact capital lease obligations.

Ideally the group would strengthen its finances further given the weak liquidity scores but, on balance, the financial health does not look to be as weak as the Z-Score might suggest.

The group can be very capital intensive, so that is worth bearing in mind.

Overall, given the operational momentum, the recently expanded fleet, and plans to open 12 new depots, I’d be a happy holder here.

Eurocell (LON:ECEL)

Share price: 274.2p (-4.79%)

Shares in issue: 111,498,522

Market cap: £305.7m

Eurocell (LON:ECEL) manufactures various PVC products, which it then distributes to a network of fabricators, small builders, and independent stockists. It also recycles customer factory offcuts (post-industrial waste) and old windows that have been replaced (post-consumer waste).

You can really see the Covid crash and recovery play out in Eurocell’s share price chart.

As with so many other stocks now, the question has shifted from ‘can it survive’ to ‘will it thrive’.

AGM trading update for the four months to 30 April

Highlights:

- Total group sales up 23% compared to the same period in 2019; up 75% on the same period in 2020,

- Life-for-like revenue up 20% on the same period 2019 and up 28% on 2020

The group says it is ‘continuing to take market share’ but has also had to increase prices slightly to mitigate raw material price inflation. Comparisons to 2020 are affected by lockdowns, when the business closed from 23 March to mid-May but growth on 2019 numbers is encouraging.

Strong demand in Eurocell’s markets has put sector supply chains under pressure and the group is experiencing an ‘increasingly inflationary environment’, with prices of certain raw materials, particularly PVC resin, rising significantly in 2021.

These rising input costs are being offset by a resin surcharge and the group’s own recycling plants, which supplied 25% of our raw material consumption in 2020.

Eurocell is also fitting out its new warehouse. This is already being used in the group’s Profiles and Building Plastics divisions and should increase capacity and operational efficiencies.

Conclusion

The short-term outlook for the first half has improved here and Eurocell says its markets are strengthening. Together this leads ‘to an improvement in our full year expectations’.

That said, raw material supply chain inflation will continue to be a concern.

Looking over the financial data, the company has managed to grow revenue in the past but has struggled to translate this into profit growth.

There’s no denying the improving outlook here and it could do well in the short term, but I’m not sure I’d want to hold this one through the economic cycles. Capex can be quite heavy and the group retains a net debt position.

Assuming the group gets back to FY19 levels of profitability, that would be a PE ratio of 14-15x. I’m not sure I’d want to pay much more than that.

Eurocell says it is taking market share but competition will always be a risk here, plus there is potential inflation to consider.

Ten Lifestyle (LON:TENG)

Share price: 99.5p (-0.5%)

Shares in issue: 81,530,891

Market cap: £81.7m

Ten Lifestyle (LON:TENG) partners with blue-chip corporate clients worldwide ‘to deliver technology-enabled travel and lifestyle services’. It’s a concierge service, basically.

I’m not sure about this one at first glance. Even though revenue has grown at a compound annual growth rate (CAGR) of 17.9%, the group has struggled to turn a profit.

Forecasts suggest this will change in FY22e, and Ten was free cash flow positive in FY20 (for the first time), so it is possible that an inflection point is approaching, but the track record of losses makes me cautious.

Highlights:

- Net revenue -28% to £17.2m,

- Adjusted EBITDA -19% to £2.1m,

- Loss before tax has increased from £3.3m to £3.6m,

- Cash of £9.2m, long-term debt of £1m.

The group continues to invest in its proprietary digital platforms - £5.5m of investment in the period compared to £5.9m in H1 2020. That’s a lot of money getting pumped into these platforms considering the small scale of revenue and losses.

These results have been affected by Covid but it looks like travel-related disruption could continue to impact results over the next few months despite a ‘strong pipeline of new contract opportunities’.

In terms of outlook and current trading, request volumes and the resulting net revenue since the end of the half year remain below prior year due to the effects of COVID-19 on Ten's core propositions in the dining, travel and live entertainment categories.

Conclusion

Ten references the fact that it has remained adjusted EBITDA positive, but I would attach greater weight to the fact that the company is loss-making on an absolute basis and has been for many years now.

FY20 did bring a much improved cash flow performance, so it’s worth keeping tabs on in the longer term.

For now though I’m not convinced of the opportunity here and the near term outlook is decidedly uncertain, with many important variables beyond the company’s control.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.