Good morning from Paul & Graham!

Today's report is now finished.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

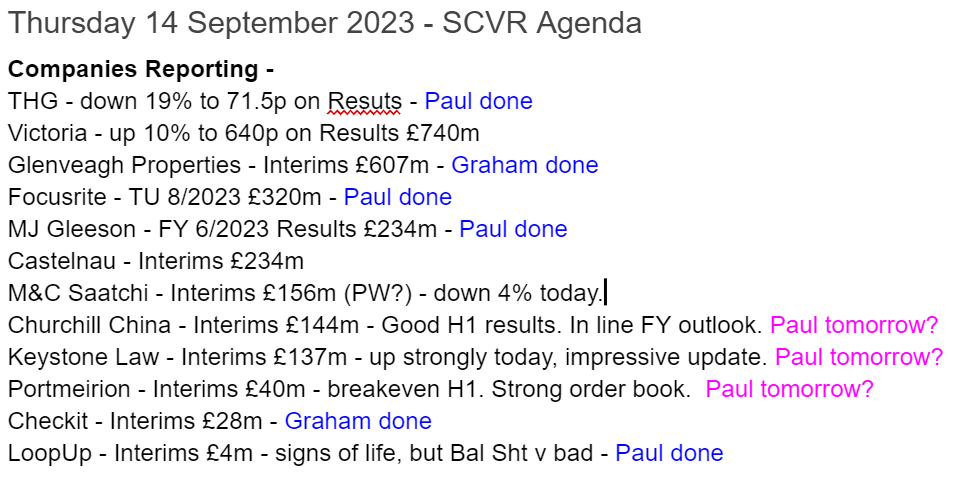

Some interesting companies reporting today! Here's our list (remember we can't cover everything) - we might have bitten off more than we can chew here, let's see how we get on. Update - annoyingly we didn't manage to cover a couple of quite interesting ones, but I've earmarked them for tomorrow.

Summaries

Glenveagh Properties (LON:GLV) - down 1% to 97c (£473/€550m) - Interim Results (in line) - Graham - GREEN

The market is unimpressed by these numbers as H1 falls to almost breakeven. However, the full-year forecast suggests that H2 will be much better. Glenveagh has already reduced its share count by 33% in three years and I’m excited that this trend might continue.

MJ GLEESON (LON:GLE) - up 3% to 403p (£238m) - Results FY 6/2023 (audited) - Paul - GREEN

In line results for FY 6/2023. Fantastic balance sheet, with shares trading at a significant discount to NTAV. Cash pile has been spent on building invetories (land and W-in-P), but that's not a problem as it has a large unused bank facility available. Surprisingly upbeat outlook comments. I can see more medium term upside than downside, so I'm happy to give this the thumbs up. Although, as with everything, I have no idea what the share price will do shorter term, in this choppy & illiquid small caps market.

Focusrite (LON:TUNE) - up 5% to 525p (£311m) - Trading Update for FY 8/2023 - Paul - GREEN

A reassuring update (towards lower end of a very tight range of forecast EBITDA numbers, so it's as good as in line to me). Negligible net debt. Very difficult markets, but its holding its own. Looks a good quality business at a reasonable price, in my view, I like it as a long-term buy & hold. You're only being asked to pay a share price that's the same as it was 4 years ago, despite profitability having substantially improved since then. Thumbs up from me.

Checkit (LON:CKT) - up 14% to 30.7p (£33m) - Interim Results (outlook ahead) - Graham - RED

Encouraging results here as cash burn slows down and even though revenue growth isn’t quite as fast as hoped, the outlook for the full-year loss is reduced. Runway at the current rate of burn is about two years. If they can stretch this out further, maybe I can turn neutral.

THG (LON:THG) - down 17% to 72.3p (£1.05bn) - Interim Results - Paul - RED

Another set of dire numbers from this eCommerce business. aEBITDA numbers are total fantasy in my view. Substantial, and growing net debt looks ominous to me. It urgently needs to start making genuine profits, otherwise this could end very badly I think.

