Good morning from Paul & Roland!

Today's report is now finished.

Thank you to everyone who contributed to the outstandingly good comments section yesterday, it was fantastic! Special mentions should go to longstanding subscriber bsharman, who bravely shared his difficult circumstances with us, including how current market doldrums have been difficult to cope with. Some fascinating replies, and gmtrader certainly put things into perspective with a poignant reply about their circumstances.

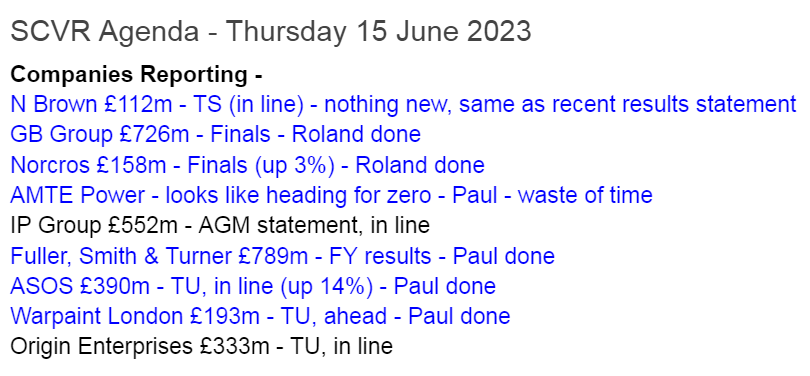

Right, on to the news today! What fresh horrors are in store for us?!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

Summaries

Warpaint London (LON:W7L)

Up 14% to 288p (£221m) - Trading Update (significantly ahead) - Paul - GREEN

Another excellent trading update from this makeup supplier, enjoying very strong organic growth (+45%) and good margins. This continues to be one of our favourite shares here, and a 19% increase in broker forecast for FY 12/2023 removes any worries about valuation having got too high. It's looking increasingly like a long-term winner.

ASOS (LON:ASC)

Up 15% to 377p (£449m) - Trading Statement - Paul - AMBER/RED

I try to untangle this complicated update, which seems to show some signs of improvement. However, this fashion eCommerce business still has major problems, so I can't decide whether it's worth taking a punt on it, or not. Bull/bear points discussed in more detail below.

GB (LON:GBG)

Down 10% to 255p (£645m) - FY 03/2023 results - Roland - AMBER

Today’s results include a surprise impairment charge that suggests GB may have overpaid for recent acquisitions. More broadly, I wonder if this business is now starting to go ex-growth. I can see some attractive qualities, but I think the valuation is probably up with events.

Norcros (LON:NXR)

Up 2% to 180p (£160m) - FY 03/2023 results - Roland - AMBER

This plumbing and kitchen products business is performing acceptably well and looks superficially cheap. But in my view, this appeal is outweighed by the likelihood that large cash pension contributions will be required for the foreseeable future.

Fuller Smith & Turner (LON:FSTA)

Up 1% to 556p (£798m) - FY 3/2023 Results - Paul - AMBER

Only a small adj PBT, and hence a high PER. However, the outlook comments are much more positive, with very good current trading. Balance sheet has strong support from freehold properties in at cost, which Directors say are worth much more than book value. Personally, I can't see any particularly obvious value in this share, as it's already pricing in a strong recovery in future profits.

Paul’s Section:

Warpaint London (LON:W7L)

253p (pre market) (£194m) - Trading Update - Paul - GREEN

Warpaint London plc (AIM: W7L), the specialist supplier of colour cosmetics and owner of the W7 and Technic brands, is pleased to provide an update on current trading.

Strong trading continues in Q2 2023

It’s another strong trading update, as this makeup supplier continues to generate very strong organic growth -

Sales for the five months to 31 May 2023 were 45% ahead of the same period last year, at £29.7 million (five months to 31 May 2022: £20.5 million), with margins continuing to be robust and ahead of those achieved in 2022.

Accordingly, driven by the continued strong start to the year, the Board now expects that the Group's full year 2023 performance will be significantly ahead of its prior expectations.

Broker update - many thanks to Shore Capital for issuing an update this morning to help us quantify the upgrade. It’s substantial - a 19% hike to forecast EPS FY 12/2023, to 14.4p, giving a PER of 17.6x which I think can easily be justified.

