Good morning! It's Paul here.

Please note that I added more sections to yesterday's report in the evening - on Eve Sleep, Ten Entertainment, and Epwin. I know it's not ideal doing that, but I find it very difficult to concentrate on writing when the market is open.

No preamble today, as there are too many company results to cover.

Last call for questions for my interview with Spreadex tomorrow. I need your questions in by midnight tonight please, to give me time to prepare. Should be an interesting audiocast. Please submit questions only using this form. Thanks!

Interserve (LON:IRV)

Share price: 83p (down 45.5% today)

No. shares: 145.7m

Market cap: £120.9m

Trading update (profit warning) - this is the biggest percentage faller of the day. Yet another profit warning, from this accident-prone international support services and construction group.

To refresh my memory, I've looked back at the archive. I wrote a piece here on 6 May 2016, on a horrible profit warning (causing the shares to drop 20% to 313p). My conclusion then was that this share was uninvestable, because management were not in control of the business. It would have been a good short at the time.

I've not followed the company since then. Today it delivers more bad news;

Trading in the UK in July and August was disappointing, particularly in support services, but also in the construction division.

As a result of this, the Board now believes that the outturn for the year will be significantly below its previous expectations.

To quantify this, Stockopedia currently has a broker consensus EPS figure for 2017 of 57.1p. What does "significantly below" mean? It could be anything really. I would take that as meaning at least 20% below expectations, possibly more.

Broker notes - I've seen two broker notes this morning. One says they're working on updated figures. The other says that they're withdrawing forecasts, as there are too many uncertainties. That sounds wise.

There's more bad news on what look like exceptional exit costs;

Further progress continues to be made on contracts within our exited Energy from Waste business. However, the anticipated timing and complexities of completion mean that the Board now considers it likely that the final costs will significantly exceed the £160m currently provided.

That provision is already bigger than the market cap, so a huge problem has just got even more huge.

Banking covenants - no immediate threat apparently, but what about in 2018? This group has a lot of debt, so I would be very concerned about that, given the above catalogue of disasters.

The Board continues to believe that the group will be able to operate within its banking covenants for the year ended 31 December 2017.

Balance sheet - this is weak, and the group is totally dependent on bank borrowings, since it had negative NTAV of -£142.6m at 30 Jun 2017. With additional provisions required, and profits dropping, who knows that could deteriorate further? NAV was positive, at £361.1m, but that's including goodwill & other intangibles, which of course don't have any actual value, they're just book entries.

Dividends - stopped in 2016, and I wouldn't expect them to resume any time soon, if at all.

My opinion - this is probably my least favourite sector. Risk:reward is all wrong. Businesses like this take on extremely low margin, large contracts, and then something major very often goes wrong, sooner or later.

I recall a few weeks ago, myself & readers here made a list of all the contracting companies which had gone wrong, and it was an astonishingly long list. Interserve looks to me like it could go bust. Who would want to refinance it now? I make a point these days of never investing in companies which are at risk of going bust.

There might be a case for looking at this share again, once it's done a (necessary) big equity fundraising (probably at a discount). At the moment though, it looks too precarious for my liking. So definitely a bargepole job for me. Why take the risk when you don't have to?

Warpaint London (LON: W7L)

Share price: 174.5p (down 13.8% today)

No. shares: 64.5m

Market cap: £112.6m

Interim results - for the 6 months ended 30 Jun 2017.

This is a cosmetics business, which floated on AIM in Nov 2016 at 97p. So despite recent falls, the share price is still up 80% in less than a year - not too shabby!

This stock became quite popular amongst private investors for a while, but seems to have lost its gloss more recently. Today's interims haven't gone down at all well, with a 14% drop in share price. So let's find out what's gone wrong.

To refresh my memory, I'm re-reading a nice little summary (even if I do say so myself!) that I wrote here on 26 Jun 2017. The company gave an in line update then, but did mention that some territories (e.g. Europe) were not generating growth.

Running through today's interims, it doesn't really look like a growth company.

Revenues were only up 3.7% to £13.3m in H1 2017. Although the main brand, W7, did achieve 8.3% revenue growth.

Operating profit fell from £3.1m to £2.9m, although the commentary says that this is after additional costs of being a plc, staff, PR, and amortisation.

Outlook comments seem upbeat, mentioning strong orders for Christmas;

With our strong Christmas orders, which are significantly ahead of last year, we are well positioned and confident that we can deliver improving shareholder returns through increased organic growth and improved margins. The business continues to generate cash with no debt to service and the W7 brand continues to grow in global awareness.