Loopup (LON:LOOP) - up 50% to 3.25p (£6m) - Interims - Paul - RED

Tiny, but I know the company quite well, so had a quick look at the numbers. Interim Results to 30 June 2023. Interesting growth product, cloud telephony. Most revenues come from legacy online meetings product. Signs of life with rapid growth (from low base) in cloud telephony. “Broadly meeting” market expectations for FY 12/2023. Ignore EBITDA, as heavy development spend is capitalised, so continuing heavy losses are reality. It’s almost out of cash, so another fundraise (or delisting) is practically certain. Very weak balance sheet, dependent on bank debt. Receivables very high too. Paul’s view - I’m steering clear until it’s done another fundraise, as dilution/delisting/insolvency risk is now extremely high, so best avoided for now I think. for investors. One for gamblers only, as risk is so high. [no section below]

Paul’s Section:

MJ GLEESON (LON:GLE)

Up 3% to 403p (£238m) - Results FY 6/2023 (audited) - Paul - GREEN

This is a housebuilder mainly in the Midlands & North, which specialises in low cost compact houses (not apartments), which it famously says can be afforded by a couple earning minimum wage. Therefore I think it probably has a competitive advantage vs other housebuilders at the moment, due to this affordability, and the fact that new build houses are well insulated, thus giving buyers a potentially decent saving on their heating bills.

There’s also a benefit from buyers who now cannot afford a mid-range house, trading down from higher priced alternatives, to a Gleeson affordable home.

Another aspect of Gleeson that I like is it recently announced a block sale of houses to a financial investor, intending to rent them out. So it’s not just dependent on private sales of new houses, which are obviously under pressure due to the large & rapid increases in interest rates impacting affordability, particularly in the South.

Another housebuilder whose shares are doing well, which we briefly mentioned the other day, was Vistry (LON:VTY) . That also has a differentiated business model, building a lot of houses for local authorities and other partners, giving it a much more resilient outlook than plain vanilla housebuilders.

Overall then I think a deeper look at this sector, focusing on the differentiated business models, could be well worthwhile. As opposed to just assuming they’re all the same and buying the ones that have the deepest discount to NAV.

On to the FY 6/2023 Results, which are obviously looking in the rear-view mirror now, since the higher interest rates only started to bite in the most recent few months.

Headlines -

Results in-line with expectations, reflecting shifting buyer demographics

Pre-emptive actions and higher selling prices ensured resilient operating margins

Some key numbers for FY 6/2023 -

Total revenue down 12% to £328m, but most of the fall is from the smaller land division. Homes division saw revenue down 4% to £321m.

Pre-exceptional PBT was £31.5m, down 43% on LY - this has been worsened by the land division’s collapse in profits (lumpy transactions). The core housebuilding division saw a 32% fall in operating profit, and a reduction in operating margin from 15.3% to 10.9%, so it’s a marked fall in profitability by any measure.

EPS 42.9p (down 45%). The StockReport is showing 39.6p consensus forecast, so it looks a beat. Although a note from Singers today says it’s in line with their expectations. At 403p/share, the PER on FY 6/2023 actuals is 9.4x - not particularly cheap given market conditions have deteriorated since.

I’m really more interested in what the outlook comments say, because we’re already aware that the housing market is struggling due to interest rate hikes, and that builders have suffered a bout of build cost inflation.

Outlook - I have to say, this is considerably more upbeat than I was expecting -

Current trading and outlook

Economic uncertainty has continued to subdue the wider market over the summer months. Gleeson Homes' net reservation rate for the 9 weeks to 1 September 2023 was 0.43 per site per week compared with 0.54 per site per week over the comparable period last year. Cancellation rates of 0.10 per site per week were unchanged from the comparable period last year.

However, with a steadying mortgage market and the implementation of a range of sales and marketing initiatives, including the introduction of a shared ownership package, we anticipate an increase in our net reservation rates during the Autumn selling season. We also continue to receive interest in multi-unit transactions, which would further strengthen sales.

Gleeson Land started the financial year in a stronger position with six consented sites and has already completed the sale of one significant site. Demand for consented sites remains strong and further site sales are anticipated throughout the year.

We therefore view the current year with confidence, whilst remaining cautious around continuing risks in the wider economy and any further impact on customer demand. As market conditions improve, we look forward to returning to significant growth.

Rather mixed messages in the last paragraph! Confident and cautious, at the same time?!

Forecasts - Singers has FY 6/2024 profit forecast roughly flat, at 41.8p. Does that look reasonable? I’d say yes, since the outlook and commentary give us good reasons to expect GLE might be able to hold profits flat, without any improvement in market conditions. The cost of living squeeze is starting to ease, as average wages have now returned to being above inflation. Possibly mortgage rates might have, or be close to a peak? And of course there’s an ongoing structural shortage of affordable housing - too many people, and not enough houses, means I cannot see any significant price drop for Gleeson’s bottom end of the market being likely.