I was worried that the share price might have got ahead of itself after a recent surge to c.300p, but a 19% earnings upgrade removes that worry, so another leg up in share price seems likely after a recent retrace to c.250p.

Cash pile is growing gradually, which is no mean feat when you consider that rapid revenue growth tends to suck in working capital - because 2 debits rise (inventories and receivables), whilst only 1 credit rises (trade creditors).

The Company continues to be cash generative and maintains a strong balance sheet with cash balances as at 31 May 2023 totalling £7.5 million (31 May 2022: £2.7 million; 31 December 2022: £5.8 million) and no debt.

Paul’s opinion - one of our favourite shares at the SCVR, it should have been on my 2023 watchlist, but I forgot to include it. This is now the 4th thumbs up from me this year (11 Jan, 24 Mar, 26 Apr), as the news on trading just gets better & better, easily justifying the rising share price. Isn't it great to see something doing so well, in such difficult macro conditions?!

I’ve previously quibbled over valuation a couple of times (but still kept a green view of W7L), so I think today’s news is a reminder that when you find a share generating strong organic growth and out-performing, maybe it’s best to forget about valuation, unless it gets crazily high? Run the winners, and all that.

My interview here in Jan 2023, with CEO Sam Bazini, got to the crux of why the business is performing so well - it couldn’t be simpler - customers love the products, and keep buying them. So W7L is expanding into many more retailers, internationally, focusing particularly on large retail chains. Hence it’s growing revenues, and at good margins. The total global market is huge, so I don’t think this share is anywhere near reaching market saturation, hence it looks an ideal share to buy & hold forever. So a strong thumbs up again from me!

Things have not all been plain sailing in the past though, as you can see below. Although I think the business is now in much better shape, with a much more clear, and successful strategy.

Note that the high StockRank is despite a poor score for value. But with forecasts going up 19% today, that looks a red herring, and is likely to push upwards once the revised forecasts come through into the data -

ASOS (LON:ASC)

Up 15% to 377p (£449m) - Trading Statement - Paul - AMBER/RED

This is Q3 (3m to 31 May 2023) of FY 8/2023.

We’ve covered the big problems at this large eCommerce fashion business here fairly extensively, so see the archive for the reasons why I’m negative on the fundamentals of Asos.

It’s now all about whether the turnaround plan works (or not). Also the shares could be in play, with press reports of a £10 bid being rejected in Dec 2022, and large shareholders (including the ubiquitous Mike Ashley of Frasers who now holds almost 10% after recent buys) jockeying for position. There’s also shorting interest in Asos, which adds to the uncertainty. Put that all together, and it’s a recipe for volatility and surprises, hence why I see this share as just for traders at this stage. Or, investors who have somehow convinced themselves that the turnaround plan will work!

The headlines sound encouraging - but this is the PR bit, which is not always a fair reflection of reality!

Return to profitability as "Driving Change" agenda delivers.

FY23 guidance reiterated.

Q3 update - some key numbers -

Q3 revenue down 14% vs Q3 LY, showing a worsening trend, as the 9 month YTD figure is down 9%.

Operating profit has improved, and -

On-track to deliver adjusted EBIT guidance of £40-60m in H2 FY23.

That’s encouraging, but remember it previously said finance costs would be about £50m in H2, so that looks like a roughly breakeven PBT. Plus Asos has been very liberal with the adjustments in the past, so I don’t trust the figures they selectively report in trading updates.

When we last got to see the full numbers (H1 results) they looked dreadful, although H2 is supposed to be better.

This bit sounds impressive, but again I’d need to see how these numbers are calculated -

c.£200m of profit optimisation and cost savings realised year-to-date ("YTD"). On track to deliver c.£300m of benefits targeted in FY23, which equates to c.£385m of gross annualised benefits.

Gross margin - has always been Asos’s achilles heel, it’s just far too low because they sell so much third party stuff. Also, Asos has adjusted out substantial stock write-offs in the recent past, which is totally unacceptable - everyone else takes the margin hit from bad buying in the reported numbers, because it’s fundamental to how fashion businesses work! You can’t remove the cost of your bad buying, and pretend it hasn’t happened!

The point below about a benefit from lower freight is important though, as the nasty headwinds on supply chain are now turning into tailwinds, which could be a trigger for the fashion sector to regain some composure perhaps?

Adjusted gross margin7 up 350bps YoY supported by freight (c.200bps) and improvements in realised selling value and sourcing.