Our e-commerce strategy, the launch of the Very Vegan range and increased Christmas business will strengthen our growth plans for this year and beyond, whilst new senior management roles that have been created will ensure we are able to deliver on growth as the business expands further.

We remain confident of the opportunities in front of us and look forward to growth in both sales and profits in the second half of 2017

Balance sheet - overall it's strong. However, both inventories and debtors look rather high to me. That is an amber flag - it can sometimes be a precursor to write-offs, for slow-moving lines, and uncollectable debtors.

My opinion - I'm underwhelmed by these interim figures.

The company will need to deliver a stronger H2 performance, to justify the current forward PER of 18.1.

Next (LON:NXT)

Share price: 4897p (up 10.9% today)

No. shares: 147.1m

Market cap: £7,203.5m

(at the time of writing, I hold a long position in this share)

Interim results - just a quick comment on this, as obviously Next is a large cap. As usual, results from Next are the gold standard in terms of presentation, clarity, and detail. This is such a high quality business, and it shows in the way they report.

A few points which caught my eye;

- Q2 (Apr-Jul) better than Q1

- Modestly upgrading sales & profit guidance for the year

- Next Directory performing well, stores performing badly

- H1 EPS down 6.2% on prior year, at 176.9p - hardly a disaster

- Productivity increases in-store more than offset increased rates of pay for staff

- Directory business is amazingly profitable, at 25% operating profit margin (helped by highly profitable credit accounts - holding firm at 2.5m customers)

- Next Directory could be seen as becoming a fashion portal, as it's now selling other brands, via wholesale & commission-based sales

- Having many physical stores helps online sales - as customers like to click & collect, and facilitates customer returns.

- International doing well

- Net debt forecast to be static, at £861m at year end (31 Jan 2018). However - very important point - the customer debtor book of £1bn more than offsets net debt. Therefore, Next really has no net debt.

- Surplus cash generation - already ear-marked 4 special divis of 45p each (plus interim divi of 53p), and final divi (105p last year, so I assume the same this year). That adds up to 338p per share in divis for this year. Even at today's higher share price, that's still a stonking yield of 6.9%. That's not all though! The company says it expects to have a further £53m of surplus cash this year, which will be used for buybacks.

- Rents are reducing on renewed leases.

- Encouraging signs for new ranges in Aug/Sep, up against very weak comparatives. So Q3 should be strong, but Q4 is against tougher comps.

- Self-inflicted damage with gaps in ranges, now being rectified.

My opinion - this is a truly remarkable business, with an outstanding operating margin, and amazing cash generation - which it pays out to shareholders in divis & buybacks.

Next's internet operations are performing well, which is being obscured by a poor year for the stores. However, I reckon the stores should recover, as a lot of the problem has been poor product, and gaps in the ranges. That's fixable.

By my calculations, Next should deliver about 417p EPS this year. Put that on a PER of 13, and it implies a share price of 5421p. Put it on a PER of 15 (justified, in my view), and that implies a share price of 6255p. So I see the current share price of 4897p as good value, even after a big rise today.

Right, I'm going to do a couple of reader requests next, namely Franchise Brands (LON:FRAN) and Haynes Publishing (LON:HYNS)

Franchise Brands (LON:FRAN)

Share price: 63p (down 10.0% today)

No. shares: 77.7m

Market cap: £49.0m

Half year report - for the six months ended 30 Jun 2017.

This company describes itself as;

a multi-brand international franchisor

It's main brands are ChipsAway, Ovenclean, Barking Mad, and Metro Rod. That reminds me, my oven's filthy, so I'll try out Ovenclean's services! Note that Nigel Wray is a founder Director, and still owns 27.7%. The group floated in Aug 2016.

Note that Metro Rod was a recent, major acquisition - bought on 11 Apr 2017, for £28.5m - funded via a £20m placing (at 67p) and a 5-year bank loan of £12m (plus additional £5m revolving credit facility).

Adjusted profit before tax in H1 rose 38% to £1.0m. That doesn't sound a lot for a company valued at £49.0m. However, DynoRod only contributed for 11 weeks, and additional costs were incurred to expand the sales team, and improve customer service. So the very small EBITDA contribution from Dyno Rod of only £287k is probably not representative of the profits it should be able to generate in future.