Balance sheet - net assets are £286m, all tied up in inventories (land and W-in-P) of £345m.

Cash has fallen sharply, from £34m to just £5m. There’s no interest-bearing debt, and other creditors are dwarfed by its huge inventories. There’s an unused £135m bank facility, so absolutely no issues over liquidity. In any case, it could reduce inventories to generate cash, should it be necessary (which it isn’t).

So the shares trade at a discount to NTAV (not unusual in the sector), market cap at £238m, NTAV at £286m, and probably only a small risk of assets having to be written down in value (e.g. Gleeson uses very cheap land, so low risk of having to write its value down), so I reckon this looks a rock solid, asset backed investment. I don’t think the same can necessarily be said of all housebuilders, operating in much higher priced regions, where selling prices could be falling faster than expected I reckon.

Although for balance I should mention that if house prices really drop hard, at the bottom end of the market, then GLE could see write-downs being required. It is possible, for sure.

Cashflow statement - looks very simple. All the cash generated was invested in additional land and W-in-P (inventories) - this is something the company largely controls itself, so it’s not a problem. The cash pile was nearly all spent on other cash outflows, eg capex, tax paid, finance charges, divis, etc. All looks fine to me.

Paul’s opinion - I haven’t read all the commentary, just plucked out the key bits. I’m reassured by the in line results, and more importantly the surprisingly upbeat outlook comments. It seems to me that, even if the housing market hasn’t bottomed yet, it looks credible that GLE’s profits might have bottomed, due to its key advantages of being at the low cost end of the market, and seeing interest from bulk purchasers (to plug any shortfall from individual buyers).

I don’t know if the share price has bottomed yet, anything could happen in this choppy stock market. I’m tempted to start dipping my toe in here again, with a small initial purchase, then monitor events and decide whether or not to top up depending on how things seem to be heading.

Chart below - forming a base possibly? Time will tell. High StockRank. Very little dilution over the last 6 years, so this chart is saying to me GLE shares could double in a general economic & property market recovery -

Focusrite (LON:TUNE)

Up 5% to 525p (£311m) - Trading Update for FY 8/2023 - Paul - GREEN

Focusrite plc (AIM: TUNE), the global music and audio products group supplying hardware and software used by audio professionals and musicians, is pleased to provide the following update on trading for the year ended 31 August 2023 (FY23).

Given tough macro conditions, I think this update seems reasonable. The market seems relieved, with shares up 5% -

…revenue for the Group in H2 FY23 was slightly ahead of the comparable period in FY22. As a result, Group revenue for FY23 is expected to be not less than £177 million (FY22: £184 million). Supported by improved gross margins, our expectations are for EBITDA1 for the full year to be around the lower end of current market expectations, which currently range between £38.2 million and £39.0 million.

That’s a very tight range, so being “around the lower end” is absolutely fine, I think.

Debt & working capital - this all sounds fine, no concerns here with such modest debt -

As at 31 August 2023 the Group had net debt2 of approximately £1.5 million (FY22: net debt £0.3 million, FY23 H1: net debt £13.2 million). This includes the acquisition of Sonnox Ltd in December 2022 for a net cash consideration of £7.2 million. Working capital has improved significantly in the second half as inventory in the channel has reduced as expected to more normal levels.

Valuation - we’re hampered by the lack of broker notes here. Surely management should be addressing that omission, for a share that a lot of private investors find interesting.

Working on the StockReport’s broker consensus numbers, we’ve got 39p EPS for FY 8/2023. It sounds like actual could be slightly below, guessing at say 37p. That would give a PER of 14.2x, which looks reasonable value I think considering it says market conditions are tough -

background of extremely challenging trading conditions throughout the year.

There have been a series of downward revisions to forecasts, which helps explain the share price weakness this year -

Paul’s view - looking at my notes previously this year, I viewed TUNE as GREEN on 3 Feb (755p), 14 Mar (665p) and 28 Apr (451p). So I was rather too optimistic earlier this year, but finally got it right on the third attempt at 451p in April!

The price looks on a firmer footing now at 525p, and looks OK value for a decent quality business. I also like that TUNE is owner/managed, has a good track record since listing, and seems to have made a series of self-funded acquisitions in a sector it knows well.

As you can see, the pandemic gave it a big boost, but it’s managed to hold on to most of the profit growth, not an easy thing to do -

Divis are modest, because its using internal cashflows to make acquisitions. That’s fine.

As you can see from the chart below, I’d say the speculative froth has come out of the price, and you’re now getting a nice quality, innovative business, at a reasonable price.