Excessive inventories are also a major problem, with Asos being hugely over-stocked last time I looked. This sounds like they’re making progress -

Inventory down by c.15% on FY22, consistent with the target of a c.20% reduction by FY23, with 86% of stock less than 12 months old. H2 FY23 intake -36% YoY with option count down 30%. H1 FY24 intake expected to be down 33% YoY with option count -13%.

Pulling it all together, guidance is unchanged, which is reassuring - at least things haven’t worsened further -

ASOS will retain its focus on profitable sales and its commitment to reducing inventory for the remainder of FY23. Expectations for H2 FY23 and full-year FY23 are unchanged from guidance issued in the H1 FY23 results announcement on 10 May 2023, as updated on 25 May to account for the cash costs of re-financing. As such, we are on track to build on the more than £400m of cash and undrawn facilities reported at H1 FY23 over the course of H2 FY23.

While the Company remains cautious on top-line outlook for the year ahead, the actions taken will continue to have a positive impact on profitability and cashflow. As such, the Company expects material cash generation in FY24 and therefore a further reduction in net debt.

"We continue to focus on making ASOS the best possible destination for our fashion-loving customers. At the same time, we are delivering on our plan to turn the business around: to right-size our stock; to generate cash; to reduce our net debt; and to structurally improve our profitability. I am confident in the direction we are going, we have restored profitability in the period and made good progress in clearing through our inventory to generate cash. We retain ample balance sheet flexibility and reiterate our expectations for improved profitability, cash generation and reduction in net debt in H2 FY23 and beyond."

Paul’s opinion - this is just too complicated to reach a firm conclusion on it. I’ve viewed this share as RED in the recent past, because the problems look so serious, and I’ve been sceptical about the turnaround.

It refinanced twice recently, with reduced, but very expensive, borrowing facilities from Bantry Bay, and the shortfall being made up with a £75m placing. However it also seems to have a large, and very cheap bond in place for several years to come, which buys it time to see if the turnaround works.

The bull case is that with revenues not far off £4bn pa, any meaningful improvement in margins could drop a lot of profit through to the bottom line. The trouble is, it’s never made decent, sustainable margins in the last 20 years, so why would we think it can suddenly start doing so now?

Then we come to the market cap, at only £449m. Somebody might be tempted to bid for the company at that level.

Today’s update reads like a PR release more than anything, plucking out positive developments. But look at the trend of broker forecasts, which doesn’t look much like a turnaround to me -

Overall, I think the jury is out, it could go either way. Given the possibility of a takeover bid, and some signs of life in today’s update, I’ll move from RED, to AMBER/RED. It’s very speculative at this stage, so more of a riskier trade, than a serious investment. It’s tempting to have a little dabble though. Same with BOO, which is much better financed and managed than Asos. It’s possible that this bombed out sector could have a sudden surge, it looks like a potentially interesting trade.

EDIT: RNS just out, saying Frasers (LON:FRAS) has increased its position in Asos to 10.6%

Quite an astonishing chart below! I've followed Asos right from the start, and as I never tire of telling other investors, my mistake was selling too early, because I thought it had got over-valued - ditching my 0.5m Asos shares for a nice profit... at 9p! You've got to laugh!!

Fuller Smith & Turner (LON:FSTA)

Up 1% to 556p (£798m) - FY 3/2023 Results - Paul - AMBER

It’s actually 53 weeks to 1 April 2023, but I’ll call that FY 3/2023.

Fuller, Smith & Turner PLC is the premium pubs and hotels business that is famous for beautiful and inviting pubs with delicious fresh food, a vibrant and interesting range of drinks, and engaging service from passionate people. Our purpose in life is to create experiences that nourish the soul. Fuller's has 200 managed businesses, with 1,024 boutique bedrooms, and 177 Tenanted Inns. The estate is predominately located in the South of England (44% of sites are within the M25) and stretches from our London heartland to the Jurassic Coast via the New Forest.

Commenting on the above table, my initial thoughts are -

Most of the £51.8m EBITDA disappears in depreciation, and interest charges, leaving only £12.7m adj PBT.

Good increase +64% in adj EPS to 16.1p (in line with expectations) - a PER of 34.5x - which suggests to me that the market expects profit to at least double in future, to get anywhere near a reasonable PER.