This section below explains the 10% drop in share price today;

Due to the lack of contribution from Kemac we expect adjusted EBITDA to be below current market expectations in the current year. Looking forward, the additional investment we have decided to make in Metro Rod and the slower rate of growth anticipated at Metro Plumb compared to the initial ambitious budget means that we also expect adjusted EBITDA to be below current market expectations in 2018.

However, during this period of investment we still expect to grow earnings, cashflow will remain strong and our gearing is expected to reduce, enabling us to maintain a progressive dividend policy.

Clearly shareholders are going to have to be patient here, to give the company time to develop its businesses.

Balance sheet - not great, but not problematically so. NAV is £23.2m, of which £26.8m are intangibles. So NTAV is negative, at -£3.6m. I'm not keen on negative NTAV, but providing the business generates good & reliable profits & cashflow, then it isn't a deal-breaker.

I probably wouldn't want to hold this share in a recession though - as profits could dry up, then there's no balance sheet downside protection.

My opinion - I'm really struggling with this one, as it's not really possible to value the company based on these results. We need to see the full picture, once all acquired businesses have been trading for 12 months, and restructured.

So I think it's really a question of getting hold of some broker forecasts, and checking them for reasonableness. Then it's a question of assessing each individual franchise business, trying to ascertain whether they have a lucrative future or not.

Franchise businesses are tricky to value, as some profits come from unpredictable, and cyclical sale of franchises - i.e. the lump sums charged when a new franchisee joins up.

Overall though, there could be potential here, so I'll keep an eye on future developments.

EPWN

Clarification - in yesterday's report, I mentioned that Epwin was a sister company to Entu (which has gone into Administration recently, with shareholders losing everything).

An adviser to Epwin rang me up, and explained that they are not sister companies. They just have a common shareholder, Brian Kennedy, who owns 15% of Epwin. Therefore Epwin doesn't want to be tarnished by association with Entu. So would I please amend my article accordingly, to say that the companies are not sister companies.

Well, I'm always very happy to amend articles when I occasionally make a factual error. So I've downloaded the AIM admission documents for both Epwin and Entu, and gone through them with a fine toothcomb.

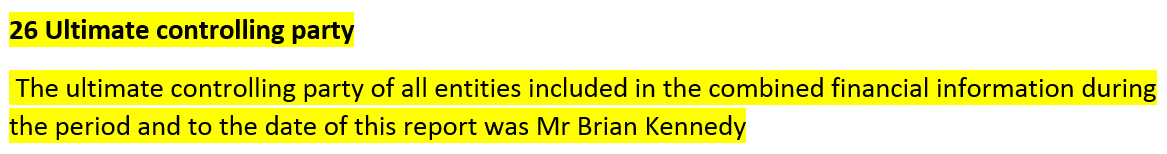

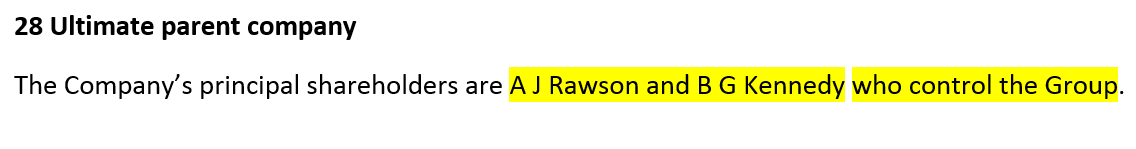

This is what is said in ENTU's AIM admission document;

And this is what it says in EPWN's AIM admission document;

Both companies were floated by the same broker, Zeus, at roughly the same time.