So it’s another thumbs up from me. Bear in mind I’m not a good predictor of share prices, but I can spot nice companies at fair valuations, and this is one of them.

THG (LON:THG)

Down 17% to 72.3p (£1.05bn) - Interim Results - Paul - RED

If you like adjustments, then these accounts are a must-read. There’s a gulf of real world costs between its £50m adj continuing EBITDA, and the £133m loss before tax in H1 results (worse than £108m LBT in H1 LY).

THG strikes me as an insanely overpriced tech boom share that is now struggling to work out how to become a viable business, before it runs out of cash.

True there’s a big cash pile still, of £393m. However, it’s all been borrowed - £672m of (expensive) debt. The terms of those borrowings will be key - a breach of the covenants could end up with borrowers potentially controlling the company, and wiping out equity completely, sooner or later. Net debt is £268m excluding leases. How is that debt going to be repaid, given that THG doesn’t make any profit?

Outlook comments suggest it can reach positive free cashflow in H2, achieving cashflow breakeven for the full year. I’d like to see how it defines free cashflow, because it probably won’t match how the rest of us define it, at a guess!

Paul’s view - very negative. This looks an accident waiting to happen. It’s not growing any more, is nowhere near profitability, and has a large and growing pile of debts. It’ll take a miracle to turn this thing around, in my view. Every now and then takeover bid rumours start circulating. Surely at some point the delusional valuation expectations of management and shareholders are likely to meet reality?

Mind you, look at Ocado (LON:OCDO) - that’s been treated as a huge valuation tech stock for many years, despite it only growing modestly, and losing £300-400m every year. So these bubble valuations can last a very long time. The story is usually that the company has some amazing underlying technology which is world-beating, and the earnings from that could dwarf its trading losses. But it never actually happens in most cases - just heavy losses, year after year.

It’s amazing to think that THG is still worth just over £1bn, when you see its chart since floating. The original IPO surely deserving of a literary award in the best fiction category?! And the buyers of the stock at IPO getting most gullible investors of the year award? Mind you, we all make mistakes, so I shouldn't really say that.

Graham’s Section:

Glenveagh Properties (LON:GLV)

Share price: 97 cents (-1%)

Market cap: £473m (€550m)

We have interim results from this Irish home builder.

I first looked at it in January, when it issued a profit warning, as planning delays were set to put the brakes on suburban unit deliveries in 2023.

However, the share price hit a low that day and has been higher even since. Here’s the two-year chart:

Today’s interim results show revenues declining year-on-year and profits evaporating. However, the results are in line with expectations and H2 should be better. Note that the full-year revenue forecast is €599m (vs. only €171.6m generated in H1)..

Perhaps the performance over six months isn’t too meaningful for smaller house builders, where sales of new developments might be lumpy, and we should try to stick to analysing annual results?

The decline in profits in H1 is blamed on “lower urban revenues, reflecting a higher H1 2022 comparative that included approximately €63m from the disposal of the East Road site, along with increased financing costs.”

At least the overall gross margin has been maintained. They say that build cost inflation was kept to only 4-5% - impressive.

In other positive news, they say they are now benefiting from “strong planning momentum”. They’ve received planning permission for 4,000 units so far this year, which sounds like a lot! All expected deliveries for 2024 have planning permission.

Buyback - they finished a c. €63m buyback programme at the start of August. There are now only 578m shares outstanding (vs. 638m at the end of 2022, and 772m at the end of 2021). Excellent!

I’m not very fussy about where future EPS growth might come from - if it comes from a declining share count, I’m fine with that!

Outlook - they reiterate full-year 2023 guidance, EPS of 7.5 to 8 cents (about the same as 2022)..

The 2024 outlook is worth a read:

A very healthy land portfolio and forward order book, combined with strong planning momentum and robust operational and manufacturing capability, gives the Group increasing confidence in its capacity to generate strong revenue and profit growth across its Suburban, Urban and Partnerships business segments in FY 2024. We are comfortable with current consensus EPS expectations for FY 2024 of approximately 17 cents

That would be an excellent EPS result (especially when you consider the share price is currently just 97 cents, so that’s a very low PER).

They also say that the return on equity target of 15% in 2024 is “our key capital metric” - excellent! I like the choice of KPI and I like the target they’ve chosen. 15% would be a fine return for shareholders.

I really like the way they have used a large share buyback to reduce the E in ROE (i.e. equity). In my book that’s a very efficient way to return surplus capital to shareholders, and it’s the right choice when you are trading at a cheap earnings multiple.