Nearly all earnings paid out in divis.

It’s so difficult to make meaningful profits from bars/inns at present.

Why is this company valued at £798m?!

There seem to be 3 classes of share, A, B, and C. This needs looking into properly, which I can’t do today, as am almost out of time. Note 6 says -

For the purposes of calculating the number of shares to be used above, 'B'shares have been treated as one-tenth of an 'A' or 'C' share.

Property values - Directors reckon it’s worth £996m, c.£400m above book value. Is this realistic, given that hardly any return is being generated from these assets? I’d say it’s more likely that asset values need to fall considerably. That said, it reports a £11.8m profit on disposal of properties this year, and £6.3m last year, which suggests maybe properties are worth more than book value, if the disposals are typical sites.

Outlook - very encouraging recent LFL sales, above inflation, and above wage inflation too, which is quite surprising to me -

Surprisingly upbeat here too -

I am more optimistic about the future than I have been since before the pandemic. While the well-documented inflationary environment has been a challenge, there are positive signs on the horizon. In addition, we are ever hopeful of a resolution to the ongoing train strikes to allow us to further benefit from the increasing numbers of office workers and international tourists returning to the Capital.

Energy costs - increased to £14.2m, up £6.6m (+87%) on LY. So it’s reasonable to assume at least some of that extra cost might reduce in future, as energy costs have been falling a lot lately. That depends on whether FSTA hedged at higher prices or not? It’s reduced consumption by c.13%, which is impressive.

Balance sheet - dominated by freehold property, in the books at cost, NBV of £426m, which the Directors reckon is worth about double that much, as mentioned above.

NAV is £443m, less £29m intangible assets = NTAV £414m. Plus another £400m of property values above cost, if you believe the Directors estimates. That means the market cap of £798m is fully backed by NTAV, which I like. Although whether current property values are sustainable, who knows? Lots of commercial property is plummeting in value in response to higher interest rates, so I wouldn’t hang my hat on NTAV here holding firm at c.£800m. Still, it’s a good starting point, even if those values do fall in future.

The pension surplus is an actuarial deficit, requiring annual repair (cash) payments of about £2.4m from the company.

Net bank debt looks quite modest at £133m, although higher interest rates might not help.

Paul’s opinions - pubs have had a hideous couple of years, and also borne the brunt of higher inflation in particular with c.20% higher cost of food & drink, staff wages typically up by c.10%, and energy prices having almost doubled. Put that together with subdued customer disposable income, and it’s a wonder they make any profit at all! Many smaller pubs are going out of business, which is leaving greater market share for the larger chains.

Forecasts suggest FSTA could grow EPS by c.50% in the new year, FY 3/2024, with consensus currently 23.8p - a PER of 23.4x - I don’t see that valuation as even remotely attractive, although it does come with very solid asset backing. But it’s not actually generating much of a return on those assets.

There’s nothing particularly wrong with this share, but I’m struggling to see why the share price would keep rising from here? So I’ll just be neutral on it, hence AMBER.

If you’re very bullish on the sector, and think profit margins could recover to historic levels, then you might see more of an attraction here. Plus there’s no doubt that the big inflationary cost headwinds should be easing from now on.

Roland's Section:

GB (LON:GBG)

Share price: -10% to 256p (09.00)

Market cap: £644m

Final results - AMBER

In April I went green on GB Group and suggested that “this software group’s problems may now be in the past”. Today’s final results have triggered a 10% share price slump, suggesting the market may not share this view.

GB shares are now trading at levels last seen in 2016. Should shareholders be worried?

Chief executive Chris Clark’s opening comment does not sound overly bullish:

GBG continued to make important strategic progress and operational improvements that will have long-term benefits; however, we were impacted by unexpectedly deep post-pandemic corrections in some end markets.

Financial summary: Today’s results cover the year to 31 March 2023. The headline numbers are in line with those provided in April’s trading update.

Revenue for the year rose by 15% to £278.8m, or by 3.7% on an underlying, constant currency basis.

Adjusted operating profit climbed 1.7% to £59.8m, giving a healthy adjusted operating margin of 21.5%.

Adjusted earnings down by 19% to 16.4p per share, in line with consensus estimates.

However, today’s results do include one new and unwelcome surprise. GB Group has applied a £122m goodwill impairment to the value of its IDology and Acuant businesses. These were acquired in 2019 and 2021 respectively, for a total of $1bn.