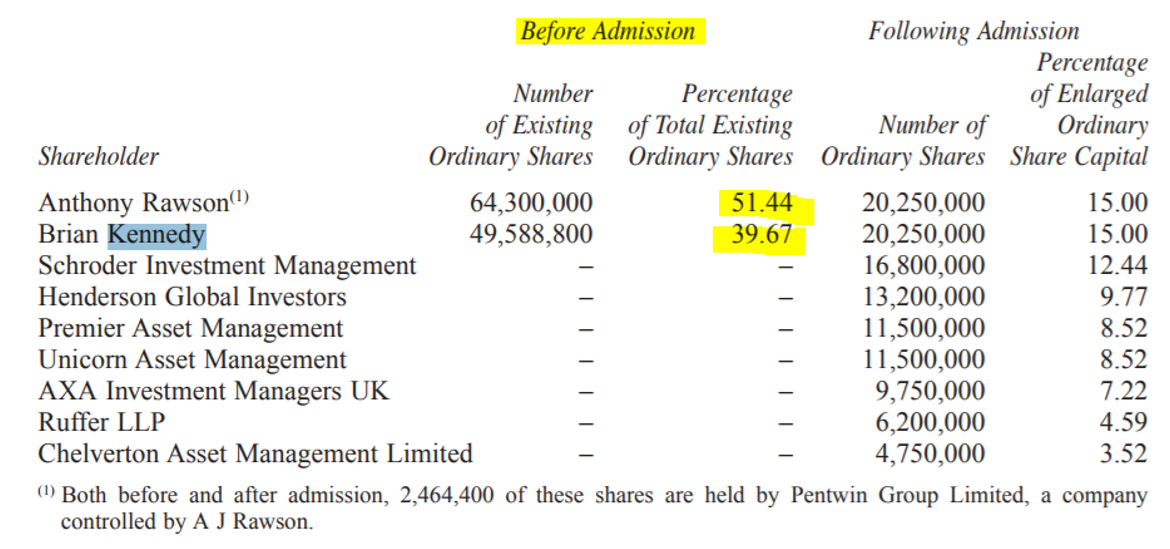

So I'm afraid, it's case closed. I was perfectly correct to describe the two companies as sister companies. Although once they floated on AIM, they ceased to be sister companies, because the controlling shareholders sold down their positions. Although note that they were still substantial shareholders in Epwin after the float - at 30% combined;

Conclusion - I will amend the wording of yesterday's report to emphasise that the companies were under common ownership at the time of listing on AIM.

Haynes Publishing (LON:HYNS)

Share price: 191p (up 3.2% today)

No. shares: 15.1m

Market cap: £28.8m

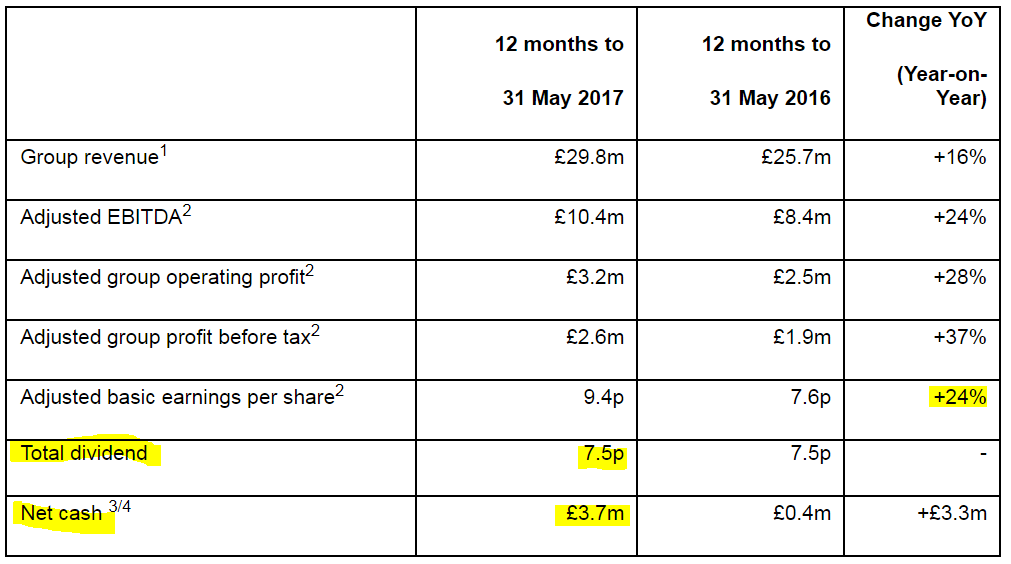

Preliminary unaudited results - for the year ended 31 May 2017.

This company is;

a creator and supplier of practical information and data solutions to drivers, enthusiasts and professional mechanics in print and digital formats

As you can see, there are some good things in the highlights;

The commentary sounds upbeat.

Current trading - Q1 of the new financial year is +7% ahead, but it's not specified if this is revenue or profit growth. I assume it is probably revenue growth.

My opinion - this looks potentially interesting. The turnaround strategy appears to be working.

Several negatives though;

- This share can be very illiquid, and is difficult to trade

- EBITDA looks great, but most of the cashflow is recycled into creating new content

- Massive pension deficit of £23.0m

Overall, I think this share might be worth further research.

All done for today! Graham is looking after you tomorrow, but I'll chip in if anything noteworthy crops up (hopefully not a profit warning!)

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.