CEO comment: I’ve picked out some of the most interesting bits.

While planning delays proved challenging at the start to the year, we have seen a strong upturn in permissions granted through 2023 and are on track to have over 70% of our current landbank fully planned and available by the end of FY 2024.

We began 2023 with no planning achieved in our Partnerships segment, to now being commenced on two of the largest such sites in the country. We are proving that public and private entities can work successfully together to deliver sustainable mixed tenure developments…

The outlook across Glenveagh's businesses is favourable and the opportunities are compelling. We are ideally placed to serve what continues to be strong private demand, in addition to working constructively with State agencies on supply-side initiatives.

Balance sheet does not appear to be excessively geared, with €240m of loans and borrowings being used to finance total assets of €970m (almost entirely tangible). Equity is high at €637m, so the company’s stock trades at a discount to book.

Graham’s view

I’m going to give this one the thumbs up due to the rapidly declining share count over the past few years, and the still cheap valuation (whether viewed through a P/B or PER perspective).

If the company hits its targets over the next 18 months and if it chooses to plough its earnings into further buybacks rather than a dividend, the share count here could collapse. Either that, or the share price would have to rise to prevent that from happening.

Either way, I think the prospects for shareholders are positive. Planning permissions have picked up to match the extraordinary demand for housing and so it should be full steam ahead for the likes of Glenveagh.

Checkit (LON:CKT)

Share price: 30.7p (+14%)

Market cap: £33m

The outlook here is ahead of expectations.

What it does: Checkit provides software and sensors that enable businesses to automate tasks, and monitor their staff and their operations more generally, improving efficiency. Key industries served include hospitality and healthcare.

Their goal is “to become the market leader in augmented work management for the deskless industry.”

The two-year chart isn’t pretty, but could it have formed a base?

Here are the key points from the interim results, for the period ending July:

H1 revenue from continuing operations +19% to £5.7m (nearly all of this is recurring).

Annual recurring revenue +24% to £12.6m.

Pre-tax loss £2.5m (H1 last year: £4.5m).

Cash £12.8m (it was £15.6m six months previously).

CEO comment:

Checkit is on an accelerated track to profitability. We're scaling growth through our land and expand model, while prioritising operational efficiency and cost reduction. Despite the challenges in the wider economy, our diverse customer base and a product suite that is built to deliver operational efficiency uniquely positions us for market capture.

The company will host a webinar today at Investor Meet Company. Here’s the link.

H1 performance: there have been “a number of small wins with potential for future upsell”, plus a large agreement with Compass (LON:CPG) involving multiple contracts and more opportunities being discussed. Checkit has also achieved its largest contract renewal with John Lewis (£6m over three years).

Cash flow is much improved, with only a £2m operating cash outflow in H1 (H1 last year: £3.6m outflow). The investing outflow was less than £1m, about the same as last year.

Outlook

We continue to execute against our growth strategy, with an exclusive focus on high quality, high value subscription revenues in our target verticals and geographies. The picture for the business remains positive; high net revenue retention rates underpin our land and expand strategy and continued contract momentum. With an accelerated focus on operational efficiency, the Board is confident in delivering an operating performance for FY24 ahead of current market expectations.

Estimates from Singers for the current year (FY January 2024) are adjusted as follows: revenues down 4% to £12m, and adj. EBITDA improves 7% to minus £3.6m.

Graham’s view

I’m impressed by the reduction in cash burn, which means that the company should be able to survive longer than I previously expected with its current cash pile. At their current rate of losses, they could survive about two years without raising more funds. And if the burn can reduce further then their runway will get correspondingly longer.

I don’t feel like I have much choice other than to maintain the negative view on the stock, however, because it’s still at such an early stage. If you like investing in early-stage companies, this could be worth a second look. From a value perspective, I have to concur with the Stockopedia ValueRank of 15. But well done to Checkit for keeping its costs under control and making its cash last that bit longer.

If they can reduce their rate of burn further, I may turn neutral on this one.

Paul adds: I'm a bit more risk tolerant than Graham, and to me Checkit looks quite interesting. I like small growth companies that are reducing cash burn, and probably have enough remaining cash to survive. This update strikes me as interesting, nice review from Graham, and I'd be willing to view it as AMBER, and do some more research on it. Although £33m mkt cap for a loss-making cash burners isn't particularly enticing. I'm not sure there's much immediate upside on that price. Although for a value report, I can see why Graham has stuck with RED.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.