According to the firm, this impairment represents 19% of these units’ previous carrying value of £644m.

GB’s current market cap is now below the value of these two acquisitions. This suggests to me that management may have overpaid, or that there is now significant value in this business. Unfortunately, I think the former is more likely, at least in the near term.

The impairment charge appears to have been driven by the slowdown in cryptocurrency trading in the US. Management also comments on the “non-repeat of US stimulus work” and the “lower volumes from internet economy customers, who benefited significantly from pandemic-related changes in consumer behaviour”.

As a result of this impairment charge and the group’s usual large amortisation charge, GB has reported a statutory operating loss of £112.4m for FY23 (FY22: £23.4m).

Opinions vary on how to adjust for the non-cash amortisation charges relating to previous acquisitions. The key point is that these non-cash accounting charges would not have occurred if the related assets had been developed in-house rather than acquired.

GB’s adjusted operating profit gives a margin of 21%, but how meaningful is this when amortisation charges account for 70% of this figure?

In my view the simplest solution in cases like this is to focus on free cash flow instead. This should reflect reality and be unrelated to whether assets were built or bought.

Cash flow: my sums suggest free cash flow of £25m last year (FY22: £39.5m). Stripping out working capital movements gives an underlying figure of £41m for both years.

Using this £41m figure gives an underlying free cash flow margin (FCF/revenue) of 14.8%. This seems like a potentially attractive level of profitability, to me.

However, GB’s market cap of c.£650m means that the free cash flow yield on the shares is only about 6%. Said differently, this means the shares are trading on 16x underlying free cash flow. I’d probably describe this as fair value rather than cheap, given the slowing growth rate of this business.

Debt: Net debt was almost unchanged last year at £106m and the company says it will focus on cash generation in FY24 in order to reduce borrowings. I don’t think this level of debt should become problematic, but a reduction would be prudent, in my view.

Outlook: chief executive Chris Clark says that “uncertainty remains” but he expects some gradual revenue acceleration in the latter part of the year. Cost savings are planned, too.

FY24 expectations are unchanged, which suggests GB adjusted earnings could rise by 6% to 17.1p per share this year. That prices the stock on about 16x earnings, after this morning’s fall.

Roland’s view: my reading of today’s results is that there’s still some small risk of disappointment in FY24.

However, for me, the bigger concern is whether this business should be valued for growth, or as a more mature operation. I’m starting to incline towards the latter view.

GB’s operating profit rose by an average of 20% per year between 2013 and 2022. But I’m starting to feel that the company is exiting this strong growth period. My feeling is that the GB’s products may now be quite well established and perhaps face stronger competition than in the past.

Despite this concern, I can see some attractive qualities to this business, notably around recurring revenue. Today’s results show 40% of revenue from term-based subscriptions (i.e. fixed annual payments), with a further 16% from consumption-based subscriptions.

On an underlying free cash flow basis, GB’s business also seems quite profitable, based on my estimate of a c.15% free cash flow margin.

However, the outlook for this year seems quite pedestrian, with forecast earnings growth of c.5%.

Today’s impairment charge also suggests to me that management may have overpaid for some past acquisitions. Certainly as a potential investor, I’d want to see evidence that the existing business is performing well and growing before supporting any further big acquisitions.

On balance, I still think this is a good quality business. But I think the shares are probably fairly priced at current levels, until we see evidence of improved growth or profitability.

Given my concerns, I’m going to go amber on GB.

Norcros (LON:NXR)

Share price up 2% to 180p (09.30)

Market cap: £160m

Final results y/e 31 March 2023

Record revenue and underlying operating profit and a strong financial position

Let’s take a look at today’s results from this bathroom and kitchen fittings group, whose UK brands include Triton, Merlyn and Johnson Tiles.

This is a perennial value stock that often appears to offer value, but whose shares have repeatedly failed to deliver:

Results summary: today’s results appear to show good underlying trading, albeit with some exceptional charges holding back statutory profits.

Revenue up 11.3% to £441.0m

Underlying operating profit up 13.2% to £47.3m

Statutory operating profit down 24.0% to £27.5m

Net debt of £49.9m (FY22: net cash of £8.6m)

Dividend up 2% to 10.2p per share

Today’s results continue the trend of revenue growth (aided by acquisitions) that we’ve seen over the last decade.

Trading is split between the UK and South Africa.

UK: revenue rose by 15.2% to £295.8m, with “a resilient trade sector” helping to offset softer demand from retail customers.

However, the Johnson Tiles UK business suffered a £5m impairment due as a result of a “reduction in demand for our locally produced tiles”.

UK underlying operating profit was £37.2m (FY22: £30.9m), giving an underlying margin of 12.6%.

South Africa: revenue rose by 4.7% on a constant currency basis to £145.2m. Demand was said to be driven by the housebuilding sector and the expansion of the House of Plumbing business.

South Africa underlying operating profit was £10.1m (FY22: £10.9m), giving an underlying margin of 7.0%.

Balance sheet: net debt rose to almost £50m last year, as a result of the £80m acquisition of bathroom and kitchen firm Grant Westfield and an additional inflow of £13m into working capital.

Norcros is an acquisitive business and this doesn’t seem too alarming to me, although it was a large deal for the firm.

Free cash flow: I estimate free cash flow of £13.9m last year, excluding acquisitions (FY22: £4.5m). This represents 83% cash conversion from net profit of £16.8m – not too bad.

Dividend: the full-year dividend of 10.2p is an increase of 2% and gives the stock a trailing yield of 5.7%.

Outlook: revenue for April and May is said to be 1.3% ahead of the same period last year, or 3.6% below on a constant currency basis, due to disruption in South Africa from electricity shortages.

Expectations for the current year are unchanged. According to a new (paid) research note from Edison this morning, earnings per share are forecast to fall by 10% to 33.7p this year. Edison also expects a dividend cut to 9.3p per share.

These numbers put Norcros on a forecast P/E of 5.3, with a prospective yield of 5.2%.

Pension scheme: no discussion about Norcros is complete without considering the company’s pension liabilities. The group’s pension liabilities were £285m at the end of last year – more than double its market cap.

My concern may seem odd, given that the group has reported a pension scheme surplus of £14.9m in today’s results. But Norcros is also tied into making annual deficit reduction payments of £3.8m until 2027.

The reality is that pension scheme accounting is very complex. The surplus reflects an accounting valuation process, while the deficit reduction payments are driven by an actuarial valuation process that’s quite different.

Rather than trying to untangle all of this, I’ve adopted an approach suggested by an investor friend with far more experience than me.

I focus on the last reported value of the scheme assets and the benefits being paid out each year. These numbers can usually be found in the footnotes of the annual report.

Using these numbers, I can estimate the required return from scheme assets to fund pension payments and gauge whether extra contributions may be required.

Here are the numbers for Norcros:

FY22 pension scheme assets: £387.9m

FY23 reported change in scheme assets: -£88.0m

Estimated FY23 pension scheme assets: £300m

Benefit paid in FY22: £23.5m (FY21: £23.2m)

Estimated ongoing return required from scheme assets: c.7.5%

While the number of pension scheme members fell last year, I’d guess that there was some upward adjustment for inflation. Even without this, I think a return of c.7% will still be needed to support pension payments.

I’m not sure it’s realistic for a pension scheme to generate sustainable cash returns at this level. In my view, this tells us why Norcros is scheduled to make deficit repair contributions of £3.8m through to 2027 despite the pension accounting surplus.

However, even when I factor in these payments, my sums suggest the pension assets may still need to generate a return of c.6%. That doesn’t look sustainable to me, either. I suspect additional contributions may be necessary in the future.

Administering this scheme isn’t cheap. Administration costs totalled £1.6m last year, forming a further drag on group cash flow and profits.

In my view, these pension liabilities are the main reason for Norcros’s perennially low valuation. The company is partly being run to support its pension scheme, rather than to generate shareholder returns.

Roland’s view: The main investment case for Norcros shares is that they offer value, but in my view this is only true if we ignore the ongoing pension liabilities. Unfortunately, these seem likely to remain a costly cash overhead each year for the foreseeable future.

I don’t see anything sufficiently distinctive about this business to justify an investment against this backdrop.

A more bullish argument would be that the business can outgrow its pension scheme, but this only seems possible by acquisitions. Given the modest return on capital employed of the group (c.10%), I’m not convinced this will be easy to do.

However, I don’t see any fundamental risk to the equity here and would suggest most of the downside is priced in at current levels, so I’m going to go amber on Norcros.